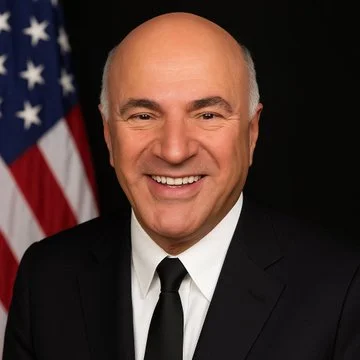

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former crypto influencer Ben Armstrong, widely known online as BitBoy. The ruling, handed down by U.S. District Judge Beth Bloom in Miami, stems from a series of social media posts published in March 2025 in which Armstrong accused O’Leary of murder and orchestrating a cover-up tied to a fatal 2019 boating accident. Court Rules Posts Were False and Defamatory In her order, Judge Bloom made clear that O’Leary was not operating the boat at the time of the 2019 collision and was never criminally charged. The accident, which occurred in Ontario, resulted in two fatalities after O’Leary’s boat struck another vessel at night. O’Leary’s wife, Linda, was charged with careless operation of a vehicle but was later acquitted following a 13-day trial. The court found that the other boat involved in the crash was operating without its navigation lights on. Despite these findings, Armstrong published multiple posts on X accusing O’Leary of being a “murderer” and claiming he had paid millions of dollars to conceal wrongdoing. According to the court’s order, those statements had no factual basis. Judge Bloom noted that Armstrong escalated his conduct by publishing O’Leary’s private phone number and encouraging followers to harass him. In the ruling, she wrote that Armstrong had: “escalated his harassment campaign” by sharing O’Leary’s private phone number and “urging his followers to ‘call a real life murderer.’” O’Leary told the court that his phone began “lighting up” after the post went live. The judge found that the disclosure of his number significantly disrupted both his professional and personal life. Armstrong’s X account was temporarily suspended for 12 hours following the incident. $2.83 Million in Damages The court entered a default judgment after Armstrong failed to respond to the complaint or appear in court. As a result, the allegations were deemed uncontested. Judge Bloom awarded: The punitive portion of the award reflects the court’s view that Armstrong’s conduct was not only defamatory but malicious. Another Legal Blow for Armstrong The ruling adds to a growing list of legal troubles for Armstrong, who was removed from the BitBoy Crypto brand in 2023 after internal disputes. Once among the most-watched crypto personalities on YouTube, his public profile has since been overshadowed by controversy. Earlier this year, Armstrong was arrested in Florida over emails he sent to a Georgia Superior Court judge while representing himself in a separate matter. He was also arrested in Georgia in July on charges related to harassing phone calls. In 2023, he was detained while livestreaming outside a former associate’s residence during a dispute involving a luxury vehicle. For O’Leary, the judgment represents a decisive legal victory and a public rebuttal of allegations that circulated widely across crypto-focused social media. The case also serves as a reminder that online influence does not shield individuals from defamation law. Even in the fast-moving world of crypto commentary, courts are increasingly willing to hold creators accountable when speech crosses into provable falsehood and targeted harassment.

Animoca Brands Secures a Virtual Asset Service Provider License in Dubai

Animoca Brands has secured a Virtual Asset Service Provider (VASP) license from Virtual Assets Regulatory Authority (VARA), clearing the Hong Kong-founded Web3 investor to expand its regulated crypto operations in Dubai and across the Middle East. The approval, recorded on VARA’s public register on Feb. 5, authorizes Animoca to provide broker-dealer services and investment management related to virtual assets in and from Dubai. The license covers institutional and qualified investors and excludes the Dubai International Financial Centre (DIFC), which operates under a separate regulatory framework. Key Takeaways Strengthening Institutional Access in Dubai With the VASP license in place, Animoca Brands can formally engage institutional capital within one of the region’s most structured digital asset regimes. The authorization enables the company to carry out brokerage, trading, management and investment services tied to digital assets under VARA’s supervision. For a firm known for backing early-stage blockchain ventures, the move signals a deeper commitment to regulated market infrastructure rather than purely venture exposure. Founded in Hong Kong, Animoca Brands has built a reputation as one of the most active Web3 investors globally. Its portfolio spans more than 600 companies and digital asset initiatives, including projects such as The Sandbox, Open Campus, and Moca Network. The firm also develops its own blockchain-based platforms and content ecosystems. Dubai’s Regulatory Momentum VARA was established in March 2022 under Dubai Law No. 4 of 2022 to regulate, supervise, and oversee virtual asset activities across Dubai’s mainland and free zones, excluding the DIFC. Since its inception, the regulator has sought to position Dubai as a compliance-driven hub for institutional crypto businesses. Animoca’s approval adds to a growing list of crypto infrastructure firms choosing Dubai as a regional base. In October 2025, digital asset infrastructure provider BitGo obtained a broker-dealer license from VARA, allowing its Middle East and North Africa arm to offer regulated trading and intermediation services to institutional clients in the emirate. At the same time, VARA has demonstrated a willingness to enforce its rulebook. The authority recently disclosed financial penalties against 19 firms for conducting unlicensed virtual asset activities and breaching its marketing regulations. The enforcement actions reinforce Dubai’s message that market access depends on regulatory compliance. A Tale of Two Regulators: VARA and DFSA While VARA oversees most of Dubai’s virtual asset ecosystem, the DIFC falls under the authority of the Dubai Financial Services Authority (DFSA). In recent weeks, the DFSA tightened its approach to privacy-focused digital assets. The regulator prohibited licensed exchanges and financial institutions within the DIFC from facilitating privacy-centric tokens such as Monero and Zcash, citing anti-money laundering and sanctions compliance risks. It also banned the use of mixers, tumblers, and other obfuscation tools designed to conceal transaction details. Additionally, the DFSA refined its definition of fiat-referenced crypto tokens, limiting the category to tokens backed by high-quality liquid assets and pegged to fiat currencies. The parallel developments highlight a broader theme in the UAE: authorities are not competing on regulatory leniency but on structured oversight. For companies like Animoca, the path to expansion runs through formal licensing rather than regulatory arbitrage. Regional Expansion and Strategic Acquisitions Animoca’s VASP license arrives shortly after the company expanded its content footprint. In January, it acquired gaming and digital collectibles company Somo, integrating Somo’s playable and tradable collectibles into its broader portfolio of blockchain-based projects. The acquisition aligns with Animoca’s strategy of combining infrastructure, digital ownership, and content distribution. Yat Siu, co-founder and executive chairman of Animoca Brands, has previously described Dubai and the UAE as among the most forward-looking jurisdictions for digital assets. According to the company, VARA has played a constructive role in guiding firms through the licensing process and encouraging regulated growth. Institutional Crypto in the Middle East The VASP license gives Animoca a formal platform to serve institutional investors from within Dubai, one of the Gulf’s leading financial centers. As global asset managers and family offices increase exposure to digital assets, regulated access points are becoming essential. For Animoca, the approval is more than a compliance milestone. It positions the firm to connect its extensive Web3 investment network with capital pools in the Middle East under a clear supervisory framework. As Dubai continues to refine its regulatory architecture—balancing innovation with enforcement—firms that secure local licenses are likely to gain a strategic edge. Animoca’s entry into VARA’s regulated ecosystem underscores a broader shift: institutional crypto growth in the region is increasingly being shaped by formal authorization rather than speculative expansion.

Scammers Are Mailing Fake Trezor and Ledger Letters With QR Codes That Lead to Phishing Sites Designed to Steal Users’ Crypto Wallet Recovery Phrases

A new campaign is targeting customers of Trezor and Ledger with physical letters that impersonate official compliance notices. The goal is simple: trick recipients into scanning QR codes that lead to phishing websites designed to steal their wallet recovery phrases—and ultimately, their funds. Unlike typical email phishing attempts, these letters arrive via postal mail, complete with company-style branding and urgent compliance language. Key Takeaways Snail Mail With a Deadline Multiple hardware wallet users have reported receiving letters that appear to come from the security or compliance teams of Trezor and Ledger. The documents claim that recipients must complete a mandatory “Authentication Check” or “Transaction Check” to avoid disruptions to wallet functionality. One letter reviewed by cybersecurity expert Dmitry Smilyanets warned Trezor users that an authentication requirement would soon become compulsory and must be completed before February 15, 2026. The notice instructed recipients to scan a QR code and finalize the process online. The letter read: It further added: A similar letter aimed at Ledger users circulated on X, warning of a mandatory “Transaction Check” with a compliance deadline of October 15, 2025. The consistent theme across both versions is urgency. Recipients are told they risk losing wallet access or facing transaction signing errors if they fail to act in time. QR Codes Lead to Fake Setup Pages Scanning the QR codes directs users to websites that closely resemble official Trezor or Ledger setup pages. In the Trezor-themed attack, victims were taken to a domain mimicking a legitimate authentication portal. The phishing site displayed a notice stating: Clicking “Get Started” led to further warnings suggesting that failure to comply could result in limited or blocked access, transaction errors, or interruptions to future updates. The final step of the process is where the theft occurs. Users are prompted to enter their 12-, 20-, or 24-word recovery phrase, supposedly to verify device ownership and activate the feature. In reality, once entered, the seed phrase is transmitted to an attacker-controlled backend endpoint. With that phrase, criminals can import the wallet onto their own device and immediately drain the assets. At the time of reporting, the Ledger-themed phishing domain had been taken offline. The Trezor-themed domain was still accessible but flagged as malicious. Why Hardware Wallet Users Are Being Targeted Recovery phrases — also known as seed phrases — are the master keys to crypto wallets. They are the human-readable representation of the private keys that control access to funds. Anyone who possesses the phrase has full control of the wallet. Hardware wallet manufacturers have long warned users never to share these phrases under any circumstances. Neither Trezor nor Ledger will ever ask customers to submit, upload, scan, or type their recovery phrase into a website. The only time a seed phrase should be entered is directly on the hardware device itself when restoring a wallet. This latest campaign raises questions about how attackers obtained victims’ home addresses. Both companies have experienced data breaches in recent years that exposed customer contact information. While it is unclear whether this campaign is directly linked to those incidents, exposed mailing data would make such targeting possible. Postal phishing campaigns remain rare compared to email scams, but they are not unprecedented. In 2021, modified Ledger devices were mailed to users in an attempt to capture recovery phrases during setup. A separate mail-based phishing wave targeting Ledger customers was reported earlier this year. A Shift in Tactics What makes this campaign particularly concerning is its use of physical mail to create legitimacy. Many users are conditioned to distrust suspicious emails, but fewer expect a phishing attempt delivered through the postal system. The use of QR codes also reduces friction. Instead of typing a suspicious web address into a browser, victims simply scan and are redirected automatically. Security professionals warn that any communication—whether digital or physical—demanding urgent action and requesting a recovery phrase should be treated as malicious. For hardware wallet users, the rule remains unchanged: your recovery phrase is your crypto. If anyone asks for it, it’s a scam. As this campaign demonstrates, attackers are willing to invest in printing, postage, and carefully staged phishing sites to obtain it.