As crypto moves closer to everyday use, the question many people ask is: “Can I actually spend my Bitcoin at the grocery store?” With the Coinbase Card, the answer is yes and it’s simpler than you might think.

Traditional debit and credit cards are great for everyday use, but they don’t bridge the gap between digital assets and real-world transactions. That’s exactly where crypto cards step in: they let you spend crypto as easily as cash, without the headache of manually converting it every time.

The demand for crypto cards is growing fast. As of 2025, over 40% of active crypto users say they prefer payment options that integrate both fiat and digital currencies. This trend is being driven by better rewards, wider acceptance at merchants, and an increased focus on user-friendly fintech solutions.

One of the most talked-about options in this space is the Coinbase Card. It gives users the ability to spend their crypto directly from their Coinbase account, earn rewards on purchases, and manage everything from one app. It’s designed for users who want convenience, transparency, and a seamless way to use crypto in daily life.

But Coinbase isn’t the only player. In this review, we’ll break down how the Coinbase Card works, what it offers, and its main pros and cons. We’ll also explore top alternatives, so you can compare and choose the best fit for your spending style.

We’ll even touch on UEEx, a fast-growing platform known for its secure trading environment and flexible payment solutions, giving users even more options to move between crypto and traditional finance.

Key Takeaway

- The Coinbase Card is a crypto-powered debit card that lets you spend your cryptocurrencies just like cash anywhere Visa is accepted.

- An important part of the Coinbase Card review is its fees and limits.

- A debit card uses your own funds for day-to-day shopping or ATM withdrawals

- The Coinbase app gives you full control over your card with just a few taps

- There are no annual fees or transaction charges, and you can earn rewards every time you make a purchase

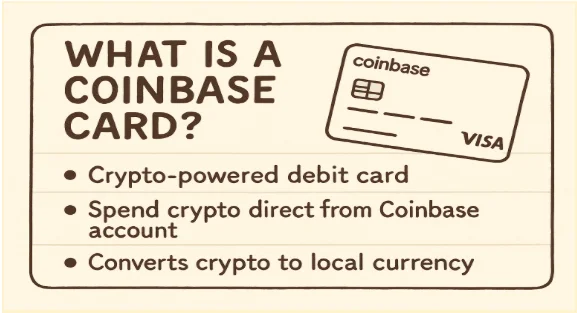

What is a Coinbase Card?

The Coinbase Card is a crypto debit card that allows users to spend their digital assets as easily as they would spend cash. Instead of manually converting crypto to fiat in advance, the card instantly converts your selected cryptocurrency into local currency at the point of sale. This makes it possible to use your crypto for everyday purchases from coffee shops to online stores just like a traditional debit card.

Issued by MetaBank® (Member FDIC) in partnership with Coinbase, one of the largest and most trusted cryptocurrency exchanges in the world, the Coinbase Card reflects the company’s goal of making crypto more practical and accessible. Coinbase has a strong global reputation for security and compliance, which helps increase user trust and adoption of its financial products.

The target audience for this card is crypto holders who want to use their digital assets in real life without unnecessary steps or delays. It’s particularly appealing to everyday users, frequent travelers, and crypto enthusiasts who want a seamless spending experience. The card is also ideal for people who earn rewards in crypto or receive payments in digital currencies and want a quick way to access those funds.

Unlike traditional debit or credit cards, the Coinbase Card doesn’t require you to top up with fiat currency from a bank account. Instead, it connects directly to your Coinbase balance, letting you choose which crypto wallet to spend from. There’s no credit check since it’s not a credit card, and all conversions happen instantly.

The card operates on the Visa network, meaning it’s accepted by millions of merchants globally. Transactions are processed in real time, and users can manage their card entirely through the Coinbase app, including selecting reward preferences, locking or unlocking the card, and tracking spending activity.

As of 2025, the Coinbase Card is available in most U.S. states (excluding Hawaii) and in several countries across Europe and the UK. Coinbase continues to expand its coverage, with plans to reach more regions as regulations evolve.

“The Coinbase Card turns your crypto into a usable currency, making everyday purchases as simple as tapping your phone.”

Quick Facts Table

| Feature | Details |

| Card Network | Visa |

| Annual Fee | $0 |

| APR Range | Not applicable (debit card, not credit) |

| Welcome Offer | None |

| Rewards Rate | Up to 4% back in crypto (varies by asset and region) |

| Foreign Transaction Fees | 0% |

| Credit Check Required | No |

| Personal Guarantee Required | No |

| Minimum Requirements | Active Coinbase account; valid ID for KYC verification |

| Application Timeline | Instant approval (in most cases); physical card delivered in 7–10 business days |

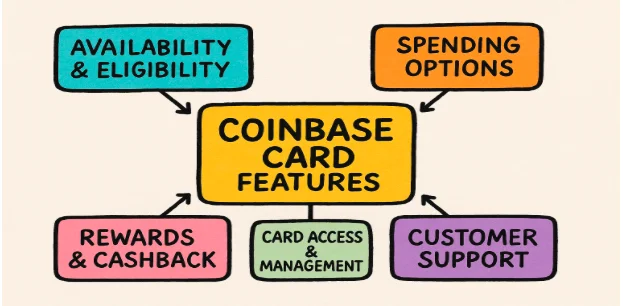

Key Features of the Coinbase Card

The Coinbase Card isn’t just another debit card, it’s designed to make spending crypto as seamless as using cash. To understand how it stands out, let’s break down its core features, rewards structure, technology, and additional perks in detail.

Instant Crypto-to-Fiat Conversion

One of the biggest advantages of the Coinbase Card is its real-time conversion of crypto into local currency. When you make a purchase, Coinbase automatically converts your chosen digital asset into fiat (e.g., USD, EUR, GBP) at the current market rate. There’s no need to pre-sell your crypto or transfer funds to a bank — everything happens in seconds at the point of sale.

Also Read: Coinbase Affiliate Program: Overview, Benefits & Commission

Global Acceptance with Visa

The card operates on the Visa network, meaning it’s accepted by millions of merchants worldwide. Whether you’re buying coffee in your neighborhood or booking a hotel abroad, the Coinbase Card works just like a regular debit card with no special merchants or platforms required.

Zero Annual Fees

Unlike many rewards cards, Coinbase charges no annual fee. You can use and hold the card without worrying about hidden maintenance costs, which makes it a cost-friendly option for both casual and frequent spenders.

Crypto Rewards on Purchases

Every eligible transaction earns crypto rewards, which can vary based on the asset you select. This means you can grow your digital portfolio simply by making everyday purchases.

Multi-Asset Spending Flexibility

Users can choose which crypto they want to spend from their Coinbase balance. Whether it’s Bitcoin, Ethereum, or stablecoins, you can switch between wallets directly in the app before making a transaction.

Real-Time Spending Insights

The Coinbase mobile app gives you instant notifications after each transaction, along with a detailed history of where and when you spent. You can also categorize transactions to keep track of expenses easily.

No Foreign Transaction Fees

For travelers and international users, this is a major perk. The Coinbase Card charges 0% foreign transaction fees, making it a great option for use abroad without extra costs.

Rewards Program

The Coinbase Card comes with a straightforward, flexible rewards structure designed to give users control over how they earn.

- Reward Rates: Up to 4% back in crypto depending on the asset and region. For example, stablecoin spending may offer lower rates, while other tokens offer higher incentives.

- Asset Selection: You can choose your preferred reward asset (e.g., Bitcoin, Ethereum, stablecoins) through the Coinbase app.

- Automatic Redemption: Rewards are automatically deposited into your chosen crypto wallet — no manual claiming required.

- No Expiration: Earned rewards do not expire, and you can hold or trade them like any other asset in your Coinbase account.

- Fluctuating Rates: Reward rates may change over time based on market and program updates, which Coinbase communicates through the app.

This structure is great for users who want to passively accumulate crypto while using their card for everyday spending.

Limits and Controls

Managing spending is simple and transparent with Coinbase Card.

- Spending Limits: Daily purchase limit: up to $2,500 (varies by user verification level and region)

- ATM withdrawal limit: $1,000 per day in most countries

- User Controls: You can freeze or unfreeze your card instantly through the Coinbase app, protecting your funds if your card is lost or stolen.

- Transaction Management: The app provides detailed insights into each transaction, helping you track spending habits and stay within your budget.

- No Overdraft: Since this is a debit card, you can’t spend more than your crypto balance, which helps avoid debt or interest charges.

Technology Integration

Coinbase Card is built to work seamlessly with the Coinbase ecosystem.

- Coinbase App Integration: Everything from card activation to spending preferences is managed directly inside the Coinbase mobile app.

- Real Time Updates: You’ll receive instant push notifications for every transaction, along with conversion details.

- API Access: Advanced users can connect their accounts via Coinbase API, making it easier to automate portfolio management or sync with accounting tools.

- Digital Wallet Compatibility: Coinbase Card supports Apple Pay and Google Pay, allowing users to make contactless payments without carrying the physical card.

This tight integration ensures a smooth user experience whether you’re a beginner or a crypto-savvy user.

Security Features

Security is a top priority for Coinbase, and its card reflects that.

- Two-Factor Authentication (2FA): Every account must be secured with 2FA, adding an extra layer of protection against unauthorized access.

- Instant Card Locking: Lost your card? You can lock or unlock it immediately through the app.

- Fraud Protection: Visa’s zero-liability policy applies, protecting you against unauthorized transactions.

- Encrypted Transactions: All transactions are protected with industry-grade encryption and real-time fraud monitoring.

- No Stored Card Number in App: For added security, sensitive data isn’t displayed directly in the app, minimizing risk in case of device compromise.

These measures ensure that users can spend crypto with confidence and control.

Additional Benefits

Beyond its core functions, Coinbase Card offers a few extra perks that make it more appealing:

- Contactless Payments: Tap-to-pay functionality for faster, more convenient transactions.

- Travel Friendly: No foreign transaction fees and wide global acceptance make it ideal for international use.

- Insurance Coverage: Eligible transactions may be covered under Visa’s purchase protection policies, depending on the region.

- Ease of Replacement: If your card is lost, you can easily request a new one through the app.

- Seamless Fiat Integration: Coinbase handles all the back-end conversion, so you don’t have to deal with manual transfers or complicated exchange processes.

Fees and Pricing Structure of the Coinbase Card

When choosing any financial card, understanding the fee structure is just as important as looking at the rewards. The Coinbase Card stands out because it offers a transparent pricing model, with no major hidden charges. Most of the costs come from the crypto-to-fiat conversion spread, not from traditional banking fees.

Below is a clear breakdown of all the relevant fees you should know before applying or using the card.

| Fee Type | Amount / Description |

| Annual Fee | $0 |

| Monthly Fee | $0 |

| Transaction Fees | No fee on purchases (crypto-to-fiat conversion included in spread) |

| Cash Advance Fees | $0 at ATMs (Visa network), but standard network or ATM owner fees may apply |

| Late Payment Fees | Not applicable (debit card, not credit) |

| Over-Limit Fees | Not applicable (can’t spend more than crypto balance) |

| Foreign Transaction Fees | $0 |

| Conversion Spread | Typically around 0.5%–2.0% depending on market volatility |

| Card Replacement Fee | $0 for standard shipping; express shipping may incur a small fee |

| Inactivity or Dormancy Fees | $0 |

| Hidden or Uncommon Fees | None reported; Coinbase discloses fees clearly within the app before transactions |

No Annual or Monthly Fees

Unlike many traditional cards, Coinbase Card has no ongoing maintenance costs. You only pay when you spend and even then, the primary cost is the conversion spread, not a fixed transaction fee.

Transaction and Cash Advance

You can make purchases and ATM withdrawals with zero Coinbase-imposed fees. However, ATM operators or the Visa network may charge their own withdrawal fee, which varies by location.

No Credit Fees

Since the Coinbase Card is a debit card, there are no late payment or over-limit charges. You can only spend funds you already hold in your Coinbase account, so there’s no interest or debt.

Foreign Use at No Extra Cost

This card is especially useful for travelers. Coinbase does not charge any foreign transaction fees, making international spending simple and affordable.

Conversion Spread

This is the main cost associated with the card. Whenever you spend, Coinbase automatically converts your chosen cryptocurrency into local fiat currency. The spread typically 0.5% to 2.0% covers this conversion. It’s displayed clearly in the app before the transaction is completed.

No Hidden or Surprise Fees:

Coinbase’s pricing structure is transparent. All costs are displayed upfront, so users can make informed spending decisions without worrying about unexpected deductions later.

“The Coinbase Card comes with a range of zero fees, making it a great choice for everyday crypto spending.”

Eligibility and Application Process

Applying for the Coinbase Card is intentionally designed to be quick, secure, and accessible to a wide range of users.

Since it functions as a debit card, the process is simpler than applying for a credit card there’s no credit check, no minimum credit score, and no lengthy financial background screening. Here’s what you need to know before you apply.

Who Can Apply

The Coinbase Card is available to individuals who are at least 18 years old, have a verified Coinbase account, and reside in a supported region. It is currently offered across most U.S. states (excluding Hawaii) as well as in select European countries and the United Kingdom.

Because this is not a credit product, there are no specific credit score requirements, and both new and experienced crypto users can apply. While the card is primarily intended for personal use, freelancers, sole proprietors, and individuals who earn in crypto can also benefit from it for everyday spending.

Required Documents

To apply successfully, users must provide a valid government-issued ID, such as a passport, driver’s license, or national ID card. Proof of residency may be requested depending on the applicant’s country or state, typically in the form of a recent utility bill or bank statement.

A verified Coinbase account is mandatory, which means the user must complete Coinbase’s KYC (Know Your Customer) process before submitting an application. A working email address and phone number are also required to enable two-factor authentication and secure communication.

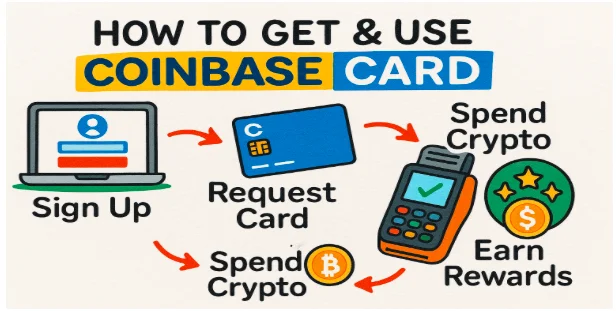

Step by Step Application Guide

- Log in to your Coinbase account (web or mobile app).

- Navigate to “Card” in the menu and select “Get Coinbase Card.”

- Verify your eligibility (region and ID must match requirements).

- Submit required documents if prompted.

- Agree to the terms and confirm your delivery address.

- Receive instant approval (in most cases).

- Wait for physical card delivery (typically 7–10 business days).

- Activate your card in the Coinbase app once it arrives.

Approval Timeline

For most users, approval happens instantly once their identity is confirmed. The physical card typically arrives within seven to ten business days, depending on shipping location. Some international applicants may experience slightly longer delivery times.

What Happens After Approval

Once approved, users receive immediate access to their virtual card, which can be added to Apple Pay or Google Pay. The physical card can be activated upon arrival through the Coinbase app.

After activation, users can choose which cryptocurrency to spend from, manage rewards, set spending limits, and enable real-time alerts for every transaction. From this point, the Coinbase Card is fully functional for everyday use at any merchant that accepts Visa.

Pros & Cons of the Coinbase Card

Like any financial product, the Coinbase Card comes with both perks and potential downsides. Here’s a clear breakdown of what to love and what to consider before applying.

Pro

- Seamless Crypto-to-Fiat Integration: One of the biggest advantages of the Coinbase Card is how easy it makes spending your crypto. You don’t need to manually convert your crypto into cash before using it.

- No Hidden Fees: There are no annual fees, no setup fees, and no monthly maintenance charges. You won’t get hit with surprise costs just for owning or using the card.

- Crypto Rewards on Everyday Spending: With the Coinbase Card, you can earn crypto-back rewards every time you make a purchase depending on the coin you choose.

- Strong Security Features: Security is a top priority with the Coinbase Card. Some key protections include Two-factor authentication (2FA), the ability to instantly freeze or unfreeze your card in the app, and real-time spending alerts.

Cons

- Limited to Coinbase Holdings: The card only pulls funds from your Coinbase account. That means you can’t spend crypto stored in external wallets or on other exchanges unless you first transfer it into Coinbase.

- Non-Availability in Some Territories (e.g. Hawaii): While Coinbase Cards are available in many countries, some locations are still excluded. For example, U.S. residents in Hawaii can’t use it due to state-specific regulations.

- Reward Rates May Fluctuate: Unlike traditional credit cards with fixed cashback percentages, the Coinbase Card’s crypto rewards can change. The available coins and their reward percentages may rotate over time based on Coinbase’s promotions or internal adjustments.

“Earn crypto rewards as you spend, the Coinbase Card offers up to 2% back in digital assets on eligible transactions.”

User Reviews and Feedback Analysis

To understand how the Coinbase Card works, it’s helpful to look beyond features and examine what actual users are saying. Reviews from platforms like TrustPilot, G2, and Capterra provide a good overview of how customers rate the card’s performance, convenience, and service quality.

Aggregate Rating

As of 2025, the Coinbase Card holds an average rating of 3.8 out of 5 stars across major review platforms.

- TrustPilot: 3.9 (based on 2,800+ reviews)

- Capterra: 3.9 (based on 300+ reviews)

Most users rate the card positively for ease of use, seamless crypto-to-fiat spending, and security, though there are a few consistent complaints.

Common Praise Themes

Many users highlight how convenient it is to use their crypto for everyday purchases without manual conversions. One G2 reviewer said,

“I love that I can tap my card and spend Bitcoin just like dollars. It’s fast and works everywhere.”

Another frequent point of praise is the lack of foreign transaction fees, which travelers particularly appreciate. A TrustPilot user wrote,

“I used my Coinbase Card across Europe with no extra fees. It made spending abroad so much easier.”

Users also value the reward structure, especially those who receive 1-4% cashback in crypto, seeing it as a simple way to grow their holdings.

Frequent Complaints

The most common negative feedback revolves around conversion spreads. While the card has no direct transaction fees, some users find the conversion costs higher than expected. A reviewer on Capterra noted,

“The only downside is the spread. Sometimes I lose more than I’d like on conversions.”

Another recurring issue is regional availability. Users in unsupported regions express frustration about not being able to access the service. There are also occasional complaints about delays in physical card delivery.

Customer Service Feedback

Customer service reviews are mixed. Some users report fast and helpful responses when locking or replacing cards. Others, however, mention slow response times during high traffic periods. This inconsistency seems to be one of Coinbase’s ongoing challenges

Top 7 Alternatives to the Coinbase Card

While the Coinbase Card offers a convenient way to spend crypto like cash, it’s not the only option in the market. Depending on your priorities whether it’s lower fees, better rewards, or enhanced global usability several alternatives provide competitive or specialized benefits. Let’s review some of the alternatives.

Crypto.com Visa Card

Best For: Crypto spenders looking for high cashback and global usability.

The Crypto.com Visa Card is a popular crypto debit card that offers up to 5% cashback depending on CRO token staking level. It’s widely accepted globally and includes perks like airport lounge access on higher tiers. With no annual fee and smooth app integration, it’s best suited for travelers and everyday spenders who want strong rewards.

Key Differentiators:

- Up to 5% cashback on purchases (depending on CRO stake).

- Airport lounge access for mid-tier and above.

- Strong mobile app integration with real-time transaction tracking.

Pricing:

- Annual Fee: $0

- CRO staking required for premium rewards tiers.

Pros:

- Competitive cashback program.

- Sleek metal card design.

- No foreign transaction fees.

Cons:

- CRO staking requirement to unlock best benefits.

- Reward reductions in recent years have frustrated some users.

Why Choose Over Coinbase:

Crypto.com offers higher cashback and stronger travel benefits, making it ideal for frequent travelers and active crypto users.

Binance Card

Best For: Frequent Binance exchange users seeking seamless wallet integration.

The Binance Card lets users spend crypto directly from their Binance wallet, offering up to 8% cashback in BNB. It’s ideal for active Binance traders and users already invested in the ecosystem. The card has no annual fee and allows real-time crypto-to-fiat conversion, making it powerful for frequent transactions.

Key Differentiators:

- Up to 8% BNB cashback.

- Direct link to Binance Spot Wallet.

- Real-time crypto-to-fiat conversion at point of sale.

Pricing:

- Annual Fee: $0

- No issuance fee in supported regions.

Pros:

- Excellent integration with Binance ecosystem.

- High cashback potential for BNB holders.

- Accepted worldwide where Visa is supported.

Cons:

- Limited regional availability.

- Cashback tied to holding BNB.

Why Choose Over Coinbase:

Ideal for users already invested in Binance — higher cashback rates and deeper ecosystem integration

Nexo Card

Best For: Users who want flexible spending with credit and debit options in one card.

The Nexo Card stands out for its dual-mode spending; users can either spend directly from their balance or use a credit line backed by crypto without selling assets. It offers up to 2% cashback in BTC or NEXO tokens. With no annual or foreign transaction fees, it’s a strong option for long-term holders.

Key Differentiators:

- Dual mode: spend credit line or directly use assets.

- Up to 2% cashback in BTC or NEXO tokens.

- No monthly or annual fees.

Pricing:

- Annual Fee: $0

- Interest applies only when borrowing.

Pros:

- No forced sale of crypto assets.

- Cashback in BTC or NEXO.

- Real-time spending notifications.

Cons:

- Requires sufficient crypto collateral.

- Limited merchant rewards outside cashback.

Why Choose Over Coinbase:

Unlike Coinbase, Nexo allows users to keep their crypto holdings intact while spending against a credit line, ideal for long-term holders.

UPay.best Card

Best For: Everyday crypto spenders looking for multi-currency functionality.

The UPay.best Card focuses on multi-currency support and transparent pricing. It supports both crypto and fiat, making it convenient for everyday users who want flexibility without complex staking requirements. It has a modest annual fee and straightforward transaction costs.

Key Differentiators:

- Supports multiple cryptocurrencies and fiat.

- Competitive exchange rates.

- Simple mobile app dashboard.

Pricing:

- Annual Fee: $20 (varies by plan)

- Competitive transaction fees.

Pros:

- Multi-currency support.

- Global merchant acceptance.

- Transparent pricing model.

Cons:

- Smaller brand than competitors.

- Fewer premium perks like lounge access.

Why Choose Over Coinbase:

UPay.best offers more currency flexibility and transparent pricing, making it a strong mid-range option for practical users.

Revolut Card

Best For: Users seeking a blend of traditional finance and crypto exposure.

The Revolut Card blends traditional banking with basic crypto functionality. It allows users to buy, sell, and spend crypto alongside fiat currencies. Regulated as a neobank, Revolut is ideal for newcomers seeking a familiar banking experience with optional crypto exposure. Travel perks and budgeting tools are added advantages.

Key Differentiators:

- Fully regulated neobank.

- Crypto buy/sell functionality integrated with fiat accounts.

- Travel insurance and budgeting tools.

Pricing:

- Annual Fee: $0–$180 (depending on plan)

- Competitive FX rates.

Pros:

- Excellent fiat and travel features.

- Regulatory protection and stability.

- User-friendly app.

Cons:

- Limited crypto withdrawal options.

- Lower crypto rewards compared to dedicated cards.

Why Choose Over Coinbase:

Revolut is a safer, more regulated environment, ideal for users new to crypto who still want traditional banking reliability.

BitPay Card

Best For: U.S. crypto users who prioritize simple spending with no hidden fees.

The BitPay Card is a simple, U.S.-based crypto card with no monthly fees and instant reload from the BitPay wallet. It’s perfect for users who value low costs and straightforward use over fancy perks. While it doesn’t offer cashback, its transparent pricing makes it attractive to domestic users.

Key Differentiators:

- Load card with multiple cryptocurrencies.

- Flat $0 monthly fees.

- Instant reload from BitPay wallet.

Pricing:

- Annual Fee: $0

- Card issuance fee: $9.95 (one-time).

Pros:

- Straightforward setup.

- Low fees for domestic users.

- Good customer service reputation.

Cons:

- U.S.-only availability.

- No cashback or premium perks.

Why Choose Over Coinbase:

BitPay is simpler and more cost-effective for U.S.-based crypto users who prioritize low fees over rewards.

Wise Debit Card

Best For: Low-cost international transfers and travel spending.

The Wise Debit Card is a strong choice for people who travel or send money abroad often. It gives you the real exchange rate without hidden fees, making it one of the cheapest options for international spending. While it doesn’t have rewards or perks, it’s simple, affordable, and very reliable.

Key Differentiators:

- Real exchange rates with no hidden markups.

- Multi-currency accounts supporting 50+ currencies.

- No minimum balance required.

Pricing:

- No annual fee.

- No foreign transaction fees.

Pros:

- Transparent fees with mid-market rates.

- Strong global presence.

- Easy-to-use app with budgeting tools.

Cons:

- No rewards program.

- Limited extra perks compared to premium cards.

Why Choose Over Revolut:

If your primary concern is low-cost currency exchange and transparent pricing, Wise is often cheaper than coinbase, especially for international transfers.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate / Cashback | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| Coinbase Card | $0 | Up to 4% (rotating crypto) | None | No | Coinbase users wanting seamless crypto spending | Instant crypto-to-fiat conversion, app integration | Conversion spread and limited region availability | 4 |

| Crypto.com Visa Card | $0 | Up to 8% (with CRO stake) | Tier-based perks (Netflix, etc.) | No | Reward-seeking crypto users and travelers | High-tier benefits, lounge access, app perks | Requires locking/staking CRO for top rewards | 4.2 |

| Binance Card | $0 | Up to ~8% (in BNB) | None (typical) | No | Users already in Binance ecosystem | Deep wallet integration and BNB cashback | Availability limited; staking holdings required | 3.8 |

| Nexo Card | $0 | Up to ~2% (in BTC or NEXO) | None | No | Long-term crypto holders who don’t want to sell | Dual mode (credit / debit), spending without selling | Collateral requirements; limited coverage in some regions | 4 |

| BitPay Card | $0 (some issuance fee) | Variable / merchant-based ≈ 1–1½% | None | No | U.S.-based users wanting simplicity | Straightforward setup, easy use | Only U.S. availability; higher ATM / FX fees | 3.5 |

| Revolut (Crypto-enabled) | $0 to premium tier | Modest crypto rewards / cashbacks (depending tier) | Depends on plan | No | Users wanting a hybrid between fiat + crypto | Combines neobank + crypto in one app | Limited crypto spending flexibility, regional constraints | 3.7 |

| Wise Debit Card | Free | None | None | No | Low-cost global transfers | Real exchange rate with no markup | No rewards program | 4.4 |

How to Choose: Decision Framework

Choosing the right crypto card can feel overwhelming, especially with multiple options that look similar on the surface. The best way to narrow it down is to match your priorities and constraints with what each card actually delivers. Below is a simple decision framework that acts like a personalized recommendation guide, whether you’re an individual user, freelancer, or business.

If Your Priority Is Rewards and Perks Consider Crypto.com Visa Card or Binance Card

If you want high cashback, travel perks, or are willing to stake tokens, then these two cards shine. Crypto.com Visa Card is best if you want flexible reward tiers and premium lifestyle perks (like Netflix or lounge access).

Binance Card is ideal if you already trade or hold assets on Binance and want to maximize BNB cashback. This suits individuals or small businesses that have stable cash flow and can lock up funds for higher rewards.

Also Read: ChangeNOW Affiliate Program: Overview, Benefits & Commission

If You Want Simplicity and Low Fees Consider BitPay or Coinbase Card

If you don’t want to stake tokens, worry about fluctuating reward rates, or deal with complicated conversions, these cards are better fits. Coinbase Card is great for users already using Coinbase for trading or storing assets.

BitPay Card fits users who prefer simple, domestic spending with minimal costs. This is especially useful for freelancers, small businesses, or individuals managing tight cash flow and needing predictable expenses.

If You Want to Spend Without Selling Your Crypto consider Nexo Card

If your goal is to spend while holding, the Nexo Card is designed for that. It lets you use crypto as collateral, so you can keep your long-term positions intact while covering short-term expenses.

This is ideal for investors, tech companies, and startups who want to protect their holdings while still having liquidity.

If You Operate Internationally Consider Revolut or Crypto.com

International users should prioritize global acceptance, low foreign transaction fees, and multi-currency support. Revolut Card blends traditional banking with crypto and works in many countries.Crypto.com Card has strong global availability and no FX fees. These are great for remote teams, digital nomads, and cross-border businesses.

If You Need Multi-Currency Flexibility Consider UPay.best or Wirex

For users who operate with both crypto and fiat across several currencies, Wirex and UPay.best stand out. They offer multi-currency wallets, transparent pricing, and straightforward management. This works well for e-commerce merchants, global service providers, or businesses working across different regions.

Conclusion

The Coinbase Card stands out as one of the simplest and most accessible crypto debit cards on the market. It allows users to spend their crypto like cash, earn up to 4% in rewards, and enjoy no annual or foreign transaction fees. Its direct integration with the Coinbase app makes it easy for users to manage funds, track transactions, and convert assets seamlessly.

This card is perfect for everyday crypto users who already use Coinbase as their main platform. If your priority is convenience, transparent pricing, and a trusted brand, the Coinbase Card is a strong fit. It works particularly well for freelancers, digital nomads, or individuals who want to spend crypto while traveling without worrying about conversion hassles or extra fees.

However, the Coinbase Card may not be ideal for everyone. If you’re seeking maximum cashback rewards, premium lifestyle perks, or multi-currency flexibility, this card has its limitations. The conversion spread can be a hidden cost over time, and it’s not available in all regions. Businesses or heavy travelers looking for advanced features may find better value elsewhere.

For users seeking higher rewards or more global flexibility, the Crypto.com Visa Card is a top alternative. It offers up to 8% cashback, lounge access, and tiered benefits for users who are willing to stake CRO tokens. If staking isn’t your thing, BitPay provides a no-frills, cost-effective option for domestic spending, while Nexo appeals to those who want to spend without selling their assets.

In the current 2025 market, Coinbase Card holds a strong mid market position: it’s not the flashiest or most feature-rich, but it’s reliable, beginner-friendly, and widely trusted. It’s best for users who value ease of use and low fees over complex reward structures or high-end perks. For those with more specific needs—like frequent travel, business spending, or advanced rewards—there are excellent alternatives to explore.

FAQs

Is there an annual fee?

Nope, there’s no annual fee to use the Coinbase Card. You won’t be charged to apply for it, keep it active, or manage it. Coinbase makes the card as low-maintenance as possible. Just note: while there’s no annual fee, some standard fees still apply (like crypto conversion spreads or ATM over-limit withdrawals).

What’s the reward rate structure?

Coinbase Card gives you crypto-back rewards every time you spend. Here’s how it works: 1% back in Bitcoin (BTC), up to 2% back in select altcoins (like Stellar, AMP, or The Graph), you get to choose which crypto you want your rewards in, right from the app, rewards rotate sometimes, so options and rates may change

How does conversion work?

When you make a purchase, Coinbase instantly converts your chosen crypto into fiat (like USD or EUR) at the time of the transaction. For example, if you’ve set your card to use Ethereum (ETH), it’ll automatically sell just enough ETH to cover the purchase in local currency.

There’s no need to manually trade crypto before spending. Just swipe, and Coinbase handles the rest.

Can I use it abroad?

Yes. The Coinbase Card works anywhere Visa is accepted, which means millions of locations worldwide. Whether you’re shopping online or traveling internationally, you can use your card for purchases and ATM withdrawals.

How is tax handled?

When you use crypto to make a purchase, it counts as a taxable event in many countries (including the U.S.). That means that Coinbase will generate tax documents showing the gains/losses from each transaction, you may owe capital gains tax if your crypto increased in value since you acquired it and Coinbase app tracks your spending and conversions to help simplify reporting