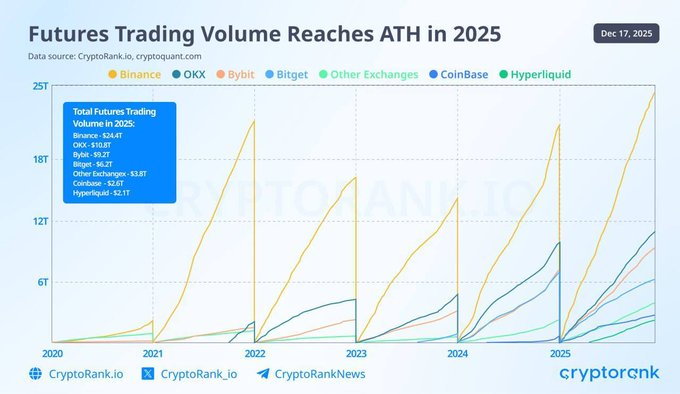

Cryptocurrency derivatives trading reached a fresh milestone in 2025, with perpetual futures volumes climbing to record levels. While centralized exchanges (CEXs) continue to dominate overall activity, the real story this year is the speed at which on-chain platforms are catching up.

At the center of that shift is Hyperliquid, a decentralized derivatives exchange that has matched the trading intensity of some of the industry’s biggest centralized players.

According to recent research from CoinGecko, Hyperliquid has processed an extraordinary amount of perpetual futures trades this year.

Year-to-date perpetual futures volume on Hyperliquid has reached approximately $2.74 trillion, putting it on par with Coinbase’s derivatives activity.

This figure places Hyperliquid firmly among the top global trading venues, despite operating fully on-chain and without custodial control of user funds.

Why Perpetual Futures Continue to Dominate

Perpetual futures have become the preferred instrument for crypto traders seeking flexibility and liquidity. Unlike traditional futures, these contracts have no expiry date, allowing positions to stay open indefinitely.

Price alignment with the spot market is maintained through funding payments exchanged between long and short traders, making the product efficient for both speculation and hedging.

Perpetual futures remain the most actively traded crypto derivatives, driven by deep liquidity, funding mechanisms, and the availability of high-risk, high-reward position sizing.

This demand has fueled explosive growth across both centralized and decentralized platforms.

Hyperliquid’s Role in the On-Chain Surge

Hyperliquid’s rise highlights how decentralized infrastructure is maturing. The platform uses a fully on-chain central limit order book, rather than an automated market maker, allowing for tighter spreads and faster execution that rivals centralized exchanges.

The exchange combines self-custody, low trading fees, and high-speed execution, attracting professional and high-volume traders to on-chain markets.

While CEXs still command the largest share of global derivatives volume, 2025 is shaping up as a turning point. Hyperliquid’s performance shows that on-chain futures trading is no longer a niche—it is becoming a core pillar of the crypto derivatives market.

No related posts.