Managing money across borders has never been simple. Traditional banks often charge high foreign transaction fees, offer poor exchange rates, and make international payments frustratingly slow. For today’s increasingly global users whether frequent travelers, remote workers, or online shoppers having a card that simplifies global spending has become more than a convenience; it’s a necessity.

The market for multi-currency and fintech-driven payment cards is expanding quickly. According to industry reports, digital banking adoption has surged by over 40% in the last five years, and cross-border e-commerce continues to grow at double-digit rates annually. In this landscape, cards that offer low-cost foreign exchange, instant app control, and flexible top-ups are in high demand.

The Revolut Card is one of the most recognized options in this space. It allows users to hold multiple currencies, spend abroad at interbank rates, and manage their finances in real time through a feature-rich app. Whether you’re traveling, sending money overseas, or simply looking to avoid unnecessary fees, Revolut positions itself as a practical solution.

That said, Revolut is not the only option worth considering. Competitors like Wise and N26 also bring strong features, while newer entrants are carving out niches with lower fees, stronger crypto integrations, or higher limits. In this review, we’ll compare Revolut against several top alternatives to help you decide which card fits your needs best.

Readers can expect a clear breakdown of features, costs, pros and cons, and an honest comparison of where Revolut stands in 2025. Additionally, we’ll briefly highlight UEEx, a fast-growing cryptocurrency exchange offering global trading options and innovative tools, for readers interested in bridging traditional finance with digital assets.

Key Takeaway

- The Revolut card is a smart debit card that you can use to spend money at home or abroad, shop online

- Getting a Revolut card is quick, easy, and 100% digital.

- The Revolut card system is designed to give you maximum flexibility

- You can make up to 5 withdrawals or withdraw up to £200 each month for free

- Revolut offers several plans: Standard (free), Plus, Premium, Metal, and Ultra.

What is the Revolut Card?

The Revolut Card is a multi-currency debit card that works alongside the Revolut app, a digital banking platform designed to simplify global money management. Unlike a traditional bank card, it’s built for flexibility—allowing users to hold, exchange, and spend multiple currencies without hidden fees. It is not a credit card but a prepaid debit card linked directly to your Revolut account balance.

Revolut was founded in 2015 in the United Kingdom and quickly grew into one of the world’s most recognized fintech companies. Today, it serves over 30 million users worldwide, offering services such as currency exchange, international transfers, crypto trading, and even stock investing all managed within its mobile app. Its rapid growth reflects a growing demand for digital-first financial solutions.

The Revolut Card is designed for people who live or spend money internationally. Frequent travelers use it to avoid foreign transaction fees, digital nomads rely on it to get paid in different currencies, and everyday shoppers benefit from its budgeting tools and instant spending notifications. It also appeals to younger, tech-savvy users who prefer managing money through an app instead of visiting a traditional bank branch.

Unlike regular debit or credit cards from banks, Revolut provides interbank exchange rates, lower fees on international transactions, and instant in-app control (such as freezing your card or setting limits). Traditional banks may take days to process transfers or add hidden costs, while Revolut focuses on transparency and speed.

The card operates on major payment networks like Visa and Mastercard, ensuring global acceptance. It is fully integrated into the Revolut mobile app, which allows users to manage accounts, exchange currencies, and track spending in real time. Security features like disposable virtual cards and two-factor authentication enhance protection.

Revolut currently offers its card and services in regions including Europe, the United Kingdom, the United States, Australia, and several Asian markets, with plans to expand further. Availability may vary by country depending on local regulations.

Quick Facts Table

| Feature | Details |

| Card Network | Visa or Mastercard (varies by region) |

| Annual Fee | Free for Standard plan; Paid plans from ~$9.99/month (Premium/Metal tiers) |

| APR Range | Not applicable (prepaid debit, not a credit card) |

| Welcome Offer | No traditional sign-up bonus; occasional promotions by region |

| Rewards Rate | Cashback and perks available on higher-tier plans (varies by region) |

| Foreign Transaction Fees | None – uses interbank exchange rates with small markup on weekends |

| Credit Check Required | No – available to most users upon identity verification |

| Personal Guarantee Required | No – as it is not a credit product |

| Minimum Requirements | Must pass KYC (identity verification) and reside in an eligible country |

| Application Timeline | Sign-up in minutes via Revolut app; virtual card available instantly |

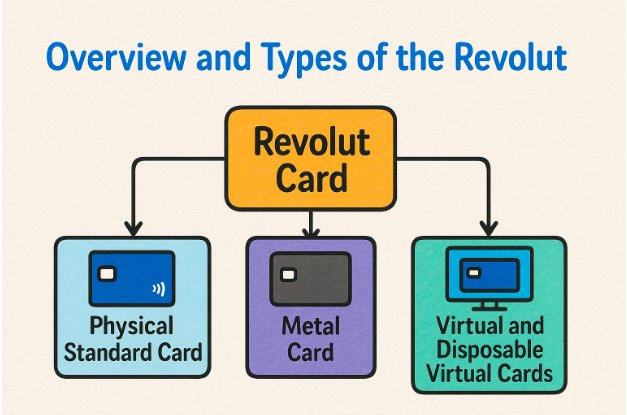

Overview and Types of the Revolut Card

When you open a Revolut account, you’re not just getting a bank account, you’re getting access to a sophisticated payment ecosystem that adapts to your lifestyle.

The Revolut card system is designed to give you maximum flexibility, whether you’re shopping online, traveling internationally, or managing your everyday expenses.

Revolut offers a range of card options to suit different needs and security preferences. Each type serves a specific purpose, from everyday spending to enhanced online security.

Physical Standard Card

This is Revolut’s basic debit card that comes with the free Standard plan. It’s a clean, minimalist plastic card you can use for everyday purchases in stores or online. You can also use it abroad with low exchange fees, and it links directly to your Revolut app for instant tracking and control.

What makes it special is its multi-currency capability. Unlike traditional bank cards that charge hefty foreign exchange fees, the Revolut standard card lets you spend in different currencies at the real exchange rate during weekdays (with small markups on weekends).

The card also comes with built-in security features. Control your card’s security in a few taps – from card freezing, to setting spending limits. Lost your card? Freeze it instantly through the app. Going on vacation? Set a spending limit to avoid overspending. These controls give you peace of mind that traditional banks rarely offer.

Metal Card

This is Revolut’s premium, ultra-sleek Metal Card, available with the Metal subscription. It’s a stainless steel card and is available exclusively to Metal plan subscribers, this card comes in five different colors and feels substantially different from plastic cards.

But it’s not just about looks. For the global travellers and traders relax with travel insurance, enjoy enhanced limits, and subscriptions worth £2,100 annually. The Metal card comes with enhanced benefits including higher ATM withdrawal limits, priority customer support, and comprehensive travel insurance.

Also Read: BankCEX Affiliate Program: Overview, Benefits & Commission

Virtual and Disposable Virtual Cards

If you shop online a lot, virtual cards are your best friend. Revolut gives you digital cards instantly in your app, so you can start spending right away.

Standard Virtual Cards work just like your physical card but exist only digitally. You can create multiple virtual cards for different purposes, one for subscriptions, another for online shopping, and so on. Each virtual card has its own card number, expiry date, and CVV code, but they all draw from the same account balance.

Disposable Virtual Cards take security to the next level. Disposable cards (also called single-use cards) are virtual prepaid debit cards that generate new details every time you make a payment. This means that vendors can’t trace them back to your account or charge you more than once without your authorization.

Revolt Card Subscription Plans & Pricing Tiers

Revolut offers five main subscription tiers, each designed for different user needs and spending patterns. The pricing structure is transparent and you can upgrade or downgrade at any time.

- Standard (Free): The Standard plan is completely free, no monthly fees, no hidden charges for basic features. This plan is perfect for people who want to try Revolut without commitment or those who have simple banking needs.

- Plus / Plus-tier Plan: Customers will pay £3.99 per month (or £40 annually) for Plus. This plan bridges the gap between free and premium, offering enhanced features without the full cost of higher tiers.

- Premium: £7.99 per month (or £80 annually) for Premium gets you into Revolut’s premium tier. The Premium plan includes significantly higher limits for fee-free ATM withdrawals and currency exchanges, comprehensive travel insurance, priority customer support, and access to Revolut’s investment features.

- Metal: £14.99 per month (or £140 annually) for Metal is Revolut’s flagship personal plan. This tier includes everything from Premium plus the distinctive metal card, enhanced travel benefits, and higher limits across the board.

- Ultra (where applicable): For those seeking the best, indulge in over £5,000¹ in annual benefits. The Ultra plan is Revolut’s most exclusive offering, available by invitation only in select markets.

Core Features of Revolut Card

The Revolut Card is more than just a way to spend money. It’s backed by an ecosystem of digital tools built for convenience, transparency, and global use. Below, we’ll break down its main features and how they compare to what you’d expect from traditional banking cards.

Multi-Currency Support

Users can hold and spend in over 30 currencies at the interbank exchange rate. This makes the card especially useful for travelers and freelancers working across borders.

Instant Currency Exchange

Through the Revolut app, users can exchange between supported currencies in real time with low fees compared to banks.

Global Acceptance

As the card operates on Visa or Mastercard networks, it’s accepted nearly everywhere worldwide, both online and in-store.

Budgeting & Analytics

The app tracks all spending with instant notifications, detailed categories, and monthly reports to help users manage their finances.

Virtual Cards

Revolut issues both physical and virtual cards. Virtual cards can be single-use (“disposable”), which helps prevent fraud when shopping online.

Peer-to-Peer Transfers

Users can send money instantly to friends or family on Revolut, regardless of their location, often without fees.

Crypto & Stock Access

Beyond spending, Revolut gives access to crypto purchases and stock investments, though fees and limits vary by region.

Rewards Program

Revolut doesn’t operate a traditional credit-card-style rewards program, but it does offer perks depending on the plan tier:

Metal users may earn up to 1% cashback on card spending, which applies both in their home country and abroad. Cashback can be received in fiat currency or crypto, depending on the user’s preference.

Revolut frequently partners with brands to offer discounts on food delivery, travel bookings, and subscription services. These perks rotate by region and user eligibility.

Instead of points, Revolut encourages savings with features like “Round Up,” where spare change from purchases is automatically saved or invested.

While Revolut’s rewards are modest compared to credit cards, they are useful additions for users who value simplicity over complex loyalty schemes.

Limits and Controls

One of Revolut’s strengths is the level of control it gives users over their money.

Spending Limits

Daily, weekly, or monthly spending caps can be set directly in the app.

Cash Withdrawal Limits

Free ATM withdrawals are capped at around €200/month for Standard users. Paid plans raise these limits.

Account Tier

Limits on currency exchange, withdrawals, and transfers depend on the plan chosen (Standard, Plus, Premium, or Metal).

Parental & Business Accounts

Revolut offers junior accounts for children (linked to a parent’s app) and advanced control options for business accounts, including expense management and employee card limits.

Technology Integration

The Revolut platform is highly app-centric, designed for mobile-first use.

Mobile App

Available on iOS and Android, the app provides real-time notifications, budgeting tools, and direct control over the card.

Web Access

A browser-based dashboard is available, mainly for business users, offering advanced analytics and tools.

APIs for Businesses

Revolut Business users can integrate APIs into their systems, automating payments, payroll, and expense reporting.

Digital Wallets

Revolut cards work with Apple Pay and Google Pay, ensuring seamless tap-to-pay experiences.

Security Features

Security is central to Revolut’s offering, especially given its focus on global and online transactions.

Instant Card Freeze/Unfreeze

If a card is lost or stolen, users can freeze it instantly in the app and unfreeze it when found.

Disposable Virtual Cards

These generate new numbers after each transaction, minimizing fraud risk.

Two-Factor Authentication

Required for account access and high-value transactions.

Location-Based Security

Users can enable location-based tracking, where transactions outside their phone’s location are automatically declined.

Encryption

All user data and transactions are protected by advanced encryption protocols.

Additional Benefits

Revolut also offers perks beyond core spending, giving it more of a “lifestyle card” feel:

Insurance Coverage

Premium and Metal plans include international medical insurance, delayed baggage coverage, and trip delay insurance.

Subscription Management

The app can identify recurring subscriptions and help users cancel or manage them easily.

Exclusive Access

Higher-tier members sometimes gain access to limited financial products, such as higher-yield savings accounts or priority customer support.

Crypto Trading & Precious Metals

For those looking to diversify, Revolut provides direct access to cryptocurrencies like Bitcoin and assets like gold and silver.

Fees & Limits of Revolut Card

| Fee Type | Details |

| Annual/Monthly Fees | Free (Standard), $3.99–$16.99/month (Plus, Premium, Metal) |

| Transaction Fees | Free for most purchases; some FX markups (weekends +0.5%–2%) |

| Cash Advance Fees | No traditional cash advance (prepaid card); ATM fees apply beyond limits |

| ATM Withdrawal Fees | Free up to €200/month (Standard); higher limits for paid plans; ~2% after |

| Late Payment Fees | Not applicable (no credit/borrowing element) |

| Over-Limit Fees | Not applicable (cannot overspend account balance) |

| Foreign Transaction Fees | None during weekdays; weekend markup up to 2% on FX conversions |

| Currency Exchange Fees | Free up to a monthly allowance (e.g., €1,000 on Standard); 0.5% after limit |

| Card Replacement Fees | Standard card replacement around €5–€10; free for higher tiers |

| Inactivity/Hidden Fees | No inactivity fee; rare service charges may apply depending on region |

Annual/Monthly Fees

Revolut offers flexibility through tiered plans.

- Standard Plan: Completely free to use, ideal for casual users who don’t need premium benefits.

- Plus, Premium, and Metal Plans: Range from about $3.99 to $16.99 per month, billed monthly or annually. These subscriptions unlock features such as higher ATM withdrawal limits, cashback, travel insurance, and premium customer support.

Transaction Fees

Everyday card payments (online or in-store) are fee-free when using the local currency or within included allowances. Where costs can appear is in foreign currency transactions.

Compared to traditional banks that often add 3–5% foreign transaction fees, Revolut’s model remains significantly cheaper.

Cash Advance Fees

Since Revolut is a prepaid debit card and not a credit card, cash advances don’t apply. You can only withdraw money you’ve topped up. However, ATM withdrawals have rules:

- Free allowance: Around €200/month (Standard plan).

- Beyond allowance: A fee of about 2% per withdrawal.

- Paid tiers increase the monthly free withdrawal allowance, making them better for frequent cash users.

Late Payment Fees

There are no late payment fees because Revolut doesn’t offer credit. You can’t spend more than your balance, which means no risk of late bill payments or accumulating debt. This is one of the reasons why Revolut is popular among users seeking a safer alternative to credit cards.

Over-Limit Fees

Traditional credit cards charge hefty over-limit penalties if you exceed your borrowing cap. Revolut avoids this entirely.

- Prepaid Model: Transactions are automatically declined if you don’t have enough funds.

- No Overdraft: Revolut doesn’t provide overdraft services in most markets, so overspending isn’t possible.

Foreign Transaction Fees

Revolut’s biggest advantage is zero traditional foreign transaction fees.

Weekday spending abroad: Uses the interbank rate, meaning you get close to the best possible exchange rate.

Weekend transactions: Small markups of 0.5%–2% apply, depending on the currency.

Also Read: Biconomy Affiliate Program: Overview, Benefits & Commission

Hidden or Uncommon Fees

Revolut is transparent, but there are a few small fees users should know about:

- Card Replacement: Standard users may pay around €5–€10 if they lose their physical card. Premium and Metal members often get free replacements.

- Currency Exchange Limit: Standard accounts allow free exchange up to €1,000/month; beyond this, a 0.5% fee applies.

- Inactivity Fees: Currently, Revolut does not charge inactivity fees, unlike some prepaid cards.

- International Transfers: Transfers to other Revolut users are free, but bank transfers outside Revolut may carry small fees depending on the country.

Eligibility and Application Process

Getting a Revolut Card is much simpler than applying for a traditional credit card. Since it’s a prepaid debit card, there are no strict credit checks or financial guarantees required.

Instead, the focus is on verifying your identity and ensuring you live in an eligible country. Below is everything you need to know.

Who Can Apply

Any adult (usually 18+) living in a supported country can apply for a personal Revolut account. Unlike credit cards, you don’t need a high credit score, proof of income, or collateral.

Revolut also offers Revolut Business accounts, designed for freelancers, startups, and established companies. These accounts provide multiple cards, expense management, and integrations with accounting tools.

No credit history or score is required since you’re spending only what you load into the account. This makes Revolut accessible to students, freelancers, or anyone new to banking.

Required Documents

Revolut follows a standard KYC (Know Your Customer) process. Depending on your country, you may be asked to provide:

- Valid Photo ID –Passport, driver’s license, or national ID card.

- Selfie or Liveness Check – A quick photo or short video to confirm you are the ID holder.

- Proof of Address (sometimes requested) – Utility bill, bank statement, or government letter showing your name and address.

- Business Applicants – May need company registration documents, proof of business address, and director/shareholder details.

Step-by-Step Application Guide

- Download the Revolut App (iOS or Android).

- Sign Up by entering your phone number and creating a secure account.

- Verify Your Identity by uploading your ID and completing the selfie check.

- Choose a Plan (Standard free plan or a paid tier with extra features).

- Top Up Your Account via bank transfer, card, or other supported methods.

- Order Your Card – A physical card can be delivered, while a virtual card is available instantly.

Approval Timeline

Most personal applications are approved within minutes to a few hours, provided the ID verification is successful. In rare cases, if further checks are needed, approval may take up to 2–3 business days. Business accounts may take longer, depending on document reviews.

What Happens After Approval

Once approved:

- A virtual card is available immediately in the app for online purchases.

- A physical card is shipped to your address, usually arriving within 5–10 business days.

- Users can instantly start exchanging currencies, setting budgets, and tracking spending.

- Business users can issue multiple cards to employees and link the account with accounting systems.

Also Read: CoinAvenir Affiliate Program: Overview, Benefits & Commission

Pros of the Revolut Card

When choosing a financial tool like the Revolut Card, it’s important to weigh both the advantages and the drawbacks. Here’s a balanced look at how Revolut performs in real-life scenarios.

No Foreign Transaction Fees

Perfect for travelers. If you’re shopping in Paris or paying for a meal in Tokyo, you’ll get close to the interbank rate instead of being hit with the 3–5% surcharge common with traditional banks.

Multi-Currency Accounts

Users can hold, exchange, and spend in over 30 currencies. Freelancers working with international clients, for example, can receive payments in euros and spend in dollars seamlessly.

Instant Spending Controls

Through the app, you can freeze or unfreeze your card, set spending limits, or generate disposable virtual cards. This is especially useful for online shoppers who want to reduce fraud risks.

Tiered Plans for Flexibility

Standard is free, while Premium and Metal add perks like higher withdrawal limits, cashback, and travel insurance. This gives users the choice to stick with free or pay for extra value.

Global Acceptance

Operating on Visa or Mastercard networks, the card works almost everywhere, unlike some niche fintech cards limited to certain regions.

Extra Features in One App

Beyond payments, Revolut includes budgeting tools, crypto and stock access, and even travel perks, reducing the need for multiple financial apps.

Cons of the Revolut Card

ATM Withdrawal Limits

Standard users only get around €200/month in free ATM withdrawals. Heavy cash users (e.g., backpackers in cash-based countries) may find the 2% fee after the limit restrictive.

Weekend Currency Markup

Spending abroad on weekends carries a 0.5%–2% FX markup. A traveler paying for a hotel on a Saturday may face slightly higher costs than during weekdays.

Customer Support Issues

While Premium and Metal users enjoy priority support, Standard users sometimes report slow responses in urgent cases.

Limited Rewards Compared to Credit Cards

Revolut’s cashback (mainly on Metal) is modest. Someone who spends heavily on flights might earn more rewards with a travel-focused credit card.

Availability Restrictions

Revolut isn’t yet available everywhere. Users in certain regions may not be able to open accounts due to regulatory limits.

| Plan | Monthly Cost | |

| Standard | €0 | Beginners or casual users |

| Plus | €3.99 | Everyday users who want extra tools |

| Premium | €7.99 | Frequent travelers & budgeters |

| Metal | €14.99 | Power users & frequent spenders |

| Ultra | €45+ | High-tier perks & exclusive benefits |

User Reviews and Feedback Analysis

To get a clearer picture of how the Revolut Card performs in real life, it’s useful to look at feedback from actual users. Aggregated reviews across platforms like Trustpilot, G2, and Capterra reveal a mix of strong praise and recurring complaints.

Aggregate Rating

Revolut has earned consistently strong ratings across major review platforms. On Trustpilot, it scores 4.3 out of 5 based on more than 150,000 reviews, reflecting its broad global user base. On G2, it holds a 4.4 out of 5, with particularly positive feedback from fintech professionals and business users.

Meanwhile, Capterra gives it a higher 4.6 out of 5, with many reviewers highlighting its ease of use and intuitive design. Taken together, Revolut averages between 4.3 and 4.5 stars overall, showing that most users are satisfied with its features, pricing, and overall performance.

Common Praise Themes

Many reviewers highlight the app’s smooth design and quick setup. One Trustpilot reviewer noted,

“Opening an account took less than 10 minutes, and I had a virtual card instantly.”

Users frequently mention the savings on foreign transactions. A G2 reviewer wrote,

“I saved hundreds in fees while traveling across Europe compared to my old bank card.”

Customers appreciate instant notifications and spending analytics. On Capterra, one small business user said,

“It helps me track every expense in real time, which is priceless for budgeting.”

Frequent Complaints

Standard users often report slow responses. Some Trustpilot reviews mention waiting days for issue resolution unless subscribed to Premium or Metal.

A small but significant number of users complain that their accounts were temporarily locked for security checks, sometimes without clear explanations.

Heavy cash users note frustration with the €200/month free withdrawal cap on the Standard plan.

Customer Service Feedback

Customer support quality appears to vary by plan tier:

- Premium/Metal Users: Generally report fast, helpful responses via live chat.

- Standard Users: Mixed experiences, with complaints of automated replies and delayed solutions

Top 7 Alternatives to the Revolut Card

While the Revolut Card has become a popular choice for global spending and digital money management, it’s not the only option on the market. Depending on your needs whether you’re a frequent traveler, budget-conscious user, crypto enthusiast, or someone who prefers traditional banking—there are strong alternatives worth considering.

Wise Debit Card

Best For: Low-cost international transfers and travel spending.

The Wise Debit Card is a strong choice for people who travel or send money abroad often. It gives you the real exchange rate without hidden fees, making it one of the cheapest options for international spending. While it doesn’t have rewards or perks, it’s simple, affordable, and very reliable.

Key Differentiators:

- Real exchange rates with no hidden markups.

- Multi-currency accounts supporting 50+ currencies.

- No minimum balance required.

Pricing:

- No annual fee.

- No foreign transaction fees.

Pros:

- Transparent fees with mid-market rates.

- Strong global presence.

- Easy-to-use app with budgeting tools.

Cons:

- No rewards program.

- Limited extra perks compared to premium cards.

Why Choose Over Revolut: If your primary concern is low-cost currency exchange and transparent pricing, Wise is often cheaper than Revolut, especially for international transfers.

N26 You (N26 Bank)

Best For: Travelers seeking insurance and premium benefits.

The N26 You card is designed for frequent travelers, especially in Europe. It includes travel and medical insurance, plus free withdrawals abroad, which adds peace of mind while on the move. The main drawback is that it’s only available in certain European countries.

Key Differentiators:

- Travel and medical insurance included.

- Free withdrawals abroad in multiple currencies.

- Dedicated sub-accounts (“Spaces”) for savings goals.

Pricing:

- €9.90/month.

- No extra foreign transaction fees.

Pros:

- Comprehensive insurance package.

- Smooth app experience.

- Regulated as a fully licensed EU bank.

Cons:

- Limited availability (mainly EU).

- Monthly subscription required.

Why Choose Over Revolut: For frequent travelers who value built-in insurance and bank-level security, N26 provides more robust coverage than Revolut’s standard tiers.

Payoneer Prepaid Mastercard

Best For: Freelancers and online sellers receiving international payments.

The Payoneer Prepaid Mastercard is a favorite for freelancers and online sellers. It makes getting paid from platforms like Amazon, Fiverr, or Upwork very easy. Payments go directly to your account, and you can spend or withdraw globally. The downside is higher fees for currency conversions and an annual fee.

Key Differentiators:

- Global payment platform for marketplaces like Amazon, Fiverr, and Upwork.

- Ability to withdraw directly in local currency.

- Accepted worldwide on the Mastercard network.

Pricing:

- Annual fee: $29.95.

- 3.5% conversion fee for non-USD transactions.

Pros:

- Tailored for freelancers and remote workers.

- Seamless global payouts.

- Reliable payment gateway integration.

Cons:

- Higher conversion fees.

- Annual fee even if not used often.

Why Choose Over Revolut: If you earn income through global freelance platforms, Payoneer’s direct integrations make it a more practical option than Revolut.

UPay Card (UPay.best)

Best For: Crypto users looking for instant liquidity and low-cost spending.

The UPay Card is built for crypto users. It lets you spend your crypto instantly as cash, and you can even get low-interest loans without selling your coins. This makes it flexible for anyone who holds digital assets, though it’s less useful if you don’t use crypto.

Key Differentiators:

- Instant crypto-to-fiat conversion at checkout.

- Low-interest crypto loans to avoid forced selling.

- Integrated with a secure digital wallet.

Pricing:

- No setup fee.

- Small spread on crypto conversions.

- Loan interest starting from 2–3%.

Pros:

- Bridges traditional finance and crypto seamlessly.

- Flexible spending across global merchants.

- Transparent fee structure.

Cons:

Limited to crypto holders.

Still expanding merchant partnerships.

Why Choose Over Revolut: For crypto-savvy users, UPay provides instant access to digital assets without liquidation, something Revolut only partially supports.

HSBC Global Money Debit Card (HSBC Bank)

Best For: Traditional banking with global account management.

The HSBC Global Money Debit Card is backed by one of the biggest traditional banks in the world. It’s a safe choice if you want strong protections and access to global banking services. However, setting up an account can be slower, and it may require maintaining certain balances.

Key Differentiators:

- Backed by one of the world’s largest banks.

- Access to Global Money Account for transfers and spending.

- Linked with full-service banking products (loans, mortgages).

Pricing:

- No annual fee (linked to HSBC Global Money Account).

- Competitive FX rates, though not always the cheapest.

Pros:

- Trusted international banking brand.

- Strong regulatory protections.

- Smooth link between savings, checking, and spending.

Cons:

- Slower onboarding compared to fintechs.

- May require higher account balances.

Why Choose Over Revolut: For users who want the stability of a traditional bank with international coverage, HSBC provides credibility that fintech cards like Revolut can’t fully match.

Monzo Plus

Best For: UK users seeking budgeting tools and premium fintech experience

The Monzo Plus card is popular in the UK for its budgeting tools and easy-to-use app. It helps track spending in real time and organize your finances. While it’s great for UK users, it’s not widely available outside the country.

The Crypto.com Visa Card is aimed at people who love crypto rewards. It offers cashback, plus perks like free Netflix or Spotify depending on your tier. The catch is that rewards depend on the value of the CRO token, which can change a lot.

Key Differentiators:

- Advanced analytics and custom categories.

- Free cash withdrawals abroad (up to certain limits).

- Ability to see all bank accounts in one place.

Pricing:

- £5/month.

- Additional fees for international ATM withdrawals above the limit.

Pros:

- Excellent app with real-time controls.

- Strong community-driven development.

- Fully licensed UK bank.

Cons:

- Availability limited to UK residents.

- Premium features locked behind subscriptions.

Why Choose Over Revolut: Monzo provides more robust budgeting tools and licensed bank protections, making it a solid UK-centric alternative

Crypto.com Visa Card (Crypto.com)

Best For: Crypto enthusiasts wanting cashback rewards.

The Crypto.com Visa Card is aimed at people who love crypto rewards. It offers cashback, plus perks like free Netflix or Spotify depending on your tier. The catch is that rewards depend on the value of the CRO token, which can change a lot.

Key Differentiators:

- Up to 5% cashback in CRO (Crypto.com’s native token).

- Perks like Spotify and Netflix rebates.

- Tiered benefits based on CRO staking.

Pricing:

- Free basic tier.

- Higher rewards require CRO staking.

Pros:

- Strong rewards structure.

- Wide range of crypto integrations.

- Attractive perks for everyday spending.

Cons:

- Rewards depend on volatile CRO token value.

- Staking requirements can lock up funds.

Why Choose Over Revolut: If you’re already in the crypto ecosystem, Crypto.com’s Visa card provides richer rewards than Revolut’s limited crypto cashback program.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| Revolut Card | Free – £14.99/month (tiered plans) | Up to 1% cashback (premium tiers) | None | No (basic), Yes (credit products) | Everyday spending & travel | Multi-currency account + budgeting | Customer support delays for free users | 4.3 |

| Wise Debit Card | Free | None | None | No | Low-cost global transfers | Real exchange rate with no markup | No rewards program | 4.4 |

| N26 You | €9.90/month | None | None | Yes (for some services) | Travelers needing insurance | Comprehensive travel/medical insurance | Limited to EU residents | 4.2 |

| Payoneer Prepaid Mastercard | $29.95/year | None | None | No | Freelancers & global sellers | Direct integration with marketplaces (Amazon, Fiverr, Upwork) | High FX conversion fees | 4 |

| UPay Card | Free | Varies with crypto usage | None | No | Crypto holders needing liquidity | Instant crypto-to-fiat conversion & low-interest loans | Limited to crypto users | 4.3 |

| HSBC Global Money Debit Card | Free (with Global Money Account) | None | None | Yes | Traditional banking with global reach | Backed by a major international bank | Slower onboarding, may require balances | 4.1 |

| Monzo Plus | £5/month | None | None | Yes | UK-based users who want budgeting tools | Advanced analytics & savings features | Availability limited to UK | 4.2 |

| Crypto.com Visa Card | Free (basic tier) | Up to 5% cashback in CRO | Spotify/Netflix rebates (with staking) | Yes (KYC required) | Crypto spenders seeking rewards | Strong perks tied to CRO staking | Rewards depend on CRO token value | 4 |

How to Choose: Decision Framework

Choosing the right card isn’t just about comparing fees or rewards, it’s about matching the card to your specific needs, business size, and financial goals. Below is a simple decision framework to guide you through the process.

Define Your Spending Context

If you travel internationally often, Wise or N26 You are the strongest options because they provide low-cost or even free foreign currency spending and avoid hidden markups.

If most of your spending is domestic, Revolut or Monzo will serve you better since they excel at everyday budgeting, categorizing expenses, and real-time notifications.

Look at Business Size and Industry

Small businesses or freelancers are best served by Payoneer, thanks to its integration with platforms like Amazon and Fiverr that make receiving global payments seamless.

Crypto-focused businesses will benefit more from UPay or the Crypto.com Visa card, both designed to handle digital assets, either through instant conversion (UPay) or cashback rewards (Crypto.com). Medium to large enterprises, on the other hand, may find the HSBC Global Money Debit Card more suitable, as it offers access to traditional banking services and broader financial management.

Assess Cash Flow and Financing Needs

If you need quick liquidity without selling assets, UPay is a strong choice because of its low-interest crypto loans that let you borrow against holdings. Those who prefer a no-debt, pay-as-you-go solution should look to Wise, which avoids credit checks and debt-based products altogether.

If structured credit options are a priority, Revolut Premium or Metal tiers and HSBC accounts provide overdraft or credit features subject to eligibility.

Evaluate Technology Requirements

For users who want advanced budgeting and analytics, Monzo Plus and Revolut are excellent choices, offering real-time expense tracking, category breakdowns, and savings tools.

If your operations rely on API or business software integrations, Payoneer or UPay will provide smoother connectivity with digital platforms. For those who simply want minimal setup and straightforward features, Wise is the most practical option.

Match with Your Priority Goal

When the goal is saving money on fees, Wise is the top pick. Travelers who want comprehensive protection should choose N26 You.

If rewards matter most, the Crypto.com Visa card delivers the most generous cashback system. For stability and reputation, HSBC provides the reassurance of traditional banking. For users who want crypto flexibility, UPay is the most versatile solution available.

Final Verdict

The Revolut Card is a flexible and modern payment solution that combines everyday banking features with global usability. With its multi-currency accounts, spending insights, and low-cost international transactions, it appeals to users who want more control and transparency in how they manage their money. Depending on the plan, it also offers perks like cashback, travel insurance, and higher withdrawal limits, making it more than just a basic debit card.

The card is perfect for frequent travelers, digital nomads, and tech-savvy users who rely on mobile-first solutions. It is also a strong fit for individuals or small businesses that want to handle cross-border payments without being tied to traditional banks. For those who value budgeting tools, real-time notifications, and the ability to hold multiple currencies, Revolut checks many boxes.

However, it may not be ideal for everyone. Users who prefer in-person customer service, those who rely heavily on cash withdrawals, or individuals who want robust credit features might find Revolut lacking. Additionally, its tiered plans mean some of the best features are locked behind monthly fees, which may not suit budget-conscious users.

For a top alternative, Wise Debit Card stands out. While it lacks rewards or premium perks, it consistently delivers the lowest-cost international transfers and transparent exchange rates, making it the better choice for anyone focused purely on affordable global spending. For crypto users, UPay also deserves attention since it bridges digital assets and traditional spending more smoothly than Revolut.

In the overall market, Revolut positions itself as a hybrid between a fintech app and a global debit card, sitting somewhere between budget-friendly providers like Wise and premium travel-focused solutions like N26. It isn’t the absolute cheapest nor the most premium, but it balances features, usability, and flexibility in a way that appeals to a broad audience. As long as users understand its limitations, Revolut remains one of the most versatile and widely used cards in 2025.

FAQs

What is the Revolut card used for?

The Revolut card is a smart debit card that you can use to spend money at home or abroad, shop online, withdraw cash, and even manage different currencies in one app. It’s perfect for everyday spending, travel, and digital banking

Can I use the Revolut card abroad?

Absolutely! Revolut is great for travel. You can use your card in over 150 countries, and it gives you access to real exchange rates, with low or no extra fees, depending on your plan.

Are there any hidden fees with Revolut?

No hidden fees! But there are limits to be aware of like monthly ATM withdrawals or currency exchange limits. If you go over, small fees apply (like 2% on extra ATM withdrawals or 0.5% for large exchanges).

Is Revolut safe to use?

Yes. Revolut uses strong security features like instant card freezing, location-based protection, and disposable virtual cards. Just make sure to use all the in-app safety settings for maximum protection.