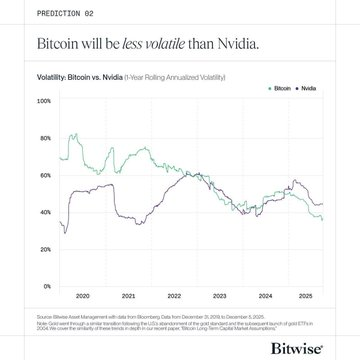

Bitcoin is showing signs of something few investors would have predicted just a few years ago: calmer price behavior than one of the world’s most actively traded technology stocks.

According to a new report released Wednesday by asset manager Bitwise, Bitcoin (BTC) has become less volatile than Nvidia (NVDA) in 2025, a development the firm attributes to the cryptocurrency’s growing maturity and a broadening investor base.

Bitwise expects this trend to persist through 2026, marking what it describes as a structural shift in how Bitcoin trades.

Key Takeaways

- Bitcoin’s price volatility fell below Nvidia’s in 2025, reflecting a marked shift in how the asset trades compared with high-growth equities.

- Institutional adoption through spot ETFs has broadened Bitcoin’s investor base and reduced the sharp price swings seen in earlier cycles.

- Long-term holder selling has been largely absorbed by deeper institutional liquidity, easing sustained sell-side pressure on the market.

- Bitwise expects Bitcoin’s lower volatility to persist into 2026 as traditional financial institutions increase their exposure to the asset.

Bitcoin Volatility Falls Below Nvidia’s

Volatility has long been one of Bitcoin’s defining traits, often exceeding that of equities and even high-growth technology stocks.

That relationship has now flipped. Bitwise data shows Bitcoin’s price moved roughly 68% between its 2025 low near $75,000 in April and its all-time high of $126,000 in early October. Over the same period, Nvidia shares recorded a far sharper swing of about 120%, climbing from around $94 to a peak near $207.

Bitwise says this crossover is not a short-term anomaly.

“Bitcoin’s volatility has steadily declined over the past ten years,” the firm noted, describing the trend as a clear sign of “derisking” as the asset integrates more deeply into traditional financial markets.

Despite Nvidia’s higher volatility, its stock has delivered stronger performance this year, rising roughly 27% year-to-date. Bitcoin, by contrast, is down about 8% since the start of 2025, reflecting a period in which crypto markets have increasingly decoupled from equities.

Institutional Access Is Changing How Bitcoin Trades

At the center of Bitcoin’s calmer price action is institutional adoption. Bitwise argues that regulated investment vehicles, particularly spot Bitcoin exchange-traded funds, have reshaped market dynamics by bringing in a different class of investor.

“The rise of ETFs and other traditional vehicles has expanded Bitcoin’s investor base beyond retail traders and crypto-native funds,” Bitwise said.

This diversification has helped absorb large buy and sell orders that once caused sharp price dislocations. Instead of reacting violently to leverage-driven speculation or narrative shocks, Bitcoin is increasingly influenced by longer-term capital allocations and portfolio strategies.

Bitwise added that traditional drivers of extreme crypto cycles, including heavy leverage and abrupt reactions to halving events, are becoming less dominant as institutional liquidity deepens.

Long-Term Holder Selling Nearing Exhaustion

Supporting the view of a stabilizing market, separate research from K33 suggests that a major source of sell-side pressure may be close to running its course. According to the research and brokerage firm, long-term Bitcoin holders have sold approximately 1.6 million BTC over the past two years, worth an estimated $138 billion.

K33 head of research Vetle Lunde said the scale of these movements points to intentional profit-taking rather than technical factors such as wallet restructuring or ETF-related transfers. The firm noted that both 2024 and 2025 rank among the largest years on record for long-term supply reactivation.

Crucially, this selling has been absorbed by what K33 describes as “deeper institutional liquidity,” suggesting that the market’s capacity to handle large distributions has improved significantly.

Looking Ahead to 2026

Bitwise views Bitcoin’s reduced volatility as a foundation for its next phase rather than a ceiling on upside. The firm expects Bitcoin to reach a new all-time high and move beyond the historical four-year boom-and-bust cycle that has defined previous market phases.

It also forecasts further institutional participation in 2026, naming major financial institutions such as Citigroup, Morgan Stanley, Wells Fargo, and Merrill Lynch as potential entrants into the crypto space.

“This is a structural shift, not a temporary phase,” Bitwise said, emphasizing that Bitcoin’s changing behavior reflects who owns it and how it is traded.

For a market once defined by extreme swings and speculative excess, Bitcoin becoming less volatile than Nvidia marks a notable turning point. Whether that stability attracts even more conservative capital may shape the asset’s trajectory heading into 2026.

No related posts.