Imagine trading crypto without a broker, without waiting for a buyer, and without even needing to trust anyone. Sounds futuristic? Let me introduce you to Automated Market Makers (AMMs).

AMMs are the engine that powers decentralized exchange (DEX) platforms where anyone can swap tokens instantly, without middlemen. Instead of using the traditional “order book” system like centralized exchanges (think Binance or Coinbase), AMMs rely on smart contracts and liquidity pools to set prices and execute trades automatically.

Since its launch, AMMs have become the backbone of DeFi (Decentralized Finance), enabling trades and opening up financial opportunities to people across the world.

Key Takeaway

- Automated Market Maker (AMM) allows you buy and sell cryptocurrencies without a traditional buyer or seller

- With an Automated Market Maker (AMM), you don’t have to wait for someone to trade with.

- AMMs use mathematical formulas to determine prices instead of order books.

- Exchange rates for cryptocurrency pairs are based on supply and demand

- Over time, Automated Market Makers (AMMs) have gone beyond simple token swaps.

What Is an Automated Market Maker (AMM)?

An Automated Market Maker (AMM) is a type of decentralized trading system that allows users to buy and sell cryptocurrencies without needing a traditional buyer or seller on the other end.

Instead of relying on an order book like traditional exchanges, AMMs use smart contracts, self-executing code on the blockchain, to automatically determine prices and execute trades.

On the other hand, centralized exchanges (CEXs) have an order book that connects buyers and sellers to complete cryptocurrency trades at a price they both agree on.

With an Automated Market Maker (AMM), you don’t have to wait for someone to trade with. They can directly interact with smart contracts to buy, sell, or swap assets using the liquidity provided by others.

Exchange rates for cryptocurrency pairs are based on supply and demand. If there’s more liquidity than demand for a token, its price drops; if demand exceeds supply, the price rises

Here’s how it works in simple terms:

- AMMs use liquidity pools, which are pools of tokens funded by users known as liquidity providers (LPs).

- When someone wants to trade, the AMM uses a mathematical formula (often something like x * y = k) to determine the price based on the supply of each token in the pool.

- The trade is executed directly between the user and the smart contract, this is called peer-to-contract trading.

- So instead of relying on another trader, you’re interacting with code that ensures the trade happens smoothly, instantly, and transparently.

Historical Background of AMMs

The idea of AMMs goes back over 20 years. The term CFMM (Constant Function Market Maker) was first proposed by Robin Hanson in 2002 as part of his research into market mechanisms and prediction markets.

Fast forward to today’s crypto, and the first real-life applications started appearing around 2017–2018. Kyber Network was one of the earliest attempts to allow token swaps using smart contracts.

Then came Uniswap in 2018, which truly revolutionized decentralized finance (DeFi). Uniswap introduced a simple yet powerful AMM model that let anyone become a liquidity provider and earn trading fees without needing to be a professional market maker.

Since then, AMMs have become the backbone of DeFi, powering thousands of trades daily across platforms like Uniswap, SushiSwap, Curve, and more.

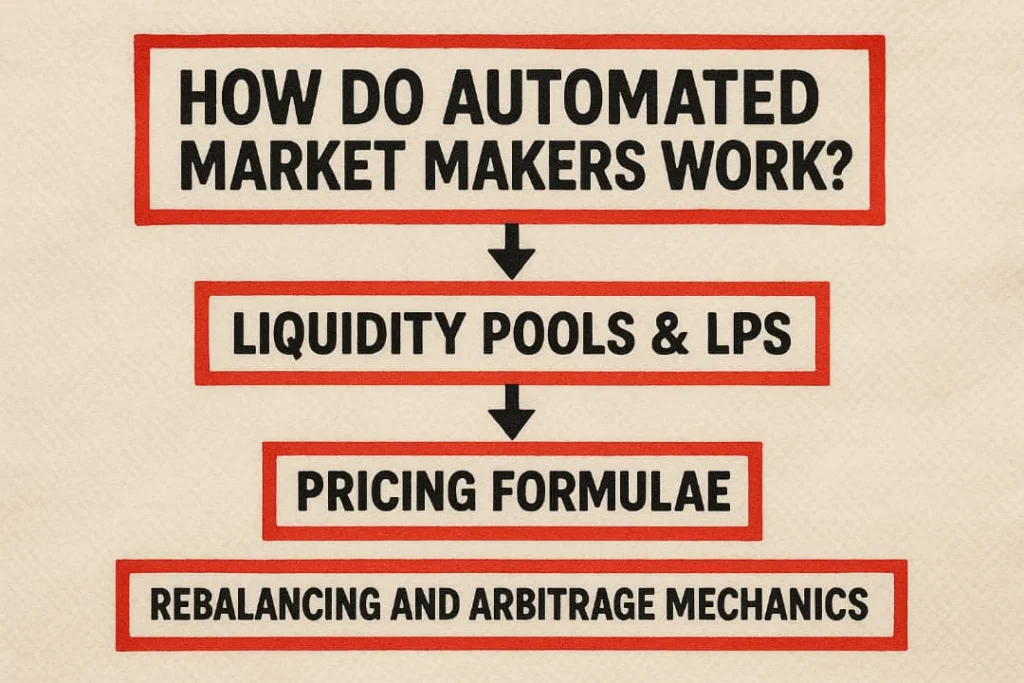

How do Automated Market Makers Work?

Automated Market Makers (AMMs) might sound complicated, but they work like programmable vending machines for cryptocurrency trading. Instead of waiting for a buyer or seller, AMMs use smart contracts, math formulas, and liquidity pools to let you trade instantly. Here’s how everything fits together

Liquidity Pools & LPs

At the core of every AMM is a liquidity pool, a shared pile of crypto tokens locked in a smart contract. A liquidity pool contains two or more tokens (for example, ETH and USDC). Users add these tokens, called Liquidity Providers (LPs).

Let’s say you want to provide liquidity to an ETH/USDC pool. You’ll deposit an equal value of both tokens (e.g., $500 worth of ETH + $500 worth of USDC).

In exchange, you receive LP tokens, which represent your share of the pool. These tokens can be staked or redeemed later to withdraw your share, + any earned fees

Whenever someone uses the pool to swap ETH for USDC or vice versa, they pay a small fee (e.g., 0.3%). These fees are distributed among all LPs, making this a form of passive income.

Pricing Formulae

AMMs use mathematical formulas to determine prices instead of order books. The most common formulas ensure that as one token is bought, its price increases, balancing supply and demand.

Constant Product Formula (x * y = k) — Uniswap Model

This is the most famous and widely used formula.

x = amount of Token A in the pool

y = amount of Token B in the pool

k = a fixed constant (product of x and y).

The rule is simple: as the amount of one token decreases, the amount of the other must increase to keep k constant.

For example, a pool starts with 100 ETH and 10,000 USDC → x*y = 1,000,000. If someone buys ETH, the ETH supply in the pool drops, → the price of ETH goes up. This creates a curve, meaning the more you trade, the worse the rate becomes (this is called slippage).

Constant Sum Formula (x + y = k)

This is used for stablecoins or similar-value assets. Allows near-zero slippage. However, the problem is If prices deviate even slightly, arbitrage traders can drain the pool. Not ideal for volatile assets.

Hybrid & Mean-Based Models

THis model is used by platforms like Curve Finance and Balancer. These models combine formulas (like weighted averages) to handle more than 2 tokens, optimize for low slippage, and allow custom weight distributions (e.g., 80% BTC, 20% ETH).

Rebalancing and Arbitrage Mechanics

Because AMMs rely on math rather than live market data, their prices can become misaligned with the broader market. That’s where arbitrage traders step in.

Arbitrage is the act of buying low on one platform and selling high on another to profit from the price difference.

How Does It Help AMMs?

Let’s say: ETH is $2,000 on Binance, but on Uniswap, due to recent trades, ETH is priced at $1,950. An arbitrage trader will buy ETH on Uniswap at $1,950, sell it on Binance for $2,000 and pocket the difference as profit

As they do this repeatedly, their trading helps restore the pool’s balance, bringing the AMM price back in line with the real market.

Types of Automated Market Makers Models & Variants

Over time, Automated Market Makers (AMMs) have gone beyond simple token swaps. Today, there are multiple types of AMM models, each with its own features, formulas, and use cases.

Classic AMM Models

These are the foundational AMM designs that most platforms started with, they are:

Constant Product Market Maker (CPMM)

Constant Product Market Maker (CPMM) is used by Uniswap v2. It handles any two-token pair, like ETH/USDC. As you buy one token, its price rises due to the formula’s curve. This model is great for volatile pairs but can lead to high slippage for larger trades.

Constant Sum Market Maker (CSMM)

Constant Sum Market Maker (CSMM) works on the formula x + y = k, making it ideal for similar-value assets such as stablecoins. It offers zero slippage until one side of the pool is drained, but is at the risk of arbitrage attacks.

Constant Mean Market Maker (CMMM)

Constant sum market makers (CSMMs) are an AMM variant that use the sum of two tokens as the basis, unlike CPMM, which uses the product.

The equation behind this is x + y = k. Accordingly, when one token’s supply increases, the other token’s supply decreases proportionally to uphold the constant sum (k).

The risk of slippage is pretty low in a CSMM model compared to other types. This is because the trade size doesn’t affect the exchange price present in the liquidity pool. Despite this, CSMMs are rarely used as a standalone market maker, due to liquidity concerns about handling large trades.

Advanced and Hybrid AMM Models

These AMMs blend formulas to reduce slippage and offer more flexibility.

StableSwap

It combines Constant Sum and Constant Product logic. Tailored for stablecoins or similar-value assets (e.g., USDC/DAI). It features extremely low slippage, even for large trades, and is ideal for stablecoin trading and yield farming.

Balancer Multi-Asset Pools

Supports up to 8 tokens per pool with customizable weights. Allows liquidity providers to create diversified crypto portfolios and also includes dynamic fee adjustments based on market volatility.

Read Also: Slippage in Crypto Trading: What It Is, and How to Avoid Costly Mistakes

Concentrated Liquidity AMMs (Uniswap v3)

Uniswap v3 introduced a game-changing concept, concentrated liquidity. Liquidity providers can choose specific price ranges to allocate their capital (e.g., provide ETH/USDC liquidity only between $1,800–$2,200). This means more efficient use of capital and higher rewards for active ranges.

Virtual AMMs (vAMMs)

vAMMs are a twist on traditional AMMs. Instead of real tokens in a pool, they use synthetic balances to simulate trades. It is common in derivatives platforms (like Perpetual Protocol). Traders can interact with a virtual pricing curve for assets like synthetic BTC, ETH, etc.

Key Benefits of Automated Marker Makers

Automated Market Makers (AMMs) have become the heartbeat of decentralized finance (DeFi) and for good reason. They’re not just tools for swapping tokens; they’re financial game-changers that empower anyone to trade, invest, and earn without banks or brokers.

Permissionless & Decentralized Access

One of the biggest benefits of AMMs is their open and borderless nature. You don’t need approval from a company or government to use an AMM.

All you need is a crypto wallet (like MetaMask) and some tokens, then you’re ready to swap, stake, or provide liquidity.AMMs operate entirely on decentralized smart contracts, meaning there’s no central authority holding your funds.

24/7 Liquidity Provision

Traditional finance has “market hours.” DeFi doesn’t. AMMs run 24/7, 365 days a year, with no downtime. You can trade tokens, add liquidity, or claim rewards at any time, from anywhere in the world. Liquidity is always available as long as the pool has tokens, even during weekends or global holidays.

This kind of always-on availability makes AMMs especially valuable in fast-moving markets like crypto.

Democratized Market-Making

Before AMMs, market-making (i.e., providing buy/sell liquidity) was reserved for big institutions with complex algorithms. AMMs change that, Anyone can become a liquidity provider (LP) by adding tokens to a pool. LPs earn a share of the trading fees, automatically. This means everyday users can earn passive income just by participating in the ecosystem.

Financial Composability

Automated Market Makers (AMMs) are valuable for connecting with various DeFi apps, creating a “money Lego” effect. They enable trading, staking, and borrowing with liquidity provider (LP) tokens, and now allow for trading NFTs and gaming tokens.

Some AMMs function across multiple blockchains, facilitating asset trading in ecosystems like Ethereum, BNB Chain, Arbitrum, and Polygon, enhancing flexibility in trading and finance.

Risks and Challenges of Automated Market Makers

While Automated Market Makers (AMMs) offer exciting opportunities, they’re not risk-free. Like any new technology, AMMs come with challenges, some visible, others hidden under the surface. If you’re trading or providing liquidity, here’s what you need to watch out for:

Impermanent Loss

Impermanent Loss happens when the price of the tokens in your liquidity pool changes compared to when you added them. This change can result in less value when you withdraw, even if the tokens themselves went up in price.

It’s called “impermanent” because the loss may reverse if prices return to the original ratio but that’s not always the case.

Slippage and Low Liquidity

Slippage is the gap between what you expect to pay for a trade and what you actually pay, often happening in small or low-liquidity pools. When trading in these pools, your transaction can shift the price more than in larger ones.

The takeaway? You might end up paying more or getting less than you anticipated. Always check your slippage tolerance on your DeFi app and opt for larger pools for better pricing.

Regulatory & Compliance Issues

While AMMs are open and borderless, they’re now on the radar of regulators around the world. Some regulators want DEXs and AMMs to verify user identity. Many users don’t realize that swaps can be taxable events, and some tokens traded via AMMs may be considered unregistered securities.

In some countries, this is leading to restrictions or legal gray zones, especially for developers and large liquidity providers.

Price Manipulation Risks

AMMs rely on token balances and sometimes price oracles to determine value. If those inputs are manipulated, the prices can be exploited. Your best defence is to stick with well-established platforms that use trusted, secure oracles (like Chainlink) and resist price manipulation through internal safeguards.

Conclusion

Automated Market Makers (AMMs) have completely changed how we trade and interact with crypto. They’ve taken the power of financial markets once reserved for big banks and trading firms and put it into the hands of everyday users.

But like any tool, AMMs come with both benefits and risks. From impermanent loss to smart contract bugs, it’s important to understand how they work before joining in. Fortunately, as the technology improves with smarter algorithms, dynamic pricing, and stronger security, AMMs are becoming even more powerful and user-friendly.

FAQs

What is an Automated Market Maker (AMM)?

An AMM is a system that lets you trade crypto directly using smart contracts, no need for a buyer or seller on the other end.

How do AMMs work without order books?

Instead of matching trades between people, AMMs use liquidity pools and math formulas to set prices and handle swaps automatically.

Can I earn money with AMMs?

Yes! By adding tokens to a liquidity pool, you become a liquidity provider (LP) and earn a share of trading fees like passive income

What’s an impermanent loss, and should I worry?

It’s a temporary loss of value when token prices change after you’ve added them to a pool. It’s normal, but sometimes it can affect your profits.

Are AMMs safe to use?

AMMs are powered by smart contracts, so risks include code bugs and hacks. Stick to audited and trusted platforms for better safety.

No related posts.