European Central Bank officials are sounding the alarm as the explosive rise of dollar-based stablecoins begins to intersect with mainstream finance in ways that could weaken the euro’s monetary influence.

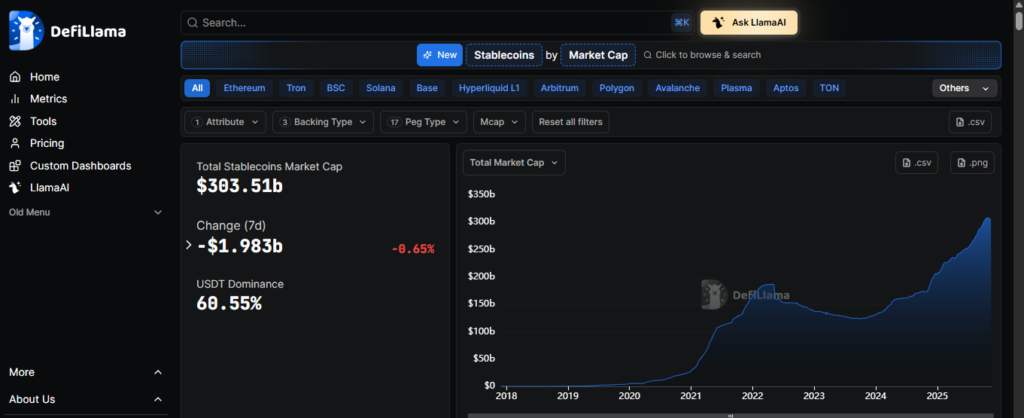

With the global stablecoin market surpassing $300 billion in 2025, senior policymakers warn that the rapid expansion of private digital dollars is moving from a crypto-niche issue to a macroeconomic threat.

Olaf Sleijpen, President of De Nederlandsche Bank and member of the ECB’s Governing Council, cautioned that the accelerating adoption of stablecoins—especially those backed by U.S. Treasuries—could eventually become systemically important. His warning is grounded in a simple but dangerous scenario: a mass redemption event.

“If stablecoins are not that stable, you could end up in a situation where the underlying assets need to be sold quickly,” Sleijpen told the Financial Times.

In such a case, issuers would be forced to liquidate large amounts of short-term U.S. government debt to meet withdrawals. That type of fire sale could ripple into global bond markets, raising yields and tightening financial conditions far beyond the crypto sector.

According to Sleijpen, the ECB might even be pushed to adjust interest rates—not because of domestic inflation trends, but to counter market instability triggered by digital dollar runs. He stressed that the central bank would first deploy financial stability tools, but did not rule out monetary policy adjustments if conditions deteriorate.

Key Takeaways

- Dollar-based stablecoins have surged past $300 billion in market value, prompting ECB officials to warn they could undermine Europe’s monetary control.

- A large-scale stablecoin redemption could force issuers to dump U.S. Treasuries, triggering global market stress and pressuring the ECB to adjust interest rates.

- Policymakers fear rising use of dollar stablecoins in Europe could weaken the euro’s international role and reduce the ECB’s ability to steer financial conditions.

- The U.S. GENIUS Act and rapid integration of stablecoins by major companies risk cementing digital dollar dominance unless Europe accelerates its own strategy.

- The ECB sees regulated euro stablecoins, a digital euro, and stronger global coordination as essential tools to protect monetary sovereignty in the digital era.

Growing Concerns Over Monetary Sovereignty

European policymakers have been warning for years that widespread use of dollar-denominated stablecoins in payments, savings, and settlement could erode Europe’s monetary autonomy.

Jürgen Schaaf, an adviser in the ECB’s Market Infrastructure and Payments Division, reiterated this risk, noting that heavy reliance on dollar stablecoins could mirror dynamics seen in dollarised economies.

Schaaf warned that such a shift would reinforce America’s global financial power, allowing the United States to finance its debt more cheaply while expanding its geopolitical influence. Europe, meanwhile, would face higher borrowing costs and reduced control over monetary conditions.

“The associated risks are obvious – and we must not play them down,” he said, listing concerns ranging from operational resilience and financial stability to consumer protection and anti-money-laundering compliance.

A Market No Longer on the Fringe

Stablecoins—crypto tokens pegged to fiat currencies and backed by liquid reserves—have grown dramatically this year.

According to DefiLlama, the sector’s market cap has surged nearly 48% in 2025, pushing it above the $300 billion mark. The overwhelming majority of this growth is concentrated in U.S. dollar stablecoins, which now represent roughly 99% of the market.

Euro-denominated stablecoins remain negligible, with a market cap below €350 million despite emerging efforts from European banks and fintechs.

What troubles regulators most is that stablecoins are increasingly intertwined with traditional financial institutions.

Their reserve portfolios—heavily concentrated in U.S. Treasuries—mean that rapid redemptions could collide with core global funding markets. The Bank for International Settlements echoed these concerns, warning that many stablecoins have already shown “fragility of their peg,” demonstrating the potential for sudden breaks in market confidence.

The U.S. Pushes Ahead, Europe Races to Respond

The United States recently accelerated its own regulatory framework with the GENIUS Act, signed into law on July 18, 2025. While broadly aligned with the EU’s MiCA regulation, analysts note that the U.S. regime is more permissive in some areas—likely fueling even faster growth.

Market projections suggest that global stablecoin supply could balloon from $230 billion in early 2025 to as much as $2 trillion by 2028.

Major U.S. companies—Visa, Mastercard, Walmart, and Amazon—are actively exploring stablecoin payments, a trend that could pull large volumes of transactions outside Europe’s traditional banking system.

Stablecoins are also becoming key tools for settlement in crypto markets, tokenised assets, decentralised finance, and emerging interbank use cases.

Some platforms offer yields on stablecoin deposits, blurring the line between digital money and money market funds. This could redirect deposits away from banks, a critical concern in Europe’s bank-centric financial system.

Europe’s Strategic Dilemma

If dollar stablecoins continue scaling at their current pace, they could directly compete with euro-denominated instruments in cross-border payments and digital settlement. Because stablecoins benefit from network effects—the more they’re used, the more valuable they become—reversing the trend later may be nearly impossible.

The ECB and European Union see several potential responses:

Support for Regulated Euro Stablecoins

Properly supervised euro tokens could meet market demand and strengthen the euro’s international role. Policymakers warn that neutrality in this area could turn into a strategic blind spot.

Advancing the Digital Euro Project

A retail central bank digital currency could serve as a safeguard for payment sovereignty, especially if stablecoins gain wider mainstream acceptance.

Modernising Europe’s Financial Infrastructure With DLT

The Eurosystem’s Pontes and Appia initiatives aim to integrate distributed ledger technology into wholesale markets, improving settlement speed and maintaining competitiveness with private stablecoin systems.

Pushing for Global Regulatory Coordination

Without harmonised rules, regulatory arbitrage may drive issuers to friendlier jurisdictions. Fragmentation would likely amplify U.S. dominance, reinforcing the dollar’s digital foothold.

A Moment of Risk—and Opportunity

Stablecoins are no longer a speculative sideshow; they are reshaping global finance. Their governance, scale, and currency denomination will increasingly influence monetary stability and global power dynamics.

While the risks are clear, European officials argue that the moment also presents an opportunity. Europe’s institutional stability, regulatory structure, and coordinated policy environment could allow it to build a stronger foundation for the euro in the digital age—if it acts quickly.

In a world where financial systems are being rewritten, the euro can still anchor the next phase of global digital money. But as stablecoins surge into the mainstream, the window to secure that future is closing fast.

No related posts.