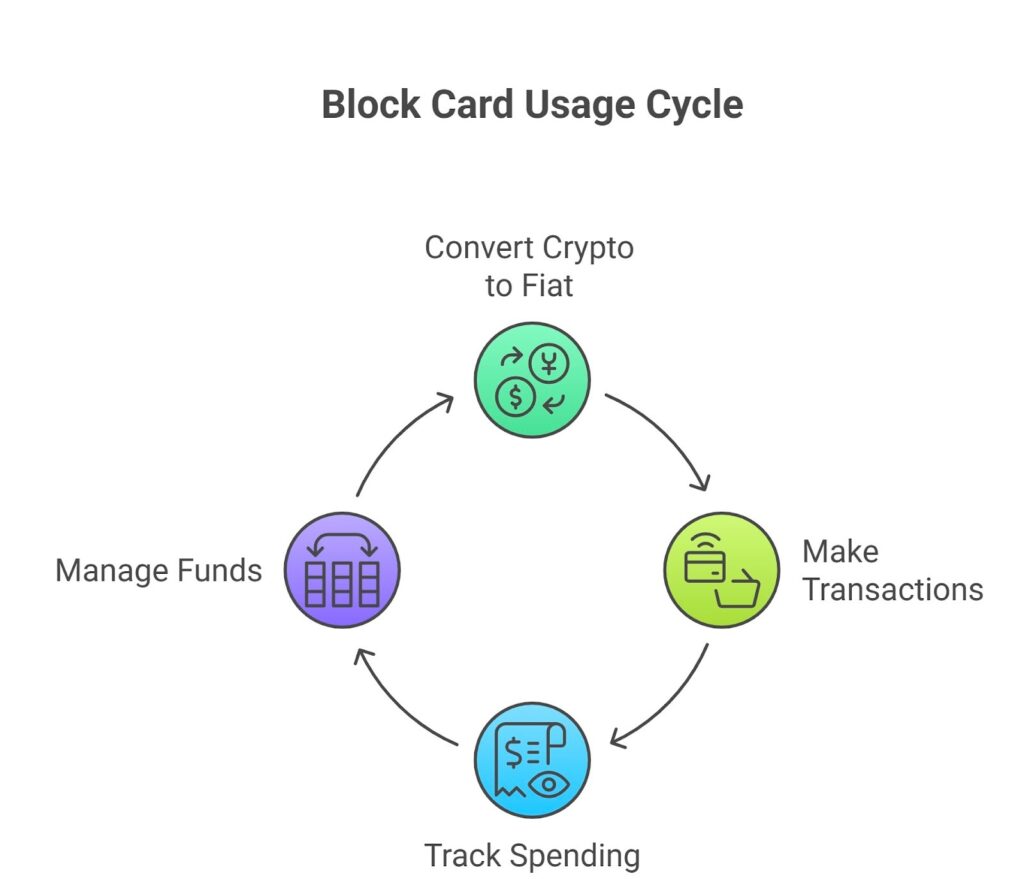

Spending cryptocurrency in daily life remains a hurdle for many users. While millions now hold Bitcoin, Ethereum, and stablecoins, most still need to convert them through exchanges before they can buy essentials or pay bills. This process takes time, often comes with extra fees, and limits the usefulness of digital assets for everyday spending.

Crypto payment cards are designed to solve this problem. These cards make it possible to pay at the same checkout terminals where traditional bank cards are accepted by linking digital wallets to Visa or Mastercard networks.

The competition in this space has grown quickly, with providers differentiating themselves through lower fees, wider currency support, and additional features like rewards or business tools.

The Embily Card positions itself as a straightforward bridge between crypto and euros. Available to residents in the European Economic Area and the UK, it allows users to top up with leading cryptocurrencies and instantly convert them into fiat for global spending.

The card is offered in both physical and virtual forms, integrates with Apple Pay and Google Pay, and comes with SEPA and IBAN support for easier transfers. On paper, it covers the key essentials for anyone who wants to spend crypto without complications.

However, Embily’s offering also has clear limits. It only supports euro balances, applies standard conversion and FX fees, and does not offer cashback or loyalty rewards. For some users, especially traders or frequent travelers, these restrictions may be enough to look for alternatives.

This review takes a close look at the Embily Card covering features, fees, limits, security, and usability while also comparing it to 8 alternative crypto cards available.

At the end, you will have a clear view of whether Embily meets your needs or if another provider offers better value for your crypto spending.

Key Takeaways

- Embily Card converts supported cryptocurrencies like BTC, ETH, and USDT into euros for everyday spending.

- Virtual cards are issued instantly, while physical cards arrive in 1–2 weeks. A completed KYC verification is required before using the card.

- Users pay a 1% crypto-to-euro conversion fee and €2 monthly maintenance per card.

- The biggest advantage is fast euro spending through Visa and mobile wallets like Apple Pay and Google Pay.

- The most significant limitation is its euro-only balance, which may not suit frequent international users.

- This review also compares Embily against 8 alternatives, including cards from Crypto.com, Wirex, and BitPay.

What Is the Embily Card?

The Embily affiliate program is designed to help users earn rewards by promoting the Embily Card and its related services. At its core, the program follows a referral-style model rather than a traditional affiliate network setup. Affiliates earn bonuses when new users sign up, activate a card, and begin using it for top-ups. This structure makes it a performance-based system where commissions are tied directly to user actions rather than impressions or clicks.

Embily itself is a regulated fintech company based in Estonia, operating under European Union financial standards. The platform issues crypto-enabled Visa cards, available in both physical and virtual formats, that allow users to convert digital assets like Bitcoin, Ethereum, and stablecoins into euros for everyday spending. As part of its growth strategy, Embily launched its affiliate program to reward existing customers and content creators who bring new cardholders to the platform. The company has gained visibility in the crypto payments space by offering IBAN accounts, SEPA transfers, and services for both individuals and businesses.

The program is best suited for crypto-focused content creators, bloggers, and communities with an audience interested in crypto cards and everyday crypto spending solutions. Since the commissions are tied to successful card activations and top-ups, affiliates who educate their readers about the benefits of crypto cards stand to benefit the most.

Unlike referral programs that often offer a one-time bonus, Embily’s structure allows affiliates to earn not only on initial activations but also a percentage of ongoing top-ups, making it more attractive for long-term income.

Unlike traditional affiliate programs integrated into networks like Impact or ShareASale, Embily manages its program in-house. This means affiliates apply directly through the platform rather than working through third-party affiliate marketplaces. While this limits visibility compared to programs listed on global affiliate networks, it also means Embily can tailor rewards more closely to cardholder activity.

Currently, the Embily affiliate program is only available in regions where the card itself can be issued, primarily the European Economic Area and the United Kingdom.

Affiliates targeting audiences in North America, Africa, or Asia may face challenges since users in those regions cannot yet order cards, although wallet services remain accessible.

The earning mechanism is straightforward. Affiliates receive fixed bonuses when referrals activate their cards, such as €25 for physical card activations and €15 for virtual card activations. In addition, affiliates earn a lifetime commission of 0.1% on all future crypto top-ups made by their referrals.

For example, if a referred user loads €1,000 worth of Bitcoin into their Embily Card, the affiliate earns €1 from that single transaction. Over time, this recurring structure can build into a steady income stream, especially if the affiliate reaches users who regularly spend crypto through Embily.

In summary, the Embily affiliate program provides a hybrid between referral bonuses and recurring commissions. It appeals to affiliates with a crypto-savvy audience in Europe and the UK and offers an opportunity to generate income as the adoption of crypto payment cards continues to grow.

Quick Facts of Embily Card

| Data Point | Details |

| Card Network | Visa |

| Cookie Duration | €24 (billed at €2 per month) |

| APR Range | Not applicable (prepaid crypto card) |

| Welcome Offer | None currently offered |

| Rewards Rate | No cashback or point rewards; referral bonuses available |

| Foreign Transaction Fees | 1.5% FX markup on non-euro transactions |

| Credit Check Required | No |

| Personal Guarantee Required | No |

| Minimum Requirements | Verified Embily account with completed KYC |

| Application Timeline | Virtual card issued within minutes after KYC; physical card delivered in 1–2 weeks |

Features of Embily Card

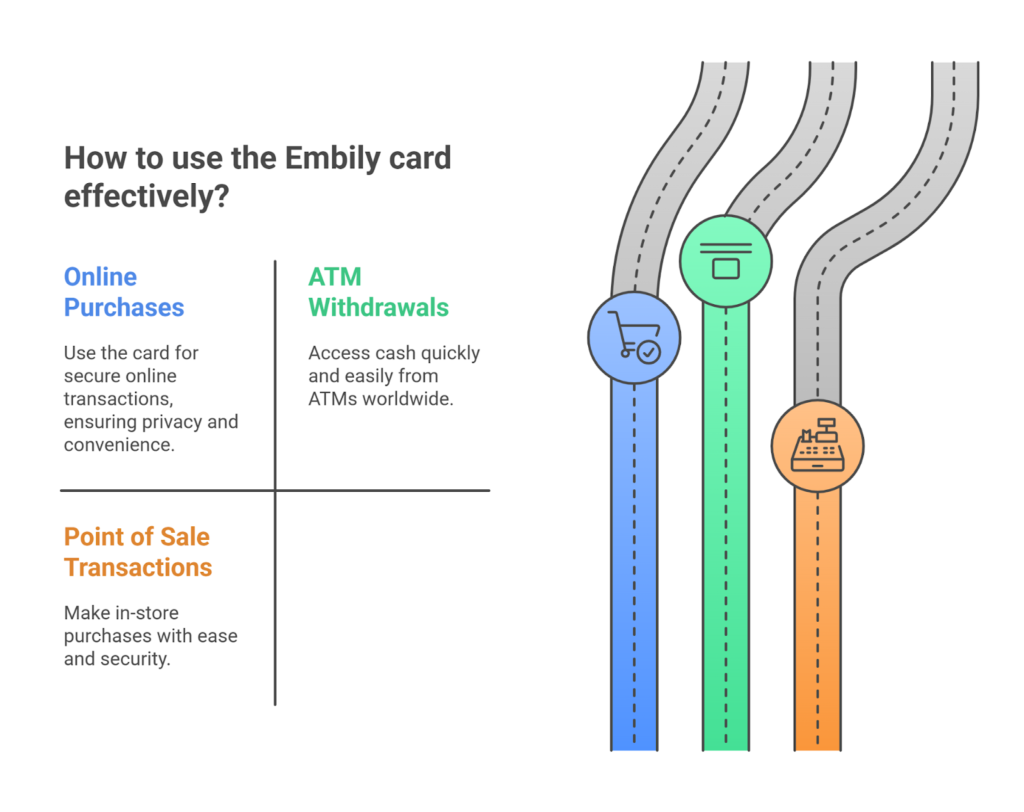

This section breaks down what you can expect when using the Embily Card for payments, withdrawals, and more.

Core Features

The Embily Card brings together several key functions that make it a practical option for anyone looking to spend cryptocurrency in real life. At its core, it allows users to convert crypto assets into euros instantly. Once the funds are in the Embily account, the card can be used anywhere Visa is accepted, both online and offline. This seamless conversion removes the need to manually trade crypto on an exchange before spending.

Embily supports a wide range of cryptocurrencies including Bitcoin, Ethereum, Tether (USDT), USD Coin (USDC), Binance Coin (BNB), and DAI. These are automatically converted into euros at the time of top-up, ensuring stable fiat balances. The platform also provides SEPA and IBAN integration, which makes it easy to send and receive euro payments directly through the Embily account.

Another core feature is the option to choose between physical and virtual cards. Virtual cards are available instantly after KYC approval, while physical cards are shipped to your address within one to two weeks. Both card types can be linked to Apple Pay or Google Pay for contactless payments. The dashboard allows users to manage multiple cards up to five under one account making it convenient for freelancers or small business owners who want to separate transactions.

Rewards Program

Embily does not offer a traditional cashback or point-based rewards system. Instead, it runs a referral program that rewards users who introduce new customers to the platform. When a referred user activates a card and begins using it, the referrer receives a fixed bonus. There is also a small recurring reward tied to each referral’s ongoing top-ups, making it a semi-passive earning opportunity.

This referral model is straightforward and easy to understand, but it lacks the depth of traditional reward structures offered by other crypto cards. Competing platforms such as Crypto.com or Binance often provide tiered cashback rates based on staking levels or card type. Embily, in contrast, focuses on simplicity and predictable bonuses rather than variable rewards.

For everyday users, this approach eliminates complexity. However, for those who spend frequently or are looking to maximize returns, the absence of direct spending rewards may be a limitation.

Limits and Controls

Embily offers flexible account limits based on verification level. Standard verified users can spend up to €10,000 per month and withdraw up to €2,500 from ATMs. Higher tiers may be available through enhanced verification, offering increased daily and monthly caps.

The platform includes several built-in spending controls that allow users to manage their accounts more effectively. Through the dashboard or mobile app, users can set personal spending limits, freeze or unfreeze cards instantly, and track all transactions in real time. These controls are especially helpful for users managing multiple cards or handling both personal and business expenses.

One important advantage is the ability to manage up to five cards under one Embily account. This structure supports better financial organization and can be particularly useful for small businesses that issue cards to employees for operational expenses.

Technology Integration

The Embily platform integrates with both Apple Pay and Google Pay, allowing users to make contactless payments directly from their phones or smartwatches. This modern integration ensures that the card functions just like any other Visa card in both online and in-store environments.

Embily also provides a simple, web-based dashboard where users can view transactions, manage card settings, and access account details. While it does not currently offer an advanced mobile app with in-depth analytics or budgeting tools, the dashboard is responsive and functional for most everyday needs.

From a business perspective, Embily supports SEPA and IBAN accounts, enabling smooth fiat transfers across Europe. This makes it a viable choice for crypto-friendly companies that handle regular euro payments but still receive income in digital assets.

Although Embily has not yet released an open API for developer integration, the company has indicated plans to expand its ecosystem in future updates, potentially connecting with accounting and payment software to enhance usability for business clients.

Security Features

Security and compliance are central to Embily’s operations. Every account must complete full KYC verification before card issuance. This includes providing government-issued identification and proof of address. This requirement aligns with EU financial regulations and helps prevent unauthorized use.

Users can protect their accounts with multiple security layers, including two-factor authentication (2FA) and personal PIN codes for ATM and in-store use. Cards can be frozen or blocked instantly from the dashboard if lost or stolen, reducing the risk of fraudulent transactions.

The platform follows strong data encryption standards to secure user information and transactions. Embily also works under the oversight of European regulators, which ensures that all funds are handled in compliance with anti-money laundering (AML) requirements.

Although the card does not currently offer built-in purchase protection or insurance, the Visa network itself provides standard fraud protection measures, giving users a reliable safety net for unauthorized charges.

Additional Benefits

Beyond its main payment features, Embily offers several added benefits designed to make crypto spending easier. One standout feature is its support for SEPA and IBAN, which allows users to receive salaries, payments, or freelance income directly into their Embily account in euros. This is particularly appealing for remote workers and freelancers who operate across borders.

Embily’s instant virtual card issuance is another convenience factor. After verification, users can generate a virtual card within minutes, load it with crypto, and start spending right away. This quick setup process gives it an edge over some competitors that require lengthy approval times.

While Embily doesn’t include travel insurance, airport lounge access, or luxury benefits like certain premium crypto cards, it focuses on core usability—speed, compliance, and simplicity. The company also plans to introduce more financial services over time, which may expand the platform’s benefits for both individual and business users.

The Embily Card is designed to make crypto practical. Its combination of instant issuance, global Visa access, simple conversion, and compliance-driven security provides a balanced experience. Though it may lack high-end perks, it fulfills its promise of bridging the gap between crypto holdings and real-world spending effectively.

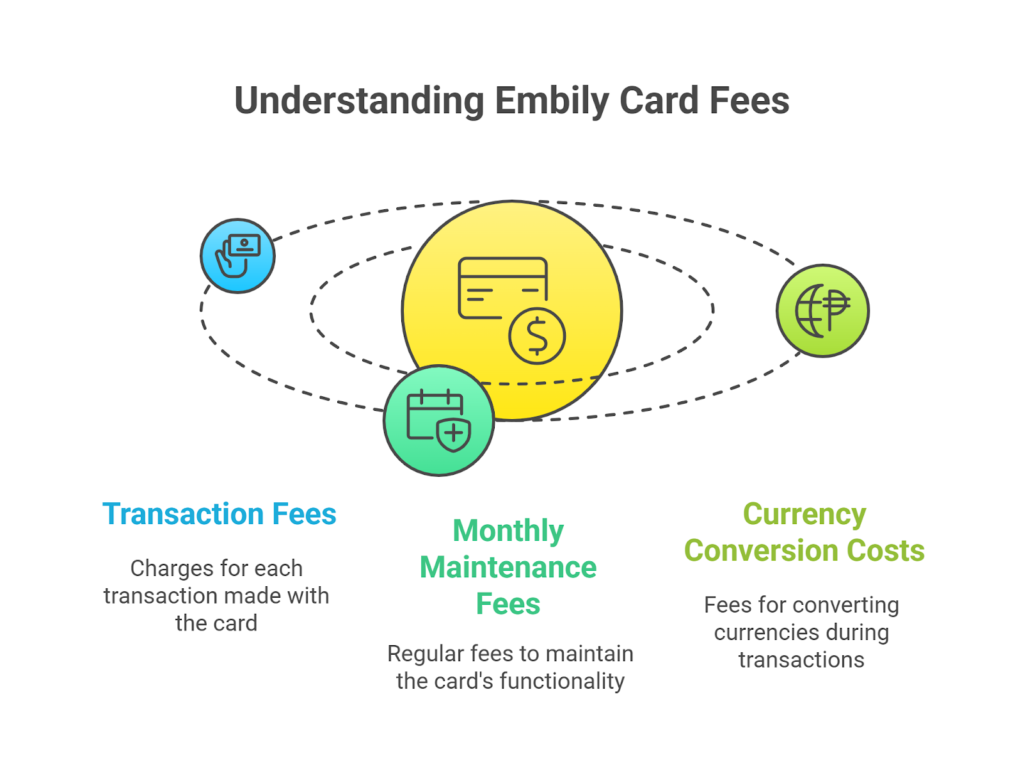

Fees and Costs of Embily Card

Knowing the costs upfront helps you use the Embily Card more efficiently and avoid surprises.

| Fee Type | Details | Notes/Explanation |

| Annual / Monthly Fee | €2 per month (€24 per year) | Covers card maintenance and account servicing |

| Card Issuance Fee | €15 | One-time charge for new physical card |

| Virtual Card Issuance | Free | Instantly available after verification |

| Replacement Card Fee | €15 | Applies if a physical card is lost or damaged |

| ATM Withdrawal Fee (Domestic / EEA) | 1.5% (minimum €1.50) | Charged per withdrawal |

| ATM Withdrawal Fee (International) | 2% (minimum €2.50) | For cash withdrawals outside the EEA |

| POS Transaction Fee (In Euro) | Free | No fee for euro-denominated purchases |

| POS Transaction Fee (Non-Euro) | 1.5% FX markup | Applies when spending in other currencies |

| Top-Up Fee (Crypto to EUR) | 0.5%–1.5% depending on asset | Covers crypto-to-fiat conversion |

| Bank Transfer (SEPA Deposit) | Free | SEPA deposits incur no charge |

| Bank Transfer (SWIFT Deposit) | 0.5% | For international fiat transfers outside SEPA |

| Inactivity Fee | €5 after 180 days of no use | Deducted monthly until balance reaches zero |

| Over-Limit Fee | Not applicable | Prepaid structure prevents overspending |

| Cash Advance Fee | Not applicable | Card cannot be used for loans or advances |

| Late Payment Fee | Not applicable | No credit function, so no late payments |

| Currency Conversion Fee | 1.5% | Applied to all non-euro transactions |

| Account Closure Fee | Free | Users can close accounts anytime without penalty |

Fee Overview and Analysis

Embily’s pricing model is built around simplicity. There are no hidden costs or surprise

deductions, which makes it easy to track total expenses. The €2 monthly maintenance fee covers essential services such as account management, transaction processing, and customer support. Users who choose only a virtual card can avoid the issuance fee altogether.

The ATM and conversion fees are fairly standard in the prepaid crypto card market. With a 1.5% foreign transaction markup, Embily sits in the midrange compared to competitors. Platforms like Crypto.com or BitPay may offer slightly lower rates, but those often require staking or premium membership tiers.

Another key advantage is the lack of traditional banking penalties. Since the Embily Card operates as a prepaid debit card, there are no late fees, interest charges, or over-limit penalties. Users can only spend what they load, providing a built-in safeguard against debt accumulation.

The inactivity fee is the only charge users should monitor closely. Accounts that remain unused for over six months will incur a €5 monthly deduction, which continues until the balance is depleted. This is common among fintech platforms but can be avoided by making small periodic transactions.

The Embily Card offers a cost structure that is predictable and fair. Its combination of low monthly maintenance, transparent crypto conversion rates, and no hidden penalties makes it appealing for users who value clarity over complex loyalty programs or premium tiers.

Also Read: eToro Affiliate Program Review: $250 CPA Deals + 7 Better Alternatives for 2026

How the Embily Card Works

Who Can Apply

The Embily Card is available to both individuals and businesses looking for an easy way to convert and spend cryptocurrency. Anyone over 18 years of age with a verified Embily account can apply. There is no credit check or income requirement because the card operates on a prepaid basis rather than a credit model. This makes it accessible to freelancers, crypto traders, entrepreneurs, and everyday users who prefer to use digital assets for daily transactions.

For business users, Embily offers corporate account options designed to handle higher transaction volumes. Companies registered within the European Economic Area (EEA) can apply for multi-user access, enabling teams to manage spending across multiple cards under one main account.

Required Documents

To comply with international regulations, Embily requires users to complete full Know Your Customer (KYC) verification. The documentation process is simple and can be completed online. You’ll need:

- Government-issued ID: A valid passport, national ID, or driver’s license to confirm identity.

- Proof of address: A recent utility bill or bank statement showing your full name and address, issued within the last three months.

- Selfie verification: A live photo or video selfie to confirm the person applying matches the ID provided.

Business applicants must provide additional documentation such as a company registration certificate, proof of ownership structure, and possibly tax or VAT identification.

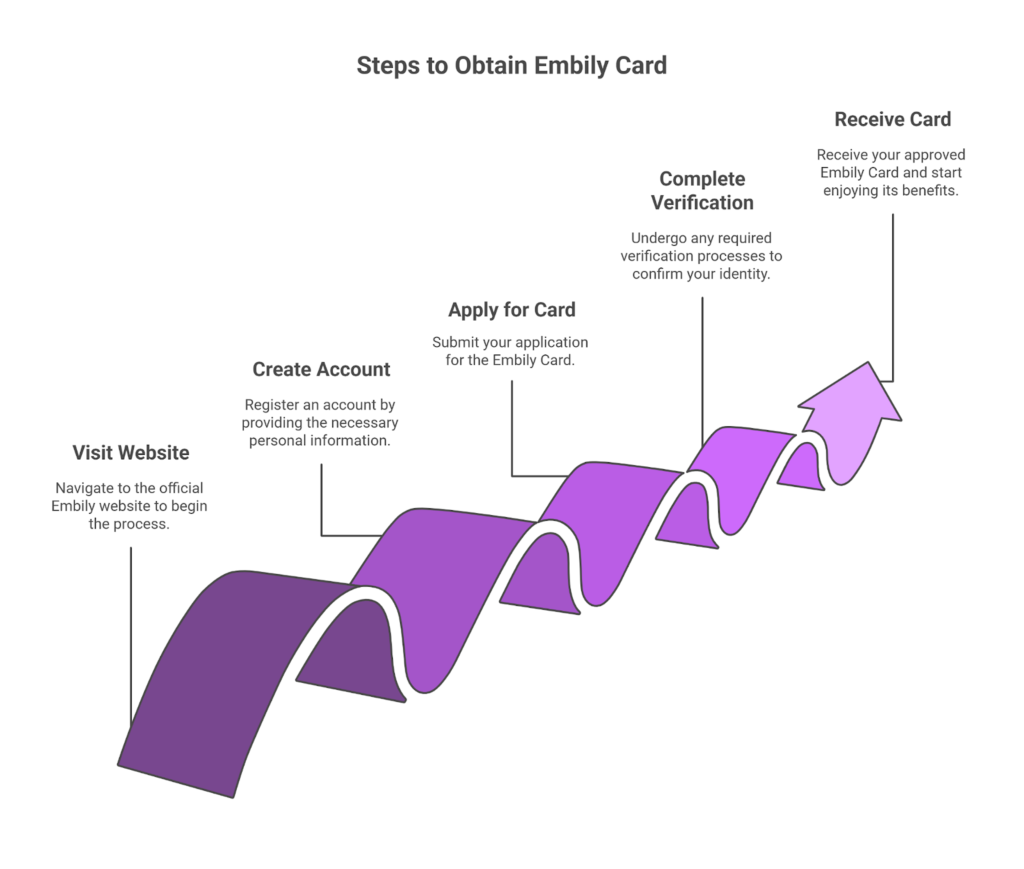

Step-by-Step Application Guide

- Visit the Embily website and create an account using your email address.

- Complete KYC verification by uploading your ID and proof of address.

- Select your card type either virtual or physical and review the associated fees.

- Fund your account using cryptocurrency or a bank transfer.

- Submit your application and wait for confirmation.

Approval Timeline

In most cases, applications are reviewed and approved within a few hours once verification is complete. Virtual cards are issued instantly after approval, while physical cards are typically delivered within 7 to 14 business days depending on your location.

What Happens After Approval

Once your card is approved, you can activate it immediately through the Embily dashboard. Users can set up a PIN, enable contactless payments, and begin using the card online or in stores where Visa is accepted. Funds can be topped up anytime using supported cryptocurrencies, and the dashboard provides real-time transaction tracking and spending management.

Embily’s straightforward application process ensures users can move from registration to active spending in as little as one business day, making it one of the more accessible options in the crypto card market.

Pros of Embily Card

Here are some reasons why many users prefer Embily for daily crypto spending.

1. Easy Crypto to Fiat Spending

Embily lets users convert crypto to euros quickly and spend it anywhere Visa is accepted. This makes it simple for crypto holders to use their assets for daily transactions without needing a separate exchange.

2. Fast Virtual Card Issuance

You can get a virtual card within minutes after completing KYC. This allows immediate access to spending, especially through mobile wallets like Apple Pay and Google Pay.

3. Wide Crypto Support

The card accepts a range of popular cryptocurrencies including Bitcoin, Ethereum, USDT (multiple chains), USDC, BNB, and DAI. Users can choose the network that suits their needs and fees.

4. Regulated and EU-Based

Embily operates under European financial regulations, with KYC, SEPA, and IBAN support. This structure builds trust for users who want more than just a basic crypto card.

5. Multi-Card Option

Each account can support up to five cards. This is helpful for users who want to manage personal and business spending separately.

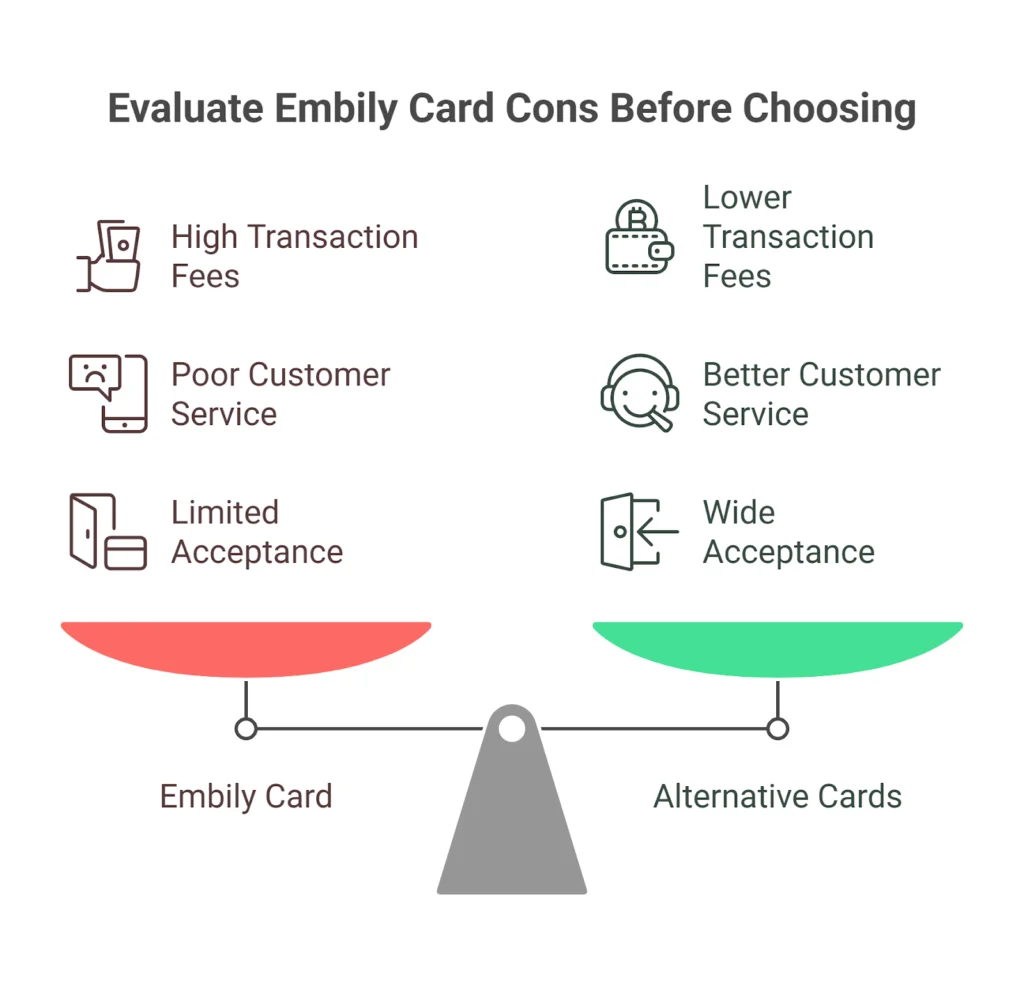

Cons of Embily Card

Like any crypto card, Embily has some limitations that may not suit every user.

1. Euro-Only Wallet

All crypto top-ups are automatically converted to euros. You cannot hold or spend crypto directly, which removes flexibility for those who prefer multi-currency wallets.

2. Limited Regional Access

As of now, the card is only available to residents in the EEA and the UK. Users in Africa, Asia, and LATAM can access wallet services but not the card itself.

3. No Cashback or Spending Rewards

Embily does not offer traditional cashback or reward points. Instead, it runs a referral program, which may not appeal to users looking for direct perks from card use.

4. Conversion and FX Fees

There’s a 1% fee for converting crypto to fiat and a 1.5% foreign exchange fee on non-euro transactions. While transparent, these fees can add up if you transact frequently in other currencies.

5. Limited Customer Support Channels

Support is available by email and Telegram, but there’s no live chat or phone line. Some users have reported delays in responses and deposit processing.

Real User Reviews and Feedback

1. Aggregate Ratings & Trends

Embily holds a Trustpilot score of 2.3 out of 5 based on 60 reviews, with 47% of reviewers giving 1 star and 43% giving 5 stars a sharp divide that shows polarized user experiences.

Traders Union corroborates this mixed sentiment and gives Embily an overall trust index of 2.4/5, with particularly low marks for customer loyalty (1.5/5) and popularity (0.4/5).

2. Praise Highlights

Some users praise Embily’s ease of use and functionality. One happy customer said, “This company provides a great and easy way to spend your crypto via Visa… Great, friendly and pretty fast resolution to issues”

Another shared on Reddit:

“Instant top-up top-9 crypto… powered by Visa… live support… Embily Card was named best in UX in 2022 by Benzinga” Source: Reddit.

These highlight key strengths like quick onboarding, multi-crypto support, broad Visa acceptance, and smooth user experience.

3. Frequent Complaints

Many users report issues with cash flow and customer support delays. One review states:

“Sometimes it takes more than a week to access my funds after a transaction… refunds take up to 45 days” Source: Product Hunt.

Others are concerned about referral bonus reliability:

“They try to get you with a referral program … once you sign in, they do not honour their commitments.”Source: Trustpilot.

Complaints often mention liquidity delays, missing bonuses, and inconsistent support responses.

4. Trends Over Time

Early positive feedback from 2021 praised service speed and simplicity. Users said things like: “Card worked perfectly… topped up with BTC, eth… euro deposited instantly my record is 3 mins” Source: Trustpilot.

However, reviews from 2023–2025 increasingly cite delays, unresolved issues, and unfulfilled expectations suggesting recent service strain or scaling challenges.

5. Company Responses

Embily often responds to negative reviews directly on Trustpilot. For instance, when called a scam, they replied: “We have a strong fraud control regarding our referral program… please contact support… they are ready to help 24/7” Source: Trustpilot.

In cases of liquidity issues, their response included: “This period has ended… enrollments will not be delayed… refunds faster than 45 days in practice” Source: Trustpilot.

These replies show Embily addressing concerns, though some users still report unresolved issues.

Top 7 Alternatives to Embily Card

Many users of crypto cards look not just for how fast or easy a card can convert crypto, but also for rewards, lower fees, global access, or business-friendly tools. While Embily Card offers strong features around crypto-to-euro conversion and Visa acceptance, it may not hit every user’s sweet spot when it comes to tiered rewards, geographic flexibility, or premium perks.

In this section, you will see 7 alternatives that span premium options, budget picks, fintech challengers, traditional finance hybrids, and niche-specific cards. We compare them in terms of fees, features, eligibility, and standout benefits so you can decide which card best fits your style of spending and crypto setup.

1. Wirex Card (Wirex)

Best For: Users who want strong rewards and flexibility with minimal annual cost.

Key Differentiators

- Cryptoback™ rewards up to 8 % in WXT token on purchases under the Elite plan.

- No annual or foreign exchange fees (for many regions/plans), plus free or low-cost ATM withdrawals up to a monthly limit.

Pricing

- Standard plan is free or low cost; Premium and Elite plans cost around €9.99/month and €29.99/month respectively.

- Some fees for ATM withdrawals above free thresholds, and small spreads (≈1 %) on crypto-to-fiat conversions.

Pros

- High rewards rate for active spenders under the correct plan.

- Flexible virtual + physical cards with geo broad coverage.

- Good user controls, including card freeze, multiple cards, and strong mobile/web interface.

Cons

- Reaching the highest rewards requires expensive subscription or token lock-ups.

- Some hidden costs (exchange spread) make exact cost per transaction less predictable.

Why Choose Over Embily Card

If you want more rewards and global flexibility and are willing to subscribe or commit, Wirex likely offers more value than Embily, especially in reward rate and fee variety.

2. Crypto.com Visa Card (Crypto.com)

Best For: Users who value tiered rewards and premium perks (like subscription rebates or lounge access).

Key Differentiators

- Multiple card tiers (e.g. Midnight Blue, Ruby Steel, Obsidian) with increasing benefits based on CRO staking.

- Perks such as subscription service rebates (Spotify, Netflix), airport lounge access, and higher ATM withdrawal limits at higher tiers.

Pricing

- Entry-level tiers often have no staking requirement / no annual fee; premium tiers require staking CRO tokens, which represents opportunity costs.

- Some ATM withdrawal limits and charges above free thresholds; FX and other fees depend on region.

Pros

- Strong rewards potential, especially for high spenders who can meet staking requirements.

- Well-known brand, extensive user base and reliability.

- Good global acceptance via Visa.

Cons

- Staking requirements can be large and locking CRO may carry risk/reward volatility.

- Benefit differences across regions (not all perks available everywhere).

Why Choose Over Embily Card

If rewards and perks matter more than simplicity, Crypto.com is a strong upgrade, particularly for users who can access its highest tiers.

3. UPay.best Card (Neutral Fintech Alternative)

Best For: Users seeking low FX fees and modern fintech integrations, especially in underserved regions.

Key Differentiators

- Claims of zero cross-border fees in many cases.

- Virtual & physical card options that integrate with mobile wallets like Apple Pay and Google Pay.

Pricing

- No or minimal annual fee in many plans; costs come mostly from usage (e.g. ATM, top-ups) depending on region.

Pros

- Cost-efficient for international users.

- Modern UX and fintech features.

- Good value for those with frequent cross-border spending.

Cons

- May have limitations in asset support or region-specific restrictions.

- Less established reputation compared to larger providers.

Why Choose Over Embily Card

If reducing foreign transaction costs and accessing more flexible regional use are priorities, UPay.best may offer an edge.

4. Nexo Card (Nexo)

Best For: Users who want to borrow against crypto holdings or earn interest while spending.

Key Differentiators

- The Nexo Card lets you switch between Credit Mode (spend without selling crypto) and Debit Mode (spend your crypto) with a tap.

- You can earn up to 2 % crypto cashback when spending in Credit Mode, and simultaneously earn interest on unused balances.

Pricing

- No monthly, annual, or inactivity fees.

- Free ATM withdrawals up to a certain monthly limit (e.g. €2,000) depending on your tier; beyond that, fees apply.

Pros

- Flexible modes let you preserve crypto or spend as you prefer.

- Cashback rewards in crypto add value back into your holdings.

- No regular fees make it accessible for many users.

Cons

- The limit on free ATM withdrawals may be restrictive for heavy users.

- Not all users globally may access full features, depending on region restrictions.

Why Choose Over Embily Card

If you like the idea of using crypto as collateral, earning interest, and receiving cashback, Nexo’s model offers more flexibility and passive returns than Embily’s straight conversion model.

5. Cypher Card (CypherHQ)

Best For: Users who need broad token support and global flexibility.

Key Differentiators

- Supports over 500 tokens across 25+ blockchains, letting users fund the card from many different crypto types.

- Instant fiat conversion at spending time, with global acceptance across millions of merchant locations.

Pricing

- Specific fees vary by token and region; issuing and trading fees apply. (Check Cypher’s fee schedule.)

- ATM withdrawal and currency conversion costs depend on jurisdiction and use case.

Pros

- Very broad crypto support gives flexibility to users holding many digital assets.

- Easy spending globally with instant conversion.

- You can use both virtual and physical cards.

Cons

- Complex token support makes fee structure harder to predict.

- High usage or cross-region usage might incur heavier fees.

Why Choose Over Embily Card

If your crypto holdings are diversified beyond top coins (like lots of altcoins), Cypher allows you to use them directly without first swapping into the limited coins Embily supports.

6. Zypto Crypto Card (Zypto)

Best For: High-volume spenders who need large limits and DeFi connectivity.

Key Differentiators:

- Very high spending and transaction limits, e.g., up to $1M monthly, and high per-transaction caps like $175K.

- Direct crypto wallet integration no banks or centralized exchanges needed for top-up.

Pricing

- Basic cards often have no monthly fees.

- Fees for conversion, cross-border use, or ATM withdrawals apply depending on region.

Pros

- Exceptional limits make it suitable for power users.

- Seamless crypto to fiat flow without intermediary platforms.

- Strong global coverage with virtual + physical card options.

Cons

- Higher operational risk if you rely heavily on the infrastructure.

- Some features might be region-limited or gated behind invitation.

Why Choose Over Embily Card

For users who routinely move large sums or want ultra-high spend capacity, Zypto gives more headroom than Embily’s moderate limits.

Also Read: Revolut Card Review: Global Spending Made Easy + Top 5 Alternatives

7. MetaMask Card (MetaMask / ConsenSys)

Best For: Users who want spending directly from their self-custodial wallet.

Key Differentiators

- You pay directly from your MetaMask wallet; no need to pre-deposit to a custodial account.

- Supports payments in multiple crypto assets (like wETH, USDC) and settlement happens at the point of sale.

Pricing

- The card itself is free to issue virtual; physical card costs (shipping, etc.) may apply.

- Fees include standard conversion costs and merchant fees as per network.

Pros

- Full control over your crypto no custodial conversion before spending.

- Easy integration with your wallet and on-chain activity.

- Broad merchant acceptance via Mastercard.

Cons

- Volatility risk since your crypto is deducted at market rate at time of transaction.

- Not all users may have access depending on region and regulatory compliance.

Why Choose Over Embily Card

If you prefer not to move funds into a separate wallet or want more transparency and control over your assets, MetaMask Card offers a more hands-on approach.

Crypto Card Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| Embily Card | €24 ( €2 / month ) | None on spending; referral bonuses only (0.1% on referrals) | Referral bonuses (referrer/referee) | No | Euro-based crypto holders who need simple spending | Instant crypto-to-euro conversion and Visa acceptance | Euro-only wallet; regional limits (EEA/UK) and limited rewards | 2.5 |

| Wirex Card | No base annual fee for entry plan; Premium €9.99/mo; Elite €29.99/mo for top tiers | Up to 8% Cryptoback (WXT) on Elite plan | Occasional promos, variable by market | No | Users who want strong spending rewards without high upfront cost | High Cryptoback rewards and multi-tier plans | Top rewards require paid tiers or commitments | 4.0 |

| Crypto.com Visa Card | No base annual fee for entry tiers; premium benefits require CRO staking (opportunity cost applies) | Up to 5% back on spending; higher travel/service rebates on upper tiers | Tiered sign-up perks historically offered (varies by region) | No | Users who want strong spending rewards without high upfront cost | High Cryptoback rewards and multi-tier plans | Top rewards require paid tiers or commitments | 4.0 |

| Nexo Card | No monthly or annual fee for standard card | Up to 2% crypto cashback in Credit Mode (depends on Loyalty Tier) | Sometimes offers joining promos; varies by campaign | No | Users who want credit vs debit flexibility and interest on balances | Credit Mode lets you spend without selling collateral; earn interest | Certain limits on free ATM withdrawals; regional availability varies | 4.0 |

| Cypher Card (CypherHQ) | Premium plan example $199 / year for advanced features; basic plans vary by region. | Variable; depends on plan and token support | Occasional promotions; varies | No | Users holding a wide range of altcoins and tokens | Very broad token support and multi-chain coverage | Complex fee structure by token makes costs harder to predict | 3.8 |

| Zypto Card | No monthly fee for base cards (company notes “no monthly fee”) | Typically none; product focuses on limits and throughput | No standard welcome bonus published | No | High-volume users and businesses needing very large limits | Extremely high transaction and withdrawal limits (up to $1M monthly / $175K per swipe) | Higher operational complexity and availability may be gated | 4.0 |

| MetaMask Card (Mastercard) | Free tier available; Metal tier subscription ~$199/year option documented | On-chain rewards possible depending on campaign; variable | No standard global welcome bonus | No | Self-custody users who want to spend directly from wallet | Spend directly from MetaMask wallet, no custodial pre-deposit required | Volatility risk at point of sale; regional rollouts and limits apply | 4.0 |

| BitPay Card | No ongoing annual fee for certain markets; issuance/activation fees may apply by region | Up to 2% cash back on qualifying merchants (varies by program) | Occasional promos and card funding bonuses | No | US customers who want straightforward USD conversion from crypto | USD conversions, broad merchant acceptance and simple app | Primarily US-focused; limited global availability | 3.8 |

How to Choose: Decision Framework

Selecting the right crypto card depends on your goals, spending habits, and where you operate. While the Embily Card is ideal for users who want a straightforward way to convert crypto to euros and spend through Visa, other options might better suit specific needs. Use this guide as a decision framework to match your priorities with the best card.

If you need seamless crypto-to-fiat conversion for daily spending → Consider the Embily Card.

Embily’s simple euro conversion and instant Visa compatibility make it practical for freelancers, remote workers, and everyday users who want quick access to crypto funds without staking or waiting for approval.

If your priority is earning rewards or cashback → Consider the Crypto.com or Wirex Card.

Both offer structured reward systems, tiered benefits, and subscription perks. Crypto.com is best if you spend heavily or travel often, while Wirex suits users who want consistent cashback without high token staking requirements.

If you have limited cash flow or want low-cost flexibility → Consider UPay.best or BitPay Card.

These cards focus on affordability, low or no annual fees, and predictable costs. They work well for individuals and small businesses that need quick transactions without premium subscription commitments.

If you operate a business or handle team payments → Consider Embily Business Account.

Embily supports multiple cards under one account, SEPA and IBAN transfers, and easy expense tracking. This makes it practical for startups or remote companies managing cross-border payrolls in Europe.

If you rely heavily on international payments or travel → Consider Wirex or Crypto.com.

Both cards have better foreign transaction support and fewer currency restrictions. Embily performs best within the EU, but international travelers may find broader coverage elsewhere.

If your business depends on integrations or software compatibility → Consider fintech-focused alternatives.

Cards like Wirex and Revolut offer app integrations, APIs, and third-party tools for accounting and expense management. These are valuable for companies automating financial workflows or connecting multiple payment channels.

Business Size Considerations

Small businesses and freelancers benefit most from Embily’s prepaid structure since it prevents overspending and eliminates credit checks. Larger organizations might prefer cards that integrate with accounting tools or have corporate management features.

Industry-Specific Needs

Creative professionals and freelancers value cards with instant issuance and virtual options. Traders or influencers, on the other hand, often prefer reward-driven cards like Crypto.com that add long-term value to daily spending.

Cash Flow Situations

If cash flow is irregular or crypto income fluctuates, Embily’s pay-as-you-go model provides stability. For users seeking continuous cashback or higher limits, a subscription-based card may justify the extra cost.

International vs. Domestic Use

Embily’s strengths are strongest in Europe due to SEPA and euro integration. For users in Asia, Africa, or Latin America, globally accepted cards such as Wirex or BitPay may offer smoother cross-currency performance.

Technology Requirements

If you rely on advanced tools, analytics, or automation, fintech alternatives with mobile apps and APIs are more suitable. If simplicity and speed are what matter most, Embily delivers exactly that without technical complexity.

How to Choose: Decision Framework

Selecting the right affiliate program is not only about chasing the highest commission. The decision depends on your business size, target audience, cash flow situation, and the tools you need to manage and scale. This framework outlines which programs best fit different needs.

1. High and Scalable Commissions

If your priority is earning the highest possible payouts, the Binance Affiliate Program is a strong choice. It offers up to 50 percent commissions, daily payouts, and sub-affiliate earnings. While it requires a large traffic base to unlock top tiers, it delivers better rewards at scale compared to Embily.

2. Predictable Bonuses and Simplicity

If you prefer a straightforward structure, the Embily Affiliate Program stands out. Affiliates earn fixed bonuses for each referral along with a lifetime percentage on top-ups. This makes it suitable for smaller creators, freelancers, or newcomers who want steady income without worrying about tier thresholds.

3. Niche or Specialized Audiences

For affiliates working in finance, fintech, or lifestyle niches, Wirex and Revolut are better suited. Wirex attracts crypto-savvy audiences with its mix of upfront and recurring commissions, while Revolut resonates with users interested in mainstream financial services.

4. Faster Payouts and Cash Flow Flexibility

Affiliates who need frequent payouts to reinvest in ads or content may find Bybit or UEEx more suitable. Bybit provides daily payments in USDT, and UEEx offers weekly processing. Both options improve liquidity compared to Embily’s monthly cycle.

5. International Reach

For affiliates targeting audiences outside of the European Economic Area or the UK, Crypto.com is a better fit. It has global coverage and brand recognition, making it attractive for creators who focus on international markets.

6. Beginner-Friendly Options

If you are just starting out, Paxful or UPay can be a good entry point. Both platforms have lower minimum payouts and flexible joining requirements. Paxful’s lifetime commissions and UPay’s hybrid recurring model are designed for affiliates building their first revenue streams.

Business Size Considerations

Small creators and early-stage businesses may find Embily’s flat structure manageable, while larger publishers should explore tiered models like Binance or Bybit to maximize revenue potential.

Industry-Specific Needs

If your audience is trading-focused, programs such as Binance, Bybit, or Crypto.com are strong fits. For lifestyle or financial literacy audiences, fintech programs like Wirex or Revolut are better aligned.

Cash Flow Situations

Affiliates who rely heavily on reinvesting in ads or content may prioritize liquidity. Programs like Bybit, UEEx, or Paxful offer faster payouts that help maintain healthy cash flow.

International vs. Domestic Use

Embily remains focused on the European market. For global traffic, especially in Asia or North America, Binance or Crypto.com provides better coverage and reach.

Technology Requirements

Advanced affiliates who need APIs, tracking dashboards, and detailed reporting may prefer Binance and Bybit. For those who value ease of use, Embily provides a simpler setup.

Also Read: Bybit Affiliate Program Review: Daily Crypto Payouts + 7 Higher-Paying Alternatives

Final Verdict

The Embily Card delivers a reliable and straightforward way to convert cryptocurrency into euros and spend it anywhere Visa is accepted. Its biggest strengths lie in its instant virtual card issuance, euro SEPA integration, and compliance-driven structure. With no credit check, predictable fees, and simple account setup, it offers one of the easiest onramps from crypto to real-world spending.

The card is perfect for freelancers, remote professionals, and everyday crypto users who want an uncomplicated method to access and use their digital funds. It suits those who prioritize functionality and regulatory safety over flashy features. Businesses that operate within the European Economic Area will also appreciate its SEPA support and the option to manage multiple cards under a single account.

However, users who want cashback, tiered rewards, or travel perks may find Embily limited. Its lack of a robust rewards system and higher foreign transaction fees make it less ideal for heavy international travelers or high-volume spenders. Those looking for mobile-first experiences, loyalty programs, or deeper app integrations may be better served by fintech alternatives such as Wirex, Crypto.com, or UPay.best, which offer richer ecosystems and global coverage.

Among all alternatives, Wirex stands out as the most balanced upgrade. It combines competitive fees, flexible multi-currency support, and tangible rewards without requiring heavy staking or premium subscriptions. For frequent travelers or digital nomads, Crypto.com provides a more premium experience through its tiered perks, while UPay.best remains a solid budget-friendly choice for low-cost international use.

Embily occupies a middle-ground position in the crypto card market — practical, secure, and compliant but not feature-heavy. It bridges the gap between everyday crypto use and regulated banking simplicity, making it a good fit for those who value clarity, transparency, and European payment infrastructure. While not the most rewarding card on the market, it remains one of the most accessible for users who simply want to spend crypto like cash without unnecessary complexity.

Frequently Asked Questions

1. Is Embily Card available in the United States?

No, the Embily Card is currently not available to residents of the United States. It is primarily offered to users in the European Economic Area and the United Kingdom.

2. How can I top up my Embily Card?

You can top up your Embily Card by sending supported cryptocurrencies like BTC, ETH, or USDT to your account, which are then automatically converted into euros.

3. Does Embily offer a virtual card?

Yes, Embily provides a virtual card option that can be issued instantly after completing KYC. It can be used online or linked to Apple Pay and Google Pay.

4. Can I withdraw cash using the Embily Card?

Yes, you can withdraw cash from any ATM that accepts Visa. A flat €1.50 fee applies to ATM withdrawals within Europe.

5. Is KYC required to get an Embily Card?

Yes, completing a Know Your Customer (KYC) process is required to activate the Embily Card. This includes submitting a government-issued ID and a selfie.

6. Can I use Embily Card outside Europe?

Yes, you can use the Embily Card globally at any location that accepts Visa, but you must be an EEA or UK resident to apply for the card.

Related posts:

- Binance Affiliate Program: Overview, Benefits & Commission

- Bitstamp Exchange Referral Program: Overview, Benefits & Commission

- Coins.ph Affiliate Program: Overview, Benefits & Commission

- Zedxion Exchange Affiliate Program: Overview, Benefits & Commission

- Topone Affiliate Program: Overview, Benefits & Commission