A recent study found that around one-third of Australian crypto investors don’t realize their cryptocurrency gains are taxable and could be blindsided by unexpected tax bills.

If you’ve made money trading, selling, or exchanging cryptocurrency, you’ve likely triggered a capital gains tax event.

Understanding how these taxes work can save you thousands of dollars and keep you compliant with tax authorities worldwide. Capital gains tax applies whenever you sell crypto for more than you paid for it.

This includes trading one cryptocurrency for another, using crypto to buy goods or services, or simply cashing out to your bank account. The tax you owe depends on how long you held the crypto and your total income level.

What is Capital Gains Tax?

Capital gains tax (CGT) is a tax you pay on the profit you make when you sell, trade, or dispose of an asset that has increased in value. You’re taxed only on the gain, that’s the difference between what you paid for it (the “cost basis”) and what you sold it for.

Governments use capital gains tax to collect revenue from wealth created through investments. Whether it’s stocks, real estate, or crypto, the idea is the same: if you profit, you owe tax.

Unlike traditional currencies, most countries treat crypto as property, not money. This classification means that anytime you sell, trade, or use crypto, it triggers a taxable event, just like selling a stock or house.

So, even if you’re just swapping Bitcoin for Ethereum or using crypto to buy a cup of coffee, that’s technically a disposal, and it may lead to capital gains or losses and possibly a tax bill.

Every crypto trade, swap, or sale could trigger a capital gains tax, even if you never convert back to cash.”

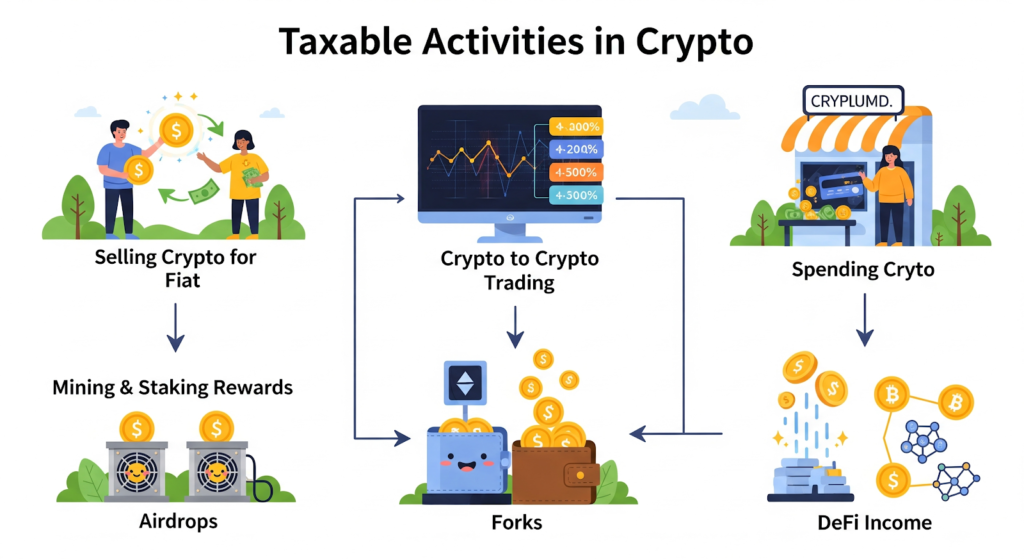

Taxable Activities in Crypto

If you think you only owe taxes when you cash out crypto to your bank account, think again. Crypto tax rules go beyond just selling for fiat. In many countries, any action that involves disposing of or receiving crypto can trigger a taxable event.

Let’s break down the most common taxable events you should know about.

Selling Crypto for Fiat

When you sell crypto for fiat currency (like USD, GBP, NGN, or EUR), you’ll either make a capital gain (if it went up in value) or a capital loss (if it went down).

The gain is added to your annual tax report and taxed at the applicable rate in your country. If you sell within a year of buying, many countries tax it at higher short-term rates.

Crypto-to-Crypto Trades

Many people think swapping one crypto for another isn’t taxable. But it usually is. For instance, you trade 1 BTC for 20 ETH, the BTC you traded was worth $60,000, you originally bought the BTC for $35,000 and now owe capital gains tax on the $25,000 profit.

Even though you didn’t cash out to fiat, it still counts as a disposal of an asset — and therefore a taxable event.

Spending Crypto (Goods/Services)

Paying with crypto for anything like coffee, a car, a phone is considered spending an asset. That triggers a capital gains calculation, just like if you sold it.

Let’s say you use 0.01 BTC to buy a laptop worth $500, you originally acquired that BTC for $300 and now you’ve just realized a $200 capital gain. You may owe tax on that $200. Countries like the US, UK, and Nigeria treat this the same as selling crypto.

Mining & Staking Rewards

Crypto earned through mining or staking is usually treated as income, not capital gains at least initially. You’re taxed on the fair market value of the crypto at the time you receive it. Later, if you sell or swap that crypto, the value may have changed, and capital gains tax applies again

Airdrops, Forks, and DeFi Income

These new forms of crypto rewards are becoming common, but yes they’re usually taxable too. Airdrops are free crypto sent to your wallet? That’s income at the time you receive it. Earnings from lending, liquidity pools, or yield farming are generally treated as ordinary income in many countries.

“Holding crypto long-term can often mean paying less tax than frequent trading, patience can save you money.”

Non-Taxable Crypto Activities

Not every crypto transaction triggers taxes. Understanding what’s tax-free can help you make smarter decisions and avoid unnecessary tax events.

Simply Buying and Holding

Purchasing crypto with cash and holding it creates no immediate tax liability. Taxes only apply when you “realize” gains by selling, trading, or using your crypto. Your investment can grow tax-free as long as you keep holding.

Charitable Donations

Donating crypto directly to qualified 501(c)(3) organizations like GiveCrypto.org can provide valuable tax deductions. This strategy lets you support causes you care about while potentially reducing your tax bill.

Receiving Gifts

Getting crypto as a gift is generally tax-free for you as the recipient. However, you’ll inherit the giver’s cost basis, which affects your taxes when you eventually sell or use the crypto.

Moving Between Your Own Wallets

Transferring crypto between wallets or accounts you control is completely tax-free. Your original cost basis and purchase date carry forward, preserving your tax tracking for future transactions.

“Staying informed about capital gains tax on crypto isn’t just about avoiding penalties, it’s about protecting your profits.”

Calculating Your Gains and Losses on Crypto Tax

Calculating crypto gains and losses starts with knowing your cost basis, which is simply what your crypto originally cost you.

How Cost Basis Works

When you buy crypto, your cost basis equals what you paid for it. However, different acquisition methods create different cost basis calculations. Crypto earned from mining or staking uses the fair market value on the day you received it.

Gifted crypto is more complex, combining the giver’s original cost basis with the market value when you received it.

Once you sell crypto, subtract your cost basis from the sale price to determine your result. If you sold for more than your cost basis, you have a capital gain and owe taxes. If you sold for less, you have a capital loss that can offset other gains or reduce your tax bill.

This simple formula determines whether you made or lost money on each crypto transaction, forming the foundation of all crypto tax calculations.

Tax Rate on Cryptocurrency

When you receive crypto as income, you owe federal and state income taxes at your regular tax bracket rates. Unlike traditional employment where taxes are automatically deducted, crypto income requires you to calculate and pay these taxes yourself. You can visit IRS.gov for recent insights on federal income taxes.

Short term Capital Gains Tax

Sold your crypto too soon? That’s going to cost you.

If you sell, trade, or spend cryptocurrency that you’ve owned for less than a year, you’ll face short-term capital gains tax.

Here’s the kicker: the IRS treats this exactly like your regular paycheck, so you’ll pay the same high rates anywhere from 10% to 37% based on your income. The message is clear: patience pays when it comes to crypto taxes.

Long term capital Gains Tax

Held your crypto for over a year? You get a tax break.

When you sell, trade, or spend cryptocurrency that you’ve owned for more than 12 months, you qualify for long-term capital gains rates.

These are much friendlier than regular income tax you’ll pay anywhere from 0% to 20% depending on how much money you make. The longer you hold, the less you owe.

Ordinary Income Tax

Whether you earned cryptocurrency from your day job, mining operations, staking rewards, or those sweet airdrop surprises, the IRS treats it just like your regular paycheck. You’ll pay ordinary income tax rates, which can bite anywhere from 10% to 37% of your crypto earnings depending on how much you make overall.

Now you’re dealing with capital gains taxes. Every time you sell your crypto, swap it for different coins, or buy that pizza with Bitcoin, you’ve triggered a taxable event. The government sees this as selling an investment, not spending money.

The key difference? Earning crypto hits you with income tax rates, while using crypto activates capital gains rules.

Tax Planning & Optimization Strategies

Paying taxes on crypto profits is unavoidable, but paying too much is not. With smart planning, you can minimize your crypto tax bill and keep more of your gains

Holding for Long-Term Gains

Patience pays off in crypto taxes. Holding your assets for over a year can dramatically reduce what you owe. Most tax systems reward long-term thinking with significantly lower rates. In the US, long-term capital gains are taxed at just 0%, 15%, or 20% compared to regular income rates that can reach 37% for short-term trades.

Timing Sales in Low-Income Years

Your crypto tax rate often depends on your total income. Lower earnings typically mean lower tax rates, making strategic timing crucial for maximizing your profits.

Consider delaying crypto sales until much later when your income naturally drops. Whether you’re in school, taking leave, between jobs, or experiencing a business downturn, these periods offer significant tax advantages.

Using Tax-Advantaged Accounts

Some countries allow you to hold crypto in special investment accounts that offer significant tax benefits. These accounts can eliminate capital gains taxes entirely. Traditional Crypto IRAs let you deduct contributions now and pay taxes later when you withdraw.

Roth Crypto IRAs work in reverse: you pay taxes on contributions upfront, but all future withdrawals including gains are completely tax-free.

Gifting and Spouse Transfer Benefits

Many countries treat crypto transfers between married couples as tax-neutral events. In the UK, spousal transfers don’t trigger capital gains tax since they’re not considered disposals. US married couples can split gains to maximize their combined tax-free allowances, while Nigeria permits spousal transfers under joint property provisions.

Tax-Loss Harvesting

One of the simplest ways to cut your crypto tax bill is through strategic loss harvesting. Tax-loss harvesting means selling crypto assets at a loss to offset your profitable trades. These losses directly reduce your capital gains tax or can be saved for future years.

Imagine you made $3,000 profit selling ETH but have an NFT worth $1,500 less than you paid. By selling that losing NFT, your taxable gain drops from $3,000 to just $1,500.

Consequences of Non-Compliance

Ignoring crypto tax obligations isn’t worth the risk. Tax authorities worldwide are cracking down harder than ever, and the consequences can be severe and long-lasting.

Audits, Fines, and Penalties

Tax authorities now have sophisticated tracking tools to identify unreported crypto transactions. When they catch you, expect substantial financial penalties on top of the taxes you already owe. Interest charges accumulate daily, turning a manageable tax bill into a crushing debt.

Many countries impose penalties ranging from 20% to 200% of the unpaid taxes, plus criminal prosecution in serious cases.

Criminal Charges in Severe Cases

Deliberate tax evasion involving large amounts of crypto can result in criminal prosecution. This means potential jail time, permanent criminal records, and complete financial ruin. Several high-profile cases have already resulted in prison sentences for crypto tax evaders, sending a clear message that authorities take this seriously.

Exchange Delistings and Account Freezing

Major exchanges increasingly cooperate with tax authorities by freezing accounts, withholding funds, or even delisting users from non-compliant jurisdictions. When your exchange account gets frozen, accessing your crypto becomes impossible until you resolve your tax issues, potentially costing you significant trading opportunities during market volatility.

Global Data Sharing Networks

International cooperation through frameworks like CARF (Crypto Asset Reporting Framework) and FATCA means there’s nowhere to hide. These systems automatically share crypto transaction data between countries, making offshore tax evasion nearly impossible. What happens in one country’s crypto market is increasingly visible to tax authorities worldwide.

Conclusion

Capital gains tax on cryptocurrency doesn’t have to be overwhelming or financially devastating. With the right knowledge and strategic approach, you can legally minimize your tax burden while staying fully compliant with tax authorities.

Remember that every crypto sale, trade, or exchange creates a potential tax event. Track your transactions carefully, understand your cost basis, and consider timing strategies like holding for long-term rates or harvesting losses to offset gains. Simple moves like transferring assets between spouses or using tax-advantaged accounts can save thousands of dollars over time.

FAQs

Do I have to pay tax every time I sell or trade crypto?

Yes. Selling crypto for cash or trading one coin for another can trigger capital gains tax if you made a profit.

Is crypto taxed even if I don’t convert it to fiat?

Yes. Crypto-to-crypto trades, spending crypto, or earning it through mining/staking can still count as taxable events.

How is capital gains tax calculated on crypto?

It’s based on the profit:

Sale price – purchase cost = gain. You may also deduct fees to reduce the taxable amount.

What happens if I don’t report my crypto taxes?

You could face penalties, audits, or even legal action. Many exchanges now report your activity to tax authorities.