Tether Has Officially Launched USA₮, a US-Regulated, Dollar-Backed Stablecoin Built for the American Market

Tether has taken a major step into the regulated U.S. stablecoin market with the official launch of USA₮, a dollar‑backed digital currency designed specifically for American institutions and platforms under the newly enacted GENIUS Act. In a formal announcement on January 27, 2026, Tether confirmed that USA₮ is now live, issued by Anchorage Digital Bank, N.A., the first federally chartered digital asset bank in the United States. This issuance places the token squarely within federal oversight, addressing long‑standing regulatory gaps that have kept Tether’s flagship stablecoin—USDT—outside U.S. compliance. The introduction of USA₮ marks the culmination of Tether’s strategy to adapt to emerging U.S. stablecoin laws and offer a product that meets rigorous regulatory standards. The GENIUS Act, passed in 2025, requires dollar‑backed stablecoins to be issued by federally or state‑qualified entities and maintain strict reserve practices — conditions USA₮ is structured to satisfy. Key Takeaways A Regulated Digital Dollar for American Users Unlike USDT, which continues to serve global markets, USA₮ is purpose‑built for the U.S. financial system and designed to reassure regulators and institutional stakeholders. Tether’s leadership has underscored that the token is backed on a 1:1 basis with liquid assets, held under strict custody and oversight arrangements. Cantor Fitzgerald—a major Wall Street financial institution—has been named reserve custodian and preferred primary dealer for the stablecoin’s backing assets. Bo Hines, former Executive Director of the White House Crypto Council, is leading the initiative as CEO of Tether USA₮, bringing policy experience and regulatory insight to the project. Within hours of the launch, USA₮ began rolling out across major exchange platforms including Bybit, Crypto.com, Kraken, OKX, and MoonPay, enabling broad access for qualified institutional users. Implications for Stablecoins and U.S. Banking The emergence of USA₮ arrives amid broader debate over the role of stablecoins in the broader financial system. A recent market analysis flagged the potential for stablecoins to exert pressure on traditional bank deposits—with as much as $100 billion of U.S. deposits possibly shifting into digital dollar assets as the sector grows. Analysts point out that stablecoin reserve practices differ significantly from traditional banking. Many issuers hold the bulk of reserves in Treasury bills rather than redepositing funds into banks, which could reduce liquidity in traditional deposit systems and alter how capital circulates in the financial economy. Institutions weighing adoption will now have a regulated alternative that seeks to mitigate regulatory uncertainty, potentially boosting confidence in digital dollars backed by rigorous oversight and federal law compliance. Strategic Positioning Against Competitors The launch of USA₮ places Tether in more direct competition with existing regulated stablecoins like Circle’s USDC, which has historically dominated U.S. institutional markets due to its early alignment with regulatory expectations. By combining Tether’s global liquidity infrastructure with a federally regulated token, USA₮ aims to attract institutional capital that has previously remained circumspect about offshore stablecoin models. Tether CEO Paolo Ardoino described USA₮ as “a dollar‑backed token made in America,” tailored to institutions that require federal oversight and transparent reserve governance. A Milestone for the Dollar’s Digital Evolution The launch of USA₮ not only reinvents Tether’s U.S. strategy but also highlights a broader shift in how digital dollars can be integrated into regulated financial markets. With the GENIUS Act establishing a clear legal framework for stablecoins, the American digital currency ecosystem stands to gain new institutional trust and participation—a development that could accelerate adoption of blockchain‑based financial tools within mainstream finance. As USA₮ gains traction in the coming months, observers will watch closely to see how it influences stablecoin market share, competition with existing players, and the evolving role of digital dollars in both domestic and international finance.

Stablecoins Saw a $2.24B Outflow in 10 Days, With Funds Moving Into Gold and Silver, Both at New ATHs

Crypto markets are showing signs of shifting investor priorities as stablecoins—typically viewed as low‑volatility digital assets—experience significant capital flight. According to on‑chain analytics provider Santiment, stablecoin balances recorded a $2.24 billion outflow over the past ten days, signaling that holders are reallocating capital away from crypto cash‑like holdings into alternative assets. This movement comes during a period of heightened demand for traditional safe‑haven stores of value. Recent data highlights that both gold and silver prices have surged to unprecedented levels, reflecting broad risk‑off sentiment across global markets. Investors appear to be redirecting portions of their portfolios into hard assets amid uncertainty in traditional financial markets and fluctuating crypto activity. Precious Metals Rally Reinforces Safe‑Haven Demand Gold has repeatedly pushed past previous ceilings, climbing above the $5,100 per ounce mark in recent trading sessions—an all‑time record—as macroeconomic concerns and geopolitical risks intensify. Market participants attribute the rally to factors including a weaker U.S. dollar, elevated trade tensions, and increasing appetite for non‑yielding assets during volatile periods. Silver’s performance has been equally notable. The metal has reached fresh historic highs, briefly trading above $115 per ounce, as industrial demand and safe‑haven flows combine with speculative interest to fuel upward momentum. What This Means for Crypto Investors The stablecoin outflow captured by Santiment suggests a tactical rebalance by holders who may be locking in perceived value or seeking refuge from short‑term crypto volatility. Stablecoins typically act as a liquid alternative to cash within crypto markets, making heavy outflows a notable development. Analysts see this as part of broader market repositioning across asset classes. While cryptocurrencies like Bitcoin and Ethereum continue to trade with varying degrees of strength and consolidation, the concurrent rally in precious metals underscores a trend where traditional safe assets are drawing capital during risk‑off episodes. This pattern could signal investor caution or hedging behavior, particularly as macroeconomic indicators and geopolitical tensions remain influential. For now, the $2.24 billion reduction in stablecoin supply reflects more than just a temporary shift—it highlights how capital flows can increasingly link crypto and traditional markets, especially when investors weigh stability versus speculative returns. As markets evolve, watch for further movement between digital assets and hard stores of value, especially if gold and silver maintain their record price levels.

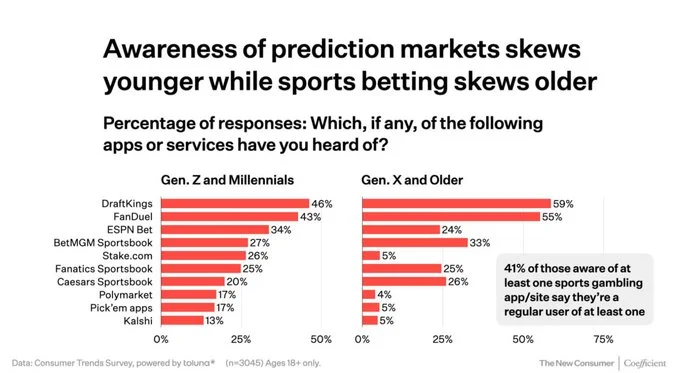

Gen Z and Millennials Are Pushing Prediction Markets Into the Mainstream

A quiet shift is taking place in how young Americans think about information, forecasting, and even finance itself. Instead of relying solely on polls, pundits, or traditional betting platforms, a growing share of Gen Z and Millennials are turning to prediction markets—and they believe these platforms are on track to become a major part of everyday culture. Recent survey data from consumer research firm The New Consumer, produced in collaboration with Coefficient Capital, shows that 31% of Americans expect prediction markets to grow into a bigger and more influential cultural force. That headline figure, however, hides a sharp generational divide. Among younger Americans, enthusiasm and awareness are far higher, signaling a long-term shift rather than a short-lived trend. “A third of young Americans think prediction markets are the future. And they’re putting their money where their mouth is.” Key Takeaways A Clear Generational Divide Prediction markets allow users to trade on the likelihood of real-world events—from elections and economic data to sports outcomes—using market prices as a signal of probability. While the concept has existed for years, it is younger consumers who are now driving adoption. According to the survey, 17% of Gen Z and Millennials are aware of Polymarket, compared with just 4% of Gen X and older respondents. Kalshi follows a similar pattern, with 13% awareness among younger users versus 5% among older generations. This gap mirrors how younger audiences gravitate toward new information platforms long before they reach the mainstream. The researchers behind the report emphasize that their work is independent. The New Consumer focuses on identifying emerging market trends and consumer behavior, and its reports—developed alongside Coefficient Capital—are not commissioned by the companies being analyzed. Capital Is Flowing In Fast The growing cultural interest is being matched by serious money. The survey, which polled more than 3,000 U.S. consumers through Toluna, arrived as prediction markets began attracting capital at a pace rarely seen in niche financial platforms. Kalshi recently raised $1 billion, pushing its valuation to $11 billion. Around the same time, Intercontinental Exchange, the owner of the New York Stock Exchange, invested $2 billion in Polymarket, valuing the platform at $9 billion. Combined, the two firms now carry an estimated $20 billion valuation. That capital is being put to work quickly. Trading volumes on both platforms have surged to record levels. “The chart has generally stayed up and to the right since the start of the year.” Kalshi is now processing roughly $1.7 billion to $2.3 billion in weekly volume, while Polymarket regularly sees $1 billion to $1.7 billion per week, based on widely cited on-chain analytics dashboards. Growth has been consistent, week after week, pointing to sustained usage rather than one-off spikes. Search Interest Signals Staying Power Public curiosity around prediction markets peaked during the 2024 U.S. election, when election-based contracts drew global attention. While search traffic cooled after the election cycle ended, interest never returned to old lows. Google Trends data shows that searches related to prediction markets are still running 20 to 30 times higher than pre-election levels. That baseline reset suggests prediction markets have crossed from novelty into ongoing relevance—especially among digital-native users who treat markets as information tools, not just betting venues. Regulation Stops Blocking—and Starts Clearing For years, regulation was the biggest obstacle facing prediction markets in the United States. That stance has softened considerably. Under CFTC Chairman Michael Selig, regulators have adopted what industry participants describe as a more forward-looking approach—signaling tolerance rather than hostility. This shift has already reshaped the landscape. Polymarket, which exited the U.S. market in 2022, returned in late 2025 with full regulatory approval. Kalshi, after winning a major legal battle against the CFTC in May 2025, gained the ability to offer federal-level election markets. While Kalshi still faces resistance from some state regulators—particularly in states with legal sports betting—the broader direction of policy is now clearer than it has been in years. For younger users, these legal battles appear to be background noise rather than deal-breakers. Prediction Markets vs. Sports Betting One of the most revealing parts of the survey asked respondents to compare the future cultural importance of sports betting and prediction markets. The results were surprisingly close. About 34% said sports betting would become more important in everyday life, while 31% said the same for prediction markets—a statistical tie. Another 38–39% believe both will largely maintain their current roles. That parity matters. Sports betting already enjoys mass adoption, major advertising budgets, and regulatory clarity in many states. For prediction markets to be mentioned in the same breath—especially by young Americans—signals a meaningful change in perception. Rather than viewing prediction markets as gambling, many younger users see them as a hybrid of finance, data analysis, and real-time forecasting. The Next Stress Test: 2026 FIFA World Cup The next major test may come sooner than expected. The 2026 FIFA World Cup is projected to generate $35 billion in bets globally, making it one of the largest betting events in history. Whether prediction markets can capture a meaningful share of that attention will help determine whether their recent momentum holds—or fades. Skeptics argue that the sector could be overheating, driven by hype, regulatory luck, and speculative capital. Supporters counter that prediction markets offer something traditional betting and media cannot: continuously updated probability signals shaped by financial incentives. For now, the data points in one direction. Awareness is rising fastest among younger generations, capital continues to pour in, and regulatory pressure has eased rather than intensified. Whether prediction markets become a core part of finance or remain a specialized tool is still an open question. But if Gen Z and Millennials are right, these markets are no longer on the fringe—and they’re not going away anytime soon.

RedotPay Card Review: Spend Crypto Anywhere + Top 5 Alternatives

Managing everyday expenses with crypto has always been tricky. Most merchants still only accept traditional currencies, which forces crypto users to juggle between exchanges, bank transfers, and long settlement times just to pay for something as simple as groceries or subscriptions. This gap is exactly what crypto debit cards aim to solve, seamlessly converting digital assets into spendable fiat at the point of purchase. In 2025, demand for crypto-linked cards continues to grow. According to recent market reports, the global crypto card market is projected to surpass $5.5 billion by 2028, driven by everyday adoption, cross-border payments, and the rise of digital wallets like Apple Pay and Google Pay. Users want a fast, borderless, and cost-efficient way to use their digital assets without friction, and that’s where cards like RedotPay step in. The RedotPay Card allows you to spend popular cryptocurrencies like BTC, ETH, USDT, and USDC directly with millions of merchants worldwide. Available in both virtual and physical formats, it integrates with digital wallets and supports global ATM withdrawals, making it a versatile option for frequent travelers and online shoppers. In this review, we’ll break down RedotPay’s features, fees, pros and cons, security, and how to get started. We’ll also highlight several top alternatives so you can compare and decide whether RedotPay is the right fit for your lifestyle. Lastly, a quick note on UEEx: this is RedotPay’s exchange platform, which acts as the backbone for wallet funding, trading, and balance management, ensuring smooth integration between your crypto and card. By the end of this guide, you’ll know exactly what RedotPay offers, how it stacks up against competitors, and whether it deserves a spot in your digital wallet. Key Takeaway What is the RedotPay Card? The RedotPay Card is a crypto-linked debit card that allows users to spend digital assets like Bitcoin (BTC), Ethereum (ETH), USDT, and USDC directly at millions of merchants worldwide. Instead of requiring a manual exchange to fiat beforehand, the card instantly converts crypto into local currency at the point of sale. This makes it a practical bridge between the digital asset ecosystem and traditional finance. RedotPay functions as a hybrid crypto-fiat debit card, available in both virtual and physical formats. The virtual card is useful for online purchases, subscriptions, and digital wallet integration, while the physical card works anywhere Mastercard/Visa is accepted, including ATMs for cash withdrawals. Licensed in Hong Kong and Singapore as a money services business, RedotPay leverages compliance and custody infrastructure to ensure security, regulatory oversight, and a smooth user experience. Unlike traditional debit or credit cards, the RedotPay Card does not require a bank account, fiat top-up, or lengthy processing. Instead, it taps directly into your crypto wallet. The conversion happens in real time, which means that you can hold digital assets until the moment of purchase. For many, this reduces exposure to inflationary fiat while still offering the flexibility of traditional cards. The card is backed by the UEEx exchange infrastructure, which powers balance management and settlement. Security is reinforced with features like two-factor authentication (2FA), encryption, and compliance-grade KYC/AML checks. It integrates with popular digital wallets (Apple Pay, Google Pay), giving users both convenience and mobility. As of 2025, the RedotPay Card is available in over 100 regions, with strong adoption in Asia, Europe, and parts of Africa. However, certain countries with restrictive crypto laws may have limited access. In short, the RedotPay Card is not just another prepaid debit card, it’s a gateway for crypto users to interact with the traditional financial world on their own terms. Quick Facts Table Feature Details Card Network Mastercard (supports both online & offline spending worldwide) Annual Fee None (no recurring monthly/annual subscription fee) APR Range Not applicable (debit/crypto card, not a credit product) Welcome Offer None (no sign-up bonus at the moment) Rewards Rate None (no cashback, points, or rewards program currently offered) Foreign Transaction Fees ~1%–1.18% per transaction (varies by network & region) Credit Check Required No (approval is based on KYC verification only) Personal Guarantee Required No (funds are crypto-backed, not credit-based) Minimum Requirements Valid ID for KYC, an active RedotPay/UEEx account, and supported crypto assets Application Timeline Instant for virtual card (issued right after KYC); 7–15 days for physical cards Key Features and Functionality of the RedotPay Card Core Features of the RedotPay Card RedotPay is positioned as a crypto-to-fiat bridge, meaning it lets users spend their digital assets like traditional money anywhere Mastercard is accepted. Here are the main highlights: Multi-Currency Support (Crypto + Fiat) The card currently supports four major cryptocurrencies (BTC, ETH, USDT, and USDC), which are auto-converted to local fiat at the point of sale. While limited in scope, this ensures stability and avoids volatility spikes. Virtual & Physical Card Options Users can get an instant virtual card for online spending after completing KYC. A physical card can also be ordered for in-store purchases, ATM withdrawals, and travel. No Pre-Top-Up Requirement Unlike many cards that require fiat deposits, RedotPay allows you to spend directly from your linked crypto wallet without needing to preload. Global Acceptance As a Mastercard, the RedotPay card works at millions of merchants worldwide—making it especially useful for frequent travelers and digital nomads. Flexible Mobile App Management The RedotPay app (integrated with UEEx) allows real-time balance checks, transaction tracking, and card controls such as freezing or unfreezing the card. Also Read: Biconomy Affiliate Program: Overview, Benefits & Commission Rewards Program One area where RedotPay falls short compared to its competitors is in the rewards and cashback department. As of mid-2025, the card does not provide any form of cashback on purchases. There is also no loyalty or points program in place, and partner discounts are not actively promoted. This lack of incentives makes RedotPay more of a utility-focused card rather than a rewards-driven one. It works well for straightforward crypto spending but does not cater to users who want extra benefits like travel points, rebates, or cashbacks. In contrast, some rival platforms such as Crypto.com and Nexo offer cashback

Revolut Card Review: Global Spending Made Easy + Top 5 Alternatives

Managing money across borders has never been simple. Traditional banks often charge high foreign transaction fees, offer poor exchange rates, and make international payments frustratingly slow. For today’s increasingly global users whether frequent travelers, remote workers, or online shoppers having a card that simplifies global spending has become more than a convenience; it’s a necessity. The market for multi-currency and fintech-driven payment cards is expanding quickly. According to industry reports, digital banking adoption has surged by over 40% in the last five years, and cross-border e-commerce continues to grow at double-digit rates annually. In this landscape, cards that offer low-cost foreign exchange, instant app control, and flexible top-ups are in high demand. The Revolut Card is one of the most recognized options in this space. It allows users to hold multiple currencies, spend abroad at interbank rates, and manage their finances in real time through a feature-rich app. Whether you’re traveling, sending money overseas, or simply looking to avoid unnecessary fees, Revolut positions itself as a practical solution. That said, Revolut is not the only option worth considering. Competitors like Wise and N26 also bring strong features, while newer entrants are carving out niches with lower fees, stronger crypto integrations, or higher limits. In this review, we’ll compare Revolut against several top alternatives to help you decide which card fits your needs best. Readers can expect a clear breakdown of features, costs, pros and cons, and an honest comparison of where Revolut stands in 2025. Additionally, we’ll briefly highlight UEEx, a fast-growing cryptocurrency exchange offering global trading options and innovative tools, for readers interested in bridging traditional finance with digital assets. Key Takeaway What is the Revolut Card? The Revolut Card is a multi-currency debit card that works alongside the Revolut app, a digital banking platform designed to simplify global money management. Unlike a traditional bank card, it’s built for flexibility—allowing users to hold, exchange, and spend multiple currencies without hidden fees. It is not a credit card but a prepaid debit card linked directly to your Revolut account balance. Revolut was founded in 2015 in the United Kingdom and quickly grew into one of the world’s most recognized fintech companies. Today, it serves over 30 million users worldwide, offering services such as currency exchange, international transfers, crypto trading, and even stock investing all managed within its mobile app. Its rapid growth reflects a growing demand for digital-first financial solutions. The Revolut Card is designed for people who live or spend money internationally. Frequent travelers use it to avoid foreign transaction fees, digital nomads rely on it to get paid in different currencies, and everyday shoppers benefit from its budgeting tools and instant spending notifications. It also appeals to younger, tech-savvy users who prefer managing money through an app instead of visiting a traditional bank branch. Unlike regular debit or credit cards from banks, Revolut provides interbank exchange rates, lower fees on international transactions, and instant in-app control (such as freezing your card or setting limits). Traditional banks may take days to process transfers or add hidden costs, while Revolut focuses on transparency and speed. The card operates on major payment networks like Visa and Mastercard, ensuring global acceptance. It is fully integrated into the Revolut mobile app, which allows users to manage accounts, exchange currencies, and track spending in real time. Security features like disposable virtual cards and two-factor authentication enhance protection. Revolut currently offers its card and services in regions including Europe, the United Kingdom, the United States, Australia, and several Asian markets, with plans to expand further. Availability may vary by country depending on local regulations. Quick Facts Table Feature Details Card Network Visa or Mastercard (varies by region) Annual Fee Free for Standard plan; Paid plans from ~$9.99/month (Premium/Metal tiers) APR Range Not applicable (prepaid debit, not a credit card) Welcome Offer No traditional sign-up bonus; occasional promotions by region Rewards Rate Cashback and perks available on higher-tier plans (varies by region) Foreign Transaction Fees None – uses interbank exchange rates with small markup on weekends Credit Check Required No – available to most users upon identity verification Personal Guarantee Required No – as it is not a credit product Minimum Requirements Must pass KYC (identity verification) and reside in an eligible country Application Timeline Sign-up in minutes via Revolut app; virtual card available instantly Overview and Types of the Revolut Card When you open a Revolut account, you’re not just getting a bank account, you’re getting access to a sophisticated payment ecosystem that adapts to your lifestyle. The Revolut card system is designed to give you maximum flexibility, whether you’re shopping online, traveling internationally, or managing your everyday expenses. Revolut offers a range of card options to suit different needs and security preferences. Each type serves a specific purpose, from everyday spending to enhanced online security. Physical Standard Card This is Revolut’s basic debit card that comes with the free Standard plan. It’s a clean, minimalist plastic card you can use for everyday purchases in stores or online. You can also use it abroad with low exchange fees, and it links directly to your Revolut app for instant tracking and control. What makes it special is its multi-currency capability. Unlike traditional bank cards that charge hefty foreign exchange fees, the Revolut standard card lets you spend in different currencies at the real exchange rate during weekdays (with small markups on weekends). The card also comes with built-in security features. Control your card’s security in a few taps – from card freezing, to setting spending limits. Lost your card? Freeze it instantly through the app. Going on vacation? Set a spending limit to avoid overspending. These controls give you peace of mind that traditional banks rarely offer. Metal Card This is Revolut’s premium, ultra-sleek Metal Card, available with the Metal subscription. It’s a stainless steel card and is available exclusively to Metal plan subscribers, this card comes in five different colors and feels substantially different from plastic cards. But it’s not just about looks. For

Coinbase Card Review: Seamless Crypto Payments + 5 Great Alternatives

As crypto moves closer to everyday use, the question many people ask is: “Can I actually spend my Bitcoin at the grocery store?” With the Coinbase Card, the answer is yes and it’s simpler than you might think. Traditional debit and credit cards are great for everyday use, but they don’t bridge the gap between digital assets and real-world transactions. That’s exactly where crypto cards step in: they let you spend crypto as easily as cash, without the headache of manually converting it every time. The demand for crypto cards is growing fast. As of 2025, over 40% of active crypto users say they prefer payment options that integrate both fiat and digital currencies. This trend is being driven by better rewards, wider acceptance at merchants, and an increased focus on user-friendly fintech solutions. One of the most talked-about options in this space is the Coinbase Card. It gives users the ability to spend their crypto directly from their Coinbase account, earn rewards on purchases, and manage everything from one app. It’s designed for users who want convenience, transparency, and a seamless way to use crypto in daily life. But Coinbase isn’t the only player. In this review, we’ll break down how the Coinbase Card works, what it offers, and its main pros and cons. We’ll also explore top alternatives, so you can compare and choose the best fit for your spending style. We’ll even touch on UEEx, a fast-growing platform known for its secure trading environment and flexible payment solutions, giving users even more options to move between crypto and traditional finance. Key Takeaway What is a Coinbase Card? The Coinbase Card is a crypto debit card that allows users to spend their digital assets as easily as they would spend cash. Instead of manually converting crypto to fiat in advance, the card instantly converts your selected cryptocurrency into local currency at the point of sale. This makes it possible to use your crypto for everyday purchases from coffee shops to online stores just like a traditional debit card. Issued by MetaBank® (Member FDIC) in partnership with Coinbase, one of the largest and most trusted cryptocurrency exchanges in the world, the Coinbase Card reflects the company’s goal of making crypto more practical and accessible. Coinbase has a strong global reputation for security and compliance, which helps increase user trust and adoption of its financial products. The target audience for this card is crypto holders who want to use their digital assets in real life without unnecessary steps or delays. It’s particularly appealing to everyday users, frequent travelers, and crypto enthusiasts who want a seamless spending experience. The card is also ideal for people who earn rewards in crypto or receive payments in digital currencies and want a quick way to access those funds. Unlike traditional debit or credit cards, the Coinbase Card doesn’t require you to top up with fiat currency from a bank account. Instead, it connects directly to your Coinbase balance, letting you choose which crypto wallet to spend from. There’s no credit check since it’s not a credit card, and all conversions happen instantly. The card operates on the Visa network, meaning it’s accepted by millions of merchants globally. Transactions are processed in real time, and users can manage their card entirely through the Coinbase app, including selecting reward preferences, locking or unlocking the card, and tracking spending activity. As of 2025, the Coinbase Card is available in most U.S. states (excluding Hawaii) and in several countries across Europe and the UK. Coinbase continues to expand its coverage, with plans to reach more regions as regulations evolve. Quick Facts Table Feature Details Card Network Visa Annual Fee $0 APR Range Not applicable (debit card, not credit) Welcome Offer None Rewards Rate Up to 4% back in crypto (varies by asset and region) Foreign Transaction Fees 0% Credit Check Required No Personal Guarantee Required No Minimum Requirements Active Coinbase account; valid ID for KYC verification Application Timeline Instant approval (in most cases); physical card delivered in 7–10 business days Key Features of the Coinbase Card The Coinbase Card isn’t just another debit card, it’s designed to make spending crypto as seamless as using cash. To understand how it stands out, let’s break down its core features, rewards structure, technology, and additional perks in detail. Instant Crypto-to-Fiat Conversion One of the biggest advantages of the Coinbase Card is its real-time conversion of crypto into local currency. When you make a purchase, Coinbase automatically converts your chosen digital asset into fiat (e.g., USD, EUR, GBP) at the current market rate. There’s no need to pre-sell your crypto or transfer funds to a bank — everything happens in seconds at the point of sale. Also Read: Coinbase Affiliate Program: Overview, Benefits & Commission Global Acceptance with Visa The card operates on the Visa network, meaning it’s accepted by millions of merchants worldwide. Whether you’re buying coffee in your neighborhood or booking a hotel abroad, the Coinbase Card works just like a regular debit card with no special merchants or platforms required. Zero Annual Fees Unlike many rewards cards, Coinbase charges no annual fee. You can use and hold the card without worrying about hidden maintenance costs, which makes it a cost-friendly option for both casual and frequent spenders. Crypto Rewards on Purchases Every eligible transaction earns crypto rewards, which can vary based on the asset you select. This means you can grow your digital portfolio simply by making everyday purchases. Multi-Asset Spending Flexibility Users can choose which crypto they want to spend from their Coinbase balance. Whether it’s Bitcoin, Ethereum, or stablecoins, you can switch between wallets directly in the app before making a transaction. Real-Time Spending Insights The Coinbase mobile app gives you instant notifications after each transaction, along with a detailed history of where and when you spent. You can also categorize transactions to keep track of expenses easily. No Foreign Transaction Fees For travelers and international users, this is a major perk. The Coinbase Card charges