These days, more people want the freedom to spend cryptocurrency as easily as cash, without waiting days for conversions or transfers. That’s precisely where crypto payment cards come in. They bridge the gap between digital assets and real-world spending, letting users pay for everyday purchases directly from their crypto balance.

With global crypto adoption on the rise and merchants increasingly open to digital payments, virtual cards have become a practical tool for seamless spending. The BitPay Virtual Card is one of the most recognized options in this space.

It enables users to instantly convert Bitcoin and other supported cryptocurrencies into fiat, allowing them to shop online, pay bills, and manage funds across borders without the hassle of complex processes or high conversion fees.

In this review, we’ll explore what makes the BitPay Virtual Card appealing, from its instant crypto-to-fiat payment system to its fee structure, usability, and security features. We’ll also compare it with six other strong alternatives that might better fit specific spending needs or offer more flexible benefits.

By the end of this guide, you’ll understand how the BitPay Virtual Card works, what its strengths and drawbacks are, and which crypto cards could serve as better options for your financial goals in 2025.

Additionally, UEEx, a fast-growing cryptocurrency exchange that offers global trading options and innovative tools, simplifies the process for users to buy, trade, and manage digital assets, which can then be utilised on crypto-friendly payment solutions like BitPay.

Key Takeaways

- BitPay Virtual Card offers seamless crypto-to-fiat spending through the BitPay app with no monthly or issuance fees.

- The card works best for crypto users who need quick and easy access to their digital assets for everyday purchases.

- This guide includes an in-depth review of six major alternatives across different pricing tiers and use cases.

- Crypto.com Visa Card emerges as the best alternative for users who value rewards and global usability.

- UPay Card is highlighted as the top choice for businesses and individuals handling international payments.

- BitPay Card usage is currently limited to U.S. residents, with support offered through email and online resources.

What Is the BitPay Virtual Card?

The BitPay Virtual Card is a prepaid cryptocurrency debit card that allows users to convert their digital assets into fiat currency in real time and spend them just like cash. Launched in 2016 by BitPay Inc., a leading global crypto payment service provider, the card simplifies how crypto holders use their funds for everyday transactions.

Unlike typical crypto wallets that require multiple steps for conversion and withdrawal, the BitPay Virtual Card provides a seamless way to shop, pay bills, or make online purchases directly using crypto.

Issued by Mastercard, the BitPay Virtual Card operates entirely online, eliminating the need for physical card delivery. It integrates smoothly with digital payment platforms such as Apple Pay and Google Pay, giving users instant access to their funds for both in-store and online payments.

The card supports a wide range of popular cryptocurrencies, including:

- Bitcoin (BTC)

- Ethereum (ETH)

- Bitcoin Cash (BCH)

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

- Litecoin (LTC)

- ApeCoin (APE)

- Polygon (POL)

- Binance USD (BUSD)

- Wrapped Bitcoin (WBTC)

- Pax Dollar (USDP)

- Gemini Dollar (GUSD)

- EURC (EURC)

- Stablecoins like USDC and DAI ensure flexibility for various types of crypto users.

The card primarily targets U.S. residents who want to spend their crypto easily without converting it manually to cash. It’s ideal for individuals who regularly shop online, travel, or want to manage personal spending directly from their crypto wallet.

Through the BitPay app, users can load their card from their BitPay Wallet or Coinbase account, monitor transactions, freeze the card for security, and withdraw cash at compatible ATMs.

What makes the BitPay Virtual Card distinct from traditional debit cards is its instant crypto-to-fiat conversion system. Instead of drawing funds from a linked bank account, the card converts cryptocurrency at the time of purchase, allowing users to spend their digital assets anywhere Mastercard is accepted.

Currently, BitPay is revamping its card program and has paused new applications, though existing users can continue using their cards. The service remains available exclusively to U.S. residents, with a waitlist open for updates.

Quick Facts Table

| Feature | Details |

| Card Network | Mastercard |

| Card Type | Prepaid Crypto Debit (Virtual + Physical Option) |

| Annual Fee | $0 |

| APR Range | Not applicable (prepaid card) |

| Welcome Offer | None |

| Rewards Rate | No cashback or rewards program |

| Foreign Transaction Fees | None |

| Credit Check Required | No |

| Personal Guarantee Required | No |

| Minimum Requirements | Must be a U.S. resident; valid government ID; verified BitPay account |

| Application Timeline | Instant digital issuance after approval (currently paused pending program revamp) |

Key Features of the Bitpay Virtual Card

The BitPay Card is designed to offer crypto users a fast, secure, and efficient way to spend their digital assets.

Here are the standout features that make it a popular choice:

Instant Crypto-to-Fiat Conversion

With the BitPay Virtual Card, your crypto is converted to fiat currency at the point of sale. This means you can spend Bitcoin, Ethereum, and other supported coins instantly, without manual exchange steps.

Accepted Anywhere Mastercard Is Accepted Online

The virtual card works wherever Mastercard is accepted online, allowing you to shop, pay bills, and subscribe to services using your crypto balance.

Supports Multiple Cryptocurrencies

The BitPay app supports a wide range of cryptocurrencies, including BTC, ETH, LTC, BCH, DOGE, DAI, USDC, and more. This provides flexibility in how you choose to fund your card.

Integration with Mobile Wallets

You can link your BitPay Virtual Card to Apple Pay and Google Pay, enabling tap-to-pay functionality for in-store purchases using your mobile device.

No Credit Checks or Bank Account Required

To get started, there’s no need for a credit history or a traditional bank account. Users only need to complete identity verification through the BitPay app.

Real-Time Spending Alerts and Controls

Manage your spending with real-time notifications, freeze/unfreeze options, and detailed transaction tracking—all accessible through the BitPay mobile app.

Read Also: List of E-commerce Sites That Accept Cryptocurrency

Rewards Program

The BitPay Virtual Card is designed with practicality and convenience in mind, but it does not currently include a traditional rewards program such as cashback, points, or crypto rebates.

Unlike some other crypto cards that incentivize spending through token rewards, BitPay’s focus is on offering a simple, transparent, and low-cost way to spend crypto anywhere Mastercard is accepted.

While there are no direct rewards or loyalty benefits, users still enjoy certain functional advantages that make the card appealing. These include no annual fees, no foreign transaction charges, and instant crypto-to-fiat conversions.

For many crypto holders, this straightforward model ensures they can access and use their digital assets efficiently without worrying about reward restrictions, staking requirements, or hidden conditions.

Limits and Controls

BitPay places limits on card usage to enhance security and regulatory compliance. Here’s how those limits break down:

| Limit Type | Value |

| Maximum Card Balance | $25,000 |

| Daily POS Purchase Limit | $10,000 |

| Daily Value Load Limit | $10,000 |

| ATM/Bank Withdrawal Limit | $2,000 per withdrawal |

| Withdrawal Frequency | 3 times/day |

| Monthly Withdrawal Limit | $25,000 |

BitPay may also implement additional security-based restrictions depending on your usage pattern.

Technology Integration

The BitPay Virtual Card is built on a robust technological foundation that connects cryptocurrency payments with traditional financial infrastructure.

Mobile App

The BitPay app is the central hub for managing the BitPay Virtual Card. Available on iOS and Android, it enables users to create, fund, and control their virtual or physical cards directly from their smartphones.

APIs for Businesses

BitPay’s API solutions empower businesses to accept cryptocurrency payments and integrate crypto checkout systems directly into their platforms. Merchants can use BitPay’s APIs to issue invoices, manage settlements in local currency, and even distribute funds to employees or vendors.

This same API technology underpins the BitPay Card ecosystem, ensuring seamless communication between wallets, payment gateways, and card networks. For developers, BitPay provides well-documented SDKs and integration tools to make crypto payment adoption straightforward.

Digital Wallets

The BitPay Virtual Card integrates smoothly with popular digital wallets like Apple Pay and Google Pay, allowing users to spend crypto through contactless payments online or in stores.

Security Features

Security is one of the strongest aspects of the BitPay Virtual Card and this include:

Two-Factor Authentication (2FA)

BitPay implements two-factor authentication (2FA) to add an extra layer of protection to user accounts. This feature ensures that even if login credentials are compromised, unauthorized access is blocked without secondary verification.

Biometric Login

For added convenience and safety, the BitPay app supports biometric authentication, including Face ID and fingerprint recognition. This modern security layer eliminates the need for passwords while ensuring that only the account owner can access funds or perform key operations.

Real-Time Transaction Alerts

BitPay provides real-time transaction notifications for every card purchase, transfer, or wallet activity. These instant alerts keep users informed about spending, helping to detect suspicious transactions immediately. This transparency enhances user confidence and reduces the risk of fraud.

Secure Wallet Backup

Users can securely back up their BitPay Wallet using a recovery phrase, ensuring that assets remain safe even if a device is lost or replaced. The recovery phrase acts as a personal safeguard, allowing users to restore access without relying on third-party support.

User-Controlled Private Keys

BitPay emphasizes user sovereignty — private keys are never stored on BitPay’s servers. Instead, they remain encrypted and locally managed by the user.

Read Also: Top Crypto Wallet Security Best Practices

Additional Benefits

Beyond its core function of enabling instant crypto-to-fiat spending, the BitPay Virtual Card offers several additional benefits, such as:

Global Spending Power

Since the BitPay Virtual Card runs on the Mastercard network, it can be used at millions of merchants worldwide, both online and in-store.

Whether you’re shopping, paying bills, or travelling abroad, you can spend your crypto seamlessly anywhere Mastercard is accepted. The card also supports ATM withdrawals, giving users access to cash whenever they need it.

Compatibility with Apple Pay and Google Pay

The BitPay Virtual Card integrates smoothly with Apple Pay and Google Pay, offering secure, contactless payment options. This digital wallet compatibility makes it easier to pay on the go, without needing to carry a physical card — a convenient option for everyday purchases and travel.

Gift Card Purchases with Crypto

Through the BitPay app, users can buy gift cards for top global brands like Amazon, Uber, DoorDash, and more — directly using cryptocurrency. This feature offers a creative way to spend crypto, even when direct merchant acceptance is limited, by turning digital assets into instantly usable value.

Merchant Directory and Crypto Payments

BitPay also offers a Merchant Directory, featuring businesses that directly accept crypto payments through the BitPay network. This gives users even more opportunities to pay with crypto without converting it to fiat, reinforcing BitPay’s mission to expand real-world crypto utility.

Fees and Pricing Structure

| Fee Type | Details |

| Annual Fee | $0.00 |

| Monthly Fee | $0.00 |

| Card Issuance Fee (Virtual) | $0.00 |

| Card Issuance Fee (Physical) | $10.00 |

| Expedited Card Replacement | $30.00 |

| POS Purchases (PIN/Signature) | $0.00 |

| Crypto-to-Fiat Conversion Fee | 1–2% + $0.25 |

| ATM Withdrawal Fee (U.S.) | $2.50 per transaction |

| Bank Teller Withdrawal Fee | $2.50 per transaction |

| Declined Transaction Fee | $0.00 |

| Cash Advance Fee | Not applicable |

| Late Payment Fee | Not applicable |

| Over-Limit Fee | $0.00 |

| Dormancy Fee | $5.00/month |

| Foreign Transaction Fee | $0.00 |

| Refund Processing Fee | $0.00 |

| Hidden or Uncommon Fees | Network/Blockchain miner fees |

Annual and Monthly Fees

The BitPay Virtual Card is one of the few crypto debit cards that comes with no annual or monthly fees. Users can create and maintain their virtual or physical card without worrying about recurring charges.

There are also no setup, activation, or maintenance costs, making it an ideal option for those seeking a cost-effective way to spend cryptocurrency. This transparent pricing model ensures that users only pay for the transactions they make — not for simply owning the card.

Transaction Fees

BitPay applies a tiered transaction fee structure based on the total monthly transaction amount.

- Transactions below $500,000 USD incur a fee of 2% plus $0.25.

- Between $500,000 and $999,999 USD, the fee drops to 1.5% + $0.25.

- For $1,000,000 USD or more, the fee is 1% + $0.25.

Everyday purchases made via POS terminals or online checkouts generally come with no additional fees, while ATM withdrawals and bank teller transactions cost $2.50 per transaction.

Cash Advance Fees

The BitPay Virtual Card is a prepaid debit card, not a credit card, meaning cash advance fees don’t apply. Users can only spend the balance they’ve loaded from their BitPay Wallet or Coinbase account.

However, withdrawing cash at ATMs or through bank tellers will incur a small $2.50 transaction fee, plus any applicable third-party ATM network charges.

Late Payment Fees

Because the BitPay Virtual Card operates on a prepaid model, there are no late payment fees. You can’t borrow funds or carry a balance like a credit card, so missed payments are not an issue. This makes it a stress-free and straightforward option for crypto holders who prefer spending only what they already own.

Over-Limit Fees

There are no over-limit fees with the BitPay Virtual Card, as the available card balance caps all spending. Transactions that exceed your balance are automatically declined at no cost, ensuring you never spend more than you’ve loaded.

Foreign Transaction Fees

The BitPay Virtual Card charges no foreign transaction fees, which is a significant advantage for international travelers and online shoppers. Since it runs on the Mastercard network, it can be used globally wherever Mastercard is accepted, without added costs for cross-border or currency conversion transactions.

Hidden or Uncommon Fees

BitPay maintains a transparent fee policy with minimal hidden costs. The only uncommon fees users may encounter include:

- A dormancy fee of $5 per month will be applied after 90 days of inactivity.

- Network or miner fees when transferring crypto into the BitPay Wallet, depending on blockchain congestion.

- Expedited card replacement fees ($30 for fast delivery).

These costs are situational rather than routine, keeping the BitPay Virtual Card one of the most budget-friendly crypto payment options available.

Eligibility and Application Process

Getting started with the BitPay Virtual Card is simple and designed for accessibility, especially for crypto users in the United States. While the card is temporarily unavailable for new applications as BitPay updates its program, understanding the eligibility criteria and process helps you prepare for when enrollment resumes.

Who Can Apply

The BitPay Virtual Card is currently available only to U.S. residents who are at least 18 years old and can complete identity verification (KYC). Unlike credit cards, BitPay does not require a credit check or personal guarantee — since it’s a prepaid debit card, there’s no borrowing or repayment involved.

This makes it ideal for:

- Individuals who hold cryptocurrency and want to spend it directly.

- Freelancers and remote workers paid in crypto.

- Crypto enthusiasts who prefer non-custodial, self-managed wallets.

Required Documents

To meet compliance and security standards, applicants must provide the following documents and verification details:

- Government-issued ID: Acceptable forms include a State ID, Driver’s License, Passport, Residence or Work Permit, or Immigrant Visa.

- Selfie verification: A clear, live selfie to match the submitted ID.

- Residential address confirmation: Proof of U.S. residency (such as a utility bill or ID with address).

These requirements ensure that BitPay complies with anti-money laundering (AML) and financial regulations while protecting users from identity fraud.

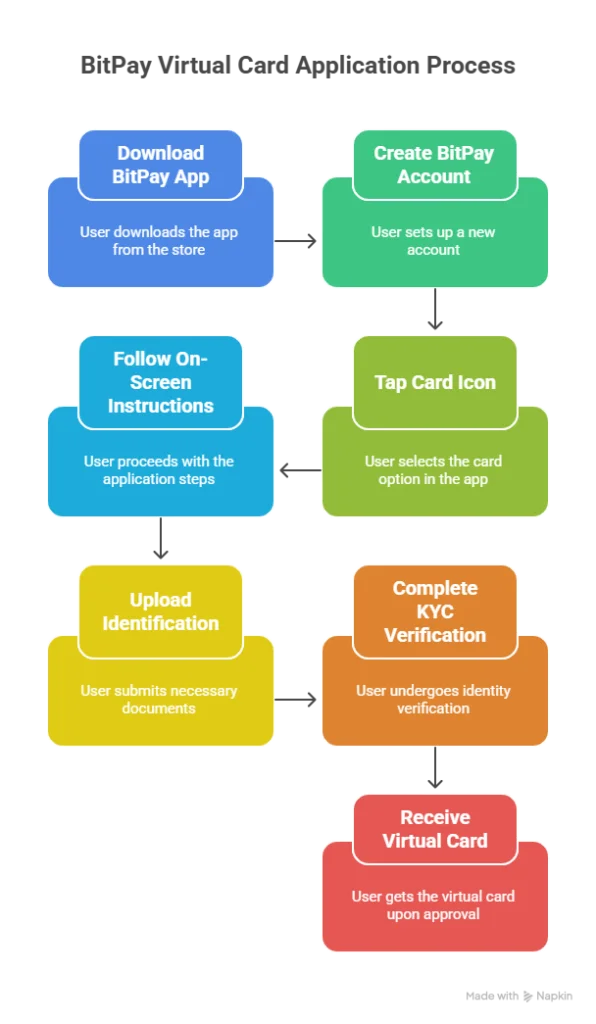

Step-by-Step Application Guide

- Download the BitPay App from the App Store or Google Play.

- Create a BitPay account using your verified email address.

- Tap the Card Icon within the app’s dashboard.

- Start the application and provide your required details.

- Upload your ID and complete the KYC verification by taking a selfie.

- Wait for instant review and approval.

Once verified, your BitPay Virtual Card is generated instantly with a 16-digit card number, CVV, and expiration date.

Approval Timeline

Most users receive approval within minutes after submitting their documents and completing identity verification. In rare cases, BitPay may take up to 24 hours for additional manual review or document validation.

What Happens After Approval

Once approved, your BitPay Virtual Card appears inside the BitPay app. You can fund it immediately using your BitPay Wallet or Coinbase account, add it to Apple Pay or Google Pay, and start spending crypto like cash.

Your card details, including number, expiration date, and CVV, are securely stored within the app. From there, you can track transactions, freeze your card, view balances, and manage all settings directly from your smartphone.

Pros and Cons of BitPay Virtual Card

| Pros | Cons |

| 1. Instant Crypto-to-Fiat Conversion – BitPay converts cryptocurrency to fiat currency in real time, allowing you to spend your crypto immediately at any merchant that accepts Mastercard. | 1. Limited Availability (U.S. Only) – Currently, the card is restricted to U.S. residents. International users must wait for potential future expansion or use alternatives like Crypto.com or Wirex. |

| 2. No Annual or Monthly Fees – The BitPay Virtual Card has no recurring fees, making it cost-effective for users who want to avoid maintenance costs often found in other crypto cards. | 2. No Rewards or Cashback Program – Unlike cards from Crypto.com or Nexo that offer cashback or staking rewards, BitPay focuses on simplicity without incentives. |

| 3. Seamless Integration with Apple Pay and Google Pay – Users can link the card to digital wallets for contactless payments in-store or online, increasing convenience and global usability. | 3. Program Temporarily Paused – BitPay has paused new card applications as it revamps the program, meaning new users can’t currently sign up. |

| 4. Transparent Fee Structure – Fees are clearly outlined and minimal: $0 for standard transactions and only small charges for ATM withdrawals or inactivity, ensuring no hidden costs. | 4. ATM Withdrawal Limits – Daily withdrawal limits of $2,000 and a maximum card balance of $25,000 may be restrictive for high-volume spenders or travelers. |

| 5. Strong Security Features – With 2FA, biometric login, wallet backups, and user-controlled private keys, BitPay offers robust protection and user sovereignty over funds. | 5. No Credit-Building Opportunity – Since it’s a prepaid debit card, usage doesn’t affect your credit score or history, which may deter users seeking to build credit. |

| 6. Merchant Directory and Gift Card Options – BitPay’s built-in directory and gift card marketplace allow users to spend crypto directly at supported merchants or convert it into brand gift cards. | 6. Dormancy Fee After Inactivity – A $5 monthly fee applies after 90 days of inactivity, which could impact occasional users who don’t use the card regularly. |

| 7. Easy-to-Use Mobile App – The BitPay app provides a simple interface for funding, tracking, and managing your card and crypto assets all in one place. | — |

User Reviews and Feedback

Below is a summary of how users perceive BitPay (including its card and payment services), based on available reviews on platforms like Capterra, GetApp, and Trustpilot.

Aggregate Ratings

- Capterra / GetApp: BitPay holds a 4.4/5 average rating based on 17 user reviews.

- Trustpilot: As of now, BitPay’s Trustpilot profile shows mixed reviews, though exact averaged TrustScore is not prominently displayed or may vary.

These ratings suggest that while many users find BitPay useful and reliable, there are notable drawbacks and inconsistencies in the user experience.

Common Praise Themes

Some users appreciate the simplicity of using the BitPay card and its integration with the app. For instance, Mary M noted on Capterra:

“What I like the most about BitPay is how simple it is to use. I love that I get a debit card to use instead of having to always send money over to my bank account.”

Paul P, another user, said:

“When I owned a coffee shop and was introduced to bitcoin, BitPay was an amazing tool to allow me to accept crypto from a new customer base without actually holding bitcoin.“

Frequent Complaints and Critiques

Others have reported issues, including delays in fund returns and challenges with customer support responsiveness. One user mentioned:

“BitPay has failed to timely return my funds… The BitPay policy is that funds will be returned within 24 hours.”

Another user on Capterra complained about how the volatility of crypto caused him a loss due to an issue he had with the Bitpay card. Brad said:

“Which is fluctuating by the hour. I went through all of this and lost ~$1500 in crypto because of these issues, so learn from my experience.“

While BitPay’s virtual card provides a functional solution for spending cryptocurrency, users have reported mixed experiences with support and reliability. Instances of delayed fund returns are notable concerns.

Customer service feedback

BitPay provides customer support through the following methods:

- Online Help Center: A comprehensive resource covering topics like card usage, identity verification, and troubleshooting.

- Email Support: Users can reach out via email for assistance with their accounts at support@bitpay.com.

- Virtual Assistant (“BitBot”): An AI-powered chatbot available on their support site for quick answers to common questions.

- Phone Call Support: Users can contact the support team via their toll-free phone line at 855-398-1373. Their team is open from 10:00 AM – 8:00 PM Eastern US Time.

Top 6 Alternatives to BitPay Virtual Card

As crypto payment cards proliferate, many users are looking beyond BitPay to find cards that match their specific needs, whether for better rewards, global access, or lower fees. Choosing an alternative may help you get more value from your spending.

Below are six categories of alternatives:

UPay Card

Best For: Users Focused on Global Payments

UPay positions itself as a crypto card + wallet for global payments. It claims ultra-low fees, real-time exchange rates, no cross-border fees, and fast onboarding. It’s stronger in international usage and cost transparency.

Key Differentiators

- Zero cross-border fees and real-time rates to reduce hidden costs.

- Asset-backed spending limits: using crypto assets or collateral in wallet to enable spend.

- Simpler fee structure with low ATM and withdrawal fees compared to many competitors.

Pricing

- Transaction fees generally are very low (1% fee + No FX)

- ATM withdrawals may incur 2%.

- No hidden fees claimed; transparency is a core selling point.

Pros

- Great for people who travel or shop globally.

- Supports Apple and Google Pay

- Low fees (1% fee + No FX) and clean structure, fewer surprises.

- Fast onboarding and broad merchant / wallet compatibility.

Cons

- Being newer, might have less entrenched partnerships or fewer perks.

- Regulatory or availability restrictions in certain countries.

Why Choose Over BitPay: If you care about low fees for international use and want a more global-oriented option, UPay may beat BitPay in cost and cross-border performance.

Crypto.com Visa / Crypto.com Prepaid Card

Best For: Users who want strong rewards and perks tied to staking

The Crypto.com Card offers up to 5% CRO back on spending (local or overseas) and rebates on popular subscriptions like Spotify/Netflix plus lounge access at higher tiers. It’s rich in perks if you meet the staking or lockup requirements; otherwise rewards are lower.

Key Differentiators

- Tiered rewards depending on how much CRO you stake or lock up.

- Subscription rebates for streaming / media services.

- Free ATM withdrawals (within limits) and different benefits per card level.

Pricing

- Annual or monthly “lockup / staking” requirement rather than a traditional annual fee. For example, to reach certain reward tiers you may need to stake CRO or pay a subscription fee.

- Other fees depend on card tier (ATM, foreign so on) but many everyday purchases have no extra fee beyond conversion/spending.

Pros:

- High reward potential for those who stake CRO.

- Good perks for travelers and media subscription users.

- Strong global acceptance, integrates with digital wallets.

Cons

- Must stake or lock up CRO to get best rewards; less upside if you don’t.

- Rewards programs and fee schedules are complex; some limits/caps apply.

Why Choose Over BitPay: If you want rewards and perks (e.g. CRO back, rebates) rather than just crypto-to-fiat conversion, Crypto.com is stronger.

Nexo Card

Best For: People who want crypto cashback with flexible usage

The Nexo Card offers rewards in crypto, provides both “Credit Mode” (borrowing against crypto) and “Debit Mode” options, and supports Apple Pay/Google Pay. It’s suitable for those who want both spending flexibility and yield on their crypto holdings.

Key Differentiators

- Earns crypto cashback depending on your loyalty tier (portion of NEXO tokens held).

- The Credit Mode feature enables spending without the immediate need to sell crypto.

- Higher free ATM withdrawal limits for specific users.

Pricing

- No annual or inactivity fees typically. Crypto rewards change by loyalty tier.

- Some tiers require maintaining specific amounts of NEXO or daily portfolio value.

- Foreign transaction fees: FX Fees on Weekdays include EEA/UK/CH: 0.2% and ROW: 2%. FX Fees on Weekends include EEA/UK/CH: 0.7% and ROW: 2.5%.

Pros

- Crypto cashback gives both spending utility and potential upside.

- Flexible usage modes (credit, debit).

- Good global merchant reach and digital wallet support.

Cons

- To unlock top benefits, you need a significant NEXO balance or meet loyalty thresholds.

- Crypto volatility risk still exists; fees or rewards may vary depending on the market or region.

Why Choose Nexo Over BitPay: If you’re looking for cashback in crypto and a more rewarding structure, Nexo offers an advantage over BitPay, which only provides conversion with no rewards.

SoFi Credit Card

Best For: Users interested in a traditional credit card.

The SoFi Unlimited 2% Credit Card gives 2 points per $1 on all purchases, with opportunities to redeem into various SoFi accounts (checking, savings, investing, and sometimes crypto), with no annual fee. It’s more of a hybrid between fintech and traditional finance.

Key Differentiators:

- Flat 2% (or promotional 3%) cash-back/rewards points on all spending.

- No foreign transaction fees on many cards.

- Flexible redemption (redeem rewards for cash, investments, crypto, or pay down loans) depending on SoFi features.

Pricing

- $0 annual fee.

- Regular APRs for credit cards apply if you carry a balance.

Pros

- Simple, flat rewards that don’t require staking or lockups.

- Good redemption flexibility.

- Ideal for individuals who prefer credit cards and are looking to build credit.

Cons

- Not a crypto debit; you’ll need to pay in fiat/credit, then convert if you want crypto.

- Using a credit card carries interest risk if the balance isn’t paid in full.

Why Choose Over BitPay: If you prefer credit card perks and rewards over the simplicity of crypto debit, SoFi offers more reward value on everyday expenses.

Chase Sapphire Preferred Credit Card

Best For: Travelers who want premium travel perks and strong customer support

While not crypto-native, cards like Chase Sapphire Preferred (or comparable travel cards) offer strong rewards on travel and dining, excellent redemption value, travel insurance, and generous partner networks.

Key Differentiators

- High rewards rates on specific categories (travel / dining).

- Strong travel and purchase protections (insurance, concierge).

- Well-established banking infrastructure and global acceptance.

Pricing

- Annual fees are usually meaningful (e.g. $95 for Chase Sapphire Preferred).

- Other fees typical of credit cards (interest if not paid in full, foreign transaction fees depending on card).

Pros

- Excellent for frequent travelers who can use travel perks.

- Strong fraud protection and customer service.

- Rewards often high value when redeemed properly.

Cons

- Not direct crypto spending; you’ll end up converting or buy crypto separately.

- Annual fee may offset some rewards if you aren’t using travel perks heavily.

Why Choose Over BitPay: If your spend is travel heavy and you prefer travel rewards and protections, traditional bank travel cards will likely yield higher long-term value than a crypto debit card.

Coinbase Card

Best For: Frequent crypto traders who want to spend their crypto directly

The Coinbase Card lets you pay using crypto from your Coinbase account, convert at the time of transaction, and earn a percentage back in crypto rewards. It’s optimal if you already use Coinbase heavily.

Key Differentiators

- Rewards are paid in crypto, often in the coin you spend or in a selected asset.

- Full integration with Coinbase’s app: simple funding, tracking, converting.

- Visa backing with wide acceptance and potential bonus offers for staking / holding certain assets or meeting usage thresholds.

Pricing

- No annual fee in many cases.

- Standard transaction conversion fees / spreads depending on geography.

Pros

- Seamless for existing Coinbase users.

- Earn crypto rewards, useful if you prefer accumulating digital assets.

- Visa network means global usability.

Cons

- Crypto volatility risk when spending.

- Some fees for conversions or for off-platform usage may apply.

Why Choose Over BitPay: If you want rewards in crypto plus tight integration with a major exchange, Coinbase Card likely offers more in that dimension than BitPay.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| BitPay Virtual Card | $0 | None | None | No | Crypto users wanting straightforward spending | Instant crypto → fiat conversion with no maintenance fees | No rewards, U.S.-only, currently paused new applications | 3.5 |

| Crypto.com Visa / Prepaid (or Crypto.com Credit variant) | $0 (but staking / lockup requirement for higher tiers) | Up to ~5 % CRO (varies by tier) (Crypto.com Help Center) | Depends on tier / offers (e.g. CRO bonus) | Yes (for credit version) | Users wanting crypto rewards and perks | Rebates, streaming subscription benefits, tiered staking rewards | Complexity of tiers, staking requirement, caps on rewards depending tier | 4 |

| Nexo Card | $0 | Up to ~2 % cashback (in NEXO or crypto) (cointracking.info) | None (typically) | No | Users wanting cashback in crypto + flexibility | Flexible “Debit Mode” / “Credit Mode” spending, integration with Nexo wallet | To unlock top benefits, you may need to meet token balance or loyalty thresholds | 3.8 |

| SoFi Unlimited 2% Credit Card | $0 | 2 % flat cash-back | May have occasional offers | Yes (credit card) | Users who prefer credit and want simple, flat rewards | Clean flat reward, redeem into investing/savings/loans | It’s a credit card—not a crypto spending card; interest if you carry balance | 3.9 |

| UPay (UPay.best card) | $0 (claimed) | Low or zero transaction fees (not traditional “rewards”) | None (as publicly stated) | Likely No | International / cross-border spenders wanting low fees | Zero cross-border fees, real-time rates | Newer card, possibly limited merchant perks or adoption | 4.6 |

| Traditional Bank Travel Card (e.g. Chase Sapphire Preferred or equivalent) | ~$95 (or similar) | Varies (e.g. 2×–5× points) | Large sign-up bonus typical | Yes | Travelers wanting premium perks, lounge access | Travel perks, protection, established support | Doesn’t spend crypto directly; you have to convert crypto outside | 4.2 |

| Coinbase Card (Visa) | $0 | Variable crypto rewards (you choose the crypto) (Coinbase) | Occasional signup bonuses | No (debit model) | Active Coinbase users who want to spend crypto and earn rewards | Strong Coinbase integration, zero hidden spend fees | Conversion spreads or fees depending on coin, limited by region | 4 |

How to Choose: Decision Framework

Selecting the right crypto or fintech card depends on your financial goals, operational needs, and spending habits. Each card serves a specific type of user—from individuals managing personal crypto holdings to small businesses handling global payments.

Below is a structured decision framework to help you decide which option best fits your situation.

Business Size Considerations

For freelancers, entrepreneurs, or small business owners who want to simplify crypto-to-fiat conversions, a low-cost and easily manageable card like the BitPay Virtual Card or UPay Card makes sense. These options eliminate high annual fees and complicated onboarding, allowing seamless spending from crypto wallets.

Larger enterprises or organizations with frequent employee spending might find Crypto.com Visa or Nexo Card more suitable. They offer reward structures, account integrations, and higher transaction limits—ideal for managing recurring payments or expense reimbursements.

Industry-Specific Needs

Your industry can determine the type of card that fits best. Tech startups or digital agencies working with international clients may value instant global settlement. The UPay Card excels here, providing real-time exchange rates and low cross-border fees.

Meanwhile, content creators, freelancers, and online service providers might prefer the Coinbase Card, which links directly to crypto earnings and lets you spend instantly. Professionals in travel, entertainment, or hospitality industries, where perks and protections matter, should look to Chase Sapphire Preferred, which provides travel rewards, insurance, and customer support.

Cash Flow Situations

If you rely on fluctuating cash flow or hold most of your value in crypto, flexibility is key. The Nexo Card offers “Credit Mode,” letting you borrow against crypto rather than selling it—ideal for maintaining liquidity during slow periods.

On the other hand, businesses or individuals with predictable, stable cash flow may prefer SoFi Unlimited 2% Credit Card, offering consistent cash-back rewards and credit-building benefits without complex token requirements.

International vs. Domestic Use

If your spending or clients are mostly local (within the U.S.), the BitPay Virtual Card or SoFi Card provides solid reliability. But if you operate globally, especially across multiple currencies, UPay and Crypto.com cards are far superior, offering low exchange costs and widespread acceptance.

Technology Requirements

Some businesses need deep integration with apps or APIs, while others only need digital wallet compatibility. BitPay and Coinbase excel in app integration with real-time transaction tracking. Meanwhile, UPay and Crypto.com offer strong API support, making them ideal for fintech startups or e-commerce companies.

Final Verdict

The BitPay Virtual Card delivers a convenient and efficient way to spend cryptocurrency directly from your digital wallet. Its integration with the BitPay app, low fees, and strong security features make it a practical solution for users who want a simple crypto-to-fiat bridge without the hassle of third-party conversions.

This card is perfect for crypto users who prioritize simplicity, instant conversion, and global accessibility. Freelancers, online professionals, and small business owners who receive crypto payments will find it especially useful for everyday expenses or business transactions. The ability to fund the card instantly from supported wallets also makes it a smooth choice for frequent spenders.

However, it may not be ideal for users seeking extensive rewards programs or those who need direct crypto-to-crypto flexibility. The lack of cashback or travel perks can make it less appealing for individuals who value incentive-based spending. Similarly, users who prefer a physical card with credit-building options might want to consider alternatives that offer more traditional financial benefits.

For those looking for added value, the Crypto.com Visa Card is a strong alternative. It offers competitive rewards, flexible staking options, and excellent global usability—making it suitable for users who want both crypto convenience and financial perks. Meanwhile, professionals managing international transactions might prefer the UPay Card, known for its low foreign transaction fees and multi-currency support.

Overall, the BitPay Virtual Card holds a solid position in the crypto payment market. It is reliable, secure, and cost-effective, catering to a niche of users focused on practicality over prestige. While it may not offer the bells and whistles of premium cards, it performs its core function exceptionally well—allowing users to spend their crypto with ease and confidence.

Frequently Asked Questions

Is BitPay Trustworthy?

Yes, BitPay is generally considered trustworthy, with over a decade in crypto payments, strong security features, and support from the Mastercard network, though some users report slow customer support.

Does Bitpay Have a Virtual Card?

Yes, BitPay offers a virtual card that allows users to spend cryptocurrency by converting it into fiat currency for online and phone transactions. This virtual card is accessible through the BitPay Wallet app and can be used immediately upon approval. However, as of now, BitPay is not accepting new applications for the card as the company is revamping the program. Additionally, the card is currently available only to U.S. residents.

How Do I Get My Money Out of Bitpay?

To withdraw funds from your BitPay account, you can use the BitPay Wallet app to sell your cryptocurrency and transfer the proceeds to your bank account via ACH or to a debit card. Alternatively, you can use the BitPay Card to spend your crypto directly or withdraw cash from compatible ATMs. Ensure your account is verified and meets any minimum withdrawal requirements.

How Much Does Bitpay Charge per Transaction?

BitPay does not charge transaction fees for domestic purchases made with the BitPay Virtual Card. However, international transactions incur a 3% currency conversion fee. Additionally, ATM withdrawals cost $2.50 per transaction, and a $5 monthly inactivity fee applies after 90 days of no card use.

What Country Is Bitpay From?

BitPay is a cryptocurrency payment service provider headquartered in Atlanta, Georgia, United States.

Related posts:

- 50X Exchange Affiliate Program: Overview, Benefits & Commission

- Coincheck Exchange Affiliate Program: Overview, Benefits & Commission

- Flipster Affiliate Program: Overview, Benefits & Commission

- Coinone Affiliate Program: Overview, Benefits & Commission

- SafeTrade Affiliate Program: Overview, Benefits & Commission