Core Yield refers to the primary return generated from staking or lending digital assets. It represents the basic earnings that investors can expect from holding specific cryptocurrencies. This yield usually comes from mechanisms like proof of stake, where users lock up their coins to support network operations in exchange for rewards.Many platforms allow users to earn Core Yield by lending their tokens to others or participating in liquidity pools. The yield can vary significantly based on factors such as the asset involved, the duration of staking, and prevailing market conditions.Investors often consider Core Yield as a steady income stream, distinct from speculative gains achieved through trading. Understanding this yield helps in evaluating potential investments and assessing overall risk and return. It serves as an attractive option for those looking to earn passive income in addition to any capital appreciation of their assets.

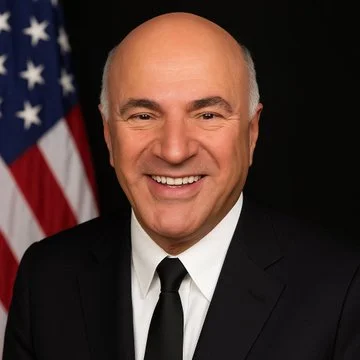

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former