The Maldives—a land of pristine beaches and a vibrant tourism sector—has embraced the wheel of digital innovation like many other nations. Since cryptocurrency is gaining traction on every continent, this island nation is gradually opening its doors and allowing digital assets to crawl into its financial ecosystem.

Crypto provides a modern solution for residents and tourists to resolve high transaction fees or currency exchange challenges in sectors related to tourism and hospitality. This article outlines some of the best crypto exchanges in the Maldives for 2025, helping you navigate this evolving digital landscape with confidence.

Key Takeaways

- Maldives’ positive outlook towards cryptocurrency usage within its shores promoted adoption among Maldivians and tourists.

- Dhicoin is a Maldivian-owned cryptocurrency exchange that lowers the barrier to accessing cryptocurrency resources in the country.

- UEEx stands out as the best cryptocurrency exchange with the highest leverage (200x).

| Exchange | Trading Fees | Best For | Max Leverage | Available Assets | Fiat Support | Security Features | Unique Features |

| UEEx | 0.09% Maker/Taker (spot);0.08-0.10% Maker/Taker (margin) | Traders looking to diversify their portfolio with crypto and stocks, all in one platform. | 200x | 200+ | USD, EUR, more | Distributed cold storage, Access control with IP and wallet whitelisting, Proof of Reserve, Unique sending addresses, Two-factor authentication, and regular updates to wallet software. | UE Coin Miner app, copy trading, Advanced trading tools, Tree-Graph consensus mechanism, Unlimited receiving addresses. |

| Dhicoins | Variable | Maldivian traders seeking local options for P2P crypto transactions | N/A | Limited | MVR only | Secure wallet integration | Localized support for Maldivian Rufiyaa (MVR), a P2P marketplace |

| Symlix | No trading fees for P2P transactions | Peer-to-peer traders looking for flexible options | N/A | 50+ | MVR, USD, EUR | Non-custodial, encrypted transactions | User-friendly platform for secure P2P t |

| Coinbase | 0.00% – 0.40% (Maker)0.05% – 0.60% (Taker) | Beginners and investors seeking a user-friendly platform | 20x | 150+ | USD, EUR | Cold storage, Multi-factor Authentication (MFA), encryption, 48 hrs waiting period, AI-behavioral analytics, Biometric security, Transport Layer Security (TLS), AES-256 encryption | Educational resources, recurring buy feature, staking, and wallet integration |

| Spectrocoin | N/A | Traders seeking crypto payment integration | N/A | 40+ | USD, EUR, MVR | Cold wallets, 2FA. Identity verification, Third-party payment restrictions | Crypto payment gateway, prepaid debit cards, Crypto loans, SpectroCoin explorer, Dedicated IBAN’s |

| Bitget | 0.1% for Maker/Taker (spot); 0.02% (maker), 0.06% (taker) (Futures) | Futures and spot trading enthusiasts. | 125x | 150+ | USD, EUR | Multi-signature wallets, cold storage | Copy trading, advanced trading features,Launchpad, savings, and earnAffiliate/referral program. |

Top Exchanges in Maldives in 2025

1. UEEx – Best Overall

Summary: UEEx is a new digital asset trading platform that offers an enormous number of digital assets, from cryptocurrencies to stocks for trading, thus facilitating trading for Maldivian traders.

Since 2021, UEEx has been committed to providing advanced tools, high-level security, and easy services for all users. The UEEx exchange provides spot, margin, and savings product trading suitable for beginner investors or professional traders in the Maldives. Its main differentiator is an in-app UE Coin Miner app where one can mine tokens and access advanced copy trading for effortless investing.

For traders in the Maldives, UEEx is a safe and stable gateway into the dynamic world of crypto. UEEx has positioned itself as a top destination for traders seeking diversification and optimization of their portfolios.

Pros:

- More than 200 types of cryptocurrencies and stocks are available for trading in the Maldives.

- Competitive trading fees.

- Offers innovative features like mining the UE Coin on Telegram

- Access copy trading for convenient investments.

- User-friendly interface and mobile app, perfect for traders managing investments on the go.

- Robust security measures, including distributed cold storage and proof-of-reserve reports, to protect traders’ assets.

Cons:

- Limited fiat currency options for Maldivian Rufiyaa (MVR), which may require reliance on USD or other global currencies.

- Being a relatively new exchange, it lacks the prestige and trust a more historic platform would generate.

- Functions such as loan services and IEOs will depend on the restrictions that apply to Maldivian jurisdiction.

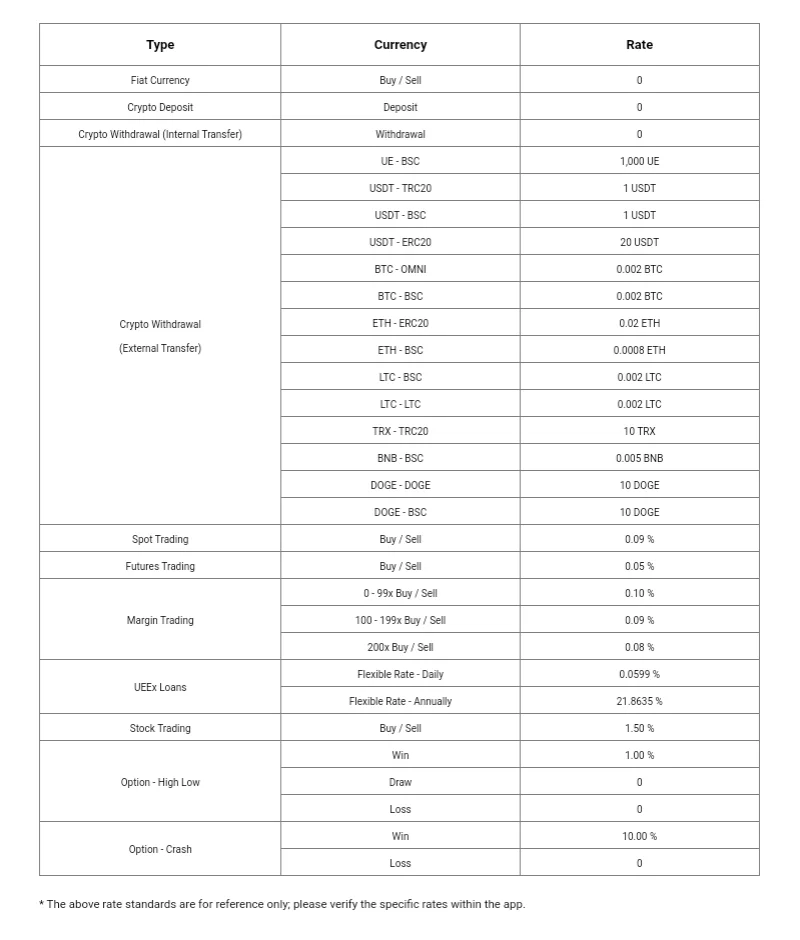

Fees:

- Spot Trading: Maker/taker fee is 0.09%.

- Margin Trading: Maker/taker fee is 0.10%.

- Deposit Fees: Free for most cryptocurrency deposits.

- Withdrawal Fees: Free for internal transfer; variable for external transfer and fiat withdrawal.

2. Dhicoin – Best for Maldivian Traders Seeking Local Options

Summary: Dhicoin is a local cryptocurrency exchange, uniquely fit for the Maldivian market, which gives traders a platform that has its basis on simplicity and ease of access. It was designed considering the special needs of the Maldivian users.

Dhicoin is reliable, with a very straightforward trading system, especially for beginners whose interest is in the purchase and sale of major cryptocurrencies like Bitcoin and Ethereum.

Dhicoin is the first-ever Maldivian-based exchange that allows for seamless and easy transactions in Maldivian Rufiyaa. This exchange will fill the entry gap for Maldivians looking to venture into the crypto space by offering them localized services and personalized support in their quest to explore the world of digital assets.

Pros:

- Localized services for Maldivian traders and easy support for Maldivian Rufiyaa (MVR).

- Beginner-friendly platform, straightforward to buy/sell.

- Personalized customer support to assist traders in case of questions.

- No need for currency conversion, saving lots of transaction costs for the Maldivians.

- High level of privacy and security for users.

Cons:

- Fewer cryptocurrencies are listed than on international platforms.

- Margin or futures trading isn’t available on the platform.

- Lower liquidity options available could affect large-volume traders.

- Limited support for either DeFi or staking services.

Fees:

- Spot Trading: The fee varies depending on the transaction size.

- Deposit Fees: Free or very negligible deposit charges in Maldivian Rufiyaa (MVR).

- Withdrawal Fees: Variable fees, depending on the cryptocurrency to be withdrawn.

3. Symlix – Best for P2P Traders Seeking for a Flexible Option

Summary: Symlix is a peer-to-peer cryptocurrency marketplace that aims to safely and comfortably connect buyers and sellers.

Symlix is a decentralized solution that can be quite beneficial to Maldivian crypto traders when it comes to trading directly without intermediaries. The exchange ensures exceptionally transparent, quick, and commission-free trades. It is a great platform for people who value privacy and efficiency.

Symlix gives Maldivian traders the flexibility to invest in Maldivian Rufiyaa, Bitcoin, Ethereum, and USDT. The website provides a service of protection via escrow for safe transactions, even for first-time buyers/sellers.

Pros:

- Peer-to-peer trading without any intermediary fees.

- Escrow protection for secure transactions between buyers and sellers.

- Transparent pricing with no hidden costs.

- Allows for local currency transaction capabilities, further facilitating this for Maldivian users.

- Flexibility in trading, as each user can put up his price and means of payment.

Cons:

- There is less liquidity compared to centralized exchanges, which could affect the speed and volume of trades.

- There are no advanced trading options, such as futures, margin, or staking.

- Reliability and pricing depend on individual traders.

- Customer support is not as strong as on centralized platforms.

Fees:

- Trading Fees: There is no commission on trades; users only pay for blockchain network fees.

- Deposit Fees: No deposit fees for local currency deposits.

- Withdrawal Fees: Blockchain network fees are variable depending on the cryptocurrency.

4. Coinbase – Best for Beginners

Summary: Coinbase is popular and widely recognized as a virtual cryptocurrency exchange for its ease of use, that is, its user-friendly interface, and the advanced level of security.

Coinbase is perfect for beginner cryptocurrency traders in the Maldives as it offers a variety of cryptocurrencies, allowing buying and selling. The exchange also allows for advanced trading options for professional traders.

For Maldivian traders, Coinbase offers an efficient way of trading in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The platform is regulated, very transparent, and secure, hence gaining the trust of its clients seeking reliability in their crypto deals.

Pros:

- Easy to use, even for beginners.

- Secure, two-factor authentication, cold storage.

- Supports numerous cryptocurrencies and many forms of payment.

- Trusted by millions of users around the world for its user-friendly experience.

- Advanced trading options for professional traders with Coinbase Pro.

Cons:

- A little pricier compared to other exchanges, particularly concerning smaller transactions.

- The website does not directly support MVR and local forms of payment.

- Fewer advanced trading options are available on the basic version, as compared to some competition.

- Customer support responses may be slow at times.

Fees:

- Spot Trading: 1.49% for buying/selling, though this may vary depending on transaction volume.

- Coinbase Pro (Advanced Trading): Maker fees: Start from 0.00% to 0.40%, based on 30-day trading volume. Taker fees: Start from 0.05% to 0.60%, depending on the same volume criteria. Discounts apply for higher trading tiers.

- Stablepair Trading: Maker fee: 0.00%. Taker fees: Range from 0.10 bps (Tier 1) to 0.45 bps (general users).

- Deposit Fees: ACH: Free. Wire (USD): $10 per deposit. SEPA (EUR): €0.15 per deposit. SWIFT (GBP): Free

- Withdrawal Fees: ACH (USD): Free. Wire (USD): $25 per withdrawal. SEPA (EUR): Free. SWIFT (GBP): £1 per withdrawal

- Crypto Withdrawals: Fees are based on network conditions at the time of withdrawal.

- USDC to USD Conversion Fees: Conversions under $40M in 30 days: 0%. Over $40M: Tiered fees from 0.05% to 0.30%, depending on the conversion volume.

- Miner Fees: Fees are dynamically calculated based on network congestion and disclosed at the time of the transaction. This fee structure is ideal for both beginner and advanced traders, offering flexible options for fiat and crypto transactions.

5. Spectrocoin – Best for Traders Seeking Crypto Payment Integration

Summary: SpectroCoin is a global cryptocurrency service platform that has a variety of solutions for Maldivian traders, investors, and businesses worldwide.

The cryptocurrency exchange platform provides secure wallets, prepaid cards, and additional merchant solutions. Over 40 cryptocurrencies and many fiat currencies are supported, which drives the versatility and accessibility of this platform for users.

For Maldivian traders, SpectroCoin presents an easy-to-navigate platform through which members can buy, sell, and store cryptocurrencies, as well as facilitate their prepaid crypto card for seamless spending of cryptocurrencies.

Pros:

- Supports more than 40 cryptocurrencies and several fiat currencies.

- Provision of a crypto prepaid card with which to spend easily.

- Merchant solutions for businesses.

- A multi-functional platform covering exchange, wallet, and payment services.

Cons:

- No direct support of Maldivian Rufiyaa (MVR).

- Very limited advanced trading, like margin or futures trading.

- High trading fees compared to other exchanges.

- Customer support can be slow for non-European users.

Fees:

- Spot Trading: Does not support trading futures contracts or margin trading on the spot market, due to the higher risks associated with these types of trading.

- Deposit Fees: Free for crypto deposits; depends on the payment method for fiat deposit fees.

- Withdrawal Fees: Vary by cryptocurrency; additional charges based on the method used for fiat withdrawals.

- Prepaid Card Fees: The SpectroCoin prepaid card is subject to monthly maintenance fees and transaction fees. Specific charges vary depending on usage and applicable terms.

7. Bitget – Best for Futures and Spot Trading Enthusiasts

Summary: Bitget is a cryptocurrency exchange hub that offers both futures and spot trading.

Set up in 2018 and based in Singapore, Bitget is the preferred exchange for Maldivian crypto traders looking for strong, secure, advanced trading tools, and innovative features such as copy trading. Bitget enables trading in more than 150 cryptocurrencies and has competitive fees, thus appealing to those who are just starting as well as trade experts.

Pros:

- Competitive rates on spot and futures trading.

- The copy trading feature allows beginners to imitate seasoned traders’ strategies.

- Highly advanced tools for professional traders, such as futures and margin trading.

- Trading options move beyond 150 cryptocurrencies.

- Robust security measures, including multisig wallets and cold storage.

Cons:

- Doesn’t directly support Maldivian Rufiyaa (MVR).

- An intricate interface may prove challenging for a beginner to navigate without guidance.

- Fewer fiat deposit options when compared to other exchanges.

Fees:

- Spot Trading: Maker fee: 0% to 0.25%; Taker fee: 0.10% to 0.40% (Fees decrease with higher 30-day trading volumes)

- Margin Trading: Maker fee: 0% to 0.02%; Taker fee: 0.01% to 0.05% (Rollover Fee: Applied every 4 hours, varies by asset (e.g., Bitcoin: 0.01%))

- Deposit Fees: Cryptocurrency: Free for most assets; Fiat: Fees vary depending on the payment method (e.g., SEPA: €1, FedWire: $0-$10).

- Withdrawal Fees: Cryptocurrency: Variable depending on asset (e.g., Bitcoin: 0.00002 BTC); Fiat: Varies by method (e.g., SWIFT: €5, ACH: Free or $4)

Why Use a Crypto Exchange in Maldives?

Image by Pexels

Crypto exchanges offer numerous opportunities for Maldivian citizens and tourists and they are:

Access to International Crypto Markets

The crypto exchange opens doors to a plethora of different cryptocurrencies for Maldivian citizens and visitors to trade, invest, and diversify. Crypto opportunities become highly essential since the Maldives is an important tourist destination that also serves as a middleman for users looking to access worldwide markets.

Simplifying Cross-Border Transactions

The Maldives is a country that relies on much import and tourist trade, thus cross-border transactions can be made easier with a crypto exchange. With cryptocurrency, users can send and receive their payments instantly without all the usual high fees that come with a “traditional” financial system.

Financial Inclusion

In a region where potential access to traditional banking may be limited, crypto exchanges give users the ability to play their parts in the global financial system. Thus it is relevant to Maldivians who are looking to find different investment options or digital payment methods.

Incentives for Tourists

For the digital assets of tourists coming to the Maldives, crypto exchange allows the conversion of these assets into the local currency or the ability to pay directly for goods and services. Many resorts and businesses in the country are starting to accept cryptocurrency payments, making the experience worth it for tech-savvy tourists.

What to Ask/Consider When Choosing a Crypto Exchange in Maldives

Image by Vecteezy

Choosing a cryptocurrency exchange in the Maldives’ requires a careful assessment of the platform’s security, accessibility, and affordability. Here are five key considerations that can help guide your decision:

Licensing and Security

Make sure the exchange is reputable and sets robust security measures like two-factor authentication, cold storage, and insurance for funds. Since Maldives’ cryptocurrency regulation remains uncertain, give priority to platforms like UEEx with international recognition and compliance.

Transaction Fees

Check the fee structure of the exchange: deposit, withdrawal, trading, and conversion. Sometimes, hidden charges can eat into the profitability, so it needs to be quite transparent.

| Exchange | Trading Fees (Spot) | Trading Fees (Futures) | Deposit Fees | Withdrawal Fees |

| UEEx | 0.09% | 0.05% | Free for most cryptocurrency deposits | Free for internal transfers; variable for external transfers and fiat withdrawals |

| Dhicoin | Variable | N/A | Free or negligible (MVR deposits) | Variable, depending on the cryptocurrency withdrawn |

| Symlix | Free for P2P transactions | N/A | No deposit fees (local currency) | Blockchain network fees (variable) |

| SpectroCoin | N/A | N/A | Free for crypto deposits; varies for fiat deposits | Varies by cryptocurrency; additional fees for fiat withdrawals |

| Bitget | Maker: 0.1%, Taker: 0.1% | Maker: 0.02%, Taker: 0.06% | Cryptocurrency deposits: Free; fiat deposits: varies | Cryptocurrency: variable (e.g., Bitcoin: 0.00002 BTC); fiat: varies by method |

Supported Cryptocurrencies

Ensure the exchange supports the cryptocurrencies you wish to trade or invest in. UEEx offers a wide selection of cryptocurrencies that you can trade with and build your portfolio.

Payment Methods

See if it gives any means of local deposits, that is, through bank transfers or mobile money.

| Exchange | Payment Methods | Local Deposits (Bank Transfers/Mobile Money) | Notes |

| UEEx | Credit/debit cards, cryptocurrencies, USD, EUR | No | Does not directly support Maldivian Rufiyaa (MVR) or local deposit options. |

| Dhicoin | Maldivian Rufiyaa (MVR) deposits, local bank transfers | Yes | Tailored to Maldivian traders, supports localized payment systems. |

| Symlix | Peer-to-peer transactions support MVR, USD, and EUR payments | Yes | Enables buyers and sellers to choose payment methods, including bank transfers or mobile payments. |

| SpectroCoin | Credit/debit cards, SEPA transfers, SWIFT payments, crypto deposits | No | MVR is not supported directly; international transfers are required for fiat deposits. |

| Bitget | Bank transfers, SEPA, SWIFT, credit/debit cards, crypto deposits | No | Does not support MVR directly or provide local deposit methods for Maldivian users. |

Usability and Customer Service

Select an intuitive, well-structured service whose customer support will ensure comfort 24/7 around the clock—preferably an option with availability through an application on Android, iOS, or websites available even for regions such as the Maldives.

Getting Started with UEEx in Maldives

Here is a basic 3-step process for starting UEEx trading in the Maldives:

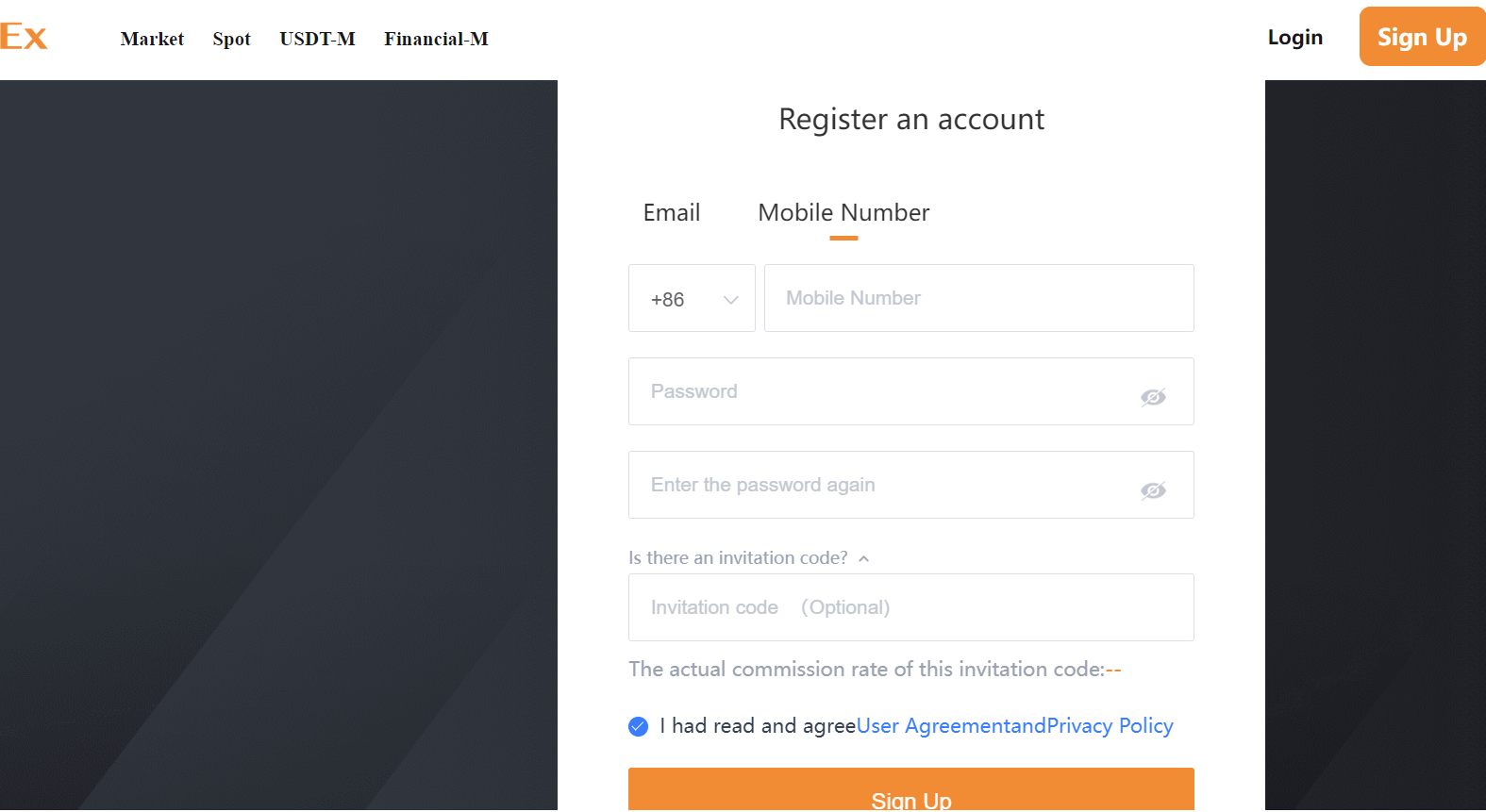

- Account Creation and Verification

Visit the UEEx website or download the application and sign up with your e-mail address or phone number. To have complete access to all the features of the website, including higher limits of trading, one will have to go through the Know Your Customer (KYC) process. For this purpose, a valid identification document, such as a national ID or passport, will be required.

- Deposit in crypto or USD

As MVR is not supported, deposits can be made through Bitcoin, USDT, or any other stablecoin, or USD. Fund your account by converting your Rufiyaa to USD via a local exchange or over-the-counter service and then transferring the USD to your UEEx account. The platform advises beginners to deposit small amounts for familiarization purposes.

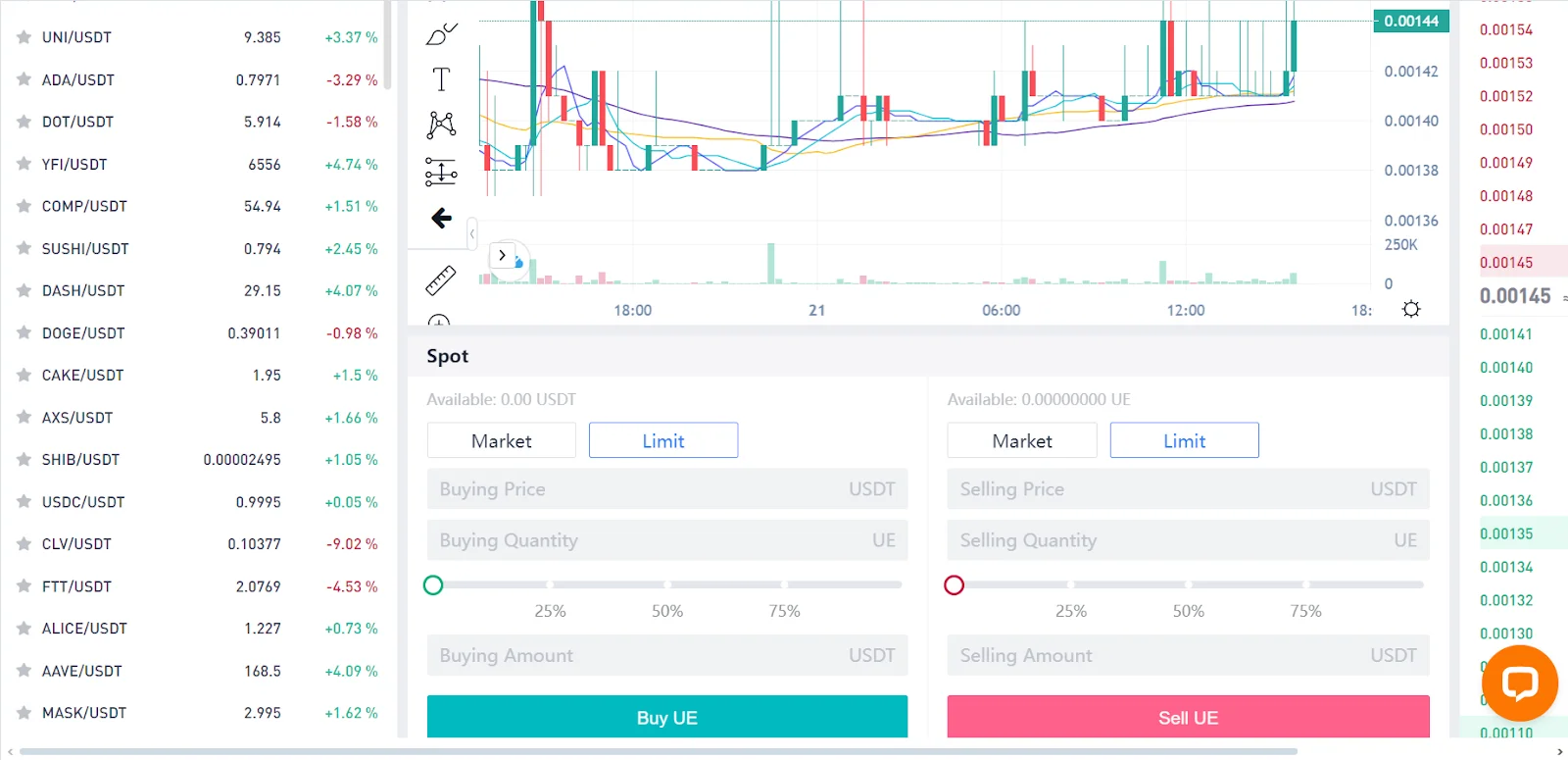

- Begin Trading and Building Your Portfolio

Then start investing or trading through its trading dashboard in cryptocurrency pairings like Bitcoin and Ethereum-based on-spot trading. You can also consider staking to increase your investments, and then visit the UE Coin Miner Telegram app to earn more.

Conclusion

As crypto adoption continues to rise globally, traders in the Maldives are in search of platforms that can solve their very specific needs: convenience in deposit options and accessibility despite regulatory challenges. While choosing the best cryptocurrency exchange in the Maldives for the year 2025, place more emphasis on those with advanced security, a transparent fee system, and a wide selection of supported cryptocurrencies.

While some of the globally renowned exchanges like Coinbase continue to operate in the global market with their reliability and enhanced features, smaller platforms focusing on accessibility and user-friendly payment methods can be equally ideal for beginners.

FAQ

- What is the best cryptocurrency exchange for Maldivian traders in 2025?

It all depends on your needs. Major exchanges like UEEx and Coinbase have excellent reputations in security, low fees, and diversity in cryptos available. For ease of deposits, prioritize exchanges that support USD or at least stablecoins like USDT.

- Does Maldivian Rufiyaa (MVR) work on any cryptocurrency exchanges?

Most cryptocurrency exchanges do not support MVR directly. You’ll need to convert MVR to USD through local services or over-the-counter exchanges before depositing funds into your crypto account.

- Is cryptocurrency trading legal in the Maldives?

While the Maldives has no explicit ban on cryptocurrencies, there are no specific regulations governing crypto trading. Traders should exercise caution and ensure compliance with general financial regulations.

- What deposit and withdrawal options are available for Maldivian residents on exchanges?

Well, Maldivian traders can fund the exchange through USD bank transfers and stablecoins like USDT or Bitcoin. It is also possible on some exchanges to use a credit/debit card or even P2P transfers.

- What trading features should I look for in a crypto exchange?

Look for user-friendly interfaces, mobile apps, spot and futures trading options, staking features, and advanced tools like charting and analysis. For beginners, exchanges with educational resources and 24/7 customer support are essential.