Steak ’n Shake Disclosed a $10 Million Bitcoin Purchase After Rolling Out $BTC Payments in May

Steak ’n Shake has quietly taken another step deeper into Bitcoin, disclosing a $10 million purchase that formally places the cryptocurrency on its balance sheet after eight months of accepting BTC payments across the United States. The Indianapolis-based fast-food chain confirmed over the weekend that the newly acquired Bitcoin was added to what it calls its Strategic Bitcoin Reserve, a treasury structure funded directly by customer payments made in BTC. While the company did not reveal its total Bitcoin holdings or the precise timing of the purchases, it said the $10 million figure reflects the cumulative impact of its crypto payment program since launch. “Eight months ago today, Steak n Shake launched its burger-to-Bitcoin transformation when we started accepting bitcoin payments,” the company wrote. “Our same-store sales have risen dramatically ever since.” The disclosure marks one of the clearest examples yet of a consumer-facing restaurant brand tying day-to-day payment activity to long-term Bitcoin accumulation rather than treating BTC as a passive investment. Key Takeaways From Payments to Treasury Strategy Steak ’n Shake began accepting Bitcoin payments nationwide in May 2025, using the Lightning Network to enable near-instant transactions and lower fees than traditional card processors. At the time, management framed the rollout as both a cost-cutting move and a way to connect with younger, crypto-native customers. Eight months later, the company says that strategy has created what it describes as a “self-reinforcing loop.” Customers who choose to pay with Bitcoin contribute directly to the reserve, while the resulting savings and appreciation help fund operational upgrades without pushing menu prices higher. “All bitcoin received from customers goes directly into our Strategic Bitcoin Reserve,” the company said in a social media post, adding that the model allows growth to be funded internally rather than through higher prices. At current market prices, the $10 million allocation is equivalent to roughly 105 BTC, making it Steak ’n Shake’s most explicit treasury commitment to Bitcoin to date. Sales Lift and Lower Fees The company has linked its Bitcoin acceptance to a noticeable improvement in same-store sales. According to Steak ’n Shake, locations that added BTC as a payment option saw year-over-year sales growth of more than 10% in the second quarter of 2025, followed by roughly 15% growth in the third quarter. Chief Operating Officer Dan Edwards previously told reporters that Bitcoin payments have also cut processing costs significantly. Edwards said the chain saves about 50% in processing fees when customers pay with Bitcoin compared with traditional credit cards. For an industry known for thin margins, those savings can add up quickly across hundreds of locations. Unlike card networks, Lightning Network payments settle directly, reducing intermediary fees while still offering speed and reliability at the point of sale. Branding Bitcoin on the Menu Steak ’n Shake’s crypto push has gone beyond payments and treasury management. In October, the chain introduced a Bitcoin-themed burger and a dedicated “Bitcoin Meal,” part of whose proceeds are donated to open-source Bitcoin development initiatives. Industry observers note that this type of consumer-level engagement is rare among large restaurant chains. While many public companies now hold Bitcoin as a reserve asset, few have integrated it into daily operations in a way customers can see and use. That approach appears to have helped the brand stand out in a crowded fast-food market while building loyalty among tech-savvy diners. A Small Treasury, but a Clear Signal In absolute terms, Steak ’n Shake’s Bitcoin holdings remain modest. Publicly traded firms such as Strategy hold vastly larger reserves, with Strategy alone controlling more than 687,000 BTC worth over $65 billion at current prices. Still, analysts say the significance lies less in the size of the purchase and more in how it was accumulated. Rather than allocating excess cash in a single treasury decision, Steak ’n Shake built its position through customer activity tied directly to its business model. Data from Bitcointreasuries shows that more than 4 million BTC are now held across corporate treasuries, governments, ETFs, and other institutional vehicles, highlighting steady accumulation even as adoption in retail payments remains limited. Bitcoin Market Context The announcement comes as Bitcoin itself shows renewed technical strength. Technical analyst Donald Dean said Bitcoin’s weekly chart remains in a rising channel after bouncing from long-term trendline support, keeping the broader uptrend intact. Dean wrote that Bitcoin is “time to move higher,” pointing to a potential channel target near $136,000 if price continues to respect weekly support. While Steak ’n Shake did not comment on price expectations, the timing of its disclosure aligns with growing optimism among traders and long-term holders. A Case Study for Retail Adoption Steak ’n Shake’s experience offers a rare real-world case study of Bitcoin functioning simultaneously as a payment rail, a treasury asset, and a marketing tool. By routing customer BTC payments directly into reserves and reinvesting the benefits into operations, the chain has created a feedback loop that appears to be working—at least so far. Whether other major restaurant brands follow remains to be seen. But for now, Steak ’n Shake has shown that Bitcoin can move from the balance sheet to the checkout counter and back again, all while selling burgers.

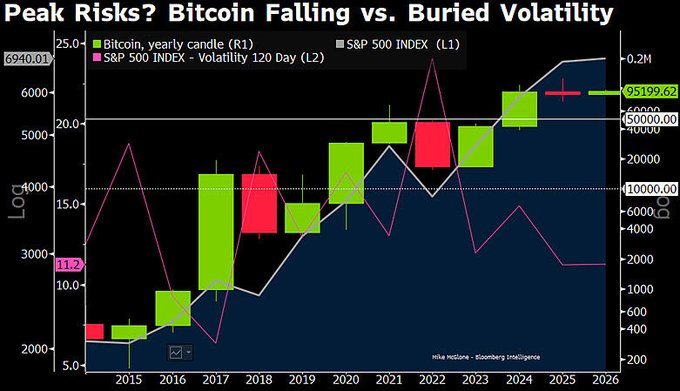

Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, Warns Bitcoin May Be Entering a Long-Term Mean Reversion

Bitcoin is facing renewed scrutiny after a fresh warning from Bloomberg Intelligence senior commodity strategist Mike McGlone, who believes the leading cryptocurrency may be approaching a prolonged period of mean reversion. His outlook raises the possibility of a deep corrective phase following what he describes as a 2025 rollover, with downside risks that could see Bitcoin retrace toward the $10,000 level. McGlone’s view is rooted in historical market behavior rather than short-term price noise. He argues that assets which significantly outperform their long-term averages often experience extended corrections as valuations normalize. In Bitcoin’s case, years of rapid appreciation, institutional adoption, and speculative inflows may now be giving way to a more sobering adjustment phase. “Bitcoin may be entering a long-term mean reversion,” McGlone cautioned, pointing to structural signals that suggest the market could be past its peak momentum for this cycle. Why the $10,000 Level Matters The $10,000 price zone is not a random figure. It has historically acted as a psychological and technical reference point for Bitcoin, marking both resistance during earlier bull markets and support during periods of stress. McGlone’s projection does not imply an imminent crash but highlights the scale of downside that could emerge if broader risk markets weaken and liquidity conditions tighten. He warned that after the 2025 rollover, Bitcoin faces “risks of a move toward $10,000,” emphasizing that mean reversion can unfold over years rather than months. Implications for Investors This warning arrives at a time when many investors remain optimistic about Bitcoin’s long-term role as a store of value and hedge against monetary debasement. However, McGlone’s analysis serves as a reminder that even widely adopted assets are not immune to cyclical drawdowns. For traders and long-term holders alike, the message is clear: risk management and realistic expectations are essential, especially as macroeconomic pressures and market maturity reshape Bitcoin’s price behavior. While Bitcoin’s long-term narrative remains intact for many proponents, McGlone’s caution underscores the possibility that the next phase may test conviction more than enthusiasm.