Cross-chain yield refers to the process of earning returns on investments that involve multiple blockchain networks. Investors can leverage assets from one blockchain to generate yields on another, maximizing their earning potential.This practice often involves decentralized finance (DeFi) platforms that facilitate the movement of tokens between different blockchains. By strategically utilizing liquidity pools and lending options across these networks, users can access higher interest rates and yield opportunities unavailable on their native blockchain.For example, an investor might take assets from Ethereum, convert them to a token on a different blockchain like Binance Smart Chain, and then use those tokens to participate in yield farming or staking. The ability to move assets across chains enhances liquidity and opens up a broader range of investment strategies.Overall, cross-chain yield embodies the interconnected nature of blockchain technologies, allowing investors to optimize their returns by tapping into various financial ecosystems.

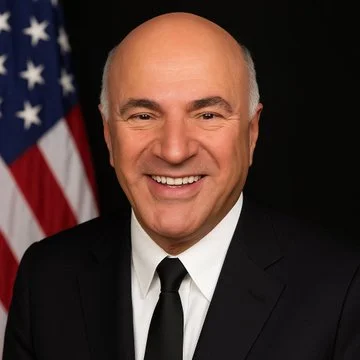

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former