By removing middlemen and concentrating power within a specific community, decentralized finance (DeFi) has made it possible for people to engage with financial services in innovative ways.

At the center of this innovation are decentralized autonomous organizations (DAOs), composed of members who collectively make decisions, rather than a central authority acting unilaterally.

But how are these decentralized systems governed fairly and transparently? In large part, the answer lies in governance tokens: digital assets that grant holders voting privileges, influence over the protocol’s direction, and ownership rights.

Try to imagine being a part of the decision-making behind features that involve your favorite crypto platform.

Key Takeaways

- Governance tokens facilitate decentralized governance and grant power to users to vote on crucial protocol changes and upgrades.

- Voting systems are highly varied.

- Well-known governance tokens like UNI, MKR, and AAVE demonstrate how token holders can vote on major changes.

- Participating in DAO governance enables everyone to contribute to the future of a decentralized protocol.

Governance Token

A governance token is a kind of cryptocurrency typically tied to decentralized protocols, decentralized applications, or DAOs, and allows for stakeholders, typically token holders, to vote to govern those protocols.

Courtesy: Metaverse Post

Essentially, governance tokens act as voting chips, which means holders can help steer the future direction of the project by proposing or voting on major protocol changes, whether that’s suggesting a technical upgrade, treasury spending, fees, or even a new partnership.

In DAOs specifically, governance tokens are commonly used for proposing and voting to achieve consensus on proposals from stakeholders. By using a token-based governance method, the growth and development of protocols are less about the whims of a centralized authority and more focused on community involvement.

Governance tokens can help bind users to the protocol, allowing users to have an influence over risk parameters or collateral requirements or even the reward system in DeFi projects. Since these types of decisions can be financially relevant to governance, token holders are incentivized to act in the best interest of the protocol.

A number of notable projects have released governance tokens as a core piece of infrastructure. For instance, UNI, the governance token for Uniswap, allows holders of UNI to vote on proposals regarding the development of the protocol as well as how to use treasury funds.

Also, MKR, the governance token for MakerDAO, allows holders to vote on risk management decisions regarding types of collateral and debt ceilings when issuing Dai stablecoin.

Read Also: What is a Token: Beginners Guide

How Governance Tokens Work

Governance tokens are the heart of decentralized decision-making, and they enable holders to have some level of influence over a protocol.

Now, how do these tokens actually work?

The way these tokens work differs based on the blockchain and DAO itself, but most governance systems convert membership into some sort of voting structure that is governed by rules.

Voting Mechanisms: On-Chain vs. Off-Chain

A significant distinction in governance tokens is whether voting occurs on-chain or off-chain.

Courtesy: Webopedia

On-chain voting is a vote directly on-chain, which means it is public and immutable. There is full decentralization in on-chain voting since every vote is executed through a smart contract; however, on-chain voting can be slower and costly (the gas fees, especially if you are on Ethereum).

Examples are protocols like Compound and Uniswap, where, such as with Compound, if a proposal passes, it is executed automatically.

Off-chain voting is faster and gasless and occurs on behalf of the voter, mainly using platforms like Snapshot. Off-chain voting is effective, but when the time comes to take the vote off-chain and execute it on-chain, it introduces a small layer of centralization risk.

Voting Systems: Token-Weighted vs. Quadratic Voting

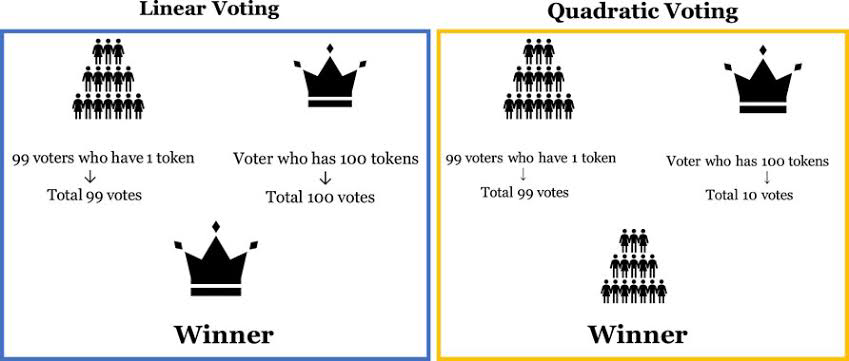

Most governance tokens are token-weighted, meaning that holders of larger token quantities have more voting influence. This can present a concern for centralization if a few holders control a significant amount of governance.

Courtesy: Frontiers

To mitigate this issue, there are a few projects that are attempting different variations of governance, such as quadratic voting. In this case you would have voting power that increases at a decreasing rate. (e.g., if you have 1 token, you have 1 vote, but if you have 10 tokens, you only have the square root of 10 votes.)

This is potentially beneficial in leveling the playing field for smallholders and reducing whale concentration of governance power.

There is also the issue of quorum thresholds, or how many votes must occur for a proposal to be passed, usually set as a minimum number of votes to be considered a valid proposal. The issue is that mass apathy is a danger to direct voting systems like those that many DAOs use. Your proposals may be great, but if only 2 or 3 people show up, who really cares?

What Do Token Holders Vote For?

Holders of governance tokens usually have the ability to vote for key protocol parameters like:

- Fee structure: You can vote to govern how the transaction fee is paid, where revenue is sent, and how incentive rewards are given.

- Protocol/Smart contracts: Governance token holders can authorize the changing of a smart contract to add a new feature (by adding a new blockchain).

- Treasury/expenditure authorization: Deciding how to spend the community treasury, i.e., sending grants to devs or spending on marketing initiatives.

- Partnerships/integrations: Vote on approving mergers, collaborations, etc.

Benefits of Holding Governance Tokens

Governance tokens are not merely a voting privilege; they offer much more than governance rights. There are advantages to governance tokens beyond governance where holders benefit significantly, and they are:

- Influence Over the Direction of the Protocol

The biggest value of a governance token is the clarity of being able to influence the development of a project. Unlike centralized finance, governance protocols are more honest, and the token holders can vote on developments, upgrades, partnerships, and major policy changes.

For example, Uniswap token holders decide the fee structure and treasury allocation decisions of their holders.

- Early Access to Ecosystem Changes.

Governance token holders also typically receive early intel on upcoming feature releases, upgrade releases, integrations, and major strategic decisions. Some DAOs give their token holders exclusive access to beta releases or testnets for some period of time before their full rollouts.

Having access gives a token holder an advantage by being able to make informed decisions ahead of important software updates, being able to make recommendations that can inform final updates, and being able to provide liquidity mining or staking opportunities to have first-mover advantages.

- Financial Advantages

Holding a governance token could also offer reward tokens to the holders of these tokens. There are DAOs that also provide extra yield for locking up governance tokens (for instance, Curve’s vote-locking model) or a percentage of fees or profits to some token holders (e.g., SushiSwap’s xSUSHI).

- Community Reputation & Connections

Active participants in governance often build a reputation in the DAO, resulting in:

- Grants or funding for whatever projects they propose,

- Being able to enact roles as delegates or advisors in the ecosystem

- Connections with other builders in DeFi or investors,

How to Get Governance Tokens

Governance tokens allow you to participate in the decentralized decision-making processes that make DAOs and DeFi protocols unique. There are many ways to obtain these tokens:

- Purchasing on Decentralized Exchanges (DEXs)

One of the easiest ways to buy governance tokens is on a decentralized exchange (DEX). Uniswap, SushiSwap, and Balancer all allow users to swap other cryptocurrencies, whether ETH or stablecoins, for various governance tokens like UNI, AAVE, or COMP. Typically, you will need a Web3 wallet such as MetaMask to connect and perform swaps.

- Earning through Staking

Another common way to receive governance tokens is to earn them. Many DeFi protocols reward their users with governance tokens for helping to perform functions that allow the network to operate. Liquidity providers, for instance, receive governance tokens as part of their yield for providing assets to decentralized exchanges or lending protocols.

- Via Airdrops

Airdrops are another way that governance tokens can be received, often as a way to reward early users, community advocates, or protocol developers. In this way, tokens are sent for free to users who meet the qualification criteria established by the protocol.

Some criteria may include usage during the early stages of the protocol or holding a specified asset at a particular “snapshot” in time. A well-known example includes the Uniswap airdrop in 2020, which sent 400 UNI to each wallet that had interacted with the protocol before a certain date.

The Future of Governance in Web3

Since early decentralized autonomous organizations (DAOs) were designed to experiment with governance models based almost entirely on token holdings, the rationale behind governance decisions was simpler.

Today, the future of governance in Web3 is favoring hybrid governance models that incorporate decentralization and usability, community, and even artificial intelligence.

The demand for scalable, secure, trustworthy, and non-biased governance systems is reformulating how decentralized entities make decisions, while at the same time potentially expanding the future boundaries of organizational design.

Today DAOs are using multi-layered governance models like bicameral models (Optimism has Token House and Citizens’ House) and delegate voting models (so smaller holders can delegate their votes to trusted community leaders).

As of 2024, DeepDAO has reported that DAOs hold more than $30 billion in assets, which highlights the scale and importance of DAOs, as well as the recognition of governance models.

A new generation of governance tools is enhancing decentralized decision-making. Platforms like Snapshot, Tally, and Agora provide easy-to-use interfaces to facilitate proposal creation, off-chain voting, and delegate tracking while lowering the friction of participation.

Tools such as Safe (formerly Gnosis Safe) and Zodiac are enabling modular, composable governance architectures that allow DAOs to assemble their own decision-making logic. These tools have also helped to boost voter turnout, signaling the growing uptake of decentralized governance use cases.

The emergence of artificial intelligence (AI) and quadratic voting will likely play a disruptive role during the next wave of crypto governance. AI can unlock governance efficiencies by summarizing proposals, detecting Sybil attacks, and gauging community sentiment—helping to reduce information asymmetry and aid decision-making.

Quadratic voting, where each additional vote costs increasingly more, prevents vote monopoly by wealthier holders of tokens. The model aims to balance influence while allowing voters to express the strength of their preferences and mitigating the influence of whales.

Projects like Gitcoin are already effectively employing quadratic funding by allocating more than $60 million in grants while ensuring community input and buy-in in the process.

Conclusion

Governance tokens are the bedrock of the decentralized web, as these tokens confer on their holders the ability to vote, set, and govern the treasury, tokenomics, and fee structures. The significance of governance tokens increases as DeFi expands and as DAOs become more advanced.

Governance tokens’ role also expands beyond that of DeFi and into aspects of decentralized media and gaming, identity, and potentially funding of public goods.

Read Also: Tokenomics and Incentive Mechanisms in the Cryptoverse

The future of governance tokens will include new innovations like AI-improved governance mechanisms, quadratic voting, and new public participation mechanisms. It will also provide a more representative, efficient, and open system of digital governance.

FAQs

Governance tokens are a type of cryptocurrency that allow holders to vote on crucial decisions that impact a decentralized protocol. The tokens are often used in DAOs and DeFi projects to vote on upgrade proposals, changes to fee structure, treasury spending decisions, and other governance-related decisions.

Governance tokens allow holders to vote on important decisions for the protocol, either on-chain or off-chain. The voting power often corresponds to how many governance tokens a holder has. Projects can either ask for holders to vote on-chain, as with traditional voting (with smart contracts on-chain), or, if they prefer, rely on a decision made off-chain.

Some of the most popular governance tokens include UNI (Uniswap), MKR (MakerDAO), and AAVE (Aave).

Governance tokens can be bought on decentralized exchanges like Uniswap; you may earn governance tokens by participating in a network or staking, or you can receive them in an airdrop.

Besides possible monetary value, governance tokens allow for governance power, community influence, and access to decision-making in a decentralized environment. They allow those holding tokens to actively contribute to the development and progress of the protocols in which they are invested.

Quadratic voting is a way of voting where the cost of voting with multiple votes increases on a quadratic basis. It is a way of balancing the influence between whales and minor token holders to promote a democratic way of governance in crypto.