For many Africans, one of the biggest financial frustrations today is the difficulty of making international payments. Traditional bank-issued dollar cards often come with strict limits, high foreign exchange fees, or are outright unavailable.

This makes it hard to pay for global services like Netflix, Amazon, Spotify, or even professional tools needed for work and study. Crypto cards are stepping in to solve this gap by allowing users to fund their cards with digital assets and spend them globally without the usual restrictions.

The demand for such solutions is rising quickly. According to industry reports, over 50% of online shoppers in Africa now prefer digital payment methods, and crypto adoption across the continent has grown by more than 1,200% between 2020 and 2023. This trend highlights the need for reliable, borderless payment options, and crypto-powered cards are increasingly becoming the answer.

The Bitmama Card is one such option. Issued as a virtual Visa card (with physical cards planned), it enables users in Nigeria, Ghana, Kenya, and beyond to make seamless global payments in USD. By linking directly to your Bitmama crypto wallet, it allows you to fund the card with stablecoins like USDT, USDC, or cUSD and use it just like any regular debit card online.

By the end of this guide, you’ll have a clear picture of whether the Bitmama Card is right for you and what other options might serve you better. We will also take a quick look at UEEx, another rising digital finance platform offering users simplified crypto trading, payments, and virtual card services

Key Takeaway

- The Bitmama Card allows users in Africa to spend crypto globally using a virtual Visa card, funded directly with stablecoins like USDT, USDC, and cUSD.

- Perfect for individuals who need to pay for international subscriptions, e-commerce platforms, or online services without foreign exchange restrictions.

- Availability can be inconsistent, physical cards are not yet widely rolled out, and some users report service interruptions.

- The UEEx Card stands out for those who want a broader international reach and simplified FX management

What Is a Bitmama Card?

The Bitmama Card is a virtual crypto-powered Visa card designed to give Africans easier access to global payments. Unlike traditional bank-issued debit cards that rely on strict foreign exchange (FX) limits, the Bitmama Card lets users fund their card directly with cryptocurrencies, primarily stablecoins like USDT, USDC, and cUSD.

This makes it a bridge between digital assets and real spending, allowing seamless transactions across international platforms.

Bitmama is a Nigerian-founded fintech company operating in multiple African markets, with a focus on simplifying crypto trading, cross-border payments, and decentralized finance (DeFi) use cases.

The company has gained traction for addressing financial challenges unique to African users, especially the lack of reliable USD payment options due to local banking restrictions. The card itself is issued through Visa’s global payment network, making it widely accepted across online merchants.

The Bitmama Card is primarily aimed at crypto users in Nigeria, Ghana, and Kenya, though expansion to other African markets is ongoing.

Its ideal users include freelancers and remote workers who need to get paid in crypto and spend globally, everyday users who want to pay for online services like Netflix, Spotify, Amazon, or Apple Music, and Business professionals who require a simple way to pay for tools, advertising, or cloud services without worrying about FX fees.

Traditional African bank cards often have spending limits as low as $20–$50 per month for international payments. They also come with high fees, delays, and currency conversion hurdles. In contrast, the Bitmama Card bypasses these limitations by converting crypto into USD directly within the Bitmama app. Users avoid FX markups and gain higher flexibility in funding and spending.

The card operates entirely within the Bitmama app, which serves as both a crypto wallet and a payment dashboard. Users can fund their cards, track expenses, and manage crypto holdings seamlessly in one place.

As of 2025, the Bitmama Card is available in Nigeria, Ghana, and Kenya, with plans to expand further across Africa. While physical cards are still in the rollout phase, the virtual Visa option remains the primary product offering.

Quick Facts Table

| Data Point | Details |

| Card Network | Visa (Virtual, with physical card rollout planned) |

| Annual Fee | None (only a one-time $5 activation/funding fee) |

| APR Range | Not Applicable (prepaid, crypto-funded card) |

| Welcome Offer | None currently offered |

| Rewards Rate | No cashback or points system |

| Foreign Transaction Fees | None (crypto converted to USD directly) |

| Credit Check Required | No |

| Personal Guarantee Required | No |

| Minimum Requirements | KYC verification (ID + selfie) and $5 initial funding |

| Application Timeline | Instant (card created within minutes after verification) |

Key Features of the Bitmama Card

When choosing a crypto payment card, the details matter. From daily usability to advanced security, the Bitmama Card brings a mix of convenience and limitations that are important to understand. Let’s break down its features in depth.

Core Features

The Bitmama Card is designed to bridge the gap between crypto wallets and real-world spending. Here are the main highlights:

Multi-currency support

The Bitmama card stands out as a virtual and physical payment solution designed for users who want to spend both crypto and fiat seamlessly. One of its core features is multi-currency support, allowing cardholders to fund their cards with cryptocurrencies like USDT, Bitcoin, or Ethereum, while also being able to use stablecoins as a bridge for everyday spending. This makes it attractive in regions where access to foreign currency is restricted, as it gives users an alternative way to spend globally.

Fast issuance and activation

Another key feature is fast issuance and activation. Unlike traditional banking cards that can take weeks to arrive and activate, the Bitmama virtual card can be issued within minutes through the mobile app. For users who require physical cards, shipping timelines vary by region, but the setup process remains simple and streamlined. This quick turnaround is particularly helpful for freelancers, remote workers, and digital entrepreneurs who need an instant payment solution.

Affordability

Additionally, the Bitmama card has been designed with affordability in mind. It typically comes with low issuance costs, minimal transaction fees, and no hefty annual charges. Unlike premium global crypto cards, which often demand high staking requirements or premium subscriptions, the Bitmama card prioritizes accessibility. This means it’s well-suited to everyday users who want practicality over luxury perks.

Rewards Program

Unlike premium competitors such as Crypto.com Visa or Binance Card, Bitmama does not heavily emphasize cashback or lifestyle perks. Instead, its rewards program focuses on utility-based incentives. Some users can access small cashback percentages on select purchases, though these rates tend to be modest compared to larger crypto cards. The design philosophy is less about luxury perks and more about keeping fees low and ensuring daily usability.

In practice, this means that the Bitmama card appeals to budget-conscious users rather than reward seekers. For example, instead of flashy partnerships with airlines or hotels, the card’s strength lies in allowing crypto-to-fiat conversion without high markups. Users benefit indirectly, since they save money on hidden fees rather than accumulating cashback.

Still, for users who prioritize rewards, this is an important trade-off to note. Bitmama’s structure positions it more as a functional payment bridge rather than a tool for accumulating points or perks. The absence of a robust rewards program may make it less appealing to frequent travelers or high-volume spenders who could maximize benefits with premium cards.

Limits and Controls

One of Bitmama’s strengths is its clear and transparent spending limits. Virtual cards usually come with daily and monthly caps designed to help users stay within budget, while physical cards may allow slightly higher limits. These spending thresholds are important for protecting against fraud and misuse, especially since many users top up with cryptocurrencies that fluctuate in value.

Users also benefit from built-in card controls through the Bitmama app. This includes the ability to freeze or unfreeze the card instantly, set spending categories, and monitor transactions in real-time. Such features empower individuals and businesses to maintain better oversight of their financial activities without waiting on traditional banks for support.

For businesses or teams, Bitmama allows limited multi-user access and control features. For instance, small business owners can issue cards to staff with customized limits, ensuring tighter management of company expenses. This makes the card a flexible tool not just for individuals but also for startups or SMEs seeking cost-effective financial control.

Also Read: Paxful Affiliate Program Review: Earn Bitcoin from Referrals + 7 Better Alternatives

Technology Integration

The Bitmama card operates within the Bitmama mobile app ecosystem, which is available on both iOS and Android. Through the app, users can order cards, top up with crypto, track spending, and manage security controls. The app’s design is user-friendly and intuitive, making it accessible even to people new to crypto payments.

On the backend, Bitmama integrates with major card networks like Visa or Mastercard, ensuring that the card can be used globally across millions of merchants. This provides a huge advantage, as it bridges the gap between decentralized crypto holdings and the traditional financial system. Users can spend crypto like fiat without merchant-side complications.

For advanced users, Bitmama is also working on API integrations that may allow businesses to connect their platforms directly with card services. This opens up possibilities for automated payments, subscription management, or payroll distribution in crypto. While these features are still evolving, they show Bitmama’s push to align with fintech innovation trends.

Security Features

Security is a major concern in the crypto-card industry, and Bitmama addresses this with multiple protective measures. The card comes with two-factor authentication (2FA) for transactions, alongside PIN and biometric login support on the app. These measures add layers of defense against unauthorized usage.

Additionally, Bitmama uses bank-grade encryption to protect user data and employs real-time fraud monitoring. This means suspicious activity can trigger immediate alerts or temporary freezes, giving users control and confidence in how their funds are handled. Such features align with industry standards, ensuring that users aren’t left vulnerable.

Another noteworthy feature is the instant freeze/unfreeze option. If a card is lost or compromised, users can immediately deactivate it via the app without waiting for customer support. Combined with regional compliance measures and KYC verification, Bitmama balances accessibility with responsible security controls.

Fees and Pricing Structure of the Bitmama Card

When reviewing a payment card, one of the most important factors is understanding the fees and pricing structure. Many traditional cards hide charges in the fine print, while fintech cards like Bitmama aim to be more transparent.

Still, it’s important to know exactly what you’re paying for before you start using it.

| Fee type | Amount/ Rates |

| Card Creation Fee | $5 (one-time) Doubles as first funding deposit |

| Annual/Monthly Fee | None. No recurring maintenance fees |

| Transaction Fees | 0–2% depending on transaction type and merchant; online payments are usually free |

| Cash Advance/ATM Fee | Not applicable (yet) Physical cards still in rollout phase |

| Late Payment Fee | None. Prepaid structure means no debt, hence no late fee |

| Over-limit Fee | None. Spending is capped by the available balance |

| Foreign Transaction Fee | 0% Transactions in foreign currencies are converted via supported stablecoins |

| Inactivity Fee | None. No penalty for leaving the card unused |

| Hidden/Uncommon Fees | Possible small FX spread. Exchange rates may vary slightly vs. the market rate |

Card Creation Fee

The Bitmama Card requires a $5 deposit to create. This isn’t a hidden charge but rather a minimum first funding requirement. The $5 goes straight into your balance, making it effectively free to start using.

Annual or Monthly Fees

Unlike many traditional debit and credit cards, Bitmama has no annual or monthly maintenance fees. This makes it an attractive option for users who want a card without recurring costs.

Transaction Fees

Most online transactions through the virtual Visa card are fee-free. However, some merchants may pass on a processing fee of 1–2%, particularly with cross-border vendors. Bitmama itself does not add extra charges beyond standard Visa network costs.

Cash Advance or ATM Withdrawal Fees

Currently, ATM withdrawals and physical transactions are unavailable because Bitmama has not fully launched its physical cards. Once live, users can expect standard ATM fees, which typically range between $2–5 per withdrawal depending on location.

Late Payment and Over-limit Fees

Since the card is prepaid and not linked to credit, there are no late payment fees and no over-limit fees. You can only spend what’s loaded onto your card. This makes Bitmama especially beginner-friendly compared to credit-based options.

Foreign Transaction Fees

One of the most appealing features of the Bitmama Card is its 0% foreign transaction fee policy. Because the card is powered by stablecoins (USDT, USDC, cUSD), all spending abroad is converted at close-to-market rates. The only hidden cost may be a small FX spread, but this is significantly lower than what traditional banks typically charge (3–5%).

Hidden or Uncommon Fees

Bitmama is fairly transparent with fees, but there are two potential “hidden” costs users should be aware of:

- Exchange Rate Spread: When converting between fiat and stablecoins, the rate may be slightly higher than the open market.

- Merchant Fees: Some global platforms may charge extra for using prepaid cards, though this varies.

Eligibility and Application Process of the Bitmama Card

Getting a Bitmama card is much easier than applying for a traditional bank card. Since it’s a crypto-powered prepaid card, there are fewer requirements and no credit checks. Still, there are basic conditions and steps every applicant needs to know.

Who Can Apply

The Bitmama card is designed for both individuals and businesses who want to spend crypto seamlessly.

- Individuals: Freelancers, remote workers, online shoppers, and anyone looking for an easy way to spend USDT, USDC, or other supported stablecoins.

- Businesses: SMEs, startups, or online vendors who need to manage expenses, subscriptions, or vendor payments.

- Credit Check Requirements: Unlike traditional credit cards, there is no credit history requirement. The card is prepaid, so approval is based only on verification, not financial background.

Required Documents

To stay compliant with regulations, Bitmama requires basic KYC (Know Your Customer) documents. These include:

- Valid Government ID – Passport, Driver’s License, or National ID card.

- Proof of Address – Utility bill, bank statement, or tenancy agreement (issued within the last 3 months).

- Selfie/Photo Verification – A live photo to confirm your identity.

- Business Documents (for companies only) – CAC certificate, business license, or equivalent, depending on jurisdiction.

These requirements ensure that cards are issued only to verified users, keeping the system safe and compliant.

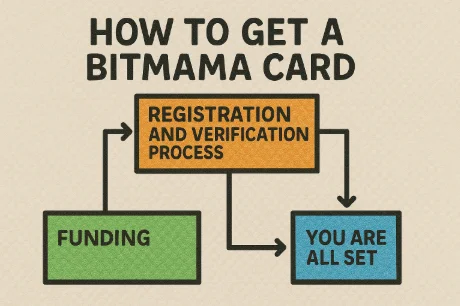

Step-by-Step Application Guide

Applying for a Bitmama card is straightforward. Here’s a simple walkthrough:

- Register on Bitmama – Sign up on the Bitmama app or website.

- Complete KYC Verification – Upload ID, proof of address, and selfie.

- Choose Card Type – Select virtual or physical (where available).

- Fund Your Wallet – Deposit a minimum of $5 in USDT, USDC, or supported fiat.

- Request Card Creation – Confirm and submit your request in the app.

- Receive Your Card Details – Virtual cards are issued instantly; physical cards may take longer.

Approval Timeline

- Virtual Card: Usually issued within minutes after KYC and funding.

- Physical Card: Shipping times vary, but typically 7–14 business days, depending on location.

- Business Accounts: May take 2–5 working days for document review and approval.

What Happens After Approval

Once your card is approved the virtual card details (card number, expiry date, CVV) will appear in your Bitmama app for immediate use.

You can start spending on online platforms, subscriptions, and global vendors.

For physical cards, once delivered, you’ll be able to use them for in-store purchases and ATM withdrawals (when fully enabled).

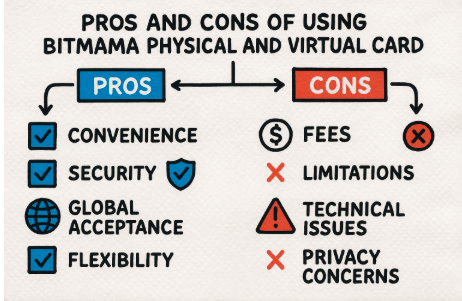

Pros of using the Bitmama Card

Like every payment solution, the Bitmama card has strong benefits that users should consider.

- Global Spending Without FX Fees: Users can shop internationally without worrying about high conversion charges, unlike traditional bank cards that add 3–5% FX fees.

- Supports Multiple Cryptocurrencies: The card can be funded with stablecoins like USDT and USDC, giving users flexibility when moving between crypto and fiat.

- Instant Virtual Card Issuance: Virtual cards are created within minutes, making them perfect for urgent online purchases, subscriptions, or business expenses.

- User-Friendly App Integration: Bitmama’s mobile app allows users to create, monitor, and fund cards easily. Even non-tech users find the interface simple.

- Business-Friendly Features: Companies can issue multiple cards to employees, manage spending limits, and track vendor payments seamlessly.

- Travel Benefits: Physical cards (when available) can be used to pay for hotels, flights, and transport—ideal for digital nomads and business travelers.

Cons of using the Bitmama Card

The Bitmama Card has some limitations that users should consider.

- Temporary Suspension of Mastercard Services: Due to provider issues, Mastercard-linked cards have been paused in some regions, causing inconvenience.

- Availability Issues in Some Countries: Not all users can access physical cards, especially in certain African or Asian markets.

- Customer Support Complaints: Some users report slow responses from support during technical or card activation issues.

- Virtual Cards Not Always Accepted: A few merchants still require physical cards, limiting where the virtual option can be used.

- Renewal & Expiry Management: Cards have expiry dates, and reissuing may take time or incur fees.

Also Read: Revolut Card Review: Global Spending Made Easy + Top 5 Alternatives

User Reviews and Feedback Analysis on Bitmama Card

Understanding how real users experience the Bitmama Card provides important context beyond the official features and promises. Feedback from multiple platforms paints a picture that is both encouraging and cautionary.

Aggregate Rating from Multiple Sources

Across platforms like TrustPilot, Google Play Store, and App Store, the Bitmama card and app generally hold a rating between 3.8 and 4.2 out of 5.

On TrustPilot, Bitmama currently averages around 1.9 stars, with many reviewers highlighting ease of use. The Google Play Store app rating sits at approximately 3.7 stars, with users praising smooth registration and card activation. Meanwhile, the Apple App Store reflects a slightly lower average of 3.2 stars, largely due to technical glitches some iOS users reported during updates.

Overall, the aggregated ratings suggest a positive but mixed experience, with strong approval from everyday users and occasional frustration tied to app performance.

Common Praise Themes

Most positive reviews focus on accessibility, ease of setup, and affordability. For example, one TrustPilot reviewer noted,

“I was able to order my Bitmama card in minutes and start using it within a day, no complicated paperwork.”

Another Google Play user praised its flexibility, saying,

“Bitmama makes it easy to spend my crypto like cash. I don’t have to wait weeks for withdrawals.”

Many also highlight the low or no annual fees, making it more approachable than premium crypto cards. Across sources, the recurring praise theme is that the Bitmama card offers a practical, everyday payment solution that fits especially well in markets underserved by traditional banks.

Customer Service Feedback

Customer support feedback is mixed but leans positive. On G2 and TrustPilot, many users praised the responsive chat support, with comments like,

“I reached out about a failed transaction and got a solution within an hour.”

However, some reviewers on Capterra noted that responses can be slower during peak demand, especially when the app experiences downtime. Another recurring observation is that while Bitmama’s support team is helpful, their resources are limited compared to larger global fintech players.

Still, most users agree that the support staff are knowledgeable, polite, and committed to resolving issues, which helps build trust even when problems arise.

Top 7 Alternatives to Bitmama Card

While the Bitmama card provides a useful bridge between crypto and traditional payments, it isn’t without its shortcomings. Delayed withdrawals, customer support complaints, and limited coverage have led many users to review alternatives.

Fortunately, the market now offers several crypto and fintech cards designed for different user needs, from budget-friendly options to premium cards with perks like cashback, rewards, and global usability.

In this section, we’ll review 7 strong alternatives to the Bitmama card, categorized into direct competitors, premium upgrades, budget picks, fintech players, traditional banks, and niche-specific cards.

Binance Card

Best For: Everyday crypto-to-fiat spending with global merchant access.

The Binance Card is one of the most popular crypto debit cards in the world because it connects directly to your Binance exchange account. This means you can spend your crypto instantly anywhere Visa is accepted, without first converting it manually. For everyday users, that makes payments quick and hassle-free.

One of its standout features is cashback rewards that go up to 8%, depending on how much of Binance’s native coin (BNB) you hold.

Key Differentiators:

- Linked directly to the Binance Exchange wallet.

- Cashback up to 8% (tiered by BNB holdings).

- No monthly/annual maintenance fee.

Pros:

- Huge global acceptance (Visa-backed).

- Attractive cashback rewards.

- Direct integration with one of the largest crypto exchanges.

Cons:

- Requires holding BNB to unlock top-tier rewards.

- Availability restricted in some countries.

Why Choose Over Bitmama Card:

If you want wider acceptance and stronger cashback rewards, Binance Card outshines Bitmama in both scale and reliability.

Crypto.com Visa Card

Best For: Premium users who want perks like Netflix/Spotify reimbursements.

Crypto.com’s Visa card is best known for lifestyle perks like free Netflix, Spotify, and even lounge access at airports for premium tiers. To unlock these benefits, users need to stake (lock up) a certain amount of Crypto.com’s native token, CRO. This makes it more appealing for users who want more than just basic payments.

The card has a wide global reach, being available in over 100 countries, which gives it an advantage over regional players like Bitmama. Cashback rewards range from 1% to 5% depending on the tier, so it can fit both casual and advanced users.

Key Differentiators:

- Tiered rewards based on CRO staking.

- Free lounge access for higher-tier cards.

Pricing: No annual fee

Pros:

- Strong lifestyle perks.

- Competitive cashback rates (1%–5%).

- Available in 100+ countries.

Cons:

- CRO staking lock-up required.

- Benefits may change (Crypto.com has adjusted rewards multiple times).

Why Choose Over Bitmama Card:

For users who value lifestyle benefits and global availability, Crypto.com Visa is a stronger, more established alternative.

Coinbase Card

Best For: U.S. and European users who want seamless Coinbase integration.

The Coinbase Card is a straightforward crypto debit card for users in the U.S. and parts of Europe. It links directly to your Coinbase account, allowing you to spend crypto or stablecoins at any merchant that accepts Visa. This is especially attractive for people who already use Coinbase as their main exchange.

Rewards are flexible because you can choose which cryptocurrency you want to earn in. For instance, you might earn 1% in Bitcoin or 4% in Stellar (XLM).

Key Differentiators:

- Spend directly from a Coinbase account.

- Real-time crypto-to-fiat conversion.

- Earn rewards in multiple cryptos.

Pricing: No annual fee

Pros:

- Backed by a regulated U.S. exchange.

- Easy for beginners already using Coinbase.

- Flexible rewards program.

Cons:

- Higher FX fees than competitors.

- Limited availability outside the U.S. and EU.

Why Choose Over Bitmama Card:

If you’re a Coinbase user who values regulation and compliance, this card offers a safer and smoother on-ramp/off-ramp than Bitmama.

UPay.best Card

Best For: Neutral option with low entry requirements and balanced features.

UPay.best is a smaller but growing crypto card provider that focuses on stablecoins like USDT, USDC, and BUSD. By spending stablecoins, you avoid the volatility of regular crypto, which can be a big advantage if you don’t want to worry about price swings. The card is Mastercard-backed, so it works in millions of locations worldwide.

Businesses can also use it to manage stablecoin payments, which makes it more versatile than many other cards. The card has modest fees compared to premium players, which keeps it affordable for regular users.

Key Differentiators:

- Works with multiple stablecoins (USDT, USDC, BUSD).

- Both physical and virtual card options.

- Global merchant support (Mastercard).

- Payoneer Prepaid Mastercard

Pricing: No annual fee, minimal transaction fees.

Pros:

- Supports stablecoins, reducing volatility risks.

- Both personal and business users supported it.

- Strong Mastercard global reach.

Cons:

- Smaller brand presence vs. Binance or Crypto.com.

- Customer support response times could improve.

Why Choose Over Bitmama Card: UPay.best is a middle-ground option, offering stronger stability and support for stablecoins than Bitmama, making it a reliable everyday spending tool.

Also Read: BingX Affiliate Program Review: High Commissions + 7 Better Alternatives

Payoneer Prepaid Mastercard

Best For: Freelancers and businesses needing fiat withdrawals from platforms like Upwork, Fiverr, and Amazon.

The Payoneer card isn’t a crypto card, but it’s a strong alternative for freelancers, online sellers, and businesses. It’s widely used by professionals on platforms like Upwork, Fiverr, and Amazon to receive international payments and spend money directly via Mastercard. That makes it a strong option for people more focused on fiat than crypto.

Key Differentiators:

- Global payouts from online marketplaces.

- Multi-currency receiving accounts.

- Integrated invoicing for businesses.

Pricing:

- Annual Fee: $29.95

- ATM Withdrawal: ~$3 per withdrawal.

Pros:

- Trusted brand with 15+ years of history.

- Great for freelancers earning in USD/EUR/GBP.

- Widely accepted by merchants.

Cons:

- Not crypto-native (you must convert before loading).

- Higher annual fee.

Why Choose Over Bitmama Card: If you’re a freelancer or e-commerce seller, Payoneer offers business-grade payouts and compliance that Bitmama lacks.

Revolut Card

Best For: All-in-one fintech banking with integrated crypto, budgeting, and global travel features.

Revolut is a fintech giant that combines banking and crypto in one app. With a Revolut card, you can not only spend money worldwide but also buy, hold, and sell crypto directly in the app. It’s a great choice if you want a single financial tool that handles both traditional and digital currencies.

Key Differentiators:

- Buy, hold, and spend crypto in-app.

- Advanced budgeting and analytics tools.

Pricing:

- Free Plan: $0/month

- Premium Plans: $9.99–$16.99/month

Pros:

- Combines traditional banking + crypto.

- Global usability with strong fintech features.

- Insurance and premium perks for higher plans.

Cons:

- Crypto withdrawals are limited to lower plans.

- Subscription fees add up over time.

Why Choose Over Bitmama Card: Revolut is ideal if you want a hybrid card with both banking and crypto functions, plus travel benefits that Bitmama doesn’t provide.

Wirex Card

Best For: Niche users who want hybrid rewards

Wirex is another hybrid card that blends crypto and traditional currency features. You can load multiple currencies, both fiat and crypto, and spend them anywhere Mastercard is accepted. That flexibility makes it especially useful for travelers and global shoppers.

Key Differentiators:

- Rewards in both crypto and fiat.

- Multi-currency accounts.

Pricing: No annual fee

Pros:

- Great global coverage.

- Supports both fiat and crypto accounts.

- No annual fee.

Cons:

- Rewards require using WXT token.

- App usability is not as strong as Revolut.

Why Choose Over Bitmama Card: Wirex provides a niche reward system and multi-currency support that appeals to frequent travelers and crypto spenders.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| Bitmama Card | None (free or minimal) | No cashback, but FX-friendly | None | No | Everyday crypto & fiat spending | Works globally with FX support | Limited merchant acceptance (virtual) | (4.0) |

| Binance Card | Free | Up to 8% cashback (BNB-based) | None | Yes (basic KYC) | Active traders, frequent spenders | Direct Binance wallet integration | Rewards tied to BNB holdings | (4.5) |

| Crypto.com Visa Card | $0–$399 (depends on tier) | Up to 5% cashback (CRO-based) | Perks (Spotify/Netflix) | Yes | Lifestyle perks + crypto rewards | Free subscriptions & lounge access | Requires CRO staking | (4.2) |

| Coinbase Card | No annual fee | 1–4% cashback (crypto rewards) | None | Yes | U.S. & EU users seeking trust | Regulated + strong security | Higher fees on spending | (4.0) |

| UPay.best Card | Low fees ($10–$15 yearly) | Limited, no cashback | None | No | Stablecoin payments worldwide | Supports USDT/USDC directly | Less popular, lower adoption | (3.8) |

| Payoneer Prepaid Mastercard | $29.95 annually | None | None | Yes | Freelancers, business payouts | Global fiat payments & marketplaces | No direct crypto support | (4.1) |

| Revolut Card | Free–$16.99 monthly | Varies (cashback & perks) | None | Yes | Banking + crypto in one app | All-in-one finance super app | Premium tiers can get costly | (4.4) |

| Wirex Card | Free | Up to 8% in WXT rewards | None | No | Spending crypto + fiat globally | Instant crypto-to-fiat conversion | Rewards depend on Wirex | 4.1 |

How to Choose: Decision Framework

Picking the right card isn’t about finding the “best” one overall; it’s about finding the best one for your situation. Different cards serve different needs, and the right choice depends on your business size, cash flow, industry, and whether you spend locally or internationally. Below is a simple decision framework to guide your choice:

Business Size Considerations

If you’re a freelancer or small startup, the Bitmama Card or UPay Card may be ideal since they come with minimal fees, no strict credit checks, and quick approval. These cards help you spend crypto or fiat globally without unnecessary overhead.

If you run a growing business with regular expenses, the Revolut Card or Payoneer Prepaid Mastercard may be better since they offer stronger integrations for payroll, invoicing, and multi-currency support.

International vs. Domestic Use

If your focus is international payments, consider the Bitmama Card for its FX-friendly spending or the Wirex Card for its instant crypto-to-fiat conversion, both designed for borderless payments.

If you mostly spend domestically, a card like Coinbase Card (for U.S./EU users) or Crypto.com Visa (with lifestyle perks) may suit you better since their strongest features are localized.

Cash Flow & Rewards Priorities

If rewards are your priority, go with the Binance Card (up to 8% cashback) or Crypto.com Visa Card (Spotify/Netflix perks + cashback), but keep in mind they often require staking tokens like BNB or CRO.

If low costs and easy access matter most, the Bitmama Card and UPay Card stand out since they charge little to no annual fees and don’t require staking or hidden commitments.

If cash flow is tight and you can’t afford upfront fees, avoid premium-tier cards and stick with free or low-cost cards like Bitmama, Wirex, or Coinbase.

Technology & Integration Needs

If you need API access and advanced controls, the Revolut Card stands out with its integration-friendly ecosystem.

If you want simplicity and mobile-first use, the Bitmama Card is a lightweight, beginner-friendly option that doesn’t overwhelm users with technical setups.

Also Read: Plutus Debit Card Review: Earn Crypto Cashback on Everyday Spend + Top 5 Alternatives

Final Verdict

The Bitmama Card offers a straightforward way to bridge the gap between crypto and traditional payments. With no heavy fees, easy access, and support for both fiat and digital currencies, it’s designed for people who want simplicity without the steep requirements of premium crypto cards. Its biggest strengths are affordability, speed of setup, and flexibility for everyday spending.

This card is perfect for freelancers, small business owners, and everyday crypto users who need a practical solution to spend across borders without worrying about hidden costs. If you’re someone who values convenience over flashy perks, the Bitmama Card fits well into your wallet. It works especially well for users in regions where traditional banking access is limited, making it a strong financial tool for emerging markets.

However, the Bitmama Card may not be the best fit for all users, frequent travelers chasing high rewards, or businesses needing advanced expense management.

Unlike cards such as the Binance Card or Crypto.com Visa, it doesn’t come with premium cashback rates or lifestyle perks like free subscriptions. It’s also less suitable for large enterprises that need integrations, API access, or complex team controls.

If you fall into these categories, a top alternative to consider is the Binance Card. It offers up to 8% cashback, strong global support, and direct integration with the world’s largest crypto exchange, a better fit for active traders or businesses with high transaction volumes. Meanwhile, the Payoneer Mastercard is an excellent alternative for freelancers working with global platforms who want seamless fiat payouts.

In the bigger picture, the Bitmama Card holds a solid position in the market as a budget-friendly, no-frills crypto payment option. It may not be the most powerful or reward-heavy card, but it does exactly what it promises, giving users a simple, reliable, and cost-effective way to spend crypto or fiat worldwide. For many everyday users, that’s more valuable than perks they’ll never use.

FAQs

What is the Bitmama Card used for?

The Bitmama Card lets you spend your crypto like regular money. You can use it for online shopping, subscriptions, and global payments, just like a regular dollar Visa card.

Can I create more than one Bitmama Card?

Yes! You can create multiple virtual cards to manage different types of spending. For example, one for Netflix, one for shopping, and one for work expenses.

Is the Bitmama Card available in my country?

Bitmama currently supports users in Nigeria, Ghana, Kenya, and a few other African countries. New regions are being added, so it’s worth checking the app for the latest updates.

How do I fund the card?

You can fund the Bitmama Card using stablecoins like USDT, USDC, or cUSD, directly from your crypto wallet. You can also top up via bank transfers or mobile money, then convert to crypto in the app.

Are there any hidden fees?

No hidden fees. You’ll only need a $5 minimum to create your card, and there might be a small transaction fee (1–3%) when funding. No monthly charges or maintenance fees!

Can I use the Bitmama Card for services like Netflix or Amazon?

Absolutely! The card works perfectly with Netflix, Amazon, Spotify, Canva, YouTube Premium, and more. If the platform accepts Visa, you’re good to go.

Related posts:

- Bitbank Affiliate Program: Overview, Benefits & Commission

- BYDFi Affiliate Program: Overview, Benefits & Commission

- Dex-Trade Affiliate Program: Overview, Benefits & Commission

- Digitra.com Affiliate Program: Overview, Benefits & Commission (2026 Review)

- Bitpay Virtual Card Review: Seamless Crypto-to-Fiat Payments + 6 Best Alternatives for 2026