Ethereum has taken a beating over the past month, shedding nearly 30% of its value and even dropping below the key $3,000 support level. Many retail traders threw in the towel, convinced the bull run had died. But beneath the fear and red candles, the biggest players in the market were quietly setting up their next move.

Exchange Supply Hits Historic Lows

While prices declined, Ethereum’s exchange reserves fell to their lowest level ever recorded — just 16.821 million ETH. For perspective, in 2022 exchanges held nearly 25 million ETH. Even in the last six months, available exchange supply fell sharply, from 21.5 million ETH down to the current figure.

This matters because coins sitting on exchanges represent potential selling pressure. When people move ETH off exchanges—generally to private wallets—it signals long-term conviction rather than an intent to sell.

In simple terms: fewer ETH is available for buyers while demand may remain constant or rise. Eventually, that mismatch can push prices upward.

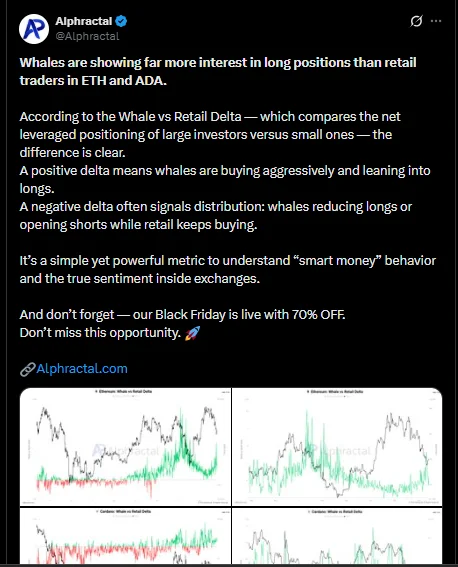

Whales vs. Retail: Different Playbooks

Analytics firm Alphractal recently noted that whale behavior has diverged sharply from retail sentiment. While smaller traders panic-sold into the drop, whales accumulated.

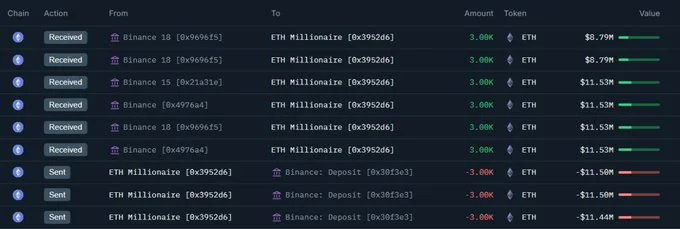

One whale in particular made headlines:

“Whale sold 30K ETH at $4,202 locking $35.4M profit

Recently bought back 18K ETH worth $63.65M

Action hints at renewed bullish sentiment”

This move was tracked by on-chain analyst Yu Jin, who pointed to this wallet’s strategic timing. The earlier sale at $4,202 was a smart profit-taking move near the peak. The recent buyback — despite ETH trading lower — involved a smaller amount of ETH but a far larger capital outlay.

This is the kind of behavior that reveals conviction, not fear.

What the Move Signals

Large holders don’t chase short-term rallies — they anticipate long-term value. There are several reasons why whales may see upside ahead:

- Shrinking liquid supply as more ETH is locked away by long-term holders

- Ethereum’s long-term utility in smart contracts, DeFi, and scaling solutions

- Potential institutional catalysts including ETH-linked financial products and staking yields

- The broader recovery expectations in crypto once market sentiment stabilizes

Retail panics. Whales plan.

When a major address re-enters the market after banking millions in profit, it’s usually not random. These players have deeper data, stronger risk tolerance, and strategic timing.

The Bigger Picture for ETH

Ethereum’s market cap currently sits around $364 billion—down from its highs—but the fundamentals haven’t weakened. If anything, the current supply-demand setup makes ETH more scarce in the hands of those least likely to sell.

As more ETH leaves exchanges and more long-term wallets accumulate, the available supply for future buyers shrinks. If demand rebounds even modestly, price movement could accelerate faster than many expect.

Final Thought

Retail traders often treat market dips like defeat. Whales treat them like entry points.

This latest $63.65 million buy-in from a seasoned ETH whale—who previously secured a $35.4 million profit on the way up—suggests confidence, not caution. The smart money seems to be signaling one message:

They expect Ethereum’s next move to be upward.

No related posts.