Internet Capital Markets (ICM) are changing the way people raise and invest money online. Anyone with an internet connection and a crypto wallet can now create a token for an idea, project, or community.

This removes the need for traditional systems like banks or venture capital firms, allowing others to buy and trade tokens quickly.

Unlike traditional markets, which often have strict rules and high barriers to entry, ICMs are open and accessible to everyone. They combine elements of crowdfunding, crypto speculation, and social media, enabling ideas to gain financial support directly from online communities.

As this space grows, new trends are shaping how these markets work and how people interact with them. This blog takes a closer look at those trends and what they might mean for the future of online finance.

Key Takeaways

- Internet Capital Markets (ICM) refer to digital platforms where ideas, projects, and communities raise and exchange value online.

- Major trends in Internet Capital Markets include tokenized fundraising, AI integration, meme and social tokens, and more.

- Tokenized fundraising lets anyone launch a project or idea without relying on traditional banks or VCs.

- Platforms like Believe.app (LAUNCHCOIN) and others offer tools for token creation and fundraising access.

- Projects like Yapper, Creator Buddy, and Kingnet AI use AI to enhance user and creator experiences.

What Is the Internet Capital Market?

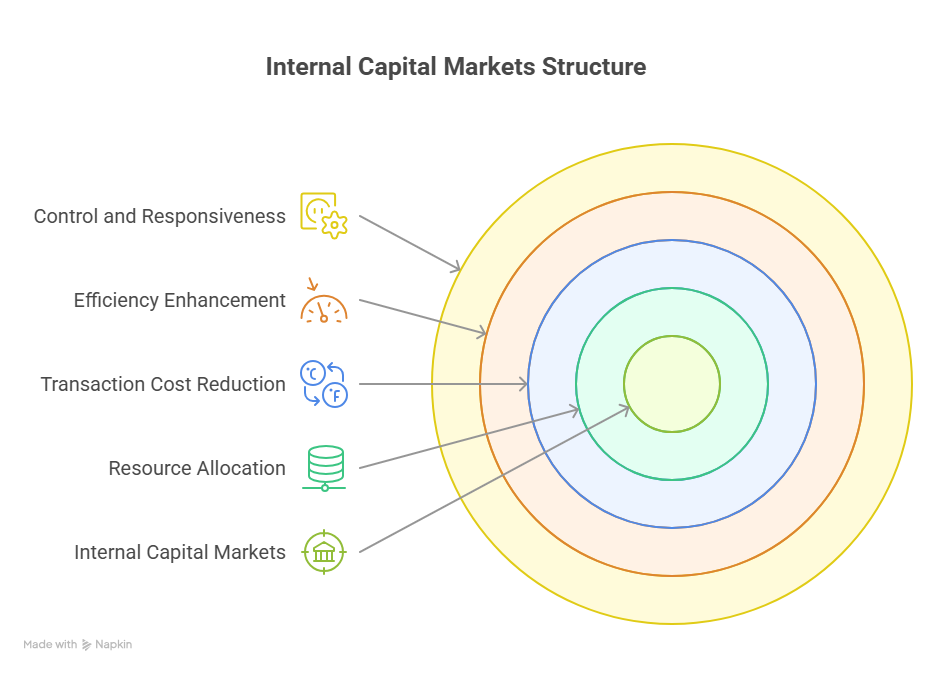

The Internet Capital Market (ICM) is a new financial system where digital ideas, projects, and even cultural trends can be turned into tradable assets using blockchain technology. In simple terms, it lets anyone create a digital token for a concept or project and offer it worldwide for people to buy and trade.

This is similar to how stocks are bought and sold on a stock exchange. However, ICM acts like a decentralized, open stock market specifically for internet-native ventures.

Unlike traditional fundraising, which often involves lengthy processes and gatekeepers like banks or venture capitalists, creators can quickly “go public” by issuing tokens.

This makes investing more accessible to a wider audience and reduces barriers such as paperwork and strict regulations. The goal of ICM is to build a global financial infrastructure that allows billions of internet users to participate in capital markets.

Anyone with a crypto wallet and internet access can invest early in projects they find promising. However, these tokens usually don’t offer traditional shareholder benefits like dividends; instead, their value often depends on community interest and market demand.

What makes ICM unique is its permissionless nature. Anyone can launch a token, and public trading generates fees that support the project’s growth.

Furthermore, ICM combines elements from earlier concepts like ICOs, meme coins, token launch platforms, and social finance marketplaces. Consequently, this creates a more democratic way to fund and trade ideas online.

Major Trends Shaping Internet Capital Markets

As Internet Capital Markets (ICM) continue to evolve, several key trends are shaping how ideas are funded, developed, and traded in this rapidly changing digital ecosystem. Here are some of the most important trends driving growth and innovation in ICM today:

Tokenized Fundraising

One of the most noticeable shifts in ICM is the rise of tokenized fundraising. Instead of going through banks or pitching venture capitalists, anyone can now launch a token to raise funds for their idea.

It doesn’t matter whether it’s a serious tech startup or a fun side project; the internet can decide what gets support. This model removes traditional challenges like legal paperwork and investor accreditation.

Projects can raise money directly from people who believe in them, often based on storytelling, not spreadsheets. Platforms like Believe.app, with its LAUNCHCOIN, help creators launch and fund their tokens in a more streamlined way.

They also automate launch processes and even share revenue, making finance more inclusive than ever. The idea is simple: if the internet likes it, it can get funded.

Artificial Intelligence

Artificial intelligence (AI) has emerged as a dominant force not only in technology but increasingly in Internet Capital Markets. AI is transforming how projects are created, managed, and funded within ICM.

Where we once used AI for customer service or basic automation, it’s now building smart contracts, creating content, and even generating full blockchain games, all with little or no code.

Several ICM projects leverage AI to build tools and platforms that benefit creators and users alike. An example is Yapper (YAPPER), which is an AI-powered content optimization tool that helps social media creators maximize engagement, especially on platforms like X (formerly Twitter).

Another example is Kingnet AI (KNET) offers a no-code AI engine for building blockchain games, opening game development to users without technical backgrounds through a collaborative web3 platform.

Thus, it is evident that the integration of AI into ICM is expanding the kinds of projects that can be funded and accelerated. This creates a more ambitious environment for innovation.

The Rise of Meme and Social Tokens

The Internet capital market is also changing what we consider “valuable”, as sometimes, a joke becomes an asset. Unlike traditional stocks that represent ownership or dividends, many ICM tokens derive value from community hype, memes, and cultural relevance.

These include social tokens tied to creators or communities and meme tokens born from internet trends. While critics argue they lack fundamentals, meme tokens like $DOGE and $PEPE highlight a new financial behavior.

Read Also: Top 27 Must See Bitcoin Memes That Went Viral

Decentralized and Permissionless Marketplaces

A core principle of ICM is its permissionless nature; anyone can launch a token or project without needing approval from regulators or gatekeepers. In traditional finance, you need approval to raise money, go public, or trade assets. However, in ICM, you don’t.

Decentralized platforms now allow anyone to launch tokens, list projects, and create marketplaces. Essentially, you can do this without needing permission from regulators or banks.

Of course, this comes with risks. Scams, rug pulls, and unchecked hype are still a problem. But newer platforms are stepping up with tools to bring more structure to the space, such as automated audits, smart contract templates, and transparent fee models.

The goal is to keep things open, but make them safer and easier to navigate.

Interoperability and Multi-Chain Ecosystems

Gone are the days when projects were bound to a single blockchain like Ethereum. Today’s ICM landscape is defined by cross-chain interoperability. This is the ability of assets and applications to move seamlessly across ecosystems like Ethereum, Solana, Base, Avalanche, and more.

Tools like bridges, Layer 0 protocols (e.g., Cosmos, Polkadot), and cross-chain DEXs (e.g., Thorchain) are empowering developers to build multi-chain applications. These tools also enable users to access liquidity wherever it’s most advantageous.

DAOs and Community Governance

Decentralized Autonomous Organizations (DAOs) are also changing how capital allocation and decision-making happen in ICM. Instead of boards and CEOs, decisions in DAOs are made collectively by token holders.

This enables more democratic governance over shared treasuries, roadmaps, and product development. For example, DAOs are being used to fund public goods and infrastructure (e.g., Gitcoin), manage large capital pools (e.g., Uniswap DAO), and more.

Global Reach and Inclusion

Perhaps the most powerful aspect of ICM is its accessibility for billions worldwide, especially those excluded from traditional capital markets. In many emerging economies, accessing venture capital, stock markets, or even basic banking services remains difficult.

Internet Capital Markets removes those barriers by eliminating paperwork, accreditation, and borders. Anyone with an internet connection can now support early-stage projects they believe in. In addition, they can launch their own tokenized ideas and also participate in communities that reflect their values.

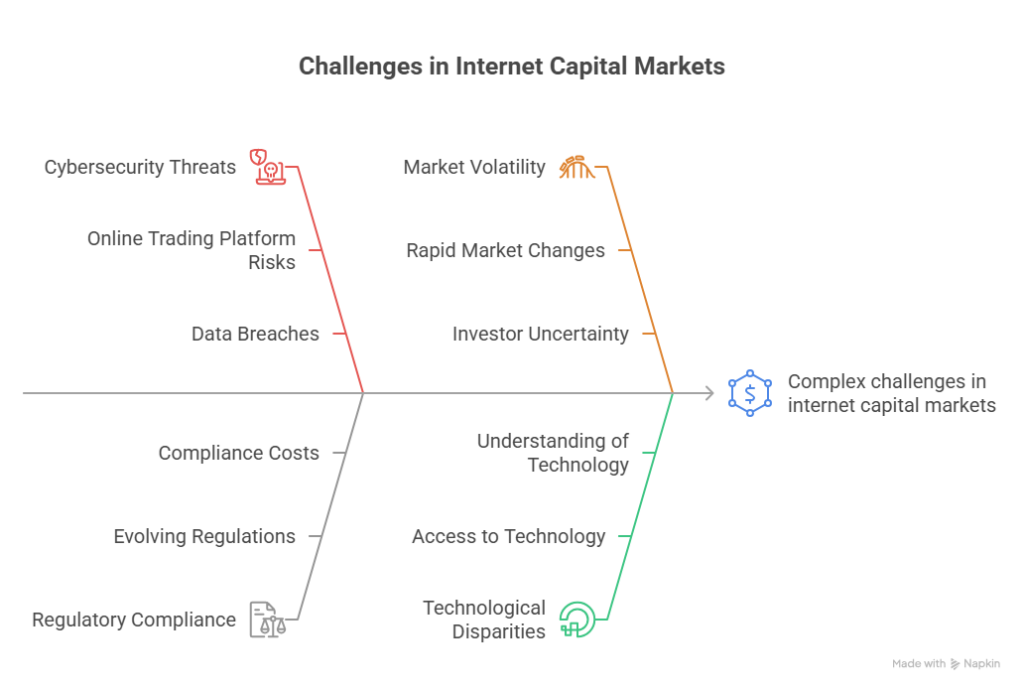

Key Challenges and Regulatory Considerations of Internet Capital Markets

While Internet Capital Markets (ICM) present several opportunities, they also face significant challenges. Below are some of the most pressing concerns:

Regulatory Uncertainty and Jurisdictional Fragmentation

A significant challenge for Internet Capital Markets is the absence of a uniform regulatory framework. Crypto assets are defined and treated differently across jurisdictions.

For example, tokens may be classified as securities in one country, commodities in another, or fall into a legal grey area altogether. This lack of consistency results in regulatory arbitrage, where projects relocate to more permissive regions. It could also lead to hesitation from traditional institutions and investors due to compliance risk.

As the ICM space matures, regulators worldwide are beginning to respond. For example, the European Union has introduced the Markets in Crypto-Assets (MiCA) regulation.

Exposure to Fraud, Scams, and Market Manipulation

The permissionless nature of ICM allows for rapid innovation but also enables malicious actors to exploit vulnerabilities. Common risks include rug pulls, pump-and-dump schemes, and impersonation scams and phishing.

Without centralized gatekeepers or strict vetting processes, retail investors are particularly vulnerable. Although some decentralized platforms are implementing verification procedures and smart contract audits, enforcement and accountability remain weak in many areas.

Lack of Standardized Disclosures and Reporting

Transparency remains a major concern within ICM. In traditional capital markets, companies are obligated to publish detailed financial statements, governance structures, and risk disclosures. However, ICM projects do not require you to disclose any verifiable information about their operations.

Many token-based ventures launch with minimal transparency regarding team identities, token distribution, funding allocation, or development roadmaps.

Although some projects voluntarily publish whitepapers, code repositories, or periodic updates, these disclosures vary significantly in quality and reliability. Without standardized reporting frameworks, it becomes difficult for investors and analysts to assess project legitimacy, compare opportunities, or track performance.

Governance Challenges in Decentralized Systems

Governance in decentralized systems, such as those operated through Decentralized Autonomous Organizations (DAOs), also has its challenges. While these systems aim to democratize decision-making, they often face low participation rates, especially in large, distributed communities.

In many cases, a small group of token holders wields disproportionate influence over protocol decisions. Consequently, this raises concerns about accountability and fairness.

Moreover, decentralized governance structures often lack formal checks and balances. Therefore, it makes them vulnerable to coordination failures, poorly designed proposals, or manipulation by well-funded entities.

The Future of Internet Capital Markets

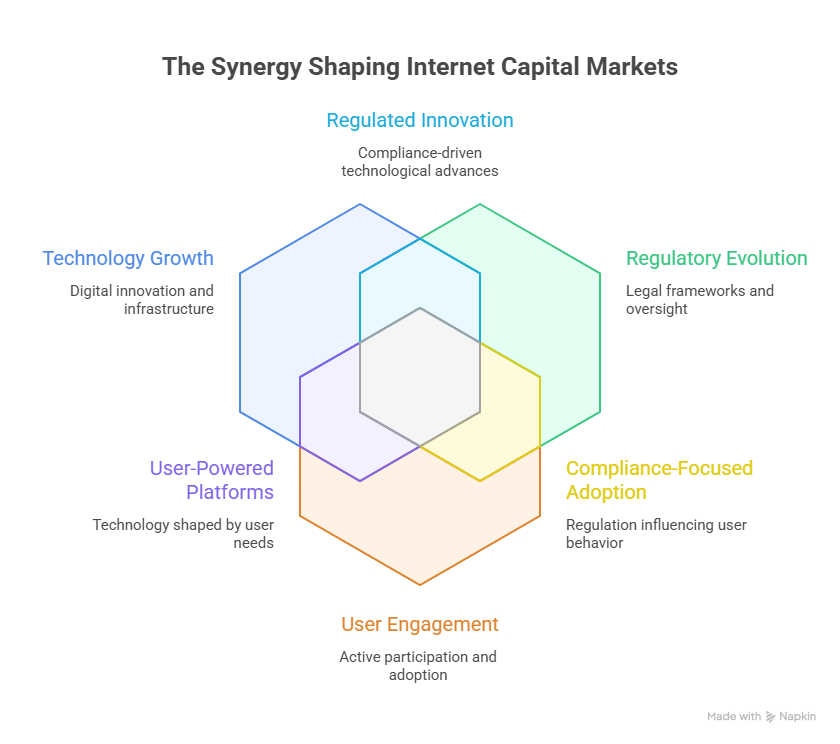

The future of Internet Capital Markets (ICM) is closely tied to the expansion of technology, regulation, and user participation.

Greater Institutional Involvement

Until recently, ICM has been dominated by retail users, startups, and crypto-native communities. However, institutional players such as asset managers, banks, and hedge funds are beginning to show interest.

Thus, their involvement is being driven by the growing legitimacy of tokenized assets, improvements in custody solutions, and regulatory frameworks like the EU’s MiCA. As a result, we can expect a gradual inflow of traditional capital into this space, bringing more liquidity, but also more scrutiny.

Regulatory Clarity

Regulation is currently one of the most significant barriers to growth. While some countries are moving toward clearer crypto laws, others continue to treat the space with uncertainty or outright hostility.

The future of ICM will therefore depend heavily on how well global regulators can balance innovation with consumer protection. A clear, coordinated approach to regulation would give investors more confidence and encourage more responsible project development.

Rise of Hybrid Models

As the lines between traditional finance (TradFi) and decentralized finance (DeFi) continue to blur, we are likely to see the rise of hybrid models.

These platforms will combine the best of both worlds: the transparency and accessibility of DeFi with the compliance and structure of traditional systems.

For example, tokenized versions of real-world assets like bonds or real estate may soon be traded on blockchain-based platforms.

Enhanced User Experience and Accessibility

Currently, participating in ICM often requires a steep learning curve. Wallets, gas fees, private keys, and complex interfaces can discourage new users.

However, the future will likely bring more intuitive platforms, mobile-first experiences, and user-friendly wallets. As infrastructure improves, participation will become easier, especially for users in emerging markets who have historically been excluded from traditional finance.

Conclusion

From everything discussed, it is evident that Internet Capital Markets have introduced new ways for people to raise money and invest in projects. Additionally, it has changed the way people participate in financial systems outside of traditional banks and stock exchanges.

With tools like tokenized fundraising, decentralized platforms, and social tokens, individuals now have more direct access to capital and investment opportunities.

Still, the space is far from perfect. Regulatory gaps, market risks, and a lack of oversight continue to raise valid concerns. For Internet Capital Markets to grow in a sustainable and trustworthy way, there needs to be a balance between innovation and accountability.

Frequently Asked Questions(FAQs)

What are Internet Capital Markets (ICM)?

Internet Capital Markets refer to digital platforms and ecosystems where capital is raised, allocated, and traded using internet-native tools like cryptocurrencies, tokens, and decentralized protocols.

How Is Tokenized Fundraising Different From Traditional Fundraising?

Tokenized fundraising allows projects to raise capital by issuing digital tokens directly to the public, without needing approval from banks or venture capital firms. This method lowers entry barriers and speeds up access to funding, especially for early-stage or unconventional ideas.

Is Investing In ICM Projects Safe?

Investing in ICM comes with higher risk due to limited regulation, frequent volatility, and the possibility of scams or failed projects. You should do your own research (DYOR) and be cautious, especially when participating in new or unvetted projects.

Can Anyone Launch A Token Or Project In ICM?

Yes, most ICM platforms are permissionless, meaning anyone with basic technical knowledge can launch a token or project.

What Should New Users Keep In Mind Before Joining ICM?

New users should remember to start small, research thoroughly, and don’t invest more than you can afford to lose. Also, be aware that hype and speculation are common, so it’s important to separate real utility from marketing noise.