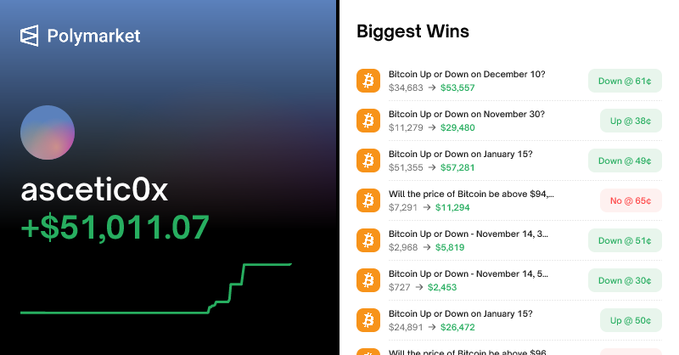

Polymarket Trader ascetic0x Turned $12 Into Over $100K by Compounding $BTC Predictions

A little-known trader operating under the name ascetic0x has stunned the crypto community after transforming just $12 into more than $100,000 on Polymarket. The achievement didn’t come from a single lucky wager, but from a series of calculated Bitcoin price predictions compounded over time on the decentralized prediction platform. Unlike high-risk strategies that rely on one oversized bet, ascetic0x followed a disciplined path. Each successful Bitcoin market call was rolled into the next position, allowing gains to stack gradually. This compounding approach mirrors traditional trading principles, but applied within a prediction market framework rather than spot or derivatives trading. Compounding Small Wins Into Six Figures The trader reportedly focused on short- to mid-term Bitcoin price direction markets, selecting outcomes with favorable probabilities rather than extreme odds. By prioritizing accuracy over payout size, ascetic0x avoided major drawdowns and maintained steady growth. “Success came from compounding accurate Bitcoin predictions instead of chasing one high-risk outcome.” This strategy highlights a key difference between prediction markets and conventional crypto trading. On platforms like Polymarket, traders are not buying or selling assets directly; they are pricing probabilities. For skilled market participants, this creates opportunities to profit from sentiment gaps, news timing, and macro signals without heavy leverage. What This Means for Prediction Markets Polymarket has seen a surge in activity in recent months, particularly around crypto-related markets. Built on blockchain infrastructure, the platform offers transparent settlement and permissionless access, features that appeal to traders seeking alternatives to centralized exchanges. “The rise of crypto-based prediction markets shows how knowledge and timing can rival technical indicators.” The ascetic0x story is already being cited as proof that small capital does not automatically limit opportunity. While such outcomes are rare and require exceptional discipline, the case underscores the growing role of prediction markets as a legitimate trading arena within crypto. For micro-traders and analysts alike, this episode reinforces a familiar lesson: consistent edge, risk control, and patience can outperform size—especially in markets where probabilities, not price charts, are the main battleground.

Dreamcash, Tether, and Selini Capital Roll Out HIP-3 Rwa Perpetuals on Hyperliquid, Collateralized With USDT

Dreamcash has moved quickly to expand the frontier of on-chain derivatives, announcing the launch of USDT-collateralized perpetual futures tied to Real World Asset (RWA) HIP-3 contracts on Hyperliquid. Rolled out on January 16, 2026, the initiative brings together Dreamcash, Tether, and Selini Capital in a coordinated effort to make sophisticated on-chain markets accessible to a wider retail audience. According to BlockBeats, the new markets are designed to run entirely on Hyperliquid while allowing traders to post USDT as collateral—removing a long-standing friction point for users accustomed to stablecoin-based trading on centralized exchanges. Key Takeaways Bridging Retail Trading Habits With On-Chain Markets The rollout reflects a broader attempt to meet retail traders where they already are. USDT remains the most widely used stablecoin globally, particularly in regions where it functions as a de facto unit of account. By supporting USDT-collateralized perpetuals, the new HIP-3 markets allow traders to move on-chain without changing how they manage capital, price risk, or track profits. Dreamcash’s role centers on distribution and usability. The platform is positioning itself as a mobile-first gateway, offering a streamlined interface that mirrors the speed and polish of mainstream fintech trading apps. The goal is not just access to on-chain markets, but a trading experience that performs reliably under real conditions—tight spreads, dependable fills, and consistent pricing during volatility. Why Perpetual Futures Matter Perpetual futures have become the dominant derivatives product in crypto, overtaking traditional options and dated futures due to their simplicity, round-the-clock trading, and built-in leverage. Their influence is now spilling into traditional finance, particularly among retail traders who favor short-dated, high-volume instruments. Data from 2025 illustrates the scale of this appetite. Same-day equity options in U.S. markets accounted for more than 61% of S&P 500 options volume in May, with retail participation estimated at roughly 54% and daily notional volumes surpassing $500 billion. The structure of perpetuals—continuous trading with no expiry—closely mirrors the immediacy retail traders seek, making them a natural candidate for tokenized real-world exposure. Hyperliquid’s HIP-3 and the Role of USDT0 Hyperliquid’s HIP-3 upgrade, introduced in October, enables permissionless deployment of perpetual markets by participants who meet staking requirements. Since launch, HIP-3 markets have generated more than $10 billion in cumulative volume within three months, underscoring strong demand for customizable on-chain derivatives. The new Dreamcash markets are built using USDT0, a cross-chain version of USDT that operates through a lock-and-mint design. Since its debut in January 2025, USDT0 has processed over $50 billion in transfers across 15 networks, maintaining a 1:1 peg with USDT while allowing capital to move efficiently between chains. Liquidity and Market Integrity A key concern for retail-facing derivatives is execution quality. To address this, Dreamcash partnered with Selini Capital, a trading firm known for institutional liquidity provision. Selini’s involvement is intended to ensure deep order books, resilient pricing, and dependable market behavior from day one—factors that often determine whether new perpetual markets gain lasting traction. On-chain data already points to rising interest in RWA-linked derivatives, and the launch of HIP-3 perpetuals backed by USDT places Dreamcash at the intersection of that trend. By combining familiar collateral, institutional liquidity, and a consumer-grade interface, the platform is betting that the next wave of retail traders will arrive on-chain without needing to relearn how they trade.

X Is Banning Rewards for Posts, Effectively Blocking “InfoFi” Projects, Says X’s Head of Product Nikita Bier

X has moved decisively to shut down a growing corner of crypto’s attention economy. The social media platform has revoked API access for applications that reward users for posting, a change that effectively blocks so-called “InfoFi” projects that pay users to generate engagement. The decision, confirmed by X’s head of product Nikita Bier, has already triggered sharp market reactions and forced major crypto analytics startups to abandon core products. The policy shift targets a model that had become widespread on Crypto Twitter: platforms tracking posts, replies, and impressions, then distributing tokens or points to users who amplified projects. While promoters framed this as a way to democratize information flow, X says the incentives produced the opposite effect. “The model created a tremendous amount of AI slop and reply spam,” Bier said, adding that the changes should quickly improve content quality once automated bots stop getting paid. According to Bier, programmatic access has already been revoked for affected developers, leaving little room for negotiation. The message was blunt: paying users to post is no longer compatible with X’s platform rules. Key Takeaways InfoFi Tokens Take an Immediate Hit Markets responded within hours. Tokens tied to InfoFi platforms sold off sharply as traders priced in the loss of their main growth engine. Kaito, Cookie DAO, BubbleMaps, Loud, Arbus, and other projects tied to engagement incentives all fell as the news spread. For many of these platforms, X was not just a distribution channel but the entire business model. Their value proposition depended on access to real-time social data and the ability to reward behavior at scale. Without API access, that loop breaks. Kaito, the most prominent player in the sector, moved quickly to confirm a strategic retreat. Founder Yu Hu announced that the company will sunset Yaps, its flagship incentivized posting product, along with its public leaderboards. In its place, Kaito plans to pivot toward a new offering called Kaito Studio, though details remain limited. The fallout has not been limited to product changes. The Kaito Yapper community, which reportedly numbered around 157,000 members, was banned on X following the policy enforcement. The $KAITO token dropped roughly 17% after the announcement, according to on-chain analysts, compounding losses that began earlier this year. Cookie, another InfoFi platform, also confirmed it would shut down Snaps, its creator campaign system, after discussions with X about API and usage policies. The company said it remains an Enterprise API customer but acknowledged that reward-based posting programs can no longer operate under the revised rules. A Model Already Under Pressure While the ban landed abruptly, the InfoFi model had been showing cracks for months. Kaito’s KAITO token launch in early 2025 sparked backlash after users discovered that accumulated Yaps points translated into far smaller token allocations than expected. Complaints quickly spread about insider-heavy tokenomics and rapid selling by early recipients, which pushed prices down and eroded trust. Those tensions worsened as generative AI tools became more accessible. Because engagement systems rewarded volume and velocity, bot networks and low-quality content farms increasingly dominated leaderboards. Long threads, generic takes, and copy-paste replies crowded out original research and thoughtful commentary. For many long-time users, Crypto Twitter became harder to read. Replies filled with templated praise, emoji spam, and automated summaries often drowned out meaningful discussion. The financial incentive to post, critics argued, warped behavior in predictable ways. X’s crackdown formalizes that critique into policy. Bier said the platform will no longer allow apps that pay users to post, citing a surge in “AI slop & reply spam,” and confirmed that terminated developers could explore migrating to rival platforms like Threads and Bluesky. Relief for Crypto Twitter, Uncertainty for Builders Reaction from traders and creators has been mixed but largely supportive of the move. Many welcomed the end of incentive farming, arguing that it hollowed out organic discourse and rewarded noise over insight. For them, the ban represents a chance to reset norms and restore credibility to crypto conversations on X. For InfoFi builders, however, the shift is existential. These projects were designed around monetizing attention on a single platform, with tokens acting as both reward and retention mechanism. Removing the ability to pay for posts forces a fundamental rethink of how value is created and captured. Some teams may attempt to pivot toward compliant partnerships, analytics tools, or off-platform products. Others may fade entirely as token prices fall and users lose interest. The speed of the market reaction suggests little patience for experiments that no longer align with X’s rules. What is clear is that the attention economy on X is changing. Tokenized rewards for posting are out. Curated, platform-approved integrations are in. Whether that leads to higher-quality crypto discourse or simply shifts incentive games elsewhere remains to be seen. For now, X has drawn a firm line. The era of getting paid to tweet about crypto projects, at least on its platform, is effectively over.

Blackrock’s Total Assets Hit a Record $14 Trillion as ETF Demand Surges

BlackRock has reached a new historic peak, pushing its total assets under management to a record $14 trillion, a milestone that underscores the accelerating demand for exchange-traded funds (ETFs) and the growing influence of institutional capital across global markets. The world’s largest asset manager reported a standout fourth quarter, with profits comfortably beating Wall Street expectations and inflows surging across both public and private investment strategies. The results arrive at a moment when investors—including those increasingly active in crypto-adjacent products—are prioritizing low-cost, liquid, and diversified exposure amid shifting monetary conditions. Key Takeaways ETF Momentum Drives Record Inflows ETFs once again proved to be the backbone of BlackRock’s growth engine. During the fourth quarter alone, long-term net inflows reached $267.8 billion, led by continued strength in the firm’s ETF business. Over the full year, BlackRock attracted a record $698 billion in total inflows, highlighting the scale at which capital is consolidating around passive and index-based strategies. Equity products brought in $126 billion during the quarter, while fixed-income funds recorded $83.8 billion in inflows, benefiting from cooling inflation and a more accommodative stance from the U.S. Federal Reserve. Investors rotated back into bond markets as yields stabilized, favoring BlackRock’s fixed-income ETFs and index offerings. This trend has direct relevance for the digital asset sector. Spot crypto ETFs and tokenized funds are increasingly viewed through the same lens as traditional ETFs—transparent, regulated vehicles that allow institutional investors to gain exposure without operational complexity. BlackRock’s dominance in this space reinforces the broader shift toward structured investment access, a theme that continues to shape crypto market participation. Earnings Beat and Shareholder Returns Financially, the quarter marked one of BlackRock’s strongest performances to date. Adjusted earnings rose to $13.16 per share, well above analyst expectations, as revenue climbed 23% year over year to $7 billion. Asset-based fees benefited from market appreciation and sustained inflows, while performance fees surged 67% to $754 million, reflecting higher contributions from private markets. Excluding one-time charges, net profit increased to $2.18 billion, compared with $1.87 billion a year earlier. BlackRock also rewarded shareholders by raising its quarterly dividend by 10% and expanding its share buyback program. The stock jumped more than 4% following the earnings release, despite having lagged the broader market earlier in the year. “BlackRock enters 2026 with accelerating momentum across our entire platform, coming off the strongest year and quarter of net inflows in our history,” CEO Larry Fink said in a statement. Private Markets Take Center Stage Beyond ETFs, BlackRock is increasingly focused on higher-margin private market strategies as it works to diversify revenue away from low-fee index products. During the quarter, its private markets division attracted $12.7 billion in inflows, contributing to a broader push into infrastructure, private credit, and real assets. The firm has committed roughly $28 billion toward major acquisitions, including Global Infrastructure Partners, HPS Investment Partners, and data provider Preqin. These deals are designed to strengthen BlackRock’s position in private credit, infrastructure equity, and institutional analytics — areas seeing rising demand as investors look beyond traditional stocks and bonds. Private assets also play a growing role in long-term portfolios, including retirement plans. BlackRock has outlined plans to integrate private market exposure into defined-contribution products, a move that could reshape how everyday investors access alternatives previously reserved for institutions. “Across the globe, clients are looking to do more with BlackRock,” Fink noted, pointing to demand spanning public markets, private mandates, and technology-driven investment solutions. Institutional Signals for Crypto Markets While BlackRock’s report centers on traditional finance, the implications for crypto markets are hard to ignore. ETFs have become the preferred bridge between institutional capital and emerging asset classes, including digital assets. The same forces driving record inflows into equity and fixed-income ETFs — cost efficiency, liquidity, and regulatory clarity — are also shaping demand for crypto-linked investment products. As BlackRock expands its ETF platform and deepens its private market footprint, its influence over capital flows continues to grow. With institutional investors increasingly comfortable allocating through familiar structures, the firm’s scale and distribution network position it as a key gatekeeper for future crypto-related investment vehicles. Despite the record-breaking asset growth, BlackRock’s shares have trailed the broader market over the past year, reflecting investor caution around rising expenses and the complexity of integrating recent acquisitions. Still, the fourth-quarter results suggest clients remain confident in the firm’s strategy. At $14 trillion in assets, BlackRock’s latest milestone is more than a headline figure. It signals where global capital is moving — toward ETFs, alternatives, and institutionally managed exposure — trends that are likely to continue shaping both traditional and crypto markets in the year ahead.

DDC Adds 200 Bitcoin to Its Balance Sheet, Bringing Total BTC Holdings to 1,383

DDC Enterprise Limited (NYSEAMERICAN: DDC) has strengthened its Bitcoin treasury with the acquisition of an additional 200 BTC, marking its first digital asset purchase of 2026 and lifting its total Bitcoin holdings to 1,383 BTC. The move reinforces the company’s steady approach to Bitcoin accumulation at a time when many firms remain cautious amid muted market sentiment. The latest purchase underscores DDC’s growing identity not just as a global Asian food platform, but also as a company that treats Bitcoin as a long-term balance sheet asset. Rather than reacting to short-term price swings, DDC continues to follow a structured treasury strategy designed to build value gradually and transparently. Key Takeaways A Calculated Start to 2026 With this transaction, DDC signals that its Bitcoin strategy remains firmly in place as the new year begins. The company disclosed that the acquisition was executed under its established governance and risk-management framework, ensuring capital deployment remains measured rather than speculative. Following the purchase, DDC’s Bitcoin position now stands at 1,383 BTC, with an average holding cost of $88,998 per Bitcoin. On a period-to-date basis, the company reports a Bitcoin yield of 16.9%, a metric often used by corporate Bitcoin holders to reflect treasury growth relative to outstanding shares. On a per-share basis, DDC now holds 0.046482 BTC for every 1,000 shares outstanding. This figure provides shareholders with a clearer view of how Bitcoin exposure translates into equity-level value, a disclosure practice increasingly adopted by public companies with digital asset treasuries. Bitcoin as a Strategic Reserve Management has repeatedly framed Bitcoin as a strategic reserve asset rather than a short-term trade. The latest purchase aligns with that position, particularly as broader crypto markets continue to trade without strong bullish momentum. While some firms pause accumulation during periods of uncertainty, DDC appears to view current conditions as an opportunity to add exposure in a controlled manner. The company emphasized that its treasury decisions are guided by long-term conviction rather than short-term market noise. “Our approach remains consistent and deliberate,” said Norma Chu, Founder, Chairwoman and CEO of DDC. “This acquisition marks our first Bitcoin purchase of 2026 and reflects the same governance-led, risk-aware framework that has guided our strategy to date. We remain confident in Bitcoin as a strategic reserve asset and committed to building durable shareholder value.” The emphasis on governance is notable. As regulators and investors pay closer attention to how public companies manage digital assets, DDC’s focus on internal controls and risk oversight positions it as a more conservative participant in the corporate Bitcoin space. Standing Out in a Quiet Market The announcement comes during a period of relatively subdued sentiment across crypto markets. Bitcoin has lacked the strong momentum seen in previous cycles, and institutional activity has been more selective. Against this backdrop, DDC’s decision to add to its holdings suggests confidence in Bitcoin’s long-term role as a store of value. Unlike companies that make large, highly publicized purchases during bullish peaks, DDC’s accumulation strategy appears incremental and disciplined. This approach may appeal to shareholders who favor balance sheet exposure to Bitcoin without excessive volatility or aggressive timing bets. By steadily increasing its holdings, DDC continues to build a sizable Bitcoin treasury that now places it among a growing group of publicly listed companies using BTC as part of their capital strategy. Looking Ahead With 1,383 BTC now on its balance sheet, DDC enters 2026 with a reinforced digital asset position and a clear message to the market: its Bitcoin strategy is not a temporary experiment. Instead, it is an ongoing component of the company’s broader financial planning. As corporate Bitcoin adoption matures, attention is likely to shift from headline-grabbing purchases to consistency, transparency, and risk management. DDC’s latest move reflects that shift, setting a measured tone for how companies can integrate Bitcoin into their treasuries while keeping long-term shareholder value in focus.