Convexity refers to the relationship between the price of an asset and the yield on that asset, particularly in the context of bonds but can also apply to cryptocurrencies. It describes how the duration of an asset changes as interest rates fluctuate.When discussing convexity, a higher degree indicates that price changes will be more pronounced with small movements in yield. In the case of cryptocurrencies, this concept can relate to how market sentiment or external factors impact price volatility.Investors often look for assets with positive convexity, meaning that as market conditions improve, the value potentially rises more significantly than it would drop in unfavorable conditions. This characteristic can make certain cryptocurrencies attractive for trading or investment strategies.Understanding convexity helps investors make informed decisions, especially when evaluating the risk and potential return of their holdings. When prices exhibit strong convexity, this can lead to enhanced returns during bullish market trends while providing some protection against bearish shifts.

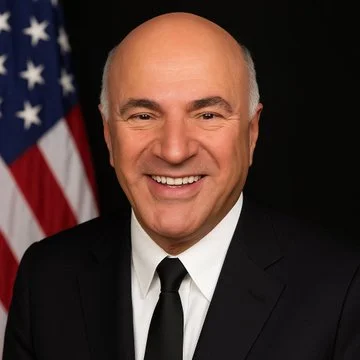

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former