The Decentralized Stablecoin USDD Surpasses $816M in Supply and $860M in TVL

The decentralized stablecoin USDD has crossed a notable threshold, recording fresh highs in both circulating supply and total value locked, a move that reflects growing confidence in its role within decentralized finance. “The decentralized stablecoin USDD has reached a significant milestone, with its supply surpassing $816 million. Additionally, the total value locked (TVL) in USDD has climbed to over $860 million.” USDD’s Latest Growth Signals Strong DeFi Demand USDD’s supply, now standing above $816 million, places it among the more actively used decentralized stablecoins in the market. At the same time, TVL exceeding $860 million suggests that a substantial portion of USDD is not sitting idle but is actively deployed across DeFi protocols, including lending, liquidity provision, and yield-focused applications. The gap between supply and TVL is particularly telling. A higher TVL than circulating supply often indicates that users are repeatedly committing USDD across multiple on-chain use cases, reinforcing its utility beyond simple value storage. This trend points to sustained on-chain activity rather than short-term speculation. Adoption Driven by Utility, Not Hype Unlike centralized stablecoins that rely on custodial reserves, USDD operates through decentralized mechanisms designed to maintain its peg while remaining accessible across multiple DeFi platforms. Its recent growth suggests users are increasingly comfortable using algorithmic and decentralized alternatives, especially as DeFi participation expands across different chains. Market observers note that stablecoin growth is often a leading indicator of broader DeFi activity. As traders and liquidity providers seek stability amid market volatility, capital tends to flow into stable assets that can be quickly redeployed when opportunities arise. USDD’s rising TVL aligns with this pattern, indicating it is being actively used as a base asset within DeFi strategies. What This Means for the DeFi Market USDD’s milestones come at a time when competition among stablecoins is intensifying. Achieving over $860 million in TVL places USDD in a stronger position to attract protocol integrations and deeper liquidity pools, both of which are critical for long-term relevance. “This growth highlights the increasing adoption and utilization of USDD in the decentralized finance (DeFi) ecosystem.” If current usage trends hold, USDD’s expanding footprint could further strengthen its role as a settlement and liquidity asset across DeFi, reinforcing the broader shift toward decentralized financial infrastructure.

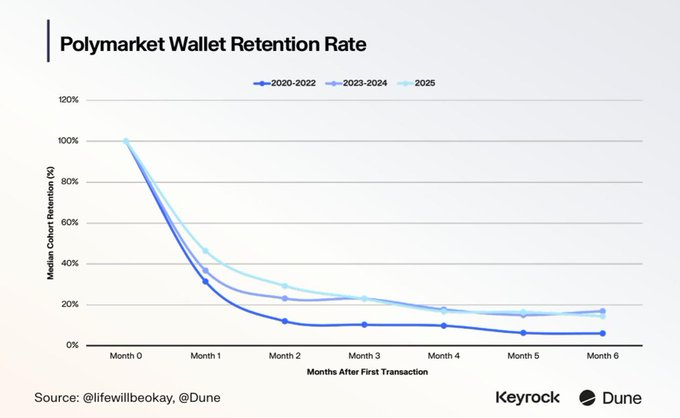

Polymarket Is Outperforming 85%+ of Crypto Protocols on User Retention

Polymarket is not just attracting users—it is keeping them, and by a wide margin. Data from a December 2025 analysis by Dune Analytics and market maker Keyrock shows that Polymarket’s average user retention rate outperforms more than 85% of crypto protocols across networks, DeFi platforms, wallets, and trading applications. In an industry where short-lived activity is common, the figures point to something deeper than temporary hype. “Among a sample of 275 crypto projects, Polymarket’s average retention outperformed over 85% of protocols.” This performance stands out at a time when many crypto products struggle to keep users engaged beyond their first month. Prediction Markets Post Explosive Growth The strong retention numbers come after a period of extraordinary growth for prediction markets. Over the last two years, monthly notional volume across major platforms surged from under $100 million to more than $13 billion—an increase of roughly 130 times. User activity expanded at a similar pace. Since early 2024, total transactions across prediction markets jumped from around 240,000 to more than 43 million, while monthly active users rose from about 4,000 to over 612,000. Polymarket played a central role in that expansion. The platform processed approximately 95 million trades during this period, accounting for around 54% of cumulative market activity. Monthly trades on Polymarket alone grew from roughly 45,000 to about 19 million, with notable spikes surrounding the 2024 U.S. presidential election and sustained momentum through October this year. What Users Are Trading On Category-level data helps explain why engagement has remained strong. According to Dune’s 2025 prediction market analysis, sports accounted for 39% of Polymarket’s total volume, followed by politics at 34% and crypto at 18%. Together, these three categories represented about 90% of all notional volume on the platform. Kalshi, Polymarket’s closest U.S.-based competitor, showed a different profile. Sports dominated its activity, contributing roughly 85% of total volume. Beyond headline categories, emerging segments also saw rapid growth. Economics-related markets expanded tenfold on Polymarket and by 905% on Kalshi. Technology and science markets grew by 1,700% on Polymarket, while open interest across both platforms was driven largely by economics, which rose 700%, and social and culture markets, up 600%. Retention: Crypto’s Persistent Weak Spot While crypto has proven effective at drawing in new users during bull cycles, sustained usage remains rare. The Dune–Keyrock study tracked monthly cohorts of new active users and measured how many returned to trade in subsequent months. The results highlighted how uncommon consistent engagement still is across the sector. “In markets where liquidity depends on frequent participation, weak retention can signal shallow growth.” Against that backdrop, Polymarket’s performance looks exceptional. Its retention metrics suggest that users are not merely speculating once and leaving, but returning repeatedly to participate in new markets. Why Prediction Markets Keep Users Coming Back Prediction markets operate differently from most crypto applications. Activity is tied directly to real-world events—elections, sports tournaments, macroeconomic releases—that unfold continuously and predictably over time. This event-driven structure creates built-in reasons for users to return. Unlike yield farming or short-term trading strategies that rely heavily on incentives, prediction markets encourage repeat participation through relevance and timing. “The engagement is linked to real-world events… creating recurring reasons for users to re-engage.” As a result, trading activity becomes habitual rather than episodic, helping platforms maintain liquidity without constant subsidies. Crypto Platforms Take Notice Polymarket’s retention advantage has not gone unnoticed. Several major crypto firms have moved to integrate or launch prediction market offerings in recent months. Coinbase is preparing to roll out tokenized equities alongside prediction markets, following reported leaks of its event-based trading interface. Wallet provider Phantom has announced a partnership with Kalshi to bring prediction markets directly into its app. Bitnomial recently received approval from the U.S. Commodity Futures Trading Commission (CFTC) to operate prediction markets and provide clearing services. Gemini has already launched its own in-house prediction market, now available across all 50 U.S. states. These moves suggest a broader industry shift. Platforms facing inconsistent engagement outside periods of high volatility appear to be searching for features that encourage steady, repeat usage. A Familiar Lesson, Revisited The idea behind prediction markets is not new. As Dune Analytics notes, the University of Iowa’s Iowa Electronic Markets, launched in 1988, consistently outperformed traditional polling in forecasting political outcomes. Later, NADEX became the first CFTC-regulated exchange to offer event-based contracts tied to economic indicators. What has changed in the 2020s is scale. Blockchain infrastructure, on-chain settlement, and clearer U.S. regulatory signals have allowed platforms like Polymarket and Kalshi to reach millions of users globally. In a sector still grappling with the challenge of long-term engagement, Polymarket’s retention data offers a rare example of sustained usage at scale. The numbers suggest that when crypto products align closely with real-world incentives and timing, users are far more likely to stay.

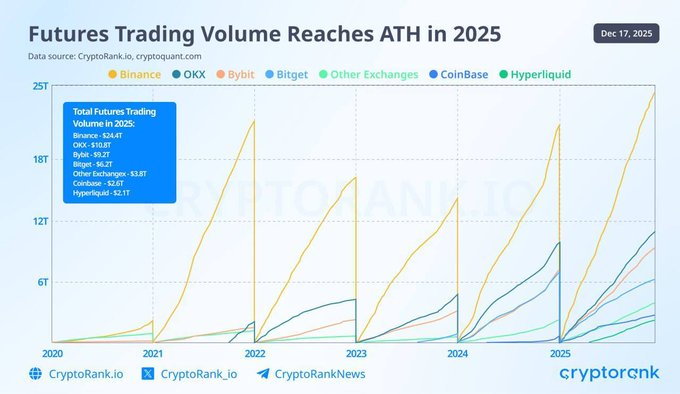

Futures Trading Volume Hit an All-Time High in 2025, Driven by On-Chain Growth Led by Hyperliquid, While CEXs Still Dominate

Cryptocurrency derivatives trading reached a fresh milestone in 2025, with perpetual futures volumes climbing to record levels. While centralized exchanges (CEXs) continue to dominate overall activity, the real story this year is the speed at which on-chain platforms are catching up. At the center of that shift is Hyperliquid, a decentralized derivatives exchange that has matched the trading intensity of some of the industry’s biggest centralized players. According to recent research from CoinGecko, Hyperliquid has processed an extraordinary amount of perpetual futures trades this year. Year-to-date perpetual futures volume on Hyperliquid has reached approximately $2.74 trillion, putting it on par with Coinbase’s derivatives activity. This figure places Hyperliquid firmly among the top global trading venues, despite operating fully on-chain and without custodial control of user funds. Why Perpetual Futures Continue to Dominate Perpetual futures have become the preferred instrument for crypto traders seeking flexibility and liquidity. Unlike traditional futures, these contracts have no expiry date, allowing positions to stay open indefinitely. Price alignment with the spot market is maintained through funding payments exchanged between long and short traders, making the product efficient for both speculation and hedging. Perpetual futures remain the most actively traded crypto derivatives, driven by deep liquidity, funding mechanisms, and the availability of high-risk, high-reward position sizing. This demand has fueled explosive growth across both centralized and decentralized platforms. Hyperliquid’s Role in the On-Chain Surge Hyperliquid’s rise highlights how decentralized infrastructure is maturing. The platform uses a fully on-chain central limit order book, rather than an automated market maker, allowing for tighter spreads and faster execution that rivals centralized exchanges. The exchange combines self-custody, low trading fees, and high-speed execution, attracting professional and high-volume traders to on-chain markets. While CEXs still command the largest share of global derivatives volume, 2025 is shaping up as a turning point. Hyperliquid’s performance shows that on-chain futures trading is no longer a niche—it is becoming a core pillar of the crypto derivatives market.