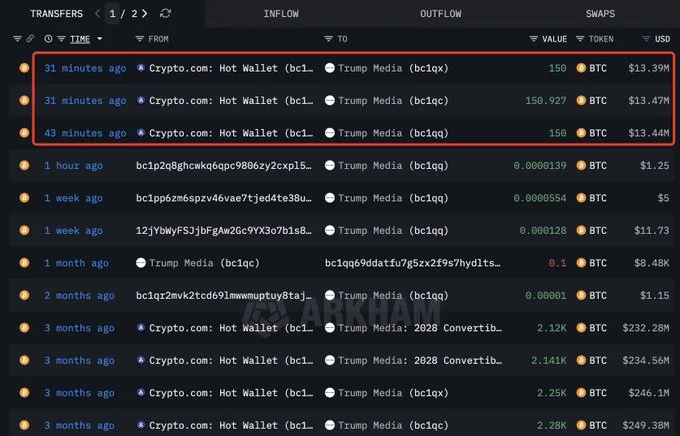

Trump Media & Technology Group has expanded its Bitcoin treasury once again, adding 451 BTC worth roughly $40 million at current market prices.

The latest purchase lifts the company’s total Bitcoin holdings to about 11,542 BTC, pushing the on-chain value of its crypto reserves beyond the $1 billion mark and reinforcing its position among the most aggressive corporate Bitcoin holders in 2025.

According to blockchain analytics firm Arkham, the acquisition was completed amid a period of heightened institutional activity in the Bitcoin market, with prices hovering near recent highs. Bitcoin was trading around $89,358 at the time of reporting, supported by strong spot volumes and sustained demand from both retail and institutional participants.

“Trump Media & Technology Group just beefed up its bitcoin portfolio, acquiring an additional 451 Bitcoin valued at roughly $40.3 million,” Arkham noted in its analysis, confirming the scale of the transaction and the company’s updated balance.

Key Takeaways

- Trump Media’s purchase of 451 BTC strengthens its position as one of the largest corporate Bitcoin holders, with total holdings now exceeding $1 billion in value.

- The steady accumulation of Bitcoin throughout 2025 signals a long-term treasury strategy rather than a short-term speculative move.

- Ongoing plans to launch a Bitcoin and Ethereum ETF show the company’s intent to expand beyond holding crypto into regulated investment products.

- The move reflects a wider 2025 trend of corporations adopting Bitcoin as a strategic balance sheet asset amid improving regulatory clarity and market infrastructure.

A Steady Build-up of Bitcoin Exposure

The purchase is not an isolated move. Throughout 2025, Trump Media has steadily increased its exposure to Bitcoin and other digital assets, signaling a deliberate shift in treasury strategy rather than a one-off speculative bet.

Public disclosures earlier this year indicated that the company held close to $2 billion in Bitcoin and related digital assets, placing crypto at the center of its balance sheet strategy.

This approach reflects a broader trend among corporations that view Bitcoin as a long-term store of value and a hedge against monetary debasement. Scarcity, transparency, and deep global liquidity have made BTC increasingly attractive to firms willing to tolerate short-term price swings in exchange for potential long-term upside.

On-chain data suggests Trump Media has been accumulating incrementally, rather than making a single outsized purchase, a strategy often used by large holders to reduce market impact and manage execution risk.

Corporate Bitcoin Treasuries in 2025

Trump Media’s latest move highlights how corporate engagement with Bitcoin has matured in 2025. Rather than treating BTC as a fringe or experimental asset, many firms now incorporate it into diversified treasury frameworks alongside cash, equities, and traditional hedging instruments.

Several factors have helped support this shift. Regulatory guidance in major jurisdictions has become clearer, even if not uniformly favorable, giving boards and executives more confidence in how digital assets should be held, disclosed, and reported.

Custody infrastructure has also improved, with institutional-grade solutions offering multi-signature security, insurance coverage, and audited controls suitable for large balance sheets.

Liquidity has been another key consideration. Deeper spot and derivatives markets allow corporate treasurers to enter or exit positions with less friction than in previous years, reducing operational risk for large allocations.

ETF ambitions and crypto product strategy

Beyond holding Bitcoin directly, Trump Media has also outlined ambitions to offer crypto-focused investment products.

In July, the company announced plans to launch the Truth Social Bitcoin and Ethereum ETF, naming Crypto.com as the exclusive custodian, prime execution agent, staking provider, and liquidity partner. Yorkville America Digital, LLC was designated as the sponsor of the fund.

“The ETF’s launch was contingent on SEC approval of a Form 19b-4 filing and the effectiveness of its registration statement,” the company said at the time, emphasizing that shares could not be bought or sold until regulatory conditions were met.

The proposed fund structure followed standard ETF mechanics, with shares issued and redeemed in blocks of 10,000 through authorized participants, using cash rather than in-kind crypto transfers. While in-kind creation and redemption were not initially included, the company left the door open to future adjustments pending regulatory clearance.

These product plans position Trump Media not only as a holder of digital assets, but also as a potential gateway for institutional and retail investors seeking regulated exposure to Bitcoin and Ethereum.

Market Reaction and Corporate Developments

Trump Media’s stock has seen sharp swings alongside these announcements. At the time of writing, shares of Trump Media & Technology Group ($DJT) were down nearly 10% on the day, reflecting broader market volatility and profit-taking.

That pullback followed a dramatic surge the previous week after the company announced an unexpected all-stock merger with TAE Technologies.

The merger, which values the combined entity at over $6 billion, marked a significant pivot for Trump Media. Shares jumped about 42% in a single session, adding more than half a billion dollars to the Trump family’s holdings, before extending gains over the following days.

The deal effectively repositioned Trump Media from a pure social media and streaming business into a fusion energy venture, with plans to develop nuclear fusion plants to support energy-intensive artificial intelligence operations. Despite the strategic shift, the company has continued to advance its crypto initiatives in parallel.

Trump Media went public in 2024 through a SPAC merger and is headquartered in Sarasota, Florida. It is led by CEO Devin Nunes and remains majority-owned by the Donald J. Trump Revocable Trust. Its operations span social networking via Truth Social, streaming through Truth+, and financial services under the Truth.Fi brand.

Bitcoin Market Backdrop

The timing of the latest Bitcoin purchase coincides with a period of strong market conditions for the asset. Bitcoin’s circulating supply stands at roughly 19.97 million BTC out of a hard-capped maximum of 21 million, reinforcing its scarcity narrative. With a market capitalization of around $1.78 trillion, Bitcoin remains the dominant digital asset by a wide margin.

Short-term volatility has moderated compared with earlier cycles, aided by deeper liquidity and increased institutional participation. That said, prices still react sharply to macroeconomic data, regulatory headlines, and large flows into or out of investment products.

For corporate holders like Trump Media, these conditions present both opportunity and risk. Rising prices can strengthen balance sheets and signal confidence, while drawdowns can introduce earnings volatility and scrutiny from investors.

What This Means for Investors

Large corporate Bitcoin purchases often serve as a signal of management’s long-term view on the asset. While an acquisition of a few hundred BTC does not materially alter global supply, it can influence market sentiment and reinforce narratives around institutional adoption.

Investors evaluating companies with sizable crypto treasuries must weigh several factors, including custody arrangements, disclosure practices, and risk management frameworks. Accounting treatment remains a key issue, as mark-to-market changes can affect reported earnings even when firms have no intention of selling their holdings.

Looking ahead, market participants will be watching for further disclosures from Trump Media, regulatory decisions affecting its proposed ETF, and broader macro developments that continue to shape crypto markets.

Conclusion

Trump Media’s addition of 451 BTC brings its total Bitcoin holdings to roughly 11,542 coins, now valued at more than $1 billion. The move underscores a defining theme of 2025: Bitcoin is no longer confined to the fringes of corporate finance, but is increasingly being adopted as a strategic treasury asset.

As regulatory pathways become clearer and infrastructure continues to improve, more companies may follow a similar path. For now, Trump Media’s growing Bitcoin balance stands as one of the most visible examples of corporate conviction in digital assets heading into 2026.

No related posts.