ETF FLOWS: After 22 Straight Days of Inflows, Solana ETFs Posted an $8.2M Net Outflow Yesterday

The streak is over for Solana. After 22 straight days of net inflows, U.S. spot Solana exchange-traded funds (ETFs) registered a net outflow of $8.2 million yesterday—the first negative session since their launch. What happened According to recent data, the drawdown was triggered largely by a massive withdrawal from 21Shares, which pulled about $34 million. Meanwhile, other issuers diverged: Bitwise added around $13.3 million, Fidelity’s FSOL added $2.5 million, Grayscale’s GSOL saw $10.4 million inflows, and VanEck remained relatively flat. The net result: the collective outflows outweighed the inflows—ending a multi-week run of consistent demand for Solana exposure. Background: The build-up When Solana ETFs debuted on October 28, 2025, they quickly gained traction. For nearly three weeks thereafter, funds poured in, bringing cumulative inflows to hundreds of millions of dollars. As recently as mid-November the funds had collectively amassed close to $476 million over 19 straight days of inflows. By late November, daily inflows had peaked — some sessions saw as much as $58 million. That run suggested growing institutional appetite for Solana — possibly tied to expectations that Solana projects and rapid-execution blockchain infrastructure might represent the next wave in crypto adoption. What this means now The outflow doesn’t necessarily spell disaster—the overall assets under management for Solana ETFs remain substantial, and several funds continue to attract fresh capital. The withdrawal from 21Shares might reflect profit-taking, rebalancing, or shifting allocations across issuers. But the break in momentum signals a turning point: market participants might be rethinking their exposure — now that an initial wave of enthusiasm is cooling off. For some investors, this could mark a pause before a fresh leg up; for others, it serves as a reminder that crypto capital flows remain volatile and fast-moving. Given this shift, all eyes will be on whether inflows resume in the coming days—especially as Solana’s fundamentals and the broader crypto environment evolve.

Michael Saylor Says “Bitcoin Volatility Is a Feature, Not a Bug.”

Michael Saylor, Executive Chairman of MicroStrategy Inc. (NASDAQ: MSTR), returned to the spotlight this week with a familiar message: Bitcoin’s volatility should be embraced—not feared. Speaking on X (formerly Twitter), Saylor shared a clip from his interview with CoinDesk, framing Bitcoin’s wild price swings as essential to its status as a “high-performance” asset. A Long-Term Investor’s Perspective Saylor reiterated a core principle of his investment philosophy: real Bitcoin conviction requires patience. He emphasized that an investor should have a minimum 4-year time horizon to hold Bitcoin, with 10 years being ideal. “And if you’re an equity investor in a digital equity like my company, you need that same 4 to 10-year time horizon,” Saylor said. The message is consistent with his previous stance that Bitcoin should be viewed more like digital property than a speculative trade. For Saylor, short-term dips and spikes are noise compared to Bitcoin’s multi-year growth trend. Why Volatility Matters Saylor addressed one of the most common criticisms of Bitcoin—its price turbulence. Instead of dismissing it, he reframed volatility as fundamental to Bitcoin’s identity and long-term opportunity. According to Saylor, if Bitcoin steadily increased at 2% per month with no volatility, it would become too stable, too predictable, and too easy for major institutional capital to dominate. “Warren Buffett would own all of it and there wouldn’t be an opportunity for us,” Saylor argued. His point is straightforward: volatility creates asymmetric opportunity. Because many traditional investors are risk-averse, early adopters and high-conviction holders can accumulate BTC before deep-pocketed institutions inevitably take larger positions over time. MicroStrategy’s Bitcoin Strategy Under Fire Saylor’s comments come as MicroStrategy—described by critics as a heavily leveraged Bitcoin vehicle—faces heightened scrutiny. Economist Peter Schiff recently questioned MicroStrategy’s inclusion in global equity benchmarks, due to the company’s deep correlation with Bitcoin’s price performance. Meanwhile, JPMorgan analysts warned that sustained sell-offs could put the stock at risk of being removed from major equity indices. The market pressure has been real: MSTR is down 40% over the past month. However, Saylor remains unshaken. He recently stated that as long as Bitcoin appreciates at 1.25% annually, MicroStrategy can maintain dividend payouts indefinitely and continue creating shareholder value. The 1.25% figure is remarkably conservative for an asset that has historically delivered annualized returns far exceeding traditional equities. Current Price Snapshot As of the latest trading session referenced in Saylor’s comments: The stock shows weakness across short-, mid-, and long-term pricing trends—something critics point to as evidence of risk, and supporters view as a discounted entry point. The Philosophy Behind the Vision Ultimately, Saylor’s message is not merely about Bitcoin—it is about financial philosophy. Traditional investors seek stability. Bitcoin, in contrast, thrives on volatility. Its rise has been defined by expansion through disruption rather than predictability. Saylor appears comfortable with the narrative that MicroStrategy is not a conventional software company anymore—it is an aggressive, public-market Bitcoin treasury vehicle. And unlike many corporate executives, he does not hedge his language or soften his commitments. If Bitcoin continues rising over the coming decade—a scenario Saylor sees as probable rather than speculative—today’s turbulence will be remembered not as a threat, but as the mechanism that filtered out short-term traders and rewarded disciplined holders.

Ethereum’s Block Gas Limit Has Been Raised From 45M to 60M After Over Half of Validators Signaled Support

Ethereum’s block gas limit has officially risen from 45 million to 60 million after more than half of validators signaled approval—a milestone that marks the largest execution capacity expansion on Ethereum’s base layer in years. Key Takeaways A Major Capacity Boost Driven by Community Push According to GasLimit.pics, the adjustment automatically took effect on Nov. 25, following validator consensus. Ethereum Foundation researcher Toni Wahrstätter announced the shift publicly on X, describing it as the result of a sustained collective effort: “Just a year after the community started pushing for higher gas limits, Ethereum is now running with a 60M block gas limit. That’s a 2× increase in a single year — and it’s only the beginning.” More than 513,000 validators had already switched to the higher ceiling before the change activated, effectively causing block sizes to begin drifting upward and increasing the network’s throughput. A higher gas limit simply means more operations can fit inside each block — including swaps, token transfers, NFT interactions, and smart contract transactions. This can help reduce congestion during periods of heavy on-chain activity and increase the base layer’s capacity for real economic settlement. Why Ethereum Can Safely Handle Bigger Blocks Now Independent blockchain researcher Zhixiong Pan attributed the successful expansion to three supporting factors: Pan explained that these developments together allow Ethereum to pursue more ambitious scaling on L1 without risking network reliability. Vitalik Buterin: Bigger Blocks, But Not for Everything Ethereum co-founder Vitalik Buterin supported the increase but made clear that future scaling will not be uniform. Instead, he suggested that some contract operations may become more costly in gas terms to prevent inefficient or computationally heavy calls from overloading blocks. This aligns with a more strategic approach to block growth: expand capacity while charging appropriately for high-computation interactions. As Buterin noted, the goal is to grow execution volume while maintaining operational stability. Network Throughput Hits All-Time High The timing of the block gas limit increase coincides with record-breaking network performance across Ethereum’s scaling stack. Over the past 24 hours, L2 networks collectively reached 31,000 transactions per second. The perpetuals-focused Lighter rollup led the surge with about 5,455 TPS and roughly $1.2 billion in total value locked. Base followed with around 137 TPS, with other rollups and zk-based systems contributing consistent flow. This reflects a maturing modular scaling model — with L2s absorbing most transactional traffic and mainnet serving as the execution and settlement anchor. The Road to Fusaka The increase comes just days before the Fusaka hard fork, tentatively scheduled for Dec. 3 and already active in testnet environments. Fusaka introduces PeerDAS — a redesigned data availability sampling system that Vitalik has previously called “key to Ethereum scaling.” PeerDAS is intended to improve how rollups publish data to the network, enabling more consistent bandwidth and dramatically expanding L2 capacity for users and builders. Beyond PeerDAS, Fusaka includes consensus refinements, client upgrades, and security reinforcements — all pointing toward a more scalable and resilient Ethereum. From “Pump the Gas” to Production Reality The campaign to expand the gas limit began in March 2024, when developers Eric Connor and Mariano Conti launched the “Pump The Gas” initiative. They encouraged validators, solo stakers, and community participants to push for higher base-layer capacity, arguing that the resulting throughput increase would meaningfully decrease network congestion and improve transaction costs. Momentum accelerated through late 2024 as validators began signaling support, culminating in this week’s systemwide shift. Only the Beginning With the increase to 60M now active, Ethereum leaders are framing the upgrade as the start of a longer evolution rather than a final destination. Wahrstätter called the expansion a coordinated ecosystem achievement. Buterin emphasized that Ethereum’s growth ahead will be more targeted — increasing general block space while selectively adjusting gas rules to avoid inefficiencies. What’s clear now is that Ethereum has entered a new phase of base-layer performance. Higher block capacity, combined with the upcoming Fusaka hard fork and continued rollup growth, positions the network to support larger volumes of activity — not just at L2, but directly on the main chain as well. Ethereum’s shift to 60 million gas stands as its strongest base-layer capacity expansion in four years, and the community consensus behind it suggests confidence in the network’s growing technical maturity and responsiveness to real user demand.

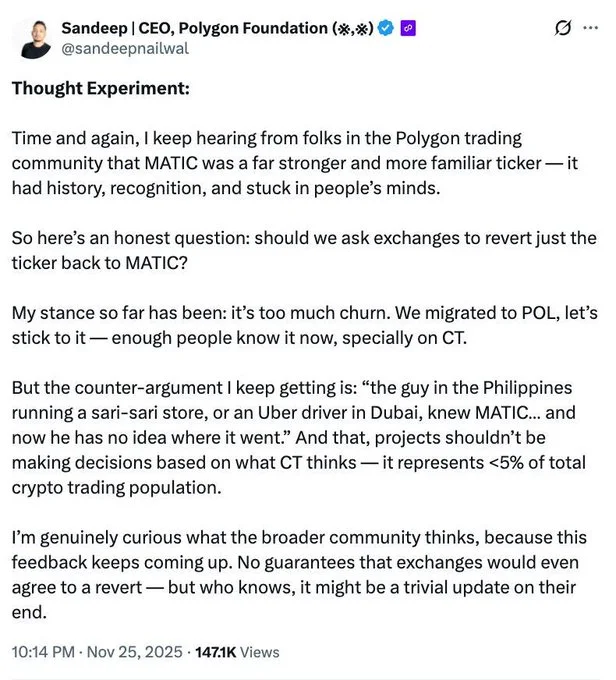

Polygon’s Co-Founder Raised the Idea of Asking Exchanges To Revert POL Back to the More Familiar MATIC Ticker

Polygon’s co-founder Sandeep Nailwal has ignited a major discussion in the crypto community after publicly floating the idea of bringing back the original MATIC ticker—just months after the ecosystem transitioned its token identity to POL under the Polygon 2.0 upgrade. Nailwal said he has consistently heard that the MATIC name remains stronger, more recognizable, and more deeply rooted in user memory compared to POL. In a candid post on X, he wrote: “Time and again, I keep hearing from folks in the Polygon trading community that MATIC was a far stronger and more familiar ticker — it had history, recognition, and stuck in people’s minds,” calling the idea a “thought experiment.” Initially, Nailwal said he opposed the idea of another change due to the disruption it could cause: “My stance so far has been: it’s too much churn. We migrated to POL, let’s stick to it—enough people know it now, especially on CT.” However, mounting feedback from traders, token holders, and ecosystem participants has compelled him to re-examine the issue. Key Takeaways MATIC’s Brand Memory vs. POL’s Intended Utility When Polygon switched from MATIC to POL in September 2024, the move was framed as a modernization step aligned with its shift toward zero-knowledge infrastructure and cross-chain liquidity via Polygon 2.0. POL was designed to expand utility, allowing holders to participate in staking, sequencing, and data availability roles. While the technical upgrade succeeded—and POL now functions as Polygon’s native gas and staking token—the branding transition has faced resistance. Users have repeatedly reported confusion when trying to locate POL on exchanges or inside their wallets. Many still instinctively search for “MATIC,” leading to mismatches, misidentification, and weaker market visibility. Even experienced traders claim the rename weakened the psychological brand strength MATIC had built for years. The older ticker was widely referenced not just within crypto circles, but among payment processors, merchants, and newer retail traders. This contrast has led to a unique situation: the network grew more advanced, but its token became less recognizable. Market Sentiment and Token Performance The frustration around the POL branding has been amplified by poor token performance. POL currently trades nearly 89% below its all-time high, further fueling dissatisfaction and criticism of the rebrand. Some traders argue the weaker name recognition contributed to poor traction among new entrants, while others believe the drop is simply market-wide pressure unrelated to branding. Still, in an ecosystem where ticker association often influences search behavior, app listings, and social visibility, naming matters—perhaps more than most projects want to admit. Polygon Community Divided Over a Possible Reversal The idea of reverting to MATIC has been met with varied reactions: The Pro-MATIC camp claims that: This sentiment is reinforced by network supporters who argue the Polygon brand is inherently tied to MATIC’s history. The Stick-With-POL group argues the opposite: A smaller group has suggested a third route entirely: introducing a completely new ticker such as PGON—representing a fresh direction without reverting to the past. Perspectives From Industry Figures Several industry participants weighed in on the debate: What Happens Next? Polygon has not announced any formal mechanism for deciding the ticker’s future. There’s no vote planned and no official community governance process initiated. This means the idea remains speculative, though publicly entertained by the network’s leadership. Nailwal also warned that even if Polygon wants to revert, exchanges might not comply or may do so slowly and inconsistently, leading to further fragmentation. He also highlighted that Crypto Twitter—despite being extremely loud—represents less than 5% of actual crypto traders, implying that real sentiment could be broader than what shows up in social media engagement. The Bigger Picture At its core, this debate is about more than letters on a screen. It’s about: MATIC built Polygon’s reputation. POL aims to position it for its future. The question is whether the network must choose one or can find a compromise without damaging momentum. For now, the conversation is ongoing, and the final outcome remains uncertain. What is clear is that Polygon is listening—publicly and openly—to what its community thinks. Whether the future token powering Polygon’s ecosystem reads as POL, MATIC, or something new entirely, the discussion represents a rare example of a major blockchain project transparently wrestling with its identity in real time.

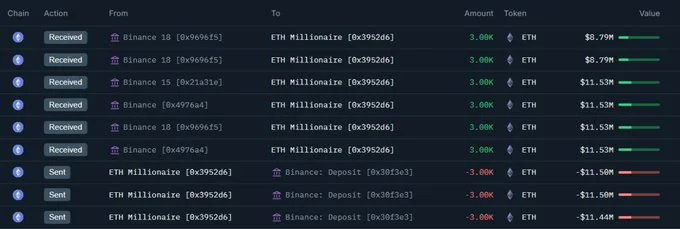

Whale Who Sold 30K $ETH at $4,202 Locking in $35.4M Profit Has Now Bought Back 18K $ETH Worth $63.65M

Ethereum has taken a beating over the past month, shedding nearly 30% of its value and even dropping below the key $3,000 support level. Many retail traders threw in the towel, convinced the bull run had died. But beneath the fear and red candles, the biggest players in the market were quietly setting up their next move. Exchange Supply Hits Historic Lows While prices declined, Ethereum’s exchange reserves fell to their lowest level ever recorded — just 16.821 million ETH. For perspective, in 2022 exchanges held nearly 25 million ETH. Even in the last six months, available exchange supply fell sharply, from 21.5 million ETH down to the current figure. This matters because coins sitting on exchanges represent potential selling pressure. When people move ETH off exchanges—generally to private wallets—it signals long-term conviction rather than an intent to sell. In simple terms: fewer ETH is available for buyers while demand may remain constant or rise. Eventually, that mismatch can push prices upward. Whales vs. Retail: Different Playbooks Analytics firm Alphractal recently noted that whale behavior has diverged sharply from retail sentiment. While smaller traders panic-sold into the drop, whales accumulated. One whale in particular made headlines: “Whale sold 30K ETH at $4,202 locking $35.4M profit Recently bought back 18K ETH worth $63.65M Action hints at renewed bullish sentiment” This move was tracked by on-chain analyst Yu Jin, who pointed to this wallet’s strategic timing. The earlier sale at $4,202 was a smart profit-taking move near the peak. The recent buyback — despite ETH trading lower — involved a smaller amount of ETH but a far larger capital outlay. This is the kind of behavior that reveals conviction, not fear. What the Move Signals Large holders don’t chase short-term rallies — they anticipate long-term value. There are several reasons why whales may see upside ahead: Retail panics. Whales plan. When a major address re-enters the market after banking millions in profit, it’s usually not random. These players have deeper data, stronger risk tolerance, and strategic timing. The Bigger Picture for ETH Ethereum’s market cap currently sits around $364 billion—down from its highs—but the fundamentals haven’t weakened. If anything, the current supply-demand setup makes ETH more scarce in the hands of those least likely to sell. As more ETH leaves exchanges and more long-term wallets accumulate, the available supply for future buyers shrinks. If demand rebounds even modestly, price movement could accelerate faster than many expect. Final Thought Retail traders often treat market dips like defeat. Whales treat them like entry points. This latest $63.65 million buy-in from a seasoned ETH whale—who previously secured a $35.4 million profit on the way up—suggests confidence, not caution. The smart money seems to be signaling one message: They expect Ethereum’s next move to be upward.

Texas Has Become the First U.S. State To Purchase Bitcoin, Investing $10 Million Into Its New Strategic Reserve

On November 20, 2025, Texas executed a $5 million purchase of Bitcoin exposure using BlackRock’s iShares Bitcoin Trust (IBIT), marking the state’s first step into the crypto treasury market. The entry point reportedly reflected a Bitcoin price of around $87,000 during a temporary market dip. With an approved allocation of $10 million, Texas has half of its reserve capacity still available for future acquisitions. This purchase stems directly from Senate Bill 21, signed into law in June 2025, which authorizes the state to hold digital assets such as Bitcoin as part of its long-term reserves. According to public filings, the law includes oversight, mandatory reporting, and regulatory compliance procedures regarding custody and transparency. Lee Bratcher, President of the Texas Blockchain Council, confirmed the transaction shortly after it was executed, noting that treasury officers had been monitoring the market and waiting for a strategic entry level. ETF First—Self-Custody Next State officials have clarified that buying IBIT shares is a transitional measure. The ETF gives Texas exposure to Bitcoin’s price movement but does not provide direct ownership of Bitcoin on-chain. A request-for-proposals process is scheduled for early 2026, during which the state will select a custodian to manage private-key holdings once Texas shifts from ETF exposure to direct self-custody. That structure is expected to include cold storage solutions—meaning offline, secure storage mechanisms. In essence, Texas bought price exposure first, and will later convert that exposure into actual Bitcoin holdings controlled by the state itself. This stepwise strategy mirrors institutional frameworks and risk-management procedures seen in major financial entities. Symbolism and Market Impact While a $10 million allocation may be small in the context of state-level financial reserves, the symbolic effect is immense. Texas is the first state to officially acknowledge Bitcoin as a treasury-grade asset—placing it conceptually alongside gold and other long-term hedges. The timing is noteworthy. Bitcoin recently endured a 40% decline from its all-time high of $127,000 before stabilizing in the low-to-mid $80,000 range. At the time of the Texas purchase, Bitcoin had dipped to around $87,000 and is now attempting to reclaim the $90,000 level ahead of month-end. Analysts believe Texas’s public endorsement of Bitcoin signals shifting sentiment—moving from speculation toward institutional acceptance. Legislators in other states are reportedly monitoring the move closely, and discussions are already underway in several jurisdictions regarding whether public funds should be diversified into digital assets. Broader Political Context Texas’s actions also reflect a national shift in policy tone. The federal government under President Trump, now in his second term, has taken a notably different posture on cryptocurrency compared to earlier years. The administration has supported state-level adoption frameworks and permitted treasury-based digital-asset accumulation programs. In Texas, this translates to the Comptroller’s office being empowered to include digital assets in long-term reserves as part of a broader financial-sovereignty strategy. Transparency and Accountability Senate Bill 21 mandates public reporting of Bitcoin reserve status, movement of funds, and custody upgrades. The state must also document any future purchases made using the remaining $5 million allocation. The reporting schedule ensures that taxpayers and lawmakers can monitor how the reserve evolves. Officials maintain the initiative is motivated by long-term financial planning rather than short-term trading. The reserve is described as a hedge against inflation, erosion of purchasing power, and exposure to national debt risk—functions typically attributed to stores of value like gold. Looking Ahead Texas’s move is more than a financial position—it is a declaration. A U.S. state is now officially treating Bitcoin as a strategic asset worth holding for the future. If other states follow—especially large-budget jurisdictions—this could drive a nationwide change in government-reserve composition. Some analysts speculate that if even a fraction of U.S. state treasuries adopt similar policies, it could deepen market liquidity, reduce sell pressure, and contribute to Bitcoin’s maturation as a recognized financial commodity. For now, Texas stands alone—but likely not for long. As one state official put it during internal briefing discussions, the intention is simple: “We’re preparing for the future—and Bitcoin is part of it.”

Bitwise Advisor Jeff Park Argues Bitcoin’s 4-Year Halving Cycle Is Over And Replaced by a 2-Year Cycle

Bitcoin’s long-held reputation for following a predictable 4-year cycle tied to its halving events is being challenged by new market forces. Bitwise advisor Jeff Park has stirred debate by suggesting that the old model — driven by supply shocks from halving — may no longer be the dominant pattern. Instead, he argues that Bitcoin is now shifting into a 2-year rhythm shaped primarily by institutional investors and ETF-driven capital flows. Halving vs. Institutional Demand For more than a decade, the halving event — which cuts block rewards to miners in half — has signaled the start of major bull movements. This played out in 2012, 2016, and 2020, with each halving followed by aggressive price expansions. However, Park claims that this historical cycle is losing relevance in the current market structure. In his view, ETF inflows and institutional fund management now exert stronger influence than mining economics. Since the launch of spot Bitcoin ETFs, billions have flowed into Bitcoin investments, reshaping demand curves and potentially outpacing the effects of reduced mining rewards. Park argues that this demand is less tied to cryptographic scarcity and more connected to financial cycles — specifically the investment rhythms of fund managers who operate on 1–2 year performance windows. ETF Flows as a Market Engine Unlike retail-driven enthusiasm of past cycles, today’s Bitcoin markets are increasingly guided by professional financial managers. Large institutions rebalance portfolios periodically, often on annual or biannual intervals tied to reporting requirements and investment cycles. This creates recurring waves of demand and profit-taking that can occur more frequently than halving milestones. Such behavior could explain price surges and corrections that don’t align cleanly with the 4-year pattern previously observed. While halvings still reduce supply, Park suggests they may now be just one factor among many — no longer the singular catalyst for Bitcoin’s macro movements. Implications for Investors If the market truly transitions into a 2-year cycle, the implications are significant: Park’s view also implies that Bitcoin is increasingly behaving like an institutional-grade asset — subject to global macro trends, asset-allocation strategies, and regulatory-influenced investment pathways. A Market Growing Up Whether one agrees with Park or not, his thesis reflects a broader reality: Bitcoin is no longer a fringe-speculative asset. It is integrated into traditional financial systems, measured with professional tools, traded through regulated products, and analyzed by market strategists. The 4-year halving model was born in a time when Bitcoin’s price moved primarily on crypto-native forces. The 2-year cycle argument represents a shift toward a market driven by capital flows, liquidity structures, and institutional psychology. As Park frames it, Bitcoin’s future rhythm may be more aligned with Wall Street’s tempo than with mining economics — and that might change how the world anticipates and interprets every movement in the crypto market.