Flippening is one of the terms you come across in crypto conversations when talk shifts from dominance to disruption. It describes the moment a competing cryptocurrency, most notably Ethereum, overtakes Bitcoin in key metrics like market cap, transaction volume, or network activity. The idea has sparked debates, market predictions, and technical analyses for years.

As Ethereum grows stronger, backed by smart contracts, DeFi, and NFTs, the conversation around coin flippening feels more relevant than ever. Analysts are tracking data points, developers are building fast, and investors are watching closely.

So, what does coin flippening truly mean, and how close are we?

Key Takeaways

- Ethereum’s growing dominance in DeFi, NFTs, and smart contracts is a major driver of the coin flippening narrative.

- Key metrics like market cap, daily transaction volume, active addresses, and network fees highlight Ethereum’s increasing usage compared to Bitcoin.

- The Merge and Ethereum’s deflationary supply model have added strong economic pressure that supports its rising market position.

- Bitcoin maintains its lead due to brand strength, institutional support, and its role as a digital store of value.

- Historical flippening attempts show that sustained dominance requires long-term utility, innovation, and network resilience.

What Is Coin Flippening?

The word “flippening” refers to a potential shift in the cryptocurrency market where a competing coin, most often Ethereum (ETH), surpasses Bitcoin (BTC) in one or more key performance metrics.

These include market capitalization, daily transaction volume, number of active addresses, and total network fees generated. It represents more than just numbers; it signals a change in how value, utility, and innovation are recognized in the crypto space.

Originally coined during Ethereum’s rapid rise in 2017, coin flippening quickly became a popular term among analysts and investors.

While Bitcoin has long held the top spot as the original and most capitalized digital asset, Ethereum’s expanding use cases—ranging from smart contracts and decentralized applications (dApps) to decentralized finance (DeFi)—have led many to believe a flippening is not just possible, but inevitable.

Metrics That Indicate a Flippening

To understand if a coin flippening is taking place, or is even close, we need to look beyond price alone. Several on-chain and network-level metrics are used to measure a cryptocurrency’s strength and impact.

Here are some indicators analysts monitor when evaluating a potential flippening, especially between Bitcoin and Ethereum.

Market Capitalization

Market cap is the most common metric used to rank cryptocurrencies. It’s calculated by multiplying the current price of a coin by its circulating supply. Bitcoin has historically held the top position in terms of market capitalization.

However, Ethereum has closed the gap significantly during major bull runs, especially when network activity surges due to DeFi, NFTs, or Layer-2 adoption.

A flippening in market cap would mean Ethereum becomes the most valuable cryptocurrency, not just by price, but by total economic weight.

Daily Transaction Volume

This metric reflects how much value is being transferred across a network on a daily basis. Ethereum often outpaces Bitcoin here, especially during periods of high DeFi or stablecoin activity. More transactions often signal greater real-world utility and user engagement.

Sustained higher daily transaction volume from Ethereum could suggest it’s being used more actively, strengthening the case for a functional and utility-driven flippening.

Number of Active Addresses

Active addresses indicate the number of wallets interacting on the blockchain within a specific period. It’s a useful measure of network participation and adoption.

While Bitcoin remains strong in terms of long-term holders and institutional wallets, Ethereum frequently shows a higher number of active users, thanks in large part to dApps, NFTs, and token transfers.

If Ethereum consistently leads in active address count, it signals broader user involvement and transactional diversity.

Total Fees Generated

Fees paid by users reflect demand for block space. When network usage is high, fees go up, often indicating that users find the network valuable enough to pay for speed or access. Ethereum has regularly outperformed Bitcoin in this area, especially during DeFi booms or high-traffic periods.

High fee generation suggests strong demand, utility, and active participation. It also speaks to miner/validator incentives, reinforcing network security.

Developer Activity

A strong and active developer community is essential for network growth and innovation. Ethereum has consistently ranked higher than Bitcoin in terms of monthly developer contributions, GitHub commits, and open-source project builds.

More developers mean more experimentation, upgrades, and user-focused applications. This metric underscores Ethereum’s evolving ecosystem and its momentum as a programmable blockchain, unlike Bitcoin’s more conservative development path.

Factors Contributing to the Flippening

The coin flippening is not driven by hype alone. It’s built on measurable shifts in utility, innovation, and market perception.

Below are the major drivers contributing to this shift:

Ethereum’s Growing Utility

Ethereum has become the backbone of some of the most active sectors in crypto. From decentralized finance (DeFi) and non-fungible tokens (NFTs) to smart contracts and Layer 2 scaling solutions, Ethereum’s versatility continues to attract developers, users, and capital.

Its programmability allows developers to create decentralized applications (dApps) that can execute complex tasks directly on-chain. This positions Ethereum as more than just a store of value—it’s a foundational layer for a wide range of decentralized ecosystems.

Moreover, Ethereum dominates in real usage metrics, including network fees, number of deployed contracts, and volume on decentralized exchanges (DEXs). These real-world use cases contribute to Ethereum’s economic gravity and add weight to the flippening narrative.

Ethereum’s Supply Reduction After the Merge

The Merge, Ethereum’s shift from Proof of Work (PoW) to Proof of Stake (PoS) in September 2022, fundamentally changed how new ETH is created. One of the most significant outcomes has been the reduction in ETH issuance and the introduction of deflationary pressure through EIP-1559, which burns a portion of transaction fees.

Post-Merge, Ethereum’s net issuance has dropped significantly—at times turning negative. This means that more ETH is being burned than minted, reducing the total supply over time.

This deflationary mechanism adds upward pressure on ETH’s price and strengthens its position in market cap comparisons with Bitcoin, which continues to rely on inflationary PoW issuance. As scarcity increases alongside growing demand, ETH becomes an increasingly competitive asset.

Bitcoin’s Limitations

While Bitcoin remains the most recognized cryptocurrency, it faces several structural limitations that have opened the door for Ethereum’s rise:

- Lack of Programmability: Bitcoin was designed as a peer-to-peer payment system and digital store of value, but it lacks the complex programmability that powers Ethereum’s smart contracts and dApps. This restricts its utility beyond simple transactions.

- Slower Development Pace: Bitcoin development is intentionally conservative, which adds to its security but slows down innovation. Ethereum’s faster-moving ecosystem allows it to iterate, scale, and adopt new technologies more quickly.

- Energy Concerns with Proof of Work: Bitcoin continues to use a PoW consensus mechanism, which has come under scrutiny due to its high energy consumption. In contrast, Ethereum’s PoS model is far more energy-efficient, aligning better with environmental and ESG (environmental, social, and governance) standards.

Bitcoin vs Ethereum: The Main Flippening Battle

The phrase “coin flippening” often centers on one of the most compelling rivalries in crypto: Bitcoin vs Ethereum. While both dominate the market and serve critical but different functions, the conversation around a flippening focuses on whether Ethereum can eventually overtake Bitcoin as the most valuable and influential cryptocurrency.

This battle is rooted in market metrics, technology, and long-term use cases.

Current Comparison of Bitcoin vs Ethereum (2025)

As of mid-2025, Bitcoin remains the largest cryptocurrency by market capitalization, but Ethereum continues to close the gap:

| Metric | Bitcoin (BTC) | Ethereum (ETH) |

| Market Cap | $2.05 trillion | $289.44 billion |

| Daily Transaction Volume | $48.5 billion | $16.2 billion (higher during DeFi activity spikes) |

| Transaction Count | 338,000 | 1.37 million |

| Active Addresses (7-day avg) | 793,000 | 508,000 |

| Total Fees Generated (7-day avg) | $533,000 | $974,000 |

| Total Value Locked | $6.2 billion | $61.2 billion (largest) |

All data taken as of June 19, 2025

- Market cap: Bitcoin still holds the lead due to its dominant brand recognition and institutional backing.

- Network fees: Ethereum consistently generates higher transaction fees, signaling stronger network usage.

- Active addresses: Ethereum now often surpasses Bitcoin in daily active users, especially when major dApps and NFT activity increase.

- Transaction volume: Though Bitcoin occasionally leads in total transfer value, Ethereum processes more complex and interactive transactions (e.g., token swaps, smart contracts).

Real-Time Flippening Index and Trackers

To track this ongoing rivalry, the crypto community has developed flippening indices—tools that compare critical Ethereum and Bitcoin metrics in real time.

One popular source is BlockchainCenter’s Flippening Index, which tracks:

- Market cap ratio

- Transactions per day

- Active addresses

- Trading volume

- Google Trends interest

- Node count

- GitHub activity

- Fees paid

June 2017 held the highest flippening index at 83.2%. As of 21st June, 2025, the Flippening Index stands around 14.1%, suggesting Bitcoin is leading in multiple metrics.

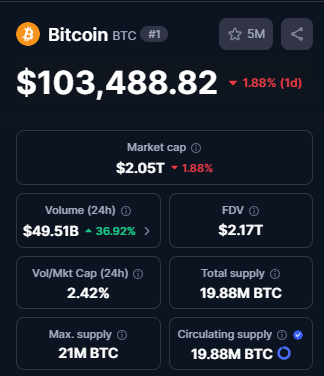

Bitcoin: The Original Market Leader

Bitcoin launched in 2009 as the first decentralized digital currency. It introduced blockchain technology to the world, with a focus on scarcity (capped at 21 million BTC), decentralization, and security. Its primary use case remains as “digital gold”—a hedge against inflation and store of value.

Source: CoinMarketCap

Bitcoin benefits from:

- Widespread institutional adoption (e.g., BlackRock, Fidelity ETFs)

- Strong name recognition and trust

- A highly secure and decentralized network

However, its use cases are limited to payments and value transfer. It lacks the infrastructure for programmable applications, which is where Ethereum shines.

Ethereum: Growth and Innovation at the Core

Source: CoinMarketCap

Ethereum was introduced in 2015 by Vitalik Buterin and others to address Bitcoin’s limitations. Its goal is to become a decentralized world computer, enabling smart contracts and dApps.

Key innovations fueling Ethereum’s growth:

- Smart contracts: Enabling decentralized finance, gaming, DAOs, and NFTs.

- EIP-1559 and The Merge: Introduced deflationary pressure and reduced energy usage by over 99.9%.

- Layer 2 scaling: Rollups like Optimism and Arbitrum reduce fees and increase throughput.

- Staking: Transition to Proof of stake improved accessibility and network efficiency.

Ethereum’s ability to adapt and evolve is one of its strongest advantages in the flippening conversation.

Technological Differences and Impact on Market Value

| Feature | Bitcoin | Ethereum |

| Consensus | Proof of Work | Proof of Stake |

| Smart Contract Support | Limited (via sidechains) | Native |

| Transaction Speed | 7 tx/s | 15–30 tx/s (more on L2s) |

| Energy Use | High (mining) | Low (staking) |

| Upgrades | Slow, conservative | Regular and community-driven |

These differences have major implications:

- Market value is increasingly tied to utility.

- Bitcoin’s value is mostly monetary.

- Ethereum’s value is technical, functional, and economic.

Has the Flippening Happened Before?

There have been several moments when Ethereum came very close to overtaking Bitcoin in key metrics, especially market capitalization.

One of the most notable instances occurred on 12 June 2017, when the Flippening Index peaked at 83.2%. Ethereum’s price surged during the ICO boom, and its market cap reached 82% of Bitcoin’s, driven by explosive interest in Ethereum-based tokens.

Another significant moment came on 1 February 2018, when the Flippening Index stood at 64.5%. This followed Ethereum’s rise during the late 2017 bull run, where the demand for smart contracts and token creation was at an all-time high.

Despite these near-flips, the flippening has never been fully achieved. Bitcoin has retained its position as the largest cryptocurrency by market cap.

Why Didn’t the Flippening Hold?

There are a few key reasons why previous flippening attempts failed to materialize into a lasting shift.

They are:

Market Corrections

In both 2017 and 2018, Ethereum’s growth was heavily tied to speculative bubbles (ICOs). When those markets cooled, ETH’s price fell sharply, reducing its market cap relative to BTC.

Bitcoin’s Brand Strength

As the first cryptocurrency, Bitcoin remains the most recognized and trusted name in crypto. It enjoys broader institutional support, especially as a store of value.

Ethereum’s Scalability Issues (at the time)

During earlier cycles, Ethereum struggled with high fees and congestion, especially during spikes in demand. These issues raised concerns about its long-term viability before the implementation of scaling solutions and the proof-of-stake transition.

Investor Sentiment and Perception

Bitcoin has consistently been viewed as “digital gold,” a non-inflationary asset with a fixed supply. This narrative holds strong appeal, especially during periods of economic uncertainty.

Final Thoughts

The coin flippening reflects a real shift in how cryptocurrencies are valued—moving from static stores of value to networks built on utility and innovation. Ethereum’s rapid growth in areas like DeFi, NFTs, and smart contracts has positioned it as a serious contender to Bitcoin’s long-standing dominance.

While the flippening hasn’t happened yet, key metrics suggest it’s closer than ever. As users and developers shape the future of blockchain, Ethereum continues to gain momentum in this ongoing market rivalry.

Frequently Asked Questions

Flippening in crypto refers to the potential moment when Ethereum surpasses Bitcoin in market capitalization or other key metrics like transaction volume, active users, or network fees.

No coin currently shows strong enough utility, adoption, or developer activity to overtake Ethereum in the near term.

Yes, Ethereum burns coins through a mechanism introduced in EIP-1559, which removes a portion of transaction fees (base fees) from circulation, reducing the total ETH supply over time