Managing everyday expenses with crypto has always been tricky. Most merchants still only accept traditional currencies, which forces crypto users to juggle between exchanges, bank transfers, and long settlement times just to pay for something as simple as groceries or subscriptions. This gap is exactly what crypto debit cards aim to solve, seamlessly converting digital assets into spendable fiat at the point of purchase.

In 2025, demand for crypto-linked cards continues to grow. According to recent market reports, the global crypto card market is projected to surpass $5.5 billion by 2028, driven by everyday adoption, cross-border payments, and the rise of digital wallets like Apple Pay and Google Pay. Users want a fast, borderless, and cost-efficient way to use their digital assets without friction, and that’s where cards like RedotPay step in.

The RedotPay Card allows you to spend popular cryptocurrencies like BTC, ETH, USDT, and USDC directly with millions of merchants worldwide. Available in both virtual and physical formats, it integrates with digital wallets and supports global ATM withdrawals, making it a versatile option for frequent travelers and online shoppers.

In this review, we’ll break down RedotPay’s features, fees, pros and cons, security, and how to get started. We’ll also highlight several top alternatives so you can compare and decide whether RedotPay is the right fit for your lifestyle.

Lastly, a quick note on UEEx: this is RedotPay’s exchange platform, which acts as the backbone for wallet funding, trading, and balance management, ensuring smooth integration between your crypto and card.

By the end of this guide, you’ll know exactly what RedotPay offers, how it stacks up against competitors, and whether it deserves a spot in your digital wallet.

Key Takeaway

- RedotPay is a crypto-powered debit card that lets you spend your digital assets anywhere major cards are accepted

- RedotPay currently supports four major cryptocurrencies, which are BTC, ETH, and USDC

- RedotPay operates under licensed financial service providers in Hong Kong and Singapore

- The physical card supports tap-to-pay, chip-and-pin, and global ATM withdrawals

- RedotPay doesn’t offer cashback or points, but it’s a solid choice if you just want to spend crypto easily and securely.

What is the RedotPay Card?

The RedotPay Card is a crypto-linked debit card that allows users to spend digital assets like Bitcoin (BTC), Ethereum (ETH), USDT, and USDC directly at millions of merchants worldwide. Instead of requiring a manual exchange to fiat beforehand, the card instantly converts crypto into local currency at the point of sale. This makes it a practical bridge between the digital asset ecosystem and traditional finance.

RedotPay functions as a hybrid crypto-fiat debit card, available in both virtual and physical formats. The virtual card is useful for online purchases, subscriptions, and digital wallet integration, while the physical card works anywhere Mastercard/Visa is accepted, including ATMs for cash withdrawals.

Licensed in Hong Kong and Singapore as a money services business, RedotPay leverages compliance and custody infrastructure to ensure security, regulatory oversight, and a smooth user experience.

Unlike traditional debit or credit cards, the RedotPay Card does not require a bank account, fiat top-up, or lengthy processing. Instead, it taps directly into your crypto wallet. The conversion happens in real time, which means that you can hold digital assets until the moment of purchase. For many, this reduces exposure to inflationary fiat while still offering the flexibility of traditional cards.

The card is backed by the UEEx exchange infrastructure, which powers balance management and settlement. Security is reinforced with features like two-factor authentication (2FA), encryption, and compliance-grade KYC/AML checks. It integrates with popular digital wallets (Apple Pay, Google Pay), giving users both convenience and mobility.

As of 2025, the RedotPay Card is available in over 100 regions, with strong adoption in Asia, Europe, and parts of Africa. However, certain countries with restrictive crypto laws may have limited access.

In short, the RedotPay Card is not just another prepaid debit card, it’s a gateway for crypto users to interact with the traditional financial world on their own terms.

“RedotPay makes it easy to spend crypto just like cash online, in-store, or even at ATMs worldwide.”

Quick Facts Table

| Feature | Details |

| Card Network | Mastercard (supports both online & offline spending worldwide) |

| Annual Fee | None (no recurring monthly/annual subscription fee) |

| APR Range | Not applicable (debit/crypto card, not a credit product) |

| Welcome Offer | None (no sign-up bonus at the moment) |

| Rewards Rate | None (no cashback, points, or rewards program currently offered) |

| Foreign Transaction Fees | ~1%–1.18% per transaction (varies by network & region) |

| Credit Check Required | No (approval is based on KYC verification only) |

| Personal Guarantee Required | No (funds are crypto-backed, not credit-based) |

| Minimum Requirements | Valid ID for KYC, an active RedotPay/UEEx account, and supported crypto assets |

| Application Timeline | Instant for virtual card (issued right after KYC); 7–15 days for physical cards |

Key Features and Functionality of the RedotPay Card

Core Features of the RedotPay Card

RedotPay is positioned as a crypto-to-fiat bridge, meaning it lets users spend their digital assets like traditional money anywhere Mastercard is accepted. Here are the main highlights:

Multi-Currency Support (Crypto + Fiat)

The card currently supports four major cryptocurrencies (BTC, ETH, USDT, and USDC), which are auto-converted to local fiat at the point of sale. While limited in scope, this ensures stability and avoids volatility spikes.

Virtual & Physical Card Options

Users can get an instant virtual card for online spending after completing KYC. A physical card can also be ordered for in-store purchases, ATM withdrawals, and travel.

No Pre-Top-Up Requirement

Unlike many cards that require fiat deposits, RedotPay allows you to spend directly from your linked crypto wallet without needing to preload.

Global Acceptance

As a Mastercard, the RedotPay card works at millions of merchants worldwide—making it especially useful for frequent travelers and digital nomads.

Flexible Mobile App Management

The RedotPay app (integrated with UEEx) allows real-time balance checks, transaction tracking, and card controls such as freezing or unfreezing the card.

Also Read: Biconomy Affiliate Program: Overview, Benefits & Commission

Rewards Program

One area where RedotPay falls short compared to its competitors is in the rewards and cashback department. As of mid-2025, the card does not provide any form of cashback on purchases. There is also no loyalty or points program in place, and partner discounts are not actively promoted.

This lack of incentives makes RedotPay more of a utility-focused card rather than a rewards-driven one. It works well for straightforward crypto spending but does not cater to users who want extra benefits like travel points, rebates, or cashbacks.

In contrast, some rival platforms such as Crypto.com and Nexo offer cashback rates ranging from 1% to 5%, usually tied to staking or holding specific tokens. This puts RedotPay at a disadvantage for those who value perks as part of their card experience.

Technology Integration

One of RedotPay’s strengths lies in its digital-first infrastructure.

App Integration

The card is managed through the UEEx-powered RedotPay app, which consolidates crypto storage, conversion, and payments in one dashboard.

Digital Wallets

The card can be linked to Apple Pay, Google Pay, and Samsung Pay, enabling tap-to-pay convenience.

API Support

While limited, RedotPay is reportedly developing APIs for businesses, enabling automated treasury management and expense handling.

Instant Notifications

Real-time alerts for every transaction help users stay on top of spending. This blend of crypto and fintech tools positions RedotPay as a bridge between blockchain and everyday payments.

Security Features

Security is always a major concern when combining cryptocurrency with traditional card networks, and RedotPay has put several measures in place to address these risks. To start, the platform requires mandatory KYC and AML verification. This ensures that all users go through identity checks, which helps reduce fraud and maintain compliance with regulatory standards.

Beyond identity verification, RedotPay also integrates two-factor authentication (2FA) to secure both account logins and transactions. This extra layer of protection helps prevent unauthorized access, even if login credentials are compromised.

All payment data is further safeguarded through network encryption that complies with PCI DSS standards, ensuring sensitive information remains secure during processing.

For users who misplace their card or suspect suspicious activity, RedotPay provides the option to instantly lock or unlock the card directly from the mobile app. Alongside this, AI-driven fraud monitoring continuously scans for unusual spending behavior and triggers alerts when activity seems out of the ordinary.

“No monthly fees, high spending limits, and instant virtual card issuance make RedotPay a top choice for crypto users.”

Fees, Limits & Cost Structure of the RedotPay Card

When choosing a crypto card like RedotPay, understanding the fees is just as important as looking at its features. The cost structure can greatly affect whether the card is right for everyday spending or just occasional use.

RedotPay is positioned as a utility-first card, meaning it emphasizes access and spending power rather than cashback rewards. However, this comes with certain fees that users should know before applying.

RedotPay Card Fee Table

| Fee Type | Amount/Policy |

| Annual / Monthly Fees | No annual fee or monthly maintenance fee for basic usage. |

| Transaction Fees | 1% – 1.18% per transaction (applies to purchases made using crypto-to-fiat conversion). |

| Cash Advance Fees | Generally not applicable since funds are prepaid in crypto; but ATM withdrawals incur network fees. |

| ATM Withdrawal Fees | Varies by network; expect small fixed + percentage fee. No fee-free withdrawals offered. |

| Late Payment Fees | Not applicable, as RedotPay is not a credit card. Users spend only what they preload. |

| Over-Limit Fees | Not applicable; spending is capped by card balance and daily limits. |

| Foreign Transaction Fees | None — crypto is converted at the point of sale; however, FX spreads apply. |

| Card Issuance Fees | Virtual card: free; Physical card: around $15–$25, depending on region. |

| Hidden / Uncommon Fees | FX spread on currency conversion, small blockchain/network withdrawal fees when topping up. |

Annual / Monthly Fees

RedotPay keeps things simple by not charging an annual or monthly maintenance fee. Many traditional banks charge users just for holding a card, even if it isn’t actively used. With RedotPay, you can keep the account open without worrying about a recurring cost eating into your balance. This makes it budget-friendly for casual users who may not spend frequently.

Transaction Fees

Whenever you use your RedotPay card to pay at a store or online, the system instantly converts your crypto into local fiat currency. For this, the card charges a 1% to 1.18% fee per transaction. This is the main way RedotPay earns revenue. While it’s higher than the zero fees offered by traditional debit cards, it’s in line with many crypto cards. If you use it daily, this is the fee you’ll notice most often.

Cash Advance Fees

Unlike credit cards, RedotPay doesn’t allow you to borrow money, so traditional “cash advance fees” don’t apply. However, when withdrawing at an ATM, you’ll face network fees. These are small charges imposed by ATM operators or payment networks to process your crypto-to-cash conversion. It’s not technically a cash advance but functions as the closest equivalent.

ATM Withdrawal Fees

ATM withdrawals are one of the most expensive features. RedotPay doesn’t provide fee-free withdrawals, meaning you’ll pay both a fixed ATM operator charge and sometimes a small percentage fee. For occasional use, this is fine, but if you rely on ATMs regularly, the costs add up quickly. Some users may prefer traditional debit cards or alternatives like Crypto.com, which include limited free withdrawals.

Late Payment Fees

This is where RedotPay differs completely from credit cards. Because it’s prepaid, you cannot overspend or miss payments. You’re only spending the balance you load onto the card. That means no interest charges and no late payment fees. This makes it safer for people who want card access but don’t want to risk falling into debt.

Over-Limit Fees

Similarly, you can’t go beyond your available balance, so there’s no risk of over-limit fees. The system automatically declines any transaction that exceeds your current balance or daily limits. This built-in control helps users manage spending responsibly without surprise penalties.

Also Read: AscendEX Affiliate Program: Overview, Benefits & Commission

Foreign Transaction Fees

RedotPay doesn’t add a direct foreign transaction fee like many credit cards that charge 2–3% extra for overseas purchases. Instead, all costs are wrapped into the FX spread. When your crypto is converted into a local currency, the exchange rate may be slightly less favorable than market prices. This hidden cost functions like a foreign transaction fee, even though it isn’t labeled as one.

Card Issuance Fees

The virtual RedotPay card is issued instantly and free of charge through the app. If you want a physical card for ATM use or tap-and-pay, you’ll need to pay a one-time fee of around $15–$25, depending on your location. Compared to premium credit cards with annual fees of hundreds of dollars, this is a relatively low entry cost.

Hidden / Uncommon Fees

The main “hidden” costs come from FX spreads and blockchain network fees. Every time you move crypto onto the card, you may pay a small network fee depending on the chain (e.g., Ethereum vs. Polygon). These fees aren’t charged by RedotPay directly but are unavoidable when interacting with crypto networks. It’s worth planning which chain you use to keep these costs lower.

Eligibility and Application Process

Getting started with the RedotPay Card is much simpler than applying for a traditional bank-issued debit or credit card. Since it is a prepaid, crypto-backed card, there are no credit score checks or complicated financial requirements. Still, there are some eligibility rules and steps you’ll need to follow before approval.

Who Can Apply?

RedotPay is open to both individuals and business users, but the majority of applicants are everyday individuals looking to spend their crypto directly. The RedotPay Card is also only available to applicants 18 years or older. Because this is not a credit card, you do not need a high credit score or a personal guarantee. Instead, eligibility depends on meeting basic identity and compliance requirements.

At present (mid-2025), RedotPay is available in multiple regions across Asia, Europe, and parts of Africa. However, availability may vary by country due to local regulations. U.S. residents, for example, may face restrictions until further licensing is approved.

Required Documents

To apply, you’ll need to complete KYC (Know Your Customer) verification. This helps RedotPay comply with anti-money laundering (AML) laws. The documents are standard and easy to provide:

- Government-issued ID (passport, driver’s license, or national ID card) – for identity verification.

- Selfie or liveness check – ensures you are the real owner of the ID.

- Proof of address (utility bill or bank statement, usually dated within the last 3 months) – verifies residency.

- Business applicants may also need registration certificates, incorporation documents, or proof of beneficial ownership.

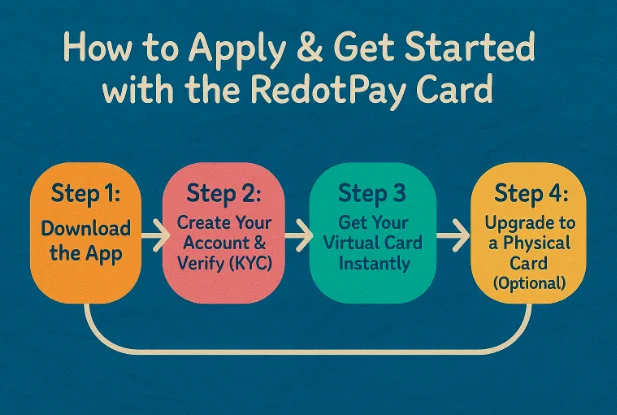

Step-by-Step Application Guide

- Download the RedotPay app from the iOS or Android store.

- Create your account by entering your email and basic details.

- Complete KYC verification by uploading your ID and proof of address, then passing the selfie check.

- Wait for approval – usually within minutes to a few hours.

- Get your virtual card instantly once approved.

- Optionally order a physical card for ATM withdrawals and in-store tap payments.

Approval Timeline

In most cases, individual accounts are approved within a few hours of submitting documents. Sometimes, it can take up to 24–48 hours if extra checks are needed. Business accounts may take longer, usually 2–5 business days, depending on the complexity of the company’s documentation.

What Happens After Approval?

Once approved, you’ll immediately gain access to a virtual RedotPay card that can be used online or added to mobile wallets like Apple Pay and Google Pay. If you order a physical card, delivery times vary by country but typically take 5–10 business days. After activation, you can load crypto onto your account and start spending worldwide.

Also Read: Apex Affiliate Program: Overview, Benefits & Commission

Pros of Using the RedotPay Card

Every payment card has strengths and weaknesses, and the RedotPay card is no exception. It performs very well in certain areas but falls short in others. Here’s a clear breakdown to help you decide if it fits your needs.

- Easy to Apply and Use

No credit checks or lengthy paperwork. You only need to pass KYC verification, which is usually completed in a few hours. Great for people without a strong credit history.

- Supports Multiple Payment Methods

Available as both a virtual card (instant use online or in Apple/Google Pay) and a physical card (for tap-and-pay or ATM withdrawals). This flexibility makes it useful in both digital and offline settings.

- Global Merchant Acceptance

The card is powered by a major payment network (Visa/Mastercard), meaning it works at over 130 million merchants worldwide. Whether you’re booking flights, shopping online, or paying in-store, you can use it just like any regular debit card.

- High Spending Limits

With daily spend limits of up to $1 million and ATM withdrawals of up to $10,000/day, the card is well-suited for high-net-worth users and frequent travelers who need large transaction capacities.

- Strong Security Controls

Built-in two-factor authentication, app-based card lock/unlock, and fraud monitoring give users peace of mind. Even if your card is lost, you can instantly freeze it in the app.

- No Debt or Interest Risk

Since it’s prepaid, you can only spend what you load. This eliminates the risk of late payment fees or getting into debt, making it safer than credit cards.

Cons of using the RedotPay Card

- No Cashback or Rewards

Unlike competitors such as Crypto.com or Nexo, which offer 1–5% cashback, RedotPay offers no rewards program. For heavy spenders, this can feel like a missed opportunity.

- Limited Crypto Support

At the moment, only BTC, ETH, USDT, and USDC are supported. Users holding other coins like SOL or XRP will need to convert before using the card.

- ATM Withdrawals Can Get Expensive

While limits are generous, no fee-free ATM withdrawals are included. Frequent cash users may see their costs pile up quickly.

- Hidden FX Spread Costs

Even though RedotPay doesn’t charge a direct foreign transaction fee, the exchange rate spread can make overseas purchases more expensive than expected.

- Occasional Support Complaints

Some users report delays in resolving deposit or blockchain network transfer issues, which can be frustrating when moving funds.

Also Read: BiFinance Affiliate Program: Overview, Benefits & Commission

User Reviews and Feedback Analysis

One of the best ways to understand whether a card is worth using is to see what real users say. RedotPay has gained traction quickly, and by mid-2025, there’s enough feedback on review sites and forums to spot clear patterns.

Aggregate Rating

Across multiple platforms, RedotPay has built a mixed but generally positive reputation. On Trustpilot, the card averages around 3.8 out of 5 stars based on more than 400 reviews, reflecting a fair balance of satisfied users alongside some criticisms. Over on G2, it performs slightly better with an average rating of 4.1 out of 5 stars, where fintech product reviewers highlight its functionality and ease of use.

In community spaces like Reddit and other crypto forums, feedback is mostly favorable as well. Many users appreciate the convenience of being able to spend crypto directly, but discussions often circle back to recurring concerns around fees and occasional customer support delays.

Common Praise Themes

Users often highlight the ease of setup and instant virtual card issuance. Many say they were able to apply, pass KYC, and start spending the same day. One reviewer on Trustpilot wrote:

“Got verified within 2 hours and my virtual card was ready immediately. Used it online without a single issue.”

Another strong point is global acceptance. Since RedotPay runs on a major network (Visa/Mastercard), users report being able to spend without restrictions while traveling. On G2, a business owner noted:

“I use it when flying between Hong Kong and Europe—works at hotels, shops, and online without rejection.”

Frequent Complaints

The biggest downside users mention is fees, especially for ATM withdrawals. Some say they were surprised by hidden FX spreads, which made overseas transactions costlier. A Reddit user pointed out:

“No foreign transaction fee, but the exchange rate wasn’t great. Ended up paying more than I expected.”

Another common frustration is with customer support response times. While many get quick help, others report long waits when dealing with blockchain deposit issues. This inconsistency is a recurring complaint across Trustpilot and forum threads.

Customer Service Feedback

Customer service gets a mixed rating. Live chat is available, but some users feel resolution is too slow when the issue involves crypto deposits rather than card transactions. For basic card queries (like locking/unlocking cards), the support seems efficient.

Top 6 Alternatives to the RedotPay Card

In this section, we’ll explore six top alternatives, including direct competitors, premium and budget options, a fintech challenger, a traditional banking solution, and the UPay.best Card, which has been gaining attention. By the end, you’ll have a clearer picture of which card fits your lifestyle best.

Crypto.com Visa Card

Best For: Users who want cashback rewards and perks like Spotify/Netflix rebates.

The Crypto.com Visa Card is one of the most popular crypto debit cards, especially known for its generous cashback program ranging from 1% to 5% depending on how much CRO you stake. It also offers perks like free Spotify or Netflix on higher tiers, making it attractive for lifestyle users. However, the staking requirement can be a drawback for those who don’t want their funds locked.

Key Differentiators:

Crypto.com’s Visa card stands out with its tiered staking model, offering up to 5% cashback depending on how much CRO you stake

Pricing: No annual fee, but staking CRO is required for higher rewards.

Pros:

- Cashback rewards up to 5%.

- Perks like Spotify, Netflix, and airport lounge benefits.

- Large global brand with a strong app ecosystem.

Cons:

- Requires CRO staking, which ties up funds.

- Rewards may fluctuate with token value.

Why Choose Over RedotPay

If rewards are your priority, Crypto.com clearly outshines RedotPay, which offers no cashback at all.

Nexo Card

Best For: Users who want a credit line against their crypto without selling assets.

The Nexo Card works differently from many competitors because it allows you to borrow against your crypto rather than sell it. This means you can keep your assets while still accessing liquidity through everyday spending. It also has the advantage of no monthly or annual fees and supports both virtual and physical cards. The downside is that rewards and benefits are more limited compared to cards like Crypto.com.

Key Differentiators:

Nexo offers a unique dual-mode card: spend either from your credit line (backed by crypto collateral) or directly from your balance

Pricing:

No annual fee. Competitive interest rates on borrowed funds.

Pros:

- Cashback in BTC or NEXO.

- Borrow against crypto without selling.

- Works at 90M+ merchants worldwide.

Cons:

- Borrowing rates depend on the loyalty tier.

- Limited to supported cryptos.

Why Choose Over RedotPay

If you want rewards plus the ability to borrow against crypto, Nexo has a clear advantage.

Binance Card

Best For: Active Binance exchange users who want to integrate trading and spending.

The Binance Card is best suited for people already using the Binance ecosystem. It supports direct crypto-to-fiat conversion at the point of sale, making it easy to spend your holdings worldwide. Cashback up to 8% (depending on BNB holdings) is a big plus, but again, this comes with staking or balance requirements. Its main limitation is that it’s not available in every country.

Key Differentiators:

The Binance Card links directly to your Binance wallet, supporting multiple coins and offering up to 2% cashback in BNB

Pricing:

No annual fee. Standard transaction fees apply.

Pros:

- Up to 2% cashback in BNB.

- Supports multiple cryptos.

- Direct integration with the Binance trading wallet.

Cons:

- Rewards limited to BNB.

- Availability restricted in some regions.

Why Choose Over RedotPay

If you’re already a Binance trader, this card gives you more convenience and perks than RedotPay.

UPay.best Card

Best For: Users looking for instant, low-cost crypto-to-fiat access with a strong loan feature.

The UPay.best Card strikes a balance between flexibility and affordability. Its key strength lies in instant crypto spending and low-interest crypto loans, allowing users to manage both payments and credit seamlessly. It’s designed to be user-friendly and accessible, making it suitable for people who want an all-in-one crypto finance tool without high fees or complicated staking.

Key Differentiators:

UPay is positioning itself as a flexible option with both crypto card services and instant loan access. It allows users to borrow against their crypto at low interest rates while also offering simple spending through its card.

Pricing:

Low or no annual fees, depending on the region. Interest rates on loans are competitive.

Pros:

- Instant crypto loans at low interest.

- Supports major stablecoins and BTC/ETH.

- Both spending and borrowing built into one app.

Cons:

- Smaller ecosystem than big exchanges.

- Not yet available in all countries.

Why Choose Over RedotPay

If you want borrowing power plus spending ability, UPay offers more versatility than RedotPay, which only focuses on payments.

Revolut Card

Best For: Users who want multi-currency support with both fiat and crypto features.

The Revolut Card is technically more of a fintech challenger bank card with crypto features. It lets you hold, exchange, and spend both fiat and digital currencies, making it highly useful for frequent travelers and international spenders. With features like budgeting tools, currency exchange at interbank rates, and optional perks through premium plans, it appeals to those who want banking and crypto in one place.

Key Differentiators:

Revolut is a fintech powerhouse, offering crypto trading within its app alongside traditional banking services. The Revolut card supports multi-currency accounts, travel perks, and even cashback on some plans.

Pricing:

Free basic plan; premium plans start at around $10/month.

Pros:

- Works like both a bank card and a crypto card.

- Great for travel with multi-currency support.

- Offers budgeting and savings tools.

Cons:

- Crypto withdrawals are limited compared to exchanges.

- Premium perks require a paid subscription.

Why Choose Over RedotPay

If you need an all-in-one finance app, Revolut is more versatile than RedotPay, which is crypto-only.

Coinbase Card

Best For: U.S. and European users already in the Coinbase ecosystem.

The Coinbase Card is a straightforward way to spend crypto directly from your Coinbase balance. It automatically converts crypto to fiat at checkout and even rewards users with up to 4% back in crypto on purchases. This makes it a beginner-friendly option, especially for those already holding assets on Coinbase. On the downside, fees can add up quickly compared to alternatives.

Key Differentiators:

The Coinbase Card directly connects to your Coinbase account and supports a wide range of coins. Users can choose which crypto to spend and earn up to 4% back in rewards (depending on coin selection).

Pricing:

No annual fee, but standard crypto transaction fees apply.

Pros:

- Up to 4% rewards in selected cryptos.

- Strong security and trusted brand.

- Wide crypto support.

Cons:

- Rewards depend on coin selection.

- Fees on conversions can add up.

Why Choose Over RedotPay

If you already use Coinbase, this card makes spending your holdings seamless and rewarding, unlike RedotPay’s no-reward structure.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| RedotPay Card | $0 (virtual) / Low fee (physical) | None | None | No | Everyday crypto spending | Supports BTC, ETH, USDT, USDC + instant issuance | No rewards or cashback | 4 |

| Crypto.com Visa | $0–$349 (tier-based) | 1%–5% (CRO staking required) | Free Spotify/Netflix (higher tiers) | Yes | Rewards + lifestyle perks | Cashback + free subscriptions | Requires CRO staking for perks | 4.3 |

| Nexo Card | $0 | Up to 2% in crypto | None | No | Borrowing against crypto | Spend without selling assets | Limited reward options | 4.1 |

| Binance Card | $0 | Up to 8% (BNB staking) | None | Yes | Active Binance users | Direct crypto-to-fiat conversion | Not available everywhere | 4.2 |

| UPay.best Card | $0 | None | None | No | Instant loans + spending | Low-interest crypto loans | No cashback/rewards | 4 |

| Revolut Card | $0–$16.99/mo (premium tiers) | Varies by plan | Varies by plan | Yes | Global spending + travel | Multi-currency exchange at real rates | Limited crypto rewards | 4.2 |

| Coinbase Card | $0 | Up to 4% in crypto | None | Yes | Coinbase account holders | Easy integration with Coinbase wallet | Higher fees compared to others | 3.8 |

| Wirex Card | $0 | Up to 2% in WXT rewards | None | No | Everyday crypto and fiat spending | Hybrid fiat/crypto support | Rewards tied to Wirex token (WXT) | 4 |

How to Choose: Decision Framework

Choosing the right crypto card can feel overwhelming with so many options on the market, each designed for different needs.

The good news is that you don’t need to overthink it, by breaking your decision into a few clear criteria, you can quickly identify which card is the best fit for your lifestyle, business, or financial goals. Below is a simple framework to help you decide.

Everyday Spending vs. Rewards

If your main goal is to spend crypto easily at shops, restaurants, or online without worrying about complicated perks, the RedotPay Card is a solid choice. It supports core cryptocurrencies like BTC, ETH, USDT, and USDC and offers instant issuance of virtual cards.

However, if rewards are important, like earning cashback or lifestyle perks, then Crypto.com Visa or Binance Card may be better options since they provide up to 5%–8% cashback, though both require staking tokens for higher rewards.

Business Size & Cash Flow

For small businesses or freelancers who want liquidity without selling crypto, the Nexo Card or UPay.best Card stands out. Both allow you to borrow against your holdings, which means you can keep your assets intact while covering expenses.

Larger businesses with more frequent international transactions may find the Revolut Card more suitable because of its strong global payments network and real exchange rates.

Industry-Specific Needs

If you’re in industries like e-commerce or digital services where recurring subscriptions are common, look for cards that support auto-conversion and recurring payments. The Coinbase Card and RedotPay Card are well-suited here, as both handle crypto-to-fiat conversion seamlessly for recurring charges like SaaS tools or online platforms.

International vs. Domestic Use

Travelers and remote workers should prioritize cards with low or no foreign transaction fees and wide merchant acceptance. The Revolut Card is the clear winner for international use thanks to multi-currency support, while the Binance Card is a strong crypto-native option, accepted in most countries where Binance operates.

If you’re based in a single country and don’t often travel, the RedotPay Card may be sufficient for simple domestic spending.

Technology & Integrations

Some users may want their card to work seamlessly with apps, wallets, or APIs. The Wirex Card and Revolut Card both provide advanced integrations and budgeting tools, making them more appealing for tech-savvy users. On the other hand, RedotPay keeps things simple, great if you prefer minimal setup and a no-frills approach.

Conclusion

The RedotPay Card delivers exactly what it promises: a straightforward way to spend crypto anywhere that accepts Visa or Mastercard. With support for major coins like BTC, ETH, USDT, and USDC, plus instant virtual card issuance and a global acceptance network, it does the job without much hassle. However, it’s not designed for those chasing flashy rewards or cashback perks.

This card is perfect for people who simply want to use their crypto for everyday purchases without needing to convert it manually to fiat. It’s also a strong option for freelancers, digital nomads, or online shoppers who value speed, convenience, and worldwide compatibility. If you want a reliable utility card that works out of the box, RedotPay is an excellent fit.

On the other hand, if you’re looking for rewards, cashback, or lifestyle perks, you may find RedotPay a bit underwhelming. Competitors like the Crypto.com Visa Card or the Binance Card offer higher cashback rates and added benefits, though they come with staking or balance requirements. For users focused on borrowing against crypto holdings rather than spending, the Nexo Card or UPay.best Card may provide better flexibility.

Among alternatives, the Revolut Card stands out as a well-rounded option if you travel frequently or need advanced multi-currency features. It blends both traditional fintech and crypto functions, making it a strong choice for international use.

Overall, RedotPay sits firmly in the market as a “no-frills utility card”. It doesn’t compete on rewards but positions itself as a simple, secure, and widely accepted tool for crypto spending. If your main goal is to spend your digital assets quickly and easily, RedotPay holds its ground. But if rewards, perks, or advanced features matter more, exploring other options might be the smarter move.

Also Read: AlphaX Affiliate Program: Overview, Benefits & Commission

FAQs

What is a RedotPay Card?

The RedotPay Card is a crypto-powered debit card that lets you spend Bitcoin, Ethereum, USDT, and USDC directly online, in stores, or at ATMs worldwide. It converts your crypto into fiat instantly at checkout.

Can I use RedotPay in my country?

RedotPay is available in over 100 countries, including most of Europe, Asia, Africa, and parts of Latin America. Just download the app, it will let you know right away if your country is supported.

How do I get started?

It’s simple. Just download the app, verify your identity (KYC), and get a virtual card instantly. If you want a physical card, you can order one through the app for a small fee.

What fees should I expect?

RedotPay charges about 1%–1.18% per transaction. There are no monthly fees, but expect small charges for ATM withdrawals, card issuance, and network deposits depending on your blockchain.

Can I link the card to Apple Pay or Google Pay?

Yes. RedotPay supports both Apple Pay and Google Pay, so you can make contactless payments using your phone, just like any regular bank card.

Does RedotPay offer cashback or rewards?

No, it doesn’t. RedotPay focuses on simplicity, high limits, and fast global access. It doesn’t offer cashback or points, but it’s a solid choice if you just want to spend crypto easily and securely.