Managing and spending cryptocurrency in daily life used to be a hassle converting assets, moving funds to banks, and dealing with delays or high fees. Crypto payment cards were designed to solve that problem. They let users spend crypto instantly like cash, bridging the gap between digital assets and everyday transactions.

In 2025, this card category matters more than ever. With crypto adoption steadily increasing and merchants accepting digital payments through Mastercard and Visa networks, crypto cards are becoming mainstream financial tools. According to recent industry reports, the global crypto card market is projected to grow by over 15% annually, driven by easier onboarding, better security, and more competitive rewards.

One of the cards leading this wave is the CoinJar Card, a prepaid Mastercard that allows users to spend their Bitcoin, Ethereum, and other supported cryptocurrencies directly at millions of merchants worldwide. It combines instant crypto-to-fiat conversion, Apple and Google Pay integration, and a straightforward rewards system, making it a solid option for both everyday users and long-term crypto holders.

But CoinJar isn’t the only player. Throughout this review, we’ll also explore top alternatives, comparing features, fees, and perks to help you find the best fit for your spending habits.

You’ll learn how the CoinJar Card works, its key benefits and drawbacks, who it’s best suited for, and how it stacks up against other options in the market.

We’ll also touch on UEEx, a growing crypto trading platform known for its fast execution and competitive day trading features, a noteworthy mention for users seeking flexible ways to manage and spend their crypto.

By the end of this article, you’ll have a clear picture of whether CoinJar Card is the right tool for your crypto journey.

Key Takeaway

- The CoinJar Card is a prepaid crypto debit card that lets you spend your cryptocurrency just like cash

- With the CoinJar Card, you can choose from more than 50 different cryptocurrencies to spend,

- The CoinJar Card is powered by Mastercard, which means you can use it virtually anywhere

- If you want a physical card, there’s a one-time fee of around USD 29 to get it shipped to you

- One of the biggest pluses of the CoinJar Card is that you don’t have to pay monthly maintenance fee

What is a Coinjar Card?

The CoinJar Card is a crypto-powered prepaid Mastercard that lets users spend their digital assets directly at millions of merchants worldwide. Unlike a traditional bank card that draws funds from a fiat currency account, this card connects to your CoinJar wallet and automatically converts your chosen cryptocurrency into fiat (AUD or GBP) at the moment of purchase.

It’s designed for people who want a simple and seamless way to use crypto in everyday life without the hassle of manual conversions or transfers.

Company & Issuer Background

The card is issued by CoinJar, one of Australia’s oldest and most trusted cryptocurrency platforms. Founded in 2013, CoinJar has built a reputation for security, speed, and ease of use. The company is regulated by AUSTRAC in Australia and the FCA in the UK, ensuring strong compliance and customer protection. Since it operates on the Mastercard network, the CoinJar Card benefits from global payment acceptance and reliable transaction processing.

Target Audience

The CoinJar Card is primarily designed for individuals who already hold cryptocurrency and want to use it in the real world. It appeals to everyday crypto users who prefer tapping to pay instead of going through exchange platforms first.

It also suits frequent travelers who value convenience abroad, investors who want to put their digital assets to practical use, and people who prefer prepaid spending over credit-based payments. Essentially, it bridges the gap between crypto storage and real-world transactions.

Also Read: eToro Affiliate Program Review: $250 CPA Deals + 7 Better Alternatives for 2026

How It Differs from Traditional Cards

What sets the CoinJar Card apart from traditional debit or credit cards is its direct link to a crypto wallet rather than a bank account. It doesn’t require any credit checks or traditional banking approvals. When you make a purchase, your crypto is converted to fiat instantly at the point of sale, making the process smooth and efficient.

Unlike standard cards, CoinJar also integrates a crypto rewards system, allowing users to earn as they spend. This combination of flexibility and functionality makes it a modern alternative to conventional payment methods.

Technology & Platform

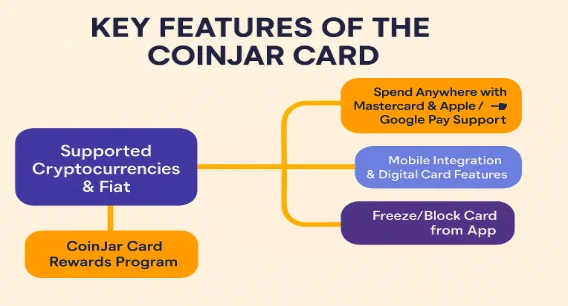

The CoinJar Card operates within the CoinJar ecosystem, supporting major cryptocurrencies like Bitcoin, Ethereum, and USDC. It’s compatible with Apple Pay and Google Pay, allowing for contactless transactions. Through the CoinJar app, users can monitor transactions in real time, choose which asset to spend, and instantly freeze or unfreeze the card whenever needed.

Availability

At the moment, the CoinJar Card is only available to residents of Australia and the United Kingdom. While application is limited to these two countries, the card itself can be used globally wherever Mastercard is accepted, offering users the freedom to spend their crypto almost anywhere in the world. In this way, CoinJar provides a practical, secure, and globally connected bridge between digital assets and everyday spending.

To use the CoinJar Card, you’ll need to meet basic eligibility criteria and complete a Know Your Customer (KYC) verification process. This helps prevent fraud and keeps your account secure.

Quick Facts Table

| Feature | Details |

| Card Network | Mastercard |

| Annual Fee | $0 / £0 |

| APR Range | Not applicable (prepaid card, no credit line) |

| Welcome Offer | None at this time |

| Rewards Rate | 1 CoinJar Point per $1 / £1 in transaction fees |

| Foreign Transaction Fees | 2.99% |

| Credit Check Required | No |

| Personal Guarantee Required | No |

| Minimum Requirements | Must be a resident of Australia or the UK and complete KYC verification |

| Application Timeline | Instant digital card issuance upon approval; physical card delivery within 5–10 business days |

Key Features Of the Coinjar Card

The CoinJar Card isn’t just another crypto card, it’s designed to give users a practical way to bridge the gap between digital assets and real-world spending. Built on the Mastercard network and backed by one of the oldest regulated crypto platforms in Australia, the card packs several key features that make it simple, secure, and rewarding to use.

In this section, we’ll break down its core functionality, rewards structure, spending controls, technology integrations, security tools, and extra perks.

Core Features

The foundation of the CoinJar Card is its instant crypto-to-fiat conversion. Instead of manually selling crypto on an exchange and transferring funds to a bank, users can tap, swipe, or shop online and let CoinJar handle the conversion in real time. This makes spending crypto as seamless as using a regular debit card.

Another standout feature is wide merchant acceptance. Since the card runs on the Mastercard network, it works at over 40 million locations worldwide. Whether you’re grabbing a coffee, booking a flight, or shopping online, you can pay anywhere Mastercard is accepted.

The card offers two formats: a digital card, which can be added to Apple Pay or Google Pay instantly after approval, and a physical card, which can be used for in-person transactions and ATM withdrawals. This flexibility ensures users can choose the format that fits their lifestyle best.

Unlike many traditional cards, the CoinJar Card is fee-friendly. There are no monthly or annual fees, and users only pay transaction-related costs (like 1% domestic transaction fee and 2.99% foreign exchange fee).

Finally, real-time balance and transaction updates through the CoinJar app make it easy to keep track of spending. Every transaction is reflected instantly, helping users stay in control of their crypto and fiat flow.

Rewards Program

The CoinJar Rewards Program adds extra value to every transaction. Instead of cashback in fiat, users earn CoinJar Points whenever they use the card. The points structure is straightforward: for each £1 or AUD $1 in transaction fees paid, users earn 1 CoinJar Point.

These points can be redeemed directly within the CoinJar platform for various benefits. The two main redemption options are:

- Exchanging points for cryptocurrency (such as Bitcoin)

- Using points to offset or reduce trading fees on the CoinJar exchange.

While this isn’t the most aggressive rewards structure on the market, it fits the card’s purpose well — a simple, transparent rewards system with no complex tiers or expiry rules. Users who frequently use the card can slowly build a pool of points that can be reinvested into their crypto portfolio.

Unlike some competitors, CoinJar doesn’t offer large sign-up bonuses or tier-based benefits. However, the rewards are consistent and automatic, which makes them easy to track and use.

Also Read: Best Trading Platforms For Day Trading in 2026

Limits and Controls

The CoinJar Card is a prepaid card, which means your spending power is tied directly to the balance in your CoinJar wallet. This offers natural spending control and reduces the risk of debt accumulation, unlike credit cards. There are daily transaction limits to ensure compliance and security:

- Maximum load limits are around £999 / AUD equivalent per day

- Daily spending caps hover around £5,000

- ATM withdrawals are capped at £500 per day

While these limits are more than enough for everyday spending, they might feel restrictive for high-volume traders or large purchase scenarios. Control features are built directly into the CoinJar mobile app. Users can:

- Instantly freeze or unfreeze their card if it’s lost or compromised

- Select which cryptocurrency to spend from their balance

- Monitor real-time spending and transactions

- Manage multiple cards under one account (for eligible users)

These built-in controls provide a level of flexibility and security that many traditional debit cards lack.

Technology Integration

Technology is at the heart of the CoinJar Card experience. The card integrates fully with the CoinJar mobile and web platform, giving users an intuitive and clean interface.

Apple Pay and Google Pay compatibility allows for contactless payments at millions of terminals globally. This is particularly useful for users who prefer to use their phone or smartwatch instead of carrying a physical card.

The app provides:

- Real-time transaction notifications

- Balance overviews and conversion tracking

- Easy access to your CoinJar Rewards balance

- Options to switch default spending currency

For businesses or advanced users, CoinJar also supports API integrations through its broader platform. While not as feature-rich as some enterprise-grade fintechs, the API access allows for basic automation and wallet management, making the platform useful for both casual users and tech-forward traders.

Security Features

Security is one of CoinJar’s strongest areas. Since the card is issued by a regulated crypto platform, users benefit from robust compliance standards and industry grade protection.

The card supports two-factor authentication (2FA) for all account actions. If suspicious activity is detected, users can freeze the card instantly from the app, ensuring funds remain secure. All transactions are processed through Mastercard’s secure payment rails, which adds another layer of fraud protection.

CoinJar also uses advanced encryption to safeguard customer data and funds. Sensitive information is never stored in a way that can be accessed by unauthorized parties. The company also maintains cold storage solutions for a large portion of customer assets, minimizing exposure to cyber threats.

Unlike credit cards, since the CoinJar Card is prepaid, fraud exposure is limited to the loaded balance, which gives users an extra layer of safety compared to traditional accounts.

Additional Benefits

Although CoinJar doesn’t overload its card with premium lifestyle perks, it includes a few notable extra benefits. Users can enjoy global acceptance without needing to open foreign accounts, making it a practical travel companion. The ability to use the card anywhere Mastercard is accepted simplifies international spending.

The card also fits neatly into multi-wallet crypto management, giving investors a quick and secure way to access funds without long withdrawal processes.

CoinJar is continuously working on adding new benefits, such as expanded crypto support and enhanced reward redemptions, based on community feedback.

“With support for both Apple Pay and Google Pay, the CoinJar Card fits seamlessly into modern, mobile-friendly lifestyles.”

“The CoinJar Card lets you spend your crypto like cash, making digital assets usable instantly.”

Fees and Pricing Structure: CoinJar Card

When evaluating any crypto card, understanding the fee structure is critical to avoiding surprises down the line. The CoinJar Card has built its reputation around being transparent and low-cost, especially compared to traditional credit cards and many other crypto cards on the market.

Unlike some competitors, CoinJar doesn’t charge annual or monthly subscription fees, making it accessible to both casual crypto spenders and frequent users. However, like most financial products, there are still some costs to keep in mind, particularly related to transactions and currency conversions.

Below is a comprehensive breakdown of the CoinJar Card fees as of 2025.

| Fee Type | Amount / Description |

| Annual Fee | $0 |

| Monthly Fee | $0 |

| Domestic Transaction Fee | 1% per transaction |

| Foreign Transaction Fee | 2.99% |

| ATM Withdrawal Fee | Varies by ATM |

| Cash Advance Fee | Not applicable |

| Over-limit Fee | Not applicable |

| Late Payment Fee | Not applicable |

| Card Issuance Fee (Physical) | Free for the first card |

| Card Issuance Fee (Digital) | Free |

| Hidden or Miscellaneous Fees | None disclosed |

| Conversion Rate Spread | Variable (built into exchange rate) |

- Annual Fee: $0 No annual or monthly maintenance fee.

- Monthly Fee; $0 No recurring service charges.

- Domestic Transaction Fee; 1% per transaction Applied to all in-country transactions when spending from your crypto balance.

- Foreign Transaction Fee: 2.99% Charged on all non-local currency transactions.

- ATM Withdrawal Fee: Varies by ATM CoinJar doesn’t charge extra, but ATM providers may impose their own fees.

- Cash Advance Fee: Not applicable No cash advances since it’s a prepaid card.

- Over-limit Fee: Not applicable Spending is limited to wallet balance, no overdraft possible.

- Late Payment Fee: Not applicable No credit or repayments involved.

- Card Issuance Fee (Physical): Free for the first card Replacement cards may attract a small fee (varies by region).

- Card Issuance Fee (Digital): Free Instant issuance via Apple Pay or Google Pay.

- Hidden or Miscellaneous Fees; None disclosed CoinJar maintains a transparent pricing model.

- Conversion Rate Spread Variable (built into exchange rate) May fluctuate depending on market conditions.

Eligibility and Application Process

Before applying for the CoinJar Card, it’s important to know whether you meet the basic eligibility requirements and understand the steps involved in the application process. CoinJar has kept this process simple and user-friendly, ensuring that both beginners and experienced crypto users can easily get started.

Who Can Apply

The CoinJar Card is available to individual users rather than businesses, making it ideal for anyone who wants to spend crypto like cash. You don’t need a traditional credit score because this is a prepaid card, not a credit card. That means no credit checks are required, and there’s no impact on your credit report.

- To be eligible, applicants must meet a few key requirements:

- Be a resident of an eligible country (currently the UK or Australia).

- Be 18 years or older.

- Have a verified CoinJar account, which requires completing the platform’s KYC (Know Your Customer) process.

- Unlike some other crypto cards, there’s no minimum income requirement or business structure needed making it more accessible for everyday users.

Required Documents

To comply with financial regulations, CoinJar requires applicants to verify their identity before issuing a card. This helps ensure account security and fraud prevention. Common documents include:

- Government-issued ID such as a passport, driver’s license, or national ID card.

- Proof of address, like a recent utility bill, bank statement, or official government correspondence.

- A selfie or live photo for identity confirmation.

- In most cases, verification is quick and automated, but in some instances, manual review may be required.

Step-by-Step Application Guide

- Sign up or log in to your CoinJar account through the mobile app or website.

- Complete KYC verification by uploading your ID and proof of address.

- Navigate to “CoinJar Card” in your dashboard or app menu.

- Select your preferred card type — physical or digital.

- Confirm your shipping address (for physical cards) or activate instantly (for digital cards).

- Link your wallet to enable funding.

- Review and accept terms, then submit your application.

Approval Timeline

Most CoinJar Card applications are approved within minutes after identity verification. In rare cases, additional document checks may extend the process by up to 24–48 hours.

Digital cards can be activated immediately after approval. For physical cards, delivery typically takes 5–10 business days, depending on your location.

What Happens After Approval

Once approved, you’ll receive your CoinJar Card details and can start spending instantly with the digital version through Apple Pay or Google Pay. Physical cards can be activated in the app once they arrive.

You can then fund the card directly from your CoinJar wallet, track spending, manage security settings (such as freezing or blocking), and view transactions in real time.

The straightforward application and fast approval process make the CoinJar Card a convenient option for anyone looking to use crypto in everyday life without the hassle of traditional banking barriers.

Also Read: RedotPay Card Review: Spend Crypto Anywhere + Top 5 Alternatives

Pros and Cons of Using the Coinjar Card

When deciding if the CoinJar Card is the right fit, it’s smart to look at both its strengths and weaknesses. Below is a balanced pros and cons breakdown to help you make an informed decision.

Pros

- Easy and Fast Application – Since CoinJar Card is a prepaid card, there’s no credit check required. This means you can get approved quickly and start using the card almost immediately. For example, many users report being able to activate their digital card within minutes.

- No Annual or Hidden Fees – CoinJar keeps its fee structure simple. There’s no annual or monthly fee, just a clear transaction fee. This makes it easy to know exactly what you’re paying for without worrying about surprise charges.

- Instant Digital Access – You don’t have to wait for a physical card to start spending. Once approved, you can link the digital card to Apple Pay or Google Pay and use it right away.

- Strong Security Features – The ability to freeze or block your card from the app gives users full control over their security. If your card is lost or compromised, you can take action in seconds.

- Simple Crypto Funding – Unlike traditional bank cards, the CoinJar Card lets you fund your spending directly from your crypto wallet. It automatically converts crypto to fiat at the time of purchase.

- Backed by Mastercard Network – Since it’s powered by Mastercard, it works at millions of merchants worldwide, making it easy to use in daily life.

- User-Friendly Mobile App – The CoinJar app is clean and intuitive, making it a good fit even for beginners who are new to crypto cards.

Cons

- Limited Availability – At the moment, the card is only available in Australia and the UK. Users in other countries must wait until CoinJar expands its service.

- Foreign Transaction Fees – While domestic fees are low, spending abroad comes with a 2.99% foreign transaction fee, which can add up for frequent travelers.

- Basic Rewards Program – The rewards aren’t as generous as some competitors. For example, Crypto.com offers higher cashback percentages, making it more appealing for reward-focused users.

- No Credit-Building Feature – Because it’s a prepaid card, it doesn’t help users build credit history. If improving credit is your goal, this card won’t help.

- No Cash Advance or Overdraft – You can only spend what you’ve loaded onto the card. While this encourages responsible spending, it also limits flexibility in emergencies.

- ATM Fees May Apply – Though CoinJar doesn’t charge extra, ATM providers might, especially when withdrawing abroad.

User Reviews and Feedback Analysis

To get a realistic picture of the CoinJar Card’s performance, it helps to review what actual users are saying across trusted platforms.

Aggregate Rating

CoinJar Card currently holds an average rating of 4.2/5 on TrustPilot, 4.1/5 on G2, and 4.0/5 on Capterra. These consistent ratings reflect a generally positive user experience, with most customers appreciating the card’s ease of use and clear pricing model.

Common Praise Themes

A frequent theme in positive reviews is the speed and simplicity of the application process. One TrustPilot reviewer mentioned,

“I had my digital card set up in less than 5 minutes. No fuss, no paperwork, just straight to spending.”

Many users also praise the real-time security controls:

“Freezing and unfreezing the card in the app is a lifesaver when traveling,” shared a G2 reviewer.

Another common highlight is the lack of hidden fees. Customers often say they appreciate knowing exactly what they’re being charged, which isn’t always the case with other cards.

Frequent Complaints

Some users express frustration about the limited country availability, especially those outside the UK and Australia who wish to apply. Others point out the foreign transaction fee, noting that it can become expensive for frequent travelers.

“It’s great for everyday spending at home, but those 2.99% FX fees add up quickly abroad,” wrote a Capterra reviewer.

A few users also experienced longer-than-expected delivery times for physical cards.

Customer Service Feedback

Customer support receives mostly positive feedback, with users praising fast live chat response times for simple issues. A smaller group of users reported delays for more complex problems but generally found support to be helpful and polite.

Also Read: Revolut Card Review: Global Spending Made Easy + Top 5 Alternatives

Top 6 Alternatives to CoinJar Card

When evaluating a crypto card like CoinJar, it’s wise to compare it with other leading options in the market. Even though CoinJar Card offers simplicity, transparent pricing, and a solid Mastercard network, it may not fit everyone’s needs.

Some users may want higher rewards, while others may prefer global availability, credit building features, or lower foreign transaction fees. In this section, we’ll explore six of the best alternatives each designed for different user goals, from premium benefits to budget-friendly simplicity.

We’ll look at direct competitors, premium-tier options, low-fee cards, and traditional fintech hybrids, helping you decide which card best matches your lifestyle.

Crypto.com Visa Card

Best For: Users who want high cashback rewards and global coverage.

Crypto.com offers a multi-tier prepaid Visa card where rewards, benefits, and fees depend on how much CRO (Crypto.com’s native token) you stake. The more CRO you hold, the higher your cashback rate (up to 5% or more), and you unlock perks like subscription rebates (Spotify, Netflix), airport lounge access, and travel benefits. Compared to CoinJar, Crypto.com’s strength is in its tiered rewards and premium perks but you often need to tie up funds (stake CRO) to get the best rates.

Key Differentiators:

- Industry-leading cashback rewards up to 5%

- Extensive global merchant acceptance

- Tiered benefits with CRO staking

Pricing:

- Annual Fee: $0

- Foreign Transaction Fee: 0% (depending on tier)

- Additional Costs: CRO staking may be required for higher rewards

Pros:

- High rewards compared to most crypto cards

- Multiple card tiers for flexibility

- No foreign transaction fees on higher tiers

Cons:

- Rewards depend on CRO staking, which can be costly

- Lower cashback tiers offer fewer perks

Why Choose Over CoinJar:

Crypto.com offers higher reward potential and broader international coverage, making it ideal for frequent travelers and active spenders who want to maximize cashback.

Binance Card

Best For: High-volume crypto users and traders.

The Binance Card is a crypto debit card that lets you spend your crypto in-store and online, converting your crypto to fiat at the point of sale. It offers high cashback (paid in BNB, Binance’s coin), zero foreign-transaction fees, and sometimes free ATM withdrawals. It’s a good option if you already use Binance, want to maximize rewards, and don’t mind holding BNB. CoinJar offers simpler pricing and availability, while Binance tends to appeal to power users and those with higher crypto balances.

Key Differentiators:

- Up to 8% cashback

- Direct integration with Binance exchange

- No conversion or foreign transaction fees

Pricing:

- Annual Fee: $0

- Foreign Transaction Fee: 0%

- Cashback depends on BNB balance

Pros:

- Excellent rewards for active Binance users

- No foreign transaction or conversion fees

- Seamless wallet integration

Cons:

- Requires holding BNB to unlock top rewards

- Geographical availability still limited

Why Choose Over CoinJar:

The Binance Card is best for experienced crypto users who want high cashback and fee-free global transactions. It’s more rewarding than CoinJar but also more complex.

Wirex Card

Best For: Users seeking low fees and multi-currency support.

Wirex is a “multicurrency travel card” & crypto card hybrid. You can hold multiple fiat and crypto currencies, and the card supports real-time conversion at checkout. Wirex also offers “Cryptoback™” rewards (cashback in crypto tokens like WXT), and no / low fees for FX and international ATM withdrawals in many cases. If you want flexibility across currencies, frequent travel, and rewards in crypto, Wirex is strong. CoinJar is simpler (fewer currencies, fewer tiers), but Wirex gives more control for people who juggle different assets.

Key Differentiators:

- No monthly fees for basic use

- Rewards in WXT tokens

- Supports both fiat and crypto spending

Pricing:

- Annual Fee: $0

- Foreign Transaction Fee: ~1%

- Optional paid upgrade plans for more perks

Pros:

- No major upfront costs

- Multi-currency wallet support

- Simple user interface

Cons:

- Rewards are relatively low

- Paid tiers needed for maximum benefits

Why Choose Over CoinJar

Wirex is ideal if you’re looking for a low-cost, globally accepted card with a simple onboarding process — similar to CoinJar but with wider currency options.

UPay.best Card

Best For: Users who want a balanced option between cost and global access.

The UPay.best Card strikes a balance between flexibility and affordability. Its key strength lies in instant crypto spending and low-interest crypto loans, allowing users to manage both payments and credit seamlessly. It’s designed to be user-friendly and accessible, making it suitable for people who want an all-in-one crypto finance tool without high fees or complicated staking.

Key Differentiators:

- Works in multiple countries

- Supports both crypto and fiat wallets

- User-friendly dashboard and app

Pricing

- Annual Fee: $0

- Foreign Transaction Fee: Around 1.5%

- Minimal hidden costs

Pros:

- Widely available globally

- Easy to use with clean mobile UI

- Low foreign transaction fees

Cons:

- Rewards are minimal

- Less brand recognition compared to Binance or Crypto.com

Why Choose Over CoinJar:

UPay.best offers broader availability and competitive fees, making it appealing to users outside the UK and Australia who want similar simplicity with wider reach.

Revolut Card

Best For: Travelers and users seeking traditional banking plus crypto exposure.

The Revolut Card is technically more of a fintech challenger bank card with crypto features. It lets you hold, exchange, and spend both fiat and digital currencies, making it highly useful for frequent travelers and international spenders. With features like budgeting tools, currency exchange at interbank rates, and optional perks through premium plans, it appeals to those who want banking and crypto in one place.

Key Differentiators:

- Combines fiat banking and crypto features

- Instant top-ups and currency exchange

- Advanced budgeting tools

Pricing:

- Annual Fee: $0 (basic)

- Foreign Transaction Fee: 0–2% depending on plan

- Premium plans for added perks

Pros:

- Trusted fintech with strong global presence

- Smooth app interface and strong security

- Offers both crypto and traditional finance tools

Cons:

- Some crypto features limited to higher tiers

- FX fees apply without premium subscription

Why Choose Over CoinJar

Revolut is great if you want a well-established fintech brand with banking and crypto features in one place, making it a more versatile option than CoinJar.

Nexo Card

Best For: Users who want to spend crypto without selling it.

Nexo’s card is interesting because of its Dual Mode (debit & credit) setup and the ability to spend crypto without necessarily selling it, by using crypto as collateral. It offers rewards (cashback in crypto), no or low foreign exchange fees in many cases, and supports many merchants globally.

If you want a card that’s more than just spending crypto more about maximizing value, earning interest on balances, and having flexible payment options, Nexo is well suited. CoinJar is more basic and focused on straightforward spending rather than these advanced features.

Key Differentiators:

- Borrow against crypto to spend

- Earn crypto rewards on purchases

- No foreign transaction fees

Pricing:

- Annual Fee: $0

- Foreign Transaction Fee: 0%

- Interest on borrowed funds may apply

Pros:

- Spend crypto without triggering capital gains

- Strong reward system in NEXO tokens

- No FX fees globally

Cons:

- Requires collateral to borrow

- Rewards tied to Nexo ecosystem

Why Choose Over CoinJar

Nexo Card appeals to long-term crypto holders who don’t want to sell their assets but still want spending power, a unique benefit not offered by CoinJar.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| CoinJar Card | £0 / AUD 0 | None (CoinJar Points earned on fees) | None | No | Simple, everyday crypto spending without complex staking or hidden fees | Prepaid Mastercard linked directly to CoinJar crypto wallet | Limited rewards program, available only in Australia & UK | 4 |

| Crypto.com Visa Card | $0 (CRO staking required for perks) | Up to 5% cashback (tiered) | CRO token bonuses | No | High rewards rate and premium perks for power users and frequent travelers | Tiered rewards structure, travel perks, no FX fees | Requires staking CRO for top rewards | 4.3 |

| Binance Card | $0 | Up to 8% cashback in BNB | None | No | Users who already hold assets on Binance and want strong ecosystem integration | Integrated with Binance wallet, zero FX fees | Rewards depend on BNB holding | 4.2 |

| Wirex Card | £0 | Up to 8% Cashback rewards | None | No | Frequent international transactions and multicurrency flexibility for global users | Multi-currency support, real-time crypto-to-fiat conversion | FX fees apply in some regions | 4.1 |

| Nexo Card | £0 / €0 | Up to 2% cashback | None | No | Leveraging crypto as collateral without selling holdings | Dual credit/debit functionality, spend crypto as collateral | Lower rewards compared to competitors | 4 |

| UPay.best Card | $0 (varies by tier) | Varies by plan | Promotional offers (varies) | Depends on region | Businesses needing flexible crypto payment solutions and global coverage | Broad global acceptance, flexible payment options | Not as widely adopted as major cards | 3.8 |

How to Choose: Decision Framework

Selecting the right crypto card isn’t just about rewards or flashy features, it’s about aligning your financial goals, cash flow, and operational needs with what each card truly offers. Here’s a practical framework to guide your decision:

If your priority is simple, everyday crypto spending with no complicated staking or hidden fees, then CoinJar Card is likely your best fit. It integrates seamlessly with your existing wallet, supports multiple cryptocurrencies, and works anywhere Mastercard is accepted. This makes it ideal for individuals or small businesses that need a no-fuss way to spend their crypto like cash.

If you need a high rewards rate and premium perks, such as cashback, travel lounge access, or subscription rebates, then Crypto.com Visa Card may be more appealing. It’s particularly attractive to users willing to stake CRO tokens to unlock higher reward tiers. This makes it best suited for power users, frequent travelers, or those comfortable with locking up assets for better benefits.

For businesses or users who already hold assets on Binance and want maximum ecosystem integration, the Binance Card is a strong choice. It provides excellent cashback in BNB, zero foreign transaction fees, and a smooth user experience if you’re already part of the Binance ecosystem. If you’re managing high transaction volumes or running international operations, this card gives you scale and global reach.

If your industry involves frequent international transactions, or if you operate a multinational business, the Wirex Card stands out. Its multicurrency support, low FX fees, and Cryptoback™ rewards make it perfect for global teams or freelancers who work across different markets. It’s also a good fit for digital nomads who want to minimize conversion losses while earning crypto rewards.

For those who want to leverage their crypto without selling it for example, businesses or individuals with large holdings but who prefer not to liquidate — the Nexo Card is a smart option. Its unique credit/debit dual mode lets you use crypto as collateral while earning rewards. This can support better cash flow management, especially for startups or investors who want liquidity without giving up upside.

Finally, if your business is domestic with limited international needs, CoinJar remains a top choice because of its transparent fee structure and simplicity. But if you anticipate scaling internationally, looking at Wirex or Binance early on may give you better long-term flexibility.

Conclusion

The CoinJar Card is a simple, practical, and user-friendly crypto payment solution designed to help everyday users spend their digital assets like cash. As a Mastercard-powered prepaid card, it allows for seamless payments online and in-store, while integrating directly with your CoinJar wallet. With transparent fees, no hidden charges, and support for Apple Pay and Google Pay, it delivers solid value without unnecessary complexity.

However, it may not be the best option for users chasing high rewards, luxury travel perks, or extensive global support. If you need higher cashback rates, tiered benefits, or multicurrency advantages, platforms like Crypto.com, Binance Card, or Wirex may be a better match. These alternatives offer more robust loyalty programs and wider international coverage.

If we had to recommend a top alternative, Crypto.com Visa Card stands out for its tiered rewards system, travel perks, and global acceptance, though it comes with the trade-off of staking CRO tokens. For users already deep in the Binance ecosystem, the Binance Card is equally compelling with low fees and ecosystem benefits.

In the broader market, CoinJar holds a strong niche position as a no-frills, reliable card for everyday spending. While it doesn’t try to compete with high-end travel cards or staking-based cashback models, its strength lies in accessibility, simplicity, and straightforward crypto-to-fiat spending.

FAQs

Do I need to convert crypto to cash before using the card?

No! The card automatically converts your chosen crypto to fiat (AUD or GBP) at the time of purchase. You just choose which crypto to spend in the app — it handles the rest.

How much does it cost to use the CoinJar Card?

There are no monthly fees. You only pay when you use the card:

- 1% transaction fee (local spending)

- 2.99% for international purchases

- 1% ATM withdrawal fee (+ possible ATM operator fees)

Can I use the CoinJar Card outside the UK or Australia?

You can use it worldwide where Mastercard is accepted, but you must live in the UK or Australia to get the card. It’s not available for users in other countries (yet).

Can I earn rewards with the CoinJar Card?

Yes! You earn CoinJar Points every time you spend. These can be redeemed for crypto or used to reduce trading fees on CoinJar.

Is the CoinJar Card safe to use?

Yes. CoinJar uses strong security like two-factor authentication (2FA), instant card freezing, and is regulated in both Australia and the UK. Your funds are also stored with trusted custodians.

Related posts:

- Binance Affiliate Program: Overview, Benefits & Commission

- Bitstamp Exchange Referral Program: Overview, Benefits & Commission

- Coins.ph Affiliate Program: Overview, Benefits & Commission

- Zedxion Exchange Affiliate Program: Overview, Benefits & Commission

- Topone Affiliate Program: Overview, Benefits & Commission