Bitcoin Realized Losses Just Spiked To Levels Last Seen During the FTX Collapse

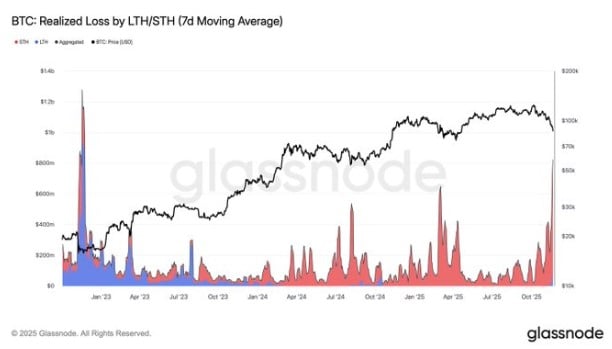

Bitcoin just recorded one of its most severe momentum breaks of the current cycle, with on-chain indicators now flashing levels of stress and capitulation not seen since the 2022 FTX meltdown. The sudden shock in market structure has left traders rattled, liquidity thin, and sentiment on edge as BTC struggles to stabilize above the mid $80,000 range. A Breakdown Few Expected This Cycle Bitcoin’s sudden fall to $80,524 on Friday stunned a market that had grown accustomed to a steady, if sometimes choppy, uptrend. The drop erased all year-to-date gains and pushed BTC more than 35% below its all-time high, reawakening fears of a deeper correction. The bounce to $84,000–$85,000 since then has offered some relief, but volatility remains elevated and the market’s tone has shifted dramatically. Several traders describe the environment as “fragile,” with BTC trading more than 3.5 standard deviations below its 200-day moving average—a deviation seen only during: Each of those episodes followed extreme fear, forced unwinding, and exhaustion. This week’s behavior fits that pattern almost perfectly. Realized Losses Surge to FTX-Era Levels On-chain data confirms the chaos. Glassnode shows realized losses—coins being sold at a loss compared to their last on-chain movement—spiking to levels last recorded during the November 2022 FTX collapse. Short-term holders (STHs), meaning wallets that bought within the last 90 days, are driving nearly all of this. They are exiting aggressively as BTC trades below major trend levels. Their realized-loss dominance has surged into a zone typically seen during outright panic. This capitulation-like behavior is what pushed Bitcoin so sharply under its trendline support. Momentum Traders Step Aside The market’s internal structure deteriorated rapidly: Independent analysts noted that the marginal buyer, who previously supported rallies, is no longer present. Without them, the market has been unable to generate sustained rebounds. Questions Over What Triggered the Flush Two competing explanations dominate trader conversations. Macro Pressure Crushed Risk Assets Hopes of imminent U.S. rate cuts faded this month. At the same time, AI stocks—leaders of the broader market—broke down sharply. Volatility jumped across equities and bonds. In that environment, highly leveraged markets like crypto were exposed. The October 10 “Mechanical Glitch” Aftershock Some analysts point to the October 10 event, when a so-called “mechanical glitch” involving a stablecoin price feed caused cascading liquidations. Nearly two million accounts were wiped out before platforms identified the error. Tom Lee argued that the market has been “limping along” since that episode, with liquidity thin and traders on edge. Adding to that, the October crash coincided with a surprise U.S. tariff announcement that sent shockwaves through global markets. More than $19 billion in leveraged positions evaporated within hours—one of the largest single-day liquidations in crypto history. The system has not fully recovered. Claims of Deliberate Downward Pressure Mike Alfred accused large players of pushing Bitcoin lower via derivatives. Lee publicly agreed. While difficult to prove, the nature of the move—fast, deep, and liquidity-driven—resembles prior episodes of aggressive positioning by whales and market-makers. Approaching a Historically Meaningful Zone Despite the chaos, some analysts see structural reasons for cautious optimism. Bitcoin’s drop brought it into the $78,000–$82,000 zone of Giovanni Santostasi’s Bitcoin power-law model, a region that has historically produced mid-cycle bounces, not full-cycle bottoms. BTC has touched this zone multiple times in 2024, and each instance has attracted buyers. However, analysts warn that without a macro catalyst—such as clearer rate-cut expectations or a surge in demand from ETFs—the market may remain unstable around these levels. Supply Signals Show More Unwinding Ahead Other on-chain supply indicators paint a cautious picture: These signs imply the unwind is still in progress. ing closes, they argue that dip-buying is no longer a reliable strategy. Where the Market Stands Now At the time of writing, Bitcoin trades around $84,977—well off the lows but still far below key trend levels. The structure remains damaged, sentiment remains fearful, and traders are preparing for more volatility. Market positioning is approaching conditions historically associated with short-term bottoms, but structural recovery requires more than a bounce. The market needs returning liquidity, stronger demand, and a clear macro environment. For now, Bitcoin sits at the intersection of washed-out short-term holders, stressed derivatives markets, and one of the deepest momentum breaks of this cycle. It could stabilize here—but until major levels are reclaimed, caution remains the dominant stance.

Bitcoin Fell as Japan’s New $135B Stimulus Sent the Yen to 10-Month Lows

Bitcoin’s sell-off deepened on Friday as Japan approved a massive ¥21.3 trillion ($135.4 billion) stimulus package, a move that pushed the yen to its weakest level in 10 months and stirred fresh volatility across global markets. The cryptocurrency briefly slipped below $85,500 before recovering slightly, extending a drop of more than 30% from its October peak of $126,000. The fall coincided with broader risk aversion, renewed doubts about U.S. rate cuts, and accelerating ETF outflows. Key Takeaways Japan’s Fiscal Push Sparks Market Turbulence Japan’s new Prime Minister, Sanae Takaichi, wasted little time rolling out one of the country’s most aggressive spending packages since the pandemic. The approved ¥21.3 trillion plan contains: Takaichi framed the package as “wise spending” designed to cushion households from rising costs and strengthen national power. But the plan lands as Japan’s economy contracts, inflation remains above the BoJ’s target, and government debt hovers at nearly 240–300% of GDP—one of the highest in the world. Investors reacted quickly. The yen slid to 157.20 per dollar, its lowest since early in the year, and Japanese government bond yields climbed to multi-year highs. The Nikkei 225 dropped 2.4% as technology shares led declines and political friction with China added pressure. Yen Weakness Complicates Bitcoin’s Outlook Historically, a weaker yen tended to support risk assets through the carry trade, where investors borrow cheaply in yen and deploy capital into higher-yielding markets. This pattern has often lined up with Bitcoin strength. But not this time. Japan’s fiscal and monetary divergence from the U.S. has altered the dynamics. With 10-year Japanese government bond yields now near 1.84%—their highest in 15 years—the yen is no longer the straightforward funding currency it once was. Rising yields increase the cost of borrowing and raise fears of a fiscal crunch. This shift has weakened the yen’s correlation with Bitcoin and heightened uncertainty across global markets. Analysts warn that if yields move higher, it could force investors to unwind yen-funded positions, increasing volatility in risk assets—including crypto. Bitcoin Struggles to Find Support Bitcoin’s latest decline reflects a blend of macro pressure and market-specific triggers: Bitcoin briefly touched $89,280, the lowest since April 22, before stabilizing near $91,000–$92,000. Technical analysts point to $92,000 as the next key support zone, with strong resistance expected around $102,000. If Bitcoin fails to hold current levels, some warn of a deeper correction, especially if global markets see further turbulence. Still, on-chain data shows long-term holders and some institutional players accumulating during the downturn. This has encouraged a segment of investors to view the dip as a potential entry point. Stimulus vs. Sentiment: A Market Caught Between Two Forces Japan’s spending package could eventually boost liquidity in Asia’s financial system, particularly as the government moves to reclassify cryptocurrencies as financial products—a shift that may expand retail and institutional access. But for now, sentiment is fragile. The upcoming 40-year Japanese bond auction is seen as a crucial test. A weak auction could drive yields higher, deepen yen instability, and intensify pressure on Bitcoin. A solid auction, on the other hand, may calm markets and help Bitcoin reclaim lost ground. What Comes Next Bitcoin’s immediate trajectory is tied closely to two factors: global risk appetite and the yen’s stability. If risk aversion grows and capital flows shift defensively, Bitcoin could remain under pressure. If markets stabilize, analysts see a potential rebound toward $112,000–$116,000 before the end of the month. Japan’s “fiscal bazooka” underscores a broader theme: governments are attempting to stimulate their economies while navigating inflation, geopolitical friction, and aging demographics. These crosscurrents are increasingly shaping Bitcoin’s movement—not just crypto-specific events. For now, Bitcoin remains trapped between macro headwinds and long-term optimism. As Japan’s stimulus ripples through global markets, the next few weeks will be pivotal for investors watching both the yen’s trajectory and crypto’s ability to regain momentum.