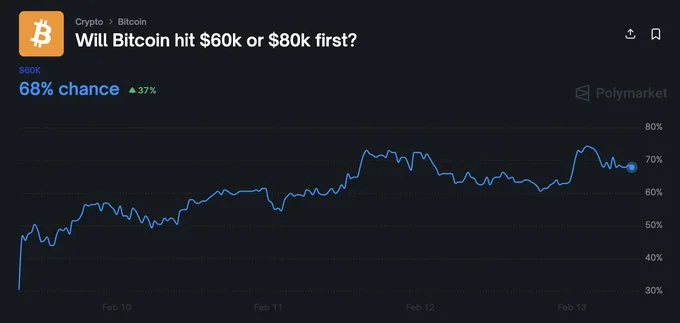

Polymarket Users Predict a 68% Chance Bitcoin Hits $60K Before $80K

Polymarket traders are currently pricing in a 68% probability that Bitcoin will touch $60,000 before reclaiming $80,000, reflecting cautious short-term sentiment as the market digests recent volatility. The odds, drawn from live positioning on Polymarket, show that participants expect further downside or at least a retest of lower levels before any sustained push higher. While prediction markets are not crystal balls, they offer a real-time window into trader conviction, especially during turbulent periods. Polymarket has seen more than $83 million in cumulative trading volume across hundreds of active Bitcoin-related markets, underscoring how closely participants are watching price action. These markets update continuously as traders buy and sell shares tied to specific outcomes, meaning the 68% figure reflects capital at risk—not casual opinion polling. Short-Term Pressure Dominates Bitcoin recently slid sharply from the $70,000 region through the $60,000 range, eventually stabilizing near the $60K area after an aggressive selloff. That decline has left the broader market tone fragile. Technically, analysts are focused on the $58,200 zone as a key support level. A decisive weekly close below that mark could expose the asset to deeper retracements, with $50,000 emerging as the next major psychological and structural support area. In that context, Polymarket’s pricing suggests traders believe a downside probe is more likely than a swift breakout toward $80,000. The current market structure supports that cautious outlook. Momentum indicators have cooled, and spot demand has yet to demonstrate the kind of strength typically associated with a strong reversal. ETF Outflows Tell a Different Story One of the more notable headwinds has been sustained capital outflows from U.S.-listed spot Bitcoin exchange-traded funds. Over a 10-day stretch, these products recorded approximately $1.19 billion in net outflows. That steady withdrawal of institutional capital contrasts with the moderate optimism implied by a 68% probability of hitting $60K first—essentially a bet on near-term stabilization rather than collapse. ETF flows often serve as a proxy for traditional investor appetite. Persistent outflows suggest institutions are reducing exposure, either locking in profits or managing risk amid macroeconomic uncertainty. Until those flows stabilize or reverse, upside momentum may remain limited. New Short-Term Markets, Faster Reactions Polymarket has also rolled out ultra-short-term markets tracking five-minute Bitcoin price movements. While these products increase engagement and liquidity on the platform, they may also amplify short-term volatility. Rapid-fire positioning can exaggerate minor price swings, particularly during low-liquidity periods. Still, short-term speculation cannot override broader liquidity trends. Institutional flows, derivatives positioning, and macroeconomic factors—such as interest rate expectations and dollar strength—remain decisive drivers for sustained moves. What the 68% Really Means A 68% probability does not imply certainty. It simply indicates that traders are willing to risk capital on the view that Bitcoin will revisit $60,000 before mounting a rally to $80,000. In probabilistic terms, that leaves meaningful room for alternative outcomes. For market participants, the key takeaway is not the headline number but the context behind it. Bitcoin is consolidating after a steep drawdown, institutional flows are negative, and technical support levels are being tested. Under those conditions, a cautious bias is understandable. Whether $60K becomes a springboard or a trapdoor will likely depend on how buyers respond at support and whether institutional demand returns. For now, prediction market pricing suggests traders are preparing for another test of lower levels before any attempt at reclaiming $80,000.

21SHARES to Distribute Staking Rewards for Its Solana ETF (TSOL), Paying $0.316871 per Share on Feb 17, 2026

21Shares has confirmed it will distribute staking rewards to investors in its Solana exchange-traded fund, marking a significant milestone for U.S.-listed crypto ETFs. Holders of the 21Shares Solana ETF (TSOL) will receive $0.316871 per share, with payments scheduled for February 17, 2026. The payout applies to shareholders on record as of February 13, 2026. According to the fund’s distribution schedule, February 12 serves as the declaration date, while February 13 marks both the ex-date and record date. The distribution represents the first time 21Shares has passed Solana staking rewards directly to U.S. ETF investors as a cash payment through traditional brokerage accounts. Key Takeaways A First for U.S. Solana ETFs TSOL, carries a 0.21% expense ratio and stakes a portion of its underlying SOL holdings through regulated custodians, including Anchorage Digital Bank, BitGo New York Trust Company, and Coinbase Custody Trust Company. With a net asset value recently around $8.01 per share, the $0.316871 payout may appear modest in dollar terms. However, the structure behind it is what sets it apart. Investors are receiving blockchain staking income without interacting with validators, managing wallets, or navigating unbonding periods. Unlike Bitcoin ETFs, which cannot generate staking yield due to Bitcoin’s proof-of-work model, Solana operates on proof-of-stake. That allows ETF issuers to stake tokens held in custody and distribute rewards to shareholders. Solana’s network staking yield has generally ranged between 5% and 8% annually, depending on validator performance and network conditions. This yield profile has become a central selling point for Solana-based ETFs in the United States. Two Competing Models: Cash vs. Reinvestment The Solana ETF market has split into two distinct approaches to staking rewards. 21Shares has opted for direct cash distributions, similar to dividend payments. Investors receive income periodically in their brokerage accounts, but each distribution may create a taxable event. By contrast, Bitwise Asset Management reinvests staking rewards in its Bitwise Solana ETF, allowing compounding to lift net asset value over time without issuing cash. This structure generally defers taxes until shares are sold. Other competitors are also competing aggressively on fees. VanEck launched its Solana ETF with a 0.30% sponsor fee but temporarily waived it on initial assets through early 2026. Grayscale Investments reduced its staking fee during a promotional window, while Franklin Templeton has waived certain staking-related fees on its Solana product for a limited period. The REX Shares and Osprey-backed Solana staking ETF entered the market with a higher expense ratio but was first to navigate the regulatory approval path. Collectively, U.S. Solana ETFs now manage approximately $1.19 billion in assets, representing roughly 1.38% of Solana’s total market capitalization as of early 2026. Tax and Structural Considerations Although staking distributions resemble dividends operationally, they are not treated as qualified dividends for U.S. tax purposes. The Internal Revenue Service generally considers staking rewards to be ordinary income based on their fair market value at the time they are received. That distinction is important for investors weighing cash distributions against reinvestment structures. A cash payout like TSOL’s may provide immediate income but can increase short-term tax liability. A reinvestment model defers taxation but offers no immediate yield payment. There are also operational risks tied to staking. Staked SOL may be subject to lock-up or unbonding periods. Validator failures or slashing events could reduce rewards or affect underlying assets. Additionally, TSOL is not registered under the Investment Company Act of 1940, meaning it does not carry all the same protections as traditional mutual funds. A Broader Shift in Crypto ETFs The TSOL payout underscores a growing divide among crypto ETFs. Bitcoin funds remain pure price-exposure vehicles with no yield component. Ethereum ETFs have begun exploring staking distributions, but Ethereum’s network yield typically sits in the 3% to 5% range—lower than Solana’s. Solana ETFs, by contrast, now offer a hybrid structure: price exposure combined with protocol-level income delivered through regulated market infrastructure. For investors, the $0.316871 distribution is more than a quarterly payment. It signals that staking income—once limited to on-chain participants—is becoming a standardized feature inside brokerage accounts. With additional quarterly distributions scheduled throughout 2026, 21Shares is positioning TSOL not just as a growth vehicle tied to SOL’s price, but as an income-generating crypto ETF competing directly with traditional yield products.