Using crypto for everyday spending has always been a challenge. While digital assets are growing in adoption, most people still face hurdles when trying to use them for groceries, online shopping, or travel. Traditional financial systems are not fully integrated with crypto yet, leaving a gap for solutions that connect digital assets with real-world payments.

That is where crypto debit and prepaid cards come in. With global crypto ownership estimated at over 560 million people in 2024, demand for practical tools to spend crypto continues to rise. Crypto-backed cards solve this by converting digital currencies into fiat at the point of sale, making it easier for users to tap, swipe, and spend as they would with any other bank card.

The Crypto.com Visa Card is one of the most recognized products in this category. It offers multiple tiers tied to CRO staking, with cashback rewards, subscription rebates, and travel perks. Unlike many traditional credit cards, it charges no annual fees, and its global availability makes it a popular choice among crypto users who want both flexibility and rewards.

In this review, we will cover the card’s features, fees, pros and cons, supported countries, and staking requirements. We will also compare it with other leading options in the market, so you can see whether it is the right fit for your needs.

Alongside Crypto.com, we will also touch on UEEx, a platform focused on simplifying cross-border payments and enhancing global crypto accessibility.

By the end of this article, you’ll have a clear understanding of how the Crypto.com Visa Card works, where it stands against alternatives, and whether it deserves a place in your wallet.

Key takeaways

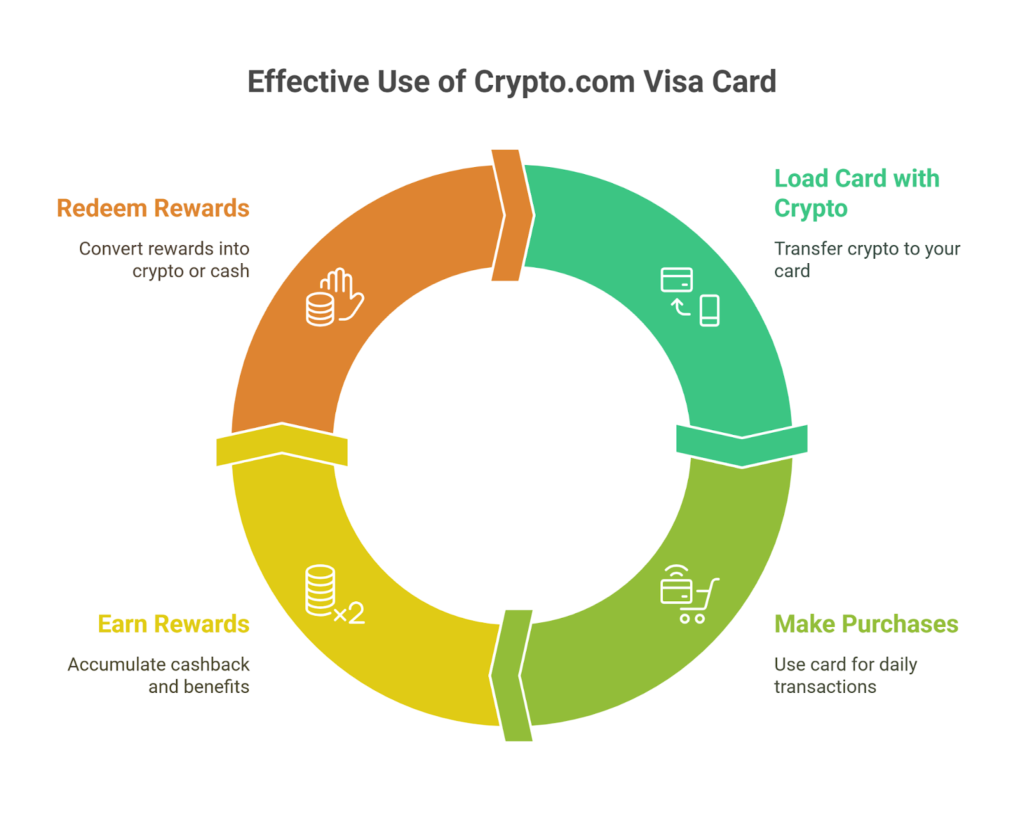

- The Crypto.com Visa Card lets you spend crypto like cash by topping it up with fiat or crypto in the app.

- All cards have no annual fees and offer interbank exchange rates for foreign currency spending.

- Higher-tier cards include perks like Spotify and Netflix rebates, airport lounge access, and travel discounts.

- Cashback rewards are paid in CRO and depend on your card tier and staking status.

- The card is available in select countries across North America, Europe, Asia, and Latin America.

What is the Crypto.com Visa Card?

The Crypto.com Visa Card is a prepaid debit card that allows users to spend cryptocurrency like traditional money anywhere Visa is accepted. Unlike a credit card, it does not extend credit but instead requires users to load funds in advance. These funds can come from fiat top-ups or by converting crypto within the Crypto.com app. The card is available in both physical and virtual formats, making it versatile for in-store payments, online shopping, and mobile wallet use.

The card is issued by Crypto.com, a global financial services company founded in 2016 and headquartered in Singapore. Crypto.com has grown into one of the largest crypto platforms, serving over 80 million users worldwide. Beyond the card, its ecosystem includes an exchange, DeFi wallet, NFT marketplace, and the Cronos blockchain. The Visa Card is a flagship product in this ecosystem, designed to connect everyday spending with digital asset ownership.

The target audience for the Crypto.com Visa Card is crypto users who want to put their assets to work in daily life. It appeals especially to people who are already invested in CRO, the native token of Crypto.com, since staking CRO unlocks higher rewards and perks. Travelers, subscription-heavy users, and those seeking cashback benefits are among the key demographics. For beginners, the free Midnight Blue tier provides a simple entry point with no staking requirement.

The card differs from traditional debit and credit cards in two important ways. First, rewards are paid in CRO tokens rather than fiat cashback or points. Second, many perks, such as higher cashback or rebates for services like Spotify and Netflix, require CRO staking. This design links the user experience directly to the performance and utility of Crypto.com’s ecosystem, something not seen in traditional banking products.

The Crypto.com Visa Card is currently available in multiple regions, including the U.S., Canada, EU, U.K., Singapore, Australia, and selected countries in Asia and Latin America. It is not yet supported in most of Africa, China, or sanctioned jurisdictions. Despite these regional limits, its coverage remains one of the broadest among crypto debit cards, helping position it as a leading option in the market today.

Quick Facts of Crypto.com Visa Card

To help you decide faster, here is a summary table highlighting the core specifications of the Crypto.com Visa Card.

| Features | Details |

| Card Network | Visa |

| Annual Fee | None |

| APR Range | Not applicable (prepaid debit card, not a credit card) |

| Welcome Offer | None; rewards unlocked via CRO staking |

| Rewards Rate | 0%–5% cashback in CRO (tier-based) |

| Foreign Transaction Fees | None (uses interbank exchange rates up to tier-specific limits) |

| Credit Check Required | No |

| Personal Guarantee Required | No |

| Minimum Requirements | KYC verification; CRO staking required for higher tiers |

| Application Timeline | Virtual card issued instantly; physical card delivered in 7–14 business days |

Key Features of Crypto.com Visa Card

To understand the card’s real value, it helps to look closely at its core features and how they work in practice.

Core Features

The Crypto.com Visa Card offers a range of core features designed to make crypto spending practical and rewarding. First, it provides cashback rewards in CRO, ranging from 0% to 5% depending on the staking tier. This positions it as a flexible rewards card for crypto users. Second, the card charges no annual fee, which lowers the barrier to entry compared to many traditional rewards cards. Third, it offers subscription rebates for platforms like Spotify, Netflix, and Amazon Prime at selected tiers, allowing users to offset common monthly expenses.

Another core feature is its travel benefits, including access to airport lounges and discounts with partners like Expedia and Airbnb at higher tiers. The card also provides free ATM withdrawals up to tier-specific limits, after which a small fee applies. Additionally, all cardholders benefit from interbank exchange rates for foreign currency transactions up to certain thresholds. Together, these features make the card suitable for everyday use, subscriptions, and travel.

Rewards Program

The rewards structure is one of the main draws of the Crypto.com Visa Card. Cashback is paid out in CRO, the platform’s native token, and is credited instantly after each purchase. The rate varies by tier: the free Midnight Blue offers no cashback, Ruby Steel provides 1%, Royal Indigo and Jade Green offer 2%, Icy White and Frosted Rose Gold reach 3%, and Obsidian tops out at 5%. Each tier also has a monthly cap for cashback, which can affect heavy spenders.

Unlike traditional cards, where rewards points may expire, CRO cashback remains in the user’s account and can be held, staked, or converted back to fiat or other cryptocurrencies. This gives users flexibility in how they use their rewards, but it also exposes them to CRO’s price volatility. For example, 3% cashback may lose value if CRO’s price falls. The card’s design encourages users to participate more deeply in the Crypto.com ecosystem by staking and holding CRO.

Limits and Controls

As a prepaid debit card, the Crypto.com Visa Card operates with no credit line. Spending limits are tied to the amount loaded on the card and vary by tier and region. For example, higher-tier cards may have higher monthly ATM withdrawal and interbank exchange limits compared to entry-level options. Ruby Steel allows around $400 in free monthly ATM withdrawals, while Obsidian users can withdraw significantly more before fees apply.

Users manage their cards fully through the Crypto.com app. From the app, they can set spending controls, freeze or unfreeze the card instantly, and review transaction history in real time. This gives flexibility and helps maintain control over funds without waiting for traditional bank support. The app also issues instant notifications for every purchase, making tracking straightforward.

Technology Integration

The card operates entirely through the Crypto.com app, which serves as the hub for loading funds, staking CRO, and monitoring rewards. The app allows users to top up the card with fiat currency, bank transfers, or crypto converted into fiat. Funds appear instantly, which simplifies the process of spending crypto without long settlement delays.

In terms of broader integration, the Crypto.com Visa Card works with mobile wallets such as Apple Pay, Google Pay, and Samsung Pay in supported regions. This allows for contactless transactions in-store and easier online payments. While the card does not provide open APIs for custom integrations, the app itself functions as the central control point for most users.

Security Features

Security is built into both the physical card and the platform. The card itself uses EMV chip technology, which is standard for secure payments. Transactions are verified through two-factor authentication (2FA) on the app, and the app supports biometric logins such as fingerprint or facial recognition. This reduces the risk of unauthorized access.

On the back end, Crypto.com applies encryption and cold storage for user funds. Fiat balances in the U.S. are held with FDIC-insured partner banks up to standard limits, while in the EU and U.K., electronic money safeguards are in place under EMI regulations. Additionally, the company carries a $100M insurance policy for digital asset storage, covering theft or breaches. Together, these measures help reassure users that both their funds and card activity are protected.

Additional Benefits

Beyond cashback and rebates, the Crypto.com Visa Card provides several additional benefits. For frequent travelers, higher tiers include airport lounge access through LoungeKey, with Obsidian and Icy White users enjoying unlimited access and guest privileges. Discounts with travel partners such as Expedia and Airbnb are also available.

Another benefit is the potential for Crypto Earn boosts, where staking CRO as part of the card program can unlock higher interest rates on deposits within the Crypto.com Earn platform. Higher-tier users also receive priority customer support, which can be helpful for resolving issues faster. While traditional cards may offer insurance or concierge services, the Crypto.com Visa Card focuses instead on perks tied to streaming, travel, and crypto earnings.

The card blends practical features like no annual fees and interbank rates with crypto-linked rewards and perks. It is most appealing to users who already hold CRO or are comfortable staking it, as the best benefits are unlocked at higher tiers. At the same time, its basic tiers provide an entry point for newcomers who simply want a functional crypto-linked spending card.

Fees and Pricing Structure

One of the strongest selling points of the Crypto.com Visa Card is its straightforward fee structure. Unlike traditional credit cards, it has no annual fees, no late payment charges, and no over-limit fees, since it functions as a prepaid debit card rather than a line of credit. Most costs are tied to ATM withdrawals, foreign exchange limits, and specific service fees that apply if you exceed included allowances.

The table below outlines the main fees associated with the card:

| Fee Type | Details |

| Annual/Monthly Fees | None |

| Transaction Fees | None for in-store, online, or contactless purchases |

| Cash Advance Fees | Not applicable (prepaid card, not a credit card) |

| Late Payment Fees | Not applicable |

| Over-Limit Fees | Not applicable (spending limited to loaded balance) |

| Foreign Transaction Fees | None, up to interbank exchange limits by tier; 0.5% fee after the limit |

| ATM Withdrawal Fees | Free up to tier-specific monthly limits (e.g., $200–$1,000); 2% after limit |

| Card Issuance Fee | Free for first card; replacement card fees may apply |

| Hidden/Uncommon Fees | Inactivity fees after 12 months in some regions; CRO unstaking reduces benefits |

Annual and transaction fees

The card charges no annual or monthly fee, and everyday transactions such as point-of-sale, online shopping, or contactless payments do not carry fees. This makes it appealing to users who want a simple structure without recurring charges.

ATM and foreign exchange fees

The most important costs relate to ATM withdrawals and foreign exchange. Each tier provides a monthly quota of free ATM withdrawals and interbank exchange transactions. For example, the Ruby Steel card offers $400 in free ATM withdrawals monthly, while Obsidian provides up to $1,000. After these limits, a 2% withdrawal fee or a 0.5% foreign exchange fee applies. These are competitive compared to traditional debit cards, though frequent travelers may need to watch their usage.

Hidden or uncommon fees

While there are no surprise charges like late fees, users should be aware of two uncommon conditions. First, some regions apply an inactivity fee if the card is unused for 12 consecutive months. Second, while not a direct fee, unstaking CRO after the required 180-day lockup reduces cashback rates and perks, which may feel like a hidden cost for users expecting consistent rewards.

The Crypto.com Visa Card remains attractive for its no-fee entry point and simple structure. Most users will only encounter charges when exceeding withdrawal or FX limits, or when replacing a lost card. Compared with traditional banks that often charge annual fees and add markups on foreign transactions, the card is competitive in everyday use.

Also Read: Embily Card Review: Spend Crypto Anywhere with Visa + 8 Better Alternatives

Eligibility and Application Process

Before you can start using the Crypto.com Visa Card, it’s important to understand who is eligible and how the application process works.

Who Can Apply

The Crypto.com Visa Card is available to individual consumers, not businesses. Unlike traditional credit cards, there are no credit score requirements because it functions as a prepaid debit card. Instead, eligibility depends on residency in a supported country and the ability to complete Know Your Customer (KYC) verification.

Applicants must be at least 18 years old, have a valid government-issued ID, and in some regions, proof of residence. Higher-tier cards require CRO staking, but entry-level Midnight Blue has no staking requirement.

Required Documents

To meet KYC and anti-money laundering (AML) rules, applicants need to submit a few standard documents:

- Government-issued photo ID (passport, national ID, or driver’s license) for identity verification.

- Selfie or live facial scan to match the applicant with the submitted ID.

- Proof of address (utility bill, bank statement, or official letter dated within 3 months) is required in some regions for address confirmation.

- Tax identification number in certain jurisdictions where financial reporting obligations apply.

These documents are uploaded through the Crypto.com app during the application process.

Step-by-Step Application Guide

- Download the Crypto.com App from the App Store or Google Play.

- Register an account with your email address and create a secure password.

- Complete KYC verification by uploading your ID, selfie, and proof of address (if required).

- Choose your card tier based on how much CRO you are willing to stake. Midnight Blue requires no stake, while premium tiers require CRO lockups.

- Stake CRO through the app if applying for a higher-tier card. The staking lockup is typically 180 days.

- Submit your application within the app once verification and staking are completed.

- Receive approval and gain access to your virtual card while waiting for the physical card.

Approval Timeline

Most applications are processed within a few minutes to 2 business days, depending on document verification and staking confirmation. In rare cases, additional compliance checks may extend the process. Once approved, a virtual card is issued instantly, and a physical card is shipped. Delivery usually takes 7 to 14 business days, though timing varies by region.

What Happens After Approval

After approval, users can immediately use the virtual card for online purchases or link it to Apple Pay, Google Pay, or Samsung Pay where supported. The physical card arrives by mail, which must be activated through the app. Cashback and perks begin right away, provided staking requirements are met.

Pros of Crypto.com Visa Card

The Crypto.com Visa Card offers several advantages that make it attractive to both crypto newcomers and experienced users.

1. Strong Cashback and Tier Benefits

Depending on your CRO stake and chosen tier, the card offers up to 5% cashback in CRO tokens. For example, Obsidian tier users get 5% back, while Icy White and Rose Gold users earn around 3%. These rewards can significantly reduce spending costs, especially for frequent transactions.

2. No Annual Fees and Interbank Exchange Rates

There is no annual or monthly fee on any card tier. Purchases and ATM withdrawals in foreign currencies use interbank exchange rates up to a tier-specific limit this avoids hidden markup fees common with traditional banks.

3. Additional Perks at Higher Tiers

Higher-tier holders enjoy value beyond cashback. For instance, Icy White users get ongoing rebates for Spotify, Netflix, and Amazon Prime, plus 10% back on Expedia bookings and lounge access.

Obsidian users add Airbnb booking rebates and unlimited airport lounge access.

Also Read: Revolut Card Review: Global Spending Made Easy + Top 5 Alternatives

Cons of Crypto.com Card

No card is perfect; here are some of the main disadvantages you should be aware of with the Crypto.com Visa Card.

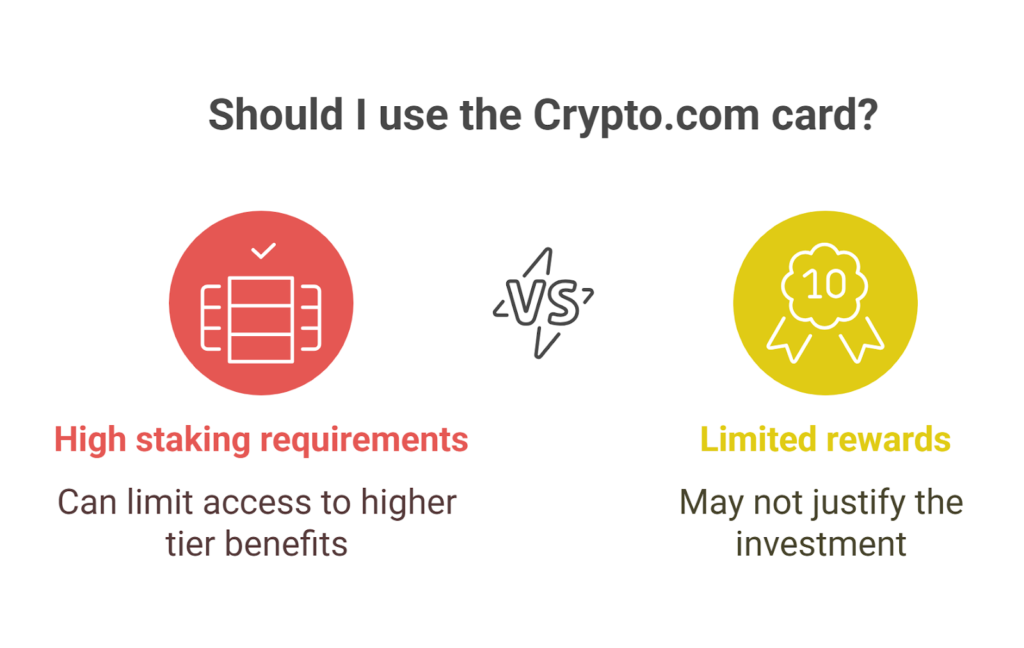

1. High CRO Staking Requirements

To access top-tier perks, you must stake large amounts of CRO up to 5 million CRO (about $400K) for Obsidian. This is a major commitment and risky if CRO’s market value drops.

2. Cashback Depends on the Volatile CRO

Rewards come in CRO tokens, whose value can swing significantly. A high cashback rate means less if CRO falls in value. Lower-tier users face monthly caps (like $25 or $50) that may limit rewards.

3. Geographic Restrictions and Complexity

Card availability varies by country, and some U.S. states (e.g., New York, California) are excluded. The ecosystem includes an app, exchange, and DeFi wallet; transferring assets between them can be confusing for new users.

In January 2022, Crypto.com disclosed a major hack that affected 483 accounts. £33–$34 million in BTC and ETH were stolen, though no losses occurred after protective actions, and users were reimbursed. The breach prompted improvement in their 2FA and incident response systems.

User Reviews and Feedback Analysis

Looking at customer experiences helps reveal common themes in service quality, rewards, and reliability.

Aggregate Rating

On Trustpilot, Crypto.com has a low average rating of 1.3 out of 5, based on over 9,200 reviews, with approximately 73% of reviewers giving one-star ratings. G2 doesn’t offer a card-specific rating, but feedback about the platform shows mixed results users appreciate the integrated ecosystem but note weak customer support.

Common Praise Themes

Some users praise the app and card’s practical benefits. A G2 reviewer highlighted the convenience: “By consolidating multiple crypto-centric services into one ecosystem … The integrated Visa card facilitated direct crypto spending at conventional merchants”. On Reddit, one user commented, “I’ve never had my card declined at a place they accept Visa… very good exchange rates when traveling abroad”.

Frequent Complaints

Negative reviews often focus on customer service, staking issues, and withdrawal delays. One Trustpilot reviewer said:

“Easy to buy high, easy to sell low. Hard to sell off stakes and removing your stake takes 18–30+ days, support is non-existent.” Trustpilot Another reported account access issues and poor handling:

“Locked out every time I change my phone or number … what is the big problem…?” Trustpilot Complaints about fund access and account freezes appear in BBB filings, where a user states Crypto.com continued withholding funds despite providing all required documentation.

Customer Service Feedback

Generally, customer support appears to be a major pain point. Trustpilot and G2 reviews frequently mention slow or unhelpful responses. G2 notes “inconsistent customer support experiences, with inquiries sometimes routed to automated chat systems lacking timely resolution”. Multiple Trustpilot users shared frustration over unresolved support tickets and repeated identity checks with no resolution

Also Read: eToro Affiliate Program Review: $250 CPA Deals + 7 Better Alternatives for 2026

Top Alternatives to the Crypto.com Visa Card

As appealing as the Crypto.com Visa Card is, it may not suit everyone. Whether you’re wary of staking requirements, live in a restricted region, or want different perks, it’s smart to explore the competition. In this section, we’ll compare six compelling alternatives across categories from low-cost cards to premium and niche solutions.

1. Coinbase Card (Issued by Coinbase)

Best For: Easy integration with Coinbase users in supported regions.

Key Differentiators

- Spends directly from your Coinbase balance.

- Offers up to 4% crypto rewards (e.g., BTC, XLM) on purchases.

- Seamless fiat conversion at point of sale.

Pricing

No annual or issuance fee; crypto conversion fees apply outside the U.S. (around 2.49%)

Pros

- Instant setup if you’re already on Coinbase.

- Up to 4% back in crypto.

- No annual fee.

Cons

- Limited to supported regions (primarily U.S., UK, parts of Europe).

- 2.49% conversion fee outside the U.S.

Why Choose Over Crypto.com

Ideal if you prefer a straightforward card without staking and already use Coinbase.

2. Nexo Card (Issued by Nexo)

Best For: Spending without selling crypto. It is great for HODLers.

Key Differentiators

- Dual-mode (debit and credit) functionality backed by crypto collateral.

- Up to 2% cashback in NEXO tokens or Bitcoin on Credit Mode; plus up to 14% interest on unused crypto in Debit Mode.

- Debit mode pays interest; credit mode provides spending power without liquidating crypto.

Pricing

No annual or monthly fees. Credit interest APR ranges from 2.9% to 13.9%. Available in the EEA and UK.

Pros

- Spend without selling your crypto.

- High interest on idle balances.

- No base fees.

Cons

- Limited availability (Europe only).

- Physical card delivery can take several weeks.

Why Choose Over Crypto.com

If you want to borrow or spend without selling crypto, this is a standout choice.

3. Wirex Card (Issued by Wirex)

Best For: Everyday spending with flexible crypto rewards.

Key Differentiators

- Supports 25–40+ cryptocurrencies and multiple fiats.

- Up to 8% “Cryptoback™” in WXT tokens.

- No annual or FX fees; global availability.

Pricing

No annual or foreign transaction fees; rewards require native WXT token holdings for full rate.

Pros

- High reward rate.

- Broad global access.

- Multi-currency support.

Cons

- Need to hold WXT for full benefits.

- Some markets have limited availability.

Why Choose Over Crypto.com

Great if you want broad compatibility and high rewards without staking CRO.

4. Gnosis Pay Card (Issued by Gnosis)

Best For: EU users seeking self-custodial control and zero fees.

Key Differentiators

- Funds stay in your wallet self-custodial setup via Gnosis Safe.

- No transaction, FX, or off-ramping fees.

- Up to 5% cashback in GNO tokens; includes OG NFT perks and ENS-based card customization.

Pricing

One-time issuance fee (~€30.23), no ongoing fees. Available in EEA and UK.

Pros

- True control over your funds.

- Zero ongoing fees.

- Unique defi-native perks.

Cons

- Upfront card cost.

- Cashback in GNO, not fiat.

Why Choose Over Crypto.com

Ideal if you value decentralization, fee transparency, and self-custody.

5. UPay Card (Issued by UPay.best)

Best For: Low-cost global usage with multi-feature integration.

Key Differentiators

- Supports USDT, with future upgrades for BTC, ETH, USDC.

- Zero cross-border or inactivity fees; multi-tool app for banking, savings, and remittances.

- Compatible with Apple Pay & Google Pay; instant conversion; VIP tiers available.

Pricing

No monthly or inactivity fees. Up to 0.5% waived on transaction fees; available globally.

Pros

- Low cost and global accessibility.

- Full mobile wallet integration.

- Broad feature set beyond payments.

Cons

- Limited crypto support initially (primarily USDT).

- Still evolving and newer in the market.

Why Choose Over Crypto.com

Best for users who want cost efficiency and a rich payment/savings tool, without CRO staking.

6. BlockCard (Issued by BlockCard)

Best For: Users who want control over which crypto is spent first.

Key Differentiators

- Customize which asset is spent first.

- Transparent fees with cashback up to ~6% and support for over 10 cryptocurrencies.

- Integrated with major exchanges for flexible funding.

Pricing

Activation fee ($10) and possible monthly fees ($5), which can be waived with sufficient non-cash volume.

Pros

- Spend strategy flexibility.

- Solid cashback.

- Exchange-linked integration.

Cons

- Monthly fees unless spending threshold is met.

- Smaller crypto support than some competitors.

Why Choose Over Crypto.com

A practical option for users who want asset-level control and decent rewards without token lockups.

7. Bitget Wallet Card (Issued by Bitget)

Best For: High-limit users and power spenders.

Key Differentiators

- No annual fees; supports multi-chain crypto; up to $3 million spending limit for top tiers.

- Earn up to 8% APY through DeFi “PayFi” ecosystem.

- Instant conversion and wide merchant acceptance.

Pricing

No charges, but high-tier access likely requires platform activity or fees.

Pros

- Massive spending limits.

- DeFi earnings baked in.

- No annual cost.

Cons

- Targeted at heavy users and may not suit casual spenders.

- High-tier onboarding process likely higher barrier.

Why Choose Over Crypto.com

Excellent for users needing high volume limits and integrated DeFi benefits.

Crypto Card Comparison Table

The table below offers a clear comparison of the Crypto.com Visa Card and its top alternatives across key factors like fees, perks, and eligibility.

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For | Key Feature | Major Limitation | Overall Rating |

| Crypto.com Visa Card | None | 0–5% CRO cashback (tier-based) | None | No | Crypto users willing to stake | High-tier perks, NO annual fee | Requires large CRO stake to unlock full benefits | 4.0 |

| Coinbase Card | None | Variable crypto rewards | None | No | Coinbase users seeking simplicity | Instant use, no staking, wide user base | Some crypto-to-fiat spread on conversions | 3.8 |

| Nexo Card | None | Up to 2% in NEXO tokens (Credit Mode) | None | No | Users wanting liquidity without selling | Dual-mode (Debit/Credit) + interest on balances | Limited to EEA/UK; token required for top tiers | 4.1 |

| Wirex Card | None | Up to 8% WXT cryptoback | None | No | High rewards and global reach | Broad crypto/fiat support, zero FX fees | Must hold WXT tokens to unlock full rewards | 4.2 |

| Gnosis Pay Card | ~€30 one-time issuance | Up to 5% GNO cashback | None | No | Tech-savvy EU users valuing self-custody | Self-custodial via Gnosis Safe | Card cost upfront; cashback in token only | 4.0 |

| UPay.best Card | None | Low-cost (primarily USDT) | None | No | Low-cost global usage | Zero cross-border/inactivity fees, Pay/Save tools | Limited crypto support at launch | 4.0 |

| Bitget Wallet Card | None | — (DeFi-linked advantages) | None | No | Heavy spenders & DeFi users | High spending limits, DeFi APY integration | High-tier access may require platform activity | 4.1 |

How to Choose: Decision Framework

With several strong options on the market, the right crypto card depends on your personal or business priorities. Instead of choosing based on hype, it helps to weigh factors like usage location, cash flow, industry needs, and technology requirements. Below is a simple framework to guide your decision.

Individual Needs and Lifestyle

For individuals who want broad rewards without staking tokens, the Wirex Card is often the most practical choice. It provides up to 8% cryptoback and supports dozens of currencies, which makes it easy for users to earn while spending both locally and abroad. On the other hand, people who value simplicity and already keep their funds on Coinbase may prefer the Coinbase Card.

It connects directly to the existing balance in their account and does not require lockups or extra steps. For those who prioritize full control over their money, Gnosis Pay offers a different approach, allowing users to manage their funds in a decentralized manner while linking directly to their wallet.

Cash Flow Situations

If you hold a large amount of crypto and prefer not to sell, the Nexo Card is well-suited for managing liquidity. It lets cardholders borrow against their assets instead of liquidating them, while still earning cashback on everyday purchases. For people working with tighter budgets, UPay.best is a practical option because it avoids hidden fees, inactivity charges, and cross-border costs, making it easier to manage steady but modest spending.

On the other end of the spectrum, if you are a high-volume spender, the Bitget Wallet Card may be more fitting. With limits up to $3 million, it is designed to handle heavy usage and includes the ability to integrate DeFi yields.

International vs. Domestic Use

Frequent travelers may find the Crypto.com Visa Card or Wirex Card especially useful. Both offer interbank exchange rates, no foreign exchange fees up to certain limits, and travel perks such as airport lounge access on higher tiers.

For users based primarily in Europe, Gnosis Pay stands out as it is tailored to the European Economic Area and offers features like ENS-based identifiers that are unique to that region. If broad global coverage is the main priority, UPay.best provides one of the widest ranges of supported countries with fewer restrictions compared to competitors.

Business and Industry Needs

Businesses that work with global contractors or rely heavily on cross-border payments may find Wirex or UPay.best, particularly cost-efficient. Both cards simplify international transactions while keeping fees under control.

Companies that operate within fintech or blockchain sectors may prefer Gnosis Pay, as it aligns with decentralized operations and provides tools that suit developer-friendly environments. For smaller startups or side projects, the Coinbase Card offers quick setup and straightforward integration into existing accounts, making it easier to adopt.

Technology Requirements

Technology preferences can also shape the decision. Users who prioritize mobile compatibility will appreciate that Crypto.com, UPay.best, and Coinbase all support Apple Pay, Google Pay, and Samsung Pay.

For those who want deeper blockchain integration, Bitget Wallet and Gnosis Pay stand out by offering stronger ties to DeFi platforms and staking opportunities, providing an option for users who want their card to function as part of a larger digital asset strategy.

Also Read: Plutus Debit Card Review: Earn Crypto Cashback on Everyday Spend + Top 5 Alternatives

Final Verdict

The Crypto.com Visa Card has established itself as one of the most recognized crypto payment cards on the market. It combines a tier-based reward structure with cashback in CRO, travel perks, and subscription rebates, all while charging no annual fees. Its widespread availability and integration with the broader Crypto.com ecosystem make it a convenient option for users who already hold or are willing to stake CRO.

This card is perfect for individuals who want to turn their everyday spending into an opportunity to earn crypto rewards. It works well for users who value perks like free Spotify or Netflix subscriptions, lounge access, or enhanced returns on Crypto.com’s Earn products. Frequent travelers and active members of the Crypto.com platform gain the most value, especially at mid- to high-tier levels where the benefits outweigh the staking requirements.

On the other hand, the Crypto.com Visa Card may not be the right fit for everyone. If you prefer not to stake CRO for long periods, the entry-level card offers very limited rewards compared to alternatives. Users who want flexible cashback in fiat, or who operate in regions where the card is still restricted, may also find it less appealing.

Businesses and individuals who rely heavily on borrowing against crypto assets, or who prioritize full control over their wallets, may find stronger solutions elsewhere.

Among the alternatives, the Wirex Card stands out as a top recommendation. It supports a wide range of currencies, offers up to 8% cryptoback without staking, and provides global coverage. For those who dislike token lockups or want to maximize flexibility, Wirex provides many of the same core benefits with fewer limitations.

In terms of overall market position, the Crypto.com Visa Card remains one of the most competitive and widely adopted crypto cards. It pioneered the tiered staking model and continues to be a benchmark for rewards-driven offerings.

While it requires a certain level of commitment from users willing to hold CRO, it strikes a balance between everyday usability and crypto integration that few competitors fully match.

Frequently Asked Questions (FAQ)

Can You Use the Card Without Staking CRO?

Yes, you can use the Midnight Blue card without staking CRO. However, it comes with no cashback rewards or premium benefits.

Is the Card Available in My Country?

The Crypto.com card is available in the U.S. (except New York), Canada, the EU, the UK, Australia, Singapore, Brazil, and select countries in Asia and Latin America. It is not available in most African countries, Russia, China, or sanctioned regions. You can confirm availability by checking the card section in the Crypto.com app.

What Happens If I Unstake My CRO?

If you unstake your CRO, your card tier benefits will be downgraded after the 180-day lockup period ends. This includes reduced cashback, loss of rebates (e.g., Spotify, Netflix), and removal of travel perks.

How Long Does Card Delivery Take?

Card delivery usually takes 7 to 14 business days after approval, depending on your region. In some areas, it may take longer due to shipping or customs delays. Virtual cards are available instantly in supported countries.

Are My Funds Safe with Crypto.com?

Yes, fiat balances are held in regulated bank accounts and protected by FDIC (U.S.) or EMI safeguards (EU/UK). Crypto assets are not insured but are stored in secure cold wallets, and the platform carries a $100M insurance policy.

Is the Cashback Taxable?

Yes, cashback in the form of CRO may be considered taxable income or a capital gain in some countries. Tax treatment depends on local laws, and it’s best to consult with a tax professional based on your location.

Related posts:

- Azbit Exchange Affiliate Program: Overview, Benefits & Commission

- BTCC Affiliate Program: Overview, Benefits & Commission

- CoinUp.io Affiliate Program: Overview, Benefits & Commission

- XEX Exchange Affiliate Program: Overview, Benefits & Commission

- Topcredit International Affiliate Program: Overview, Benefits & Commission