The first thing that comes to mind when you hear Wrapped stETH is probably Ethereum staking, but there’s more going on beneath the surface. Wrapped stETH (wstETH) isn’t just another crypto token; it’s a smarter way to interact with staked ETH across DeFi protocols.

It takes the yield-generating benefits of Lido’s stETH and wraps it into a fixed-balance ERC-20 token, making it easier to use in platforms like Aave, Curve, and Balancer.

What makes this important is utility. stETH constantly rebases to reflect staking rewards, but that flexibility comes at the cost of compatibility. Wrapped stETH solves that. It allows you to hold a non-rebasing, DeFi-friendly version that still reflects your staking rewards over time.

Starting to learn new things, you’re not there yet. Let’s break down how Wrapped stETH works, what makes it different, and why it’s showing up everywhere in DeFi.

Key Takeaways

- Wrapped stETH (wstETH) is a non-rebasing token that represents staked ETH from Lido, optimized for use in DeFi.

- It maintains value growth through staking rewards without changing token balance, making it compatible with lending and liquidity protocols.

- wstETH is widely used on platforms like Aave, Curve, and Balancer for earning yield while keeping exposure to staked ETH.

- It offers better price stability and liquidity compared to many other staking derivatives, such as cbETH and rETH.

- Built on audited smart contracts and backed by staked ETH, wstETH provides strong technical security and transparency.

What is Wrapped stETH?

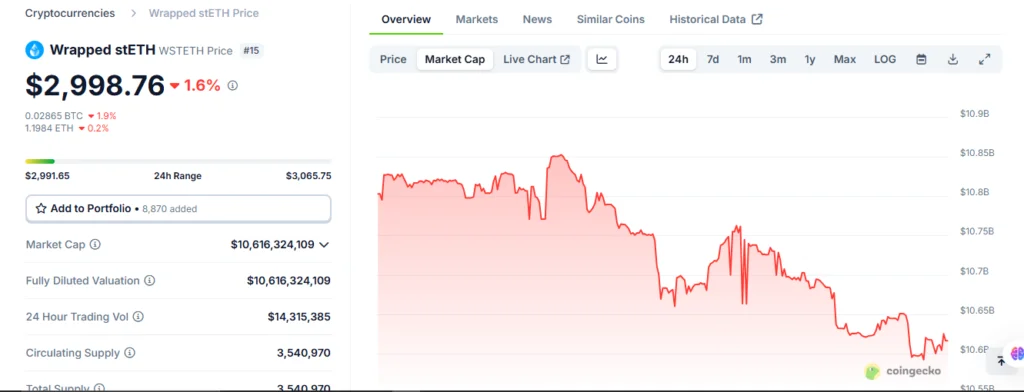

Source: CoinGecko

Wrapped stETH (wstETH) is a tokenized version of stETH, the liquid staking token issued by Lido Finance for staked Ethereum. While stETH continuously updates its balance to reflect staking rewards (a process known as “rebasing”), wstETH maintains a fixed balance and instead increases in value over time to account for those rewards.

This makes wstETH particularly useful in DeFi (Decentralized Finance) protocols that don’t support rebasing tokens. By wrapping stETH, users can seamlessly interact with DeFi platforms, such as Aave, Curve, Balancer, and Uniswap, without dealing with balance changes or technical limitations.

wstETH is fully backed 1:1 by stETH and can be unwrapped at any time. It essentially represents a user’s share of the increasing stETH pool, offering exposure to ETH staking rewards while enabling broader DeFi utility.

How Does Wrapped stETH Work?

Wrapped stETH (wstETH) works by transforming the dynamic, rebasing stETH token into a non-rebasing, fixed-balance ERC-20 token that’s easier to integrate with DeFi protocols.

Let’s break down how this process works.

Wrapping/Unwrapping Process

Source: Lido Finance

The wrapping process is straightforward and fully reversible. Users can convert their stETH into wstETH through smart contracts developed by Lido Finance or via integrated DeFi platforms and wallets, such as 1inch, MetaMask, or DeBank.

When a user wraps stETH:

- They send a specified amount of stETH to the wrapping smart contract.

- The contract calculates the current exchange rate between stETH and wstETH.

- Based on this rate, the user receives a corresponding amount of wstETH.

The key idea is this: 1 wstETH does not equal 1 stETH, but rather represents a growing amount of stETH over time. That’s because the stETH balance increases daily to reflect staking rewards, while the wstETH balance remains constant. The value of each wstETH unit, therefore, increases relative to ETH and stETH.

When a user unwraps wstETH:

- They send wstETH back to the smart contract.

- The contract calculates the current value of wstETH in terms of stETH.

- The user receives an equivalent amount of stETH, which will include the accrued staking rewards.

Connection to Lido Finance and ETH Staking

To understand wstETH, you must first understand how Lido Finance handles ETH staking. Lido allows users to stake ETH without locking it up or running a validator node themselves. When users stake ETH via Lido:

- They receive stETH in return, a liquid token that reflects their staked ETH plus rewards.

- The ETH is pooled and delegated to professional validators who secure the Ethereum network.

- Staking rewards are distributed daily and automatically increase each user’s stETH balance.

However, many DeFi protocols cannot handle stETH’s rebasing mechanism because it requires constant balance updates. This is where wstETH comes in.

Wrapped stETH is a tokenized share in the growing stETH pool. It allows users to hold a fixed amount of tokens that increase in value over time, rather than increasing in quantity.

This structure makes wstETH ideal for integration with:

- Lending platforms like Aave

- Liquidity pools on Curve and Balancer

- Yield aggregators and derivatives protocols

Smart Contract Mechanics and Value Accrual

At the core of wstETH are smart contracts that manage the conversion and valuation of stETH and wstETH. These contracts handle:

Conversion Logic

The contract maintains an exchange rate between stETH and wstETH. This rate changes daily as stETH accrues staking rewards. The conversion formulas are:

- wstETH_amount = stETH_amount / exchange_rate

- stETH_amount = wstETH_amount * exchange_rate

Accrual of Value

Since wstETH is non-rebasing, its quantity remains constant. Instead, its value per unit increases as staking rewards are added to the overall stETH pool. Holding 1 wstETH over time means you effectively own a larger share of the stETH pool, and by extension, more ETH.

Transparency and Auditability

Lido’s smart contracts are open-source and audited, allowing users to track the current exchange rate and total supply of wstETH in real-time via on-chain data or explorers such as Etherscan and Dune Analytics.

Security Features

The contracts are governed by Lido DAO, which also oversees validator selection and protocol upgrades. Additionally, slashing risks (penalties from validator misbehaviour) are socialized across the Lido pool, reducing the risk to any single user.

Read Also: Smart Contracts: A Comprehensive Beginner’s Overview

What is Wrapped stETH Used For?

Wrapped stETH (wstETH) plays a critical role in the DeFi ecosystem by unlocking utility for staked Ethereum that would otherwise be limited. Its primary purpose is to enable users to earn staking rewards while still utilizing their tokens across a wide range of DeFi protocols.

Here’s a detailed breakdown of how wstETH is used and why it’s favored over stETH in many scenarios.

Use Cases in DeFi

One of the main reasons users wrap their stETH into wstETH is to maximize capital efficiency. With wstETH, you don’t have to choose between earning ETH staking rewards and participating in DeFi—you can do both simultaneously. It is used in DeFi for:

- Lending & Borrowing: Platforms like Aave and Compound support wstETH as collateral. Users can deposit wstETH to earn interest, borrow stablecoins, or leverage their staked ETH position to gain additional exposure—all while continuing to earn staking rewards.

- Yield Farming: wstETH is used in multiple liquidity pools where users earn trading fees and protocol incentives. For instance, providing liquidity in Curve Finance’s wstETH/ETH pool allows users to collect yields from both swap fees and LDO or CRV rewards.

- Staking Derivatives and Structured Products: DeFi platforms like Pendle or Element Finance allow users to tokenize and trade the future yield of wstETH, opening up structured yield strategies and interest rate arbitrage opportunities.

Interoperability with Protocols Like Aave, Curve, Balancer

wstETH’s non-rebasing design provides it with a significant advantage in terms of compatibility. Most DeFi protocols are not equipped to handle rebasing tokens, such as stETH, because balance changes can disrupt calculations for collateral, interest rates, or yield distribution.

This is where wstETH thrives:

- Aave: wstETH is accepted as collateral in Aave V3 on Ethereum. Its predictable, non-rebasing nature makes it safer and more stable for lending and borrowing operations.

- Curve: One of the most liquid pools for ETH staking derivatives is the wstETH/ETH pool on Curve. Users can provide liquidity and earn from both volume-based fees and incentives, such as CRV and LDO tokens.

- Balancer: Balancer supports weighted pools with wstETH, enabling automated portfolio strategies and index-like baskets that include yield-bearing assets.

Because wstETH maintains a fixed token quantity, its integration with these platforms is technically straightforward and economically efficient.

Benefits of wstETH Over stETH in Liquidity and Price Stability

While both stETH and wstETH represent staked ETH, wstETH offers several clear advantages, especially when it comes to DeFi usability and stability:

- Fixed Balance: wstETH does not rebase. This is essential for protocols that rely on stable balances for accurate calculations. The token’s value increases over time, but its quantity remains constant, making it more predictable and easier to integrate.

- Improved Liquidity: Many DeFi platforms prefer wstETH due to its stability and low transaction fees. As a result, wstETH pools, especially on Curve and Balancer, often have deeper liquidity and lower slippage than those for stETH, enhancing the trading experience.

- Stable Price Peg: Unlike stETH, which sometimes deviates slightly from ETH’s price due to rebasing effects and market demand, wstETH maintains a more consistent peg by design. This makes it more attractive for long-term holders and institutional DeFi users.

- Composability: Since wstETH behaves like a standard ERC-20 token, it integrates more easily with smart contracts, aggregators, and dApps. This opens the door to more complex financial strategies and cross-platform interoperability.

Wrapped stETH Price History

Wrapped stETH (wstETH) is designed to track the value of stETH, which in turn reflects the value of staked ETH plus accumulated staking rewards.

While wstETH doesn’t have the same kind of fluctuating supply as stETH, because it’s a non-rebasing token, its price history still tells an essential story about staking dynamics, Ethereum market sentiment, and overall DeFi adoption.

Historical Price Trends and Performance

Source: Coingecko

Since its introduction by Lido Finance, wstETH has closely followed the price of Ethereum, but with a key distinction: it appreciates over time relative to ETH. That’s because wstETH doesn’t reflect staking rewards by increasing your token count—instead, each unit of wstETH becomes worth more as staking rewards accumulate.

For example, If 1 wstETH was equal to 1 ETH at inception, and staking rewards yield 5% annually, then after one year, 1 wstETH would be worth approximately 1.05 stETH, even if ETH’s price remained the same.

Historically, this has made wstETH a reliable, yield-bearing asset. During bull markets, its price surges in tandem with ETH; during downtrends, it typically holds slightly better due to the built-in staking yield, which cushions the loss.

Correlation with ETH Price and stETH Peg

The price of wstETH is tightly correlated with ETH, since both represent the same underlying asset. However, there are some distinctions:

- wstETH ≈ stETH + rewards: wstETH grows in value over time as staking rewards accrue.

- stETH ≈ ETH: stETH is designed to track ETH closely but can deviate slightly depending on market liquidity and demand.

Because wstETH is essentially a wrapper around stETH, its value is indirectly affected by both ETH’s market price and how well stETH maintains its peg.

In highly volatile markets, stETH may briefly de-peg from ETH, particularly during liquidity crunches (e.g., following the FTX crash or major sell-offs). When this happens, wstETH can also see short-term pricing dislocations—but it typically maintains a more stable valuation due to lower volatility and deeper integration in DeFi protocols.

Factors Affecting wstETH Price

While the primary driver of wstETH’s value is the performance of ETH, several other key factors influence its price and growth, which include:

Ethereum Staking Rewards

wstETH holders passively earn ETH staking rewards. These rewards, which currently average 3%–5% annually, are automatically reflected in the token’s value. As the ETH network becomes more active, staking rewards may increase, which in turn pushes up the wstETH exchange rate relative to ETH.

ETH Market Sentiment

Positive momentum in the ETH market typically lifts all staking derivatives, including wstETH. Conversely, negative sentiment may trigger selling pressure or temporary liquidity shortages, affecting wstETH’s secondary market price.

Lido Protocol Health

As wstETH is a product of Lido Finance, any news related to Lido’s governance, validator performance, audits, or smart contract risks can influence user confidence and, by extension, wstETH pricing and liquidity.

Liquidity in DeFi Markets

The availability of liquid pools (e.g., wstETH/ETH on Curve or Balancer) affects how efficiently users can trade wstETH. Low liquidity can lead to higher slippage and price deviations, particularly during large trades or periods of high market volatility.

Protocol Integrations

The adoption of wstETH by major DeFi platforms, such as Aave and Rocket Pool, has strengthened its value proposition. The more widely it’s accepted, the more demand it attracts, which supports both price stability and deeper liquidity.

How Many Wrapped stETH Are There?

Currently, as at the time of writing, there are approximately 3,540,970 wstETH in circulation, but this number fluctuates based on user conversions between stETH and wstETH. Unlike stETH, which rebases daily to reflect rewards and can grow in supply as more ETH is staked, wstETH supply only changes when users wrap or unwrap tokens.

- Total Supply: The total supply of wstETH is visible on platforms like CoinGecko, Etherscan, or the Lido dashboard.

- Circulating vs Locked: A portion of wstETH may be locked in lending protocols or liquidity pools, reducing its adequate circulating supply.

It’s important to note that each wstETH token represents a growing amount of stETH, so holding wstETH long-term means you’re continually gaining more value without minting new tokens or receiving additional rewards in your wallet.

Where to Buy and Use Wrapped stETH

Here’s where you can buy and use wstETH effectively.

Top Platforms to Buy Wrapped stETH

Lido Finance

The most direct way to obtain wstETH is through Lido’s website or official app. Users can stake ETH to receive stETH, and then instantly wrap it into wstETH using Lido’s smart contract. This method ensures complete transparency, real-time exchange rate info, and no slippage.

DeFi Aggregators & DEXs

Wrapped stETH is widely available on major decentralized exchanges and aggregators, where you can swap ETH or stablecoins for wstETH:

- 1inch – Routes your trade through the best available DEXs for optimal price.

- CowSwap – A gas-efficient DEX that supports direct wstETH swaps.

- Uniswap (v3) – Offers deep wstETH/ETH and wstETH/USDC pools.

- Curve Finance – Popular for low-slippage trading, especially in ETH/wstETH pairs.

- Balancer – Used for weighted index-like pools, including wstETH.

These platforms are best suited for users familiar with wallets like MetaMask or Ledger and those who prefer complete control of their assets.

Centralized Exchanges (CEXs)

While wrapped tokens are primarily a DeFi asset, wstETH has started appearing on a few CEXs, especially those that focus on Ethereum-native tokens:

- Binance (occasionally lists wstETH pairs; availability may vary by region)

- Kraken and Coinbase have listed stETH, but may not yet support wstETH natively. However, tokens purchased on-chain can still be transferred to wallets for use in decentralised finance (DeFi).

Where to Use Wrapped stETH

Once you’ve acquired wstETH, it can be deployed across a wide variety of DeFi platforms for lending, liquidity provision, and advanced yield strategies:

- Aave – Supply wstETH as collateral to borrow assets or earn interest.

- Curve – Join liquidity pools to earn swap fees and CRV/LDO rewards.

- Balancer – Contribute to smart index funds and liquidity pools.

- Pendle – Tokenize and trade wstETH yield separately for interest rate strategies.

- Yearn – Deposit wstETH into automated vaults to compound returns.

- Instadapp – Use wstETH in automated strategies with leverage or debt optimization.

These platforms enable users to earn passive income from staking while simultaneously generating DeFi yields, thereby increasing capital efficiency without compromising exposure to Ethereum staking rewards.

Wrapped stETH vs Other Staking Derivatives

| Feature | wstETH | cbETH | rETH | sETH2 |

| Issuer | Lido Finance | Coinbase | Rocket Pool | StakeWise |

| Rebase Token | N/A | N/A | N/A | Dual-token |

| DeFi Integration | High | Moderate | Moderate | Low |

| Decentralization | Partial | Low | High | Partial |

| Liquidity | Deep | Growing | Moderate | Limited |

| Value Accrual | Internal | Internal | Internal | Split (rETH2) |

| Use in Lending Protocols | Broad | Selective | Selective | Rare |

As Ethereum staking matures, users have multiple options for gaining exposure to staked ETH while maintaining liquidity. Wrapped stETH (wstETH), produced by Lido Finance, is one of the most widely adopted staking derivatives—but it’s not alone.

Competitors like cbETH (Coinbase ETH), rETH (Rocket Pool ETH), and sETH2 (StakeWise) offer similar benefits with distinct trade-offs.

wstETH vs stETH

- stETH is the rebase version of Lido’s staking token, where your token balance increases over time to reflect staking rewards.

- wstETH wraps stETH into a non-rebasing ERC-20 token where your balance stays fixed but the value grows.

Why wrap? wstETH is more compatible with DeFi protocols like Aave, Curve, and Balancer, which often struggle with rebase mechanics.

Choose wstETH for DeFi usage and composability. Use stETH if you’re holding long-term and not interacting with DeFi protocols.

wstETH vs cbETH (Coinbase ETH)

- cbETH is issued by Coinbase and represents ETH staked through the exchange.

- Unlike wstETH, cbETH is centralized—relying on a single entity for staking and custody.

- cbETH doesn’t maintain a 1:1 peg with ETH. Instead, its price grows over time as rewards accumulate, similar to wstETH.

- cbETH’s DeFi adoption is growing, but it is still behind wstETH, with fewer integrations and liquidity options.

wstETH offers more decentralization, DeFi utility, and on-chain transparency. cbETH may suit users who trust centralized platforms and prefer fiat on-ramps.

wstETH vs rETH (Rocket Pool ETH)

- rETH is issued by Rocket Pool, a decentralized staking protocol that allows anyone to run a node with just 16 ETH.

- rETH automatically accrues rewards and is non-rebasing, like wstETH.

- Rocket Pool prioritizes decentralization, meaning users rely less on a centralized validator set.

- However, rETH’s market liquidity is thinner, and its DeFi integrations are fewer compared to wstETH.

wstETH excels in liquidity, integrations, and composability. rETH appeals to users prioritizing decentralization and supporting Ethereum’s validator diversity.

wstETH vs sETH2 (StakeWise ETH)

sETH2 is a staking derivative from StakeWise. It operates using a dual-token model:

- sETH2 = your staked ETH

- rETH2 = your earned rewards

This structure separates capital from yield, which can be helpful for structured products. However, it adds complexity and isn’t as widely adopted in DeFi as wstETH. Liquidity for sETH2 is limited and requires more manual management.

wstETH is simpler and more widely accepted. sETH2 may appeal to advanced users or protocols that require the ability to independently manipulate staking rewards.

Is Wrapped stETH Secure?

Yes, Wrapped stETH (wstETH) is considered secure, but like any DeFi asset, its safety depends on multiple factors. It is built on audited smart contracts developed by Lido Finance, the largest Ethereum staking protocol.

The wrapping process itself is non-custodial and transparent—users retain control of their tokens, and the underlying stETH is backed 1:1 by staked ETH with validators on the Ethereum network.

Additionally, wstETH’s smart contracts have undergone multiple third-party audits, and Lido uses a distributed set of professional validators to reduce centralization risks.

However, risks such as smart contract bugs, slashing of validators, or protocol-level exploits persist. Users should assess risk tolerance and use trusted wallets and DeFi platforms when interacting with wstETH.

Read Also: 15 Best Crypto Staking Platforms For Maximum Passive Income

Final Thoughts

Wrapped stETH provides a flexible and efficient way to earn Ethereum staking rewards while remaining liquid and active across DeFi protocols. Its integration with platforms like Aave, Curve, and Balancer makes it one of the most useful staking derivatives available.

Backed by Lido and supported by audited smart contracts, wstETH combines utility with security. If you’re looking to put your ETH to work without locking it up, Wrapped stETH stands out as a smart choice. As Ethereum staking continues to grow, wstETH remains a valuable tool for maximizing yield and utility.

Frequently Asked Questions

What Does It Mean if a Token Is Wrapped?

A wrapped token represents another underlying asset on a blockchain, allowing it to be used in ecosystems or applications where the original token isn’t natively supported.

What Is Wrapped Staked Ether?

Wrapped Staked Ether (wstETH) is a token that represents staked ETH through Lido, designed for easier use in DeFi by maintaining a fixed token balance while its value increases with staking rewards.

What Is the Point of Wrapped Ethereum?

The purpose of Wrapped Ethereum (WETH) is to make ETH compatible with ERC-20 tokens, enabling it to be used seamlessly in DeFi applications, such as trading, lending, and liquidity pools.

Can a Wrapped Token Be Unwrapped?

Yes, a wrapped token can be unwrapped, converting it back to its original asset using the protocol’s smart contract or supported platform.

How to Bridge wstETH?

To bridge wstETH, use trusted cross-chain bridge platforms like Across, Orbiter Finance, or LayerZero-powered bridges. Connect your wallet, select the source and destination networks (e.g., Ethereum to Arbitrum), choose wstETH, and confirm the transaction. Always verify bridge fees and contract addresses before proceeding.