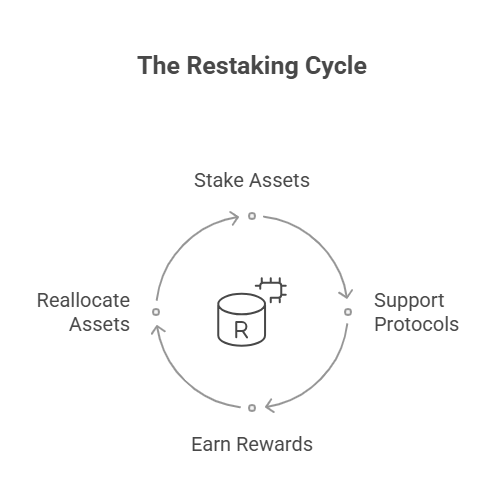

Restaking enables staked crypto assets to be reused across multiple protocols which helps generate additional rewards. What this means for This reinforces network security by leveraging existing staked capital for new decentralized services.

Reports indicate a surge in the total value locked (TVL) of liquid restaking platforms, reaching nearly $8 billion. This growth suggests increasing confidence in this emerging crypto model.

So what exactly is restaking, and why is it attracting so much attention? Time to find out.

Key Takeaways

- Restaking lets you reuse staked crypto assets to support multiple protocols, increasing rewards without needing to stake new funds.

- EigenLayer is the main restaking platform, allowing staked ETH or liquid staking tokens to secure additional services like oracles, rollups, and bridges.

- Types of restaking include native, liquid, and modular, offering flexibility for both technical and non-technical users.

- Benefits include higher capital efficiency, better network security, and improved decentralization across emerging blockchain ecosystems.

- Restaking comes with added risks, such as increased chances of slashing if validators fail across the protocols they support.

What is Restaking in Crypto?

Restaking is a way to get more use out of your already locked-up crypto. Instead of just letting your asset sit in one place, you can use it again to support other blockchain projects and earn extra rewards, without needing to add more money.

It allows you to reallocate already staked assets to secure and support additional protocols beyond the original blockchain on which they were staked.

A key player in this space is EigenLayer, a protocol that allows you to opt in and secure new services using your already-staked ETH. This means your staked assets are reused across multiple layers of decentralized infrastructure. This boosts your capital efficiency without requiring you to lock up more funds.

Let’s say you have 32 ETH staked on Ethereum through a service like Lido. Using EigenLayer, you can restake your Lido Staked ETH (stETH) to also help secure a new decentralized oracle protocol. In return, you could earn additional rewards from the oracle project, on top of your original Ethereum staking yield.

Read Also: 15 Best Crypto Staking Platforms For Maximum Passive Income

Traditional crypto staking is when you lock your tokens to secure a single network (e.g., Ethereum or Cosmos), but restaking extends the utility of those tokens.

Restaking enables you to contribute to the security and functionality of other emerging decentralized applications, chains, or services. As such, you earn rewards from multiple layers of participation without needing to be unstaked.

Brief Historical Background of Staking and Evolution into Restaking

Staking began as a core component of Proof-of-Stake (PoS) consensus mechanisms, introduced as an energy-efficient alternative to Proof-of-Work (PoW). Ethereum’s transition to PoS through the Ethereum 2.0 upgrade marked a significant milestone in staking adoption, opening up broader participation in network security.

As DeFi grew, users began seeking more flexible and productive uses for their locked assets. This led to the emergence of liquid staking, which allows users to stake tokens while still being able to use them in DeFi activities via derivative tokens (e.g., stETH for staked ETH). However, liquid staking is still focused on a single base network.

Restaking is the next evolutionary step. Introduced and popularized by protocols like EigenLayer, restaking enables already staked assets (such as ETH staked via Ethereum validators) to be reused to provide security and consensus to additional networks or services. This evolution allows for layered trust models and more scalable, modular blockchain ecosystems.

In May 2024, EigenDA, a data availability layer built on EigenLayer, began using restaked ETH to secure its operations. Rather than setting up a new validator set, it relied on restakers. This reduces bootstrapping costs and immediately benefits from Ethereum’s existing trust layer.

Restaking, in this sense, turns passive staking into an active contributor to the broader Web3 ecosystem, helping launch and secure new services without fragmenting economic security.

“Restaking allows you to reallocate already staked assets to secure and support additional protocols beyond the original blockchain they were staked on.”

How Restaking Works

Restaking fundamentally changes how staked assets can be utilized within the decentralized ecosystem. Rather than having a token staked to secure only one protocol or blockchain, restaking extends its utility to support additional systems, all while keeping the original stake intact.

This is made possible by programmable smart contracts and infrastructure platforms like EigenLayer, which enable secure delegation of trust and responsibility across layers.

Reuse of Staked Assets

The core idea behind restaking is the reuse of staked assets. When a user stakes tokens, such as ETH on Ethereum, they typically lock them to support consensus and earn rewards.

Restaking allows these already staked tokens (often via liquid staking derivatives like stETH or through native staking) to be committed again to help secure other networks, such as new data availability layers, rollups, or middleware services. This means one token can be actively used to secure multiple protocols, maximizing capital efficiency and yield.

Cross-Protocol Staking

In cross-protocol restaking, the staked asset’s economic security is extended to more than one protocol. For instance, ETH staked through Ethereum validators can be restaked to secure an oracle network, a layer-2 rollup, or a decentralized storage protocol.

This is achieved through restaking platforms that track validator behavior, enforce slashing conditions, and reward users for participating in multiple systems. It enables shared security models across different protocols without each having to build their own validator sets from scratch.

Types of Restaking

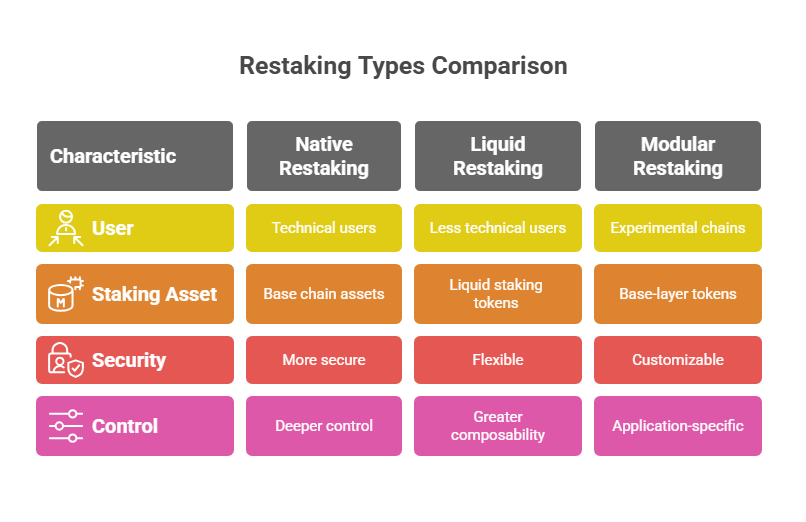

Restaking can be implemented in several forms, each with its own advantages and trade-offs depending on the use case and the type of user participation.

Native Restaking

In native restaking, users who stake assets directly on a base chain (like Ethereum) opt-in to extend their validator responsibilities through a restaking protocol.

This often involves direct integration at the node or validator level, enabling deeper control and reduced dependency on third-party intermediaries. Native restaking is generally more secure but may require more technical expertise from participants.

Liquid Restaking

Liquid restaking involves the use of liquid staking tokens (LSTs) such as stETH, rETH, or cbETH. Users can deposit these tokens into restaking protocols, which then use them to secure other systems.

This form allows users to maintain liquidity and flexibility, as LSTs can often still be used in DeFi platforms while also being restaked. It’s ideal for less technical users and those seeking greater composability and capital mobility.

Modular Restaking

Modular restaking allows for the creation of flexible restaking modules that can plug into various parts of the blockchain stack, such as execution, consensus, or data availability.

This approach supports customized trust assumptions, letting protocols define their own restaking logic while still drawing from the pooled security of base-layer tokens. It is especially useful for experimental or application-specific chains looking to balance autonomy with security guarantees.

“The core idea behind restaking is the reuse of staked assets, letting one token actively secure multiple protocols and maximize capital efficiency.”

Key Components Involved

Validators

Validators are responsible for maintaining consensus and validating transactions on the base layer and, through restaking, also extend these duties to other protocols.

In restaking frameworks, validators may be subject to additional slashing conditions if they fail to meet the expectations of the secondary protocol. This incentivizes reliable behavior across all systems they support.

Stakers

Stakers (or delegators) are token holders who lock or delegate their assets to validators or smart contracts. In restaking, stakers can choose to opt into restaking protocols either natively or through liquid derivatives. They earn additional rewards but may also bear increased risk if validators misbehave and get slashed.

Smart Contracts

Smart contracts act as the trustless coordinators of restaking activities. They manage the staking, restaking, reward distribution, and enforcement of slashing conditions. These contracts must be highly secure and auditable, as they are responsible for linking multiple protocols and ensuring fair, transparent execution of restaking logic.

Technologies that Enable Restaking

The rise of restaking has been made possible through a new class of infrastructure protocols that enable secure and programmable extension of staked assets across multiple layers.

At the forefront of this innovation is EigenLayer, which introduced the restaking concept as a way to scale decentralized trust.

What is EigenLayer?

EigenLayer is a permissionless middleware protocol built on Ethereum that allows users to “opt-in” their staked ETH or liquid staking tokens (LSTs) to secure additional services beyond Ethereum’s base layer.

Through EigenLayer, stakers and validators can provide decentralized trust to external protocols, including oracle networks, bridges, rollups, and data availability layers.

EigenLayer acts as a marketplace for trust, where services can tap into Ethereum’s economic security without building their own validator set. It does this by imposing custom slashing conditions and reward structures on participants who choose to restake.

This enables the modularization of blockchain infrastructure while promoting security sharing and yield stacking.

Alternatives to EigenLayer

While EigenLayer is the leading restaking protocol, other platforms are exploring similar concepts to decentralize trust and improve capital efficiency:

- Symbiotic – A generalized restaking protocol designed to support any asset, not just ETH, and allow applications to define their own security assumptions.

- Karura (on Polkadot) – Offers liquid staking and programmable trust services, which can be extended to restaking mechanisms for Kusama and Polkadot-based assets.

- Ojo (Cosmos ecosystem) – Provides decentralized oracle services that could leverage restaked ATOM or other IBC-compatible tokens in the future.

These alternatives highlight how the restaking model is spreading across ecosystems, each adapting it to their native architecture and economic structure.

“EigenLayer acts as a marketplace for trust, where services can tap into Ethereum’s economic security without building their own validator set.”

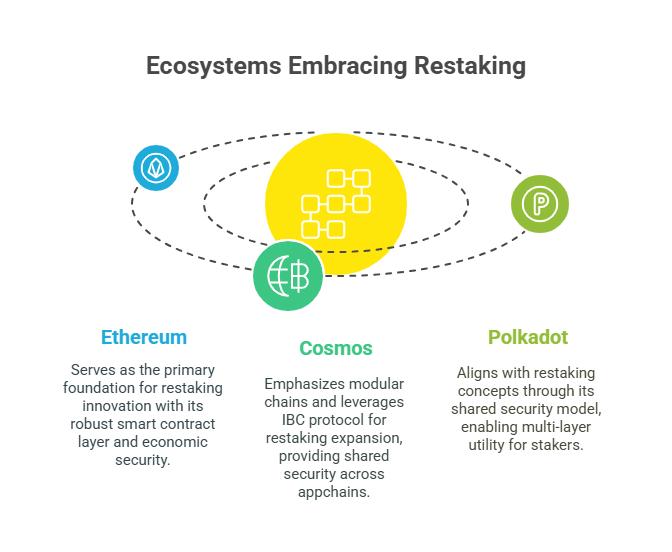

Blockchain Networks That Support Restaking

While Ethereum is currently the most prominent network embracing restaking, several other ecosystems are also integrating similar principles, either directly or through extensions.

Ethereum

Ethereum serves as the primary foundation for restaking innovation. With a massive base of staked ETH and widespread use of LSTs like stETH, rETH, and cbETH, Ethereum offers ideal conditions for protocols like EigenLayer to thrive.

Its robust smart contract layer, combined with Ethereum’s economic security, enables restaking to be executed trustlessly and at scale.

Cosmos

Cosmos’ Inter-Blockchain Communication (IBC) protocol and emphasis on modular chains make it a strong candidate for restaking expansion.

Protocols within the Cosmos Hub could leverage restaked ATOM or other IBC-compatible tokens to provide shared security across sovereign appchains, especially via mesh security or consumer chain models.

Polkadot

Polkadot’s shared security model is inherently aligned with restaking concepts. Parachains on Polkadot already benefit from the relay chain’s security.

However, restaking could further evolve within the ecosystem by enabling parachain tokens to be reused to support third-party services or tools across the network, providing multi-layer utility to DOT and KSM stakers.

Benefits of Restaking

Here are some of the benefits of restaking.

Capital Efficiency and Increased Yields

One of the most compelling advantages of restaking is enhanced capital efficiency. Traditionally, staked assets are locked to a single network or protocol, limiting their utility. With restaking, the same asset, like ETH, can be used to secure multiple systems simultaneously.

This multi-purpose staking means users can earn layered rewards from different protocols while maintaining their initial position. Platforms like EigenLayer exemplify this yield stacking by allowing stakers to earn both Ethereum staking rewards and rewards from securing additional services.

Network Security Enhancement

Restaking strengthens the security landscape of emerging protocols. New or small networks often struggle with limited validator sets and low economic security.

Tapping into already staked assets on a trusted base layer like Ethereum, restaking protocols provide a shared security model that bolsters trust, deters attacks, and supports rapid scaling of decentralized services like rollups, bridges, and oracles.

Boosted Decentralization

Restaking fosters greater validator participation and diversity by enabling stakers to support multiple protocols from a single interface. Instead of each protocol building and maintaining its own validator set (which can lead to fragmentation), restaking allows for collaborative security models that reuse infrastructure and encourage decentralization at scale.

Read Also: Beyond Trading: How to Earn Crypto Rewards and Secure Your Earnings

This benefits smaller, modular blockchains that can now launch with access to hardened, decentralized security networks.

Incentive Alignment Among Participants

Restaking protocols help align the incentives of stakers, validators, and the services that rely on them. Stakers earn more for contributing to broader security, validators increase their revenue for taking on additional duties, and protocols gain access to trusted infrastructure without compromising decentralization. This cooperative ecosystem fosters sustainability and reliability across DeFi and Web3.

“Restaking strengthens the security landscape of emerging protocols by leveraging the economic trust of established networks like Ethereum.”

Risks and Challenges of Restaking

Source: Cosmos Network

Slashing and Double-Signing Risks

The biggest operational risk in restaking is slashing, the loss of a portion or all of a validator’s staked assets due to misconduct, unavailability, or malicious behavior.

When validators take on responsibilities across multiple protocols, they are exposed to compound slashing conditions. Double-signing (signing conflicting blocks or states) in any protocol could result in slashes that affect not just the validator but also all the delegators who restaked through them.

Smart Contract Vulnerabilities

Restaking relies heavily on smart contracts to enforce trustless execution. These contracts, if not thoroughly audited or maintained, can become vectors for exploitation.

Bugs, faulty logic, or vulnerabilities in restaking protocols could result in loss of funds or incorrect enforcement of slashing/rewards. As with any DeFi product, the security of code is paramount.

Centralization Risks

Ironically, while restaking can boost decentralization in theory, in practice, it might lead to validator concentration. Since restaking increases revenue potential, a small group of well-resourced validators could dominate multiple networks simultaneously, creating a central point of failure.

This could harm the decentralization of the protocols they secure and increase systemic risk across the ecosystem.

Liquidity and Lock-up Periods

Some restaking mechanisms involve lock-up periods or reduced liquidity, especially when restaking native staked assets.

Users who restake may face limitations on accessing their funds quickly or participating in other DeFi opportunities. While liquid restaking via LSTs helps mitigate this, it still introduces smart contract and market risks associated with the liquid token.

Regulatory and Compliance Concerns

Restaking introduces legal grey areas, particularly when multiple jurisdictions, financial incentives, and layered protocols are involved.

Regulators may scrutinize whether restaking constitutes a form of financial derivative, investment contract, or pooled security offering. Compliance requirements could eventually impact how protocols implement restaking, especially for institutional or cross-border use cases.

Restaking vs Traditional Staking

Traditional crypto staking involves locking up assets to help secure a blockchain network, typically in exchange for rewards. This staking is usually tied to the protocol’s consensus layer (e.g., staking ETH to validate Ethereum). Once staked, the assets are committed to that network’s security, and their utility is limited to that ecosystem.

Restaking, on the other hand, allows those same staked assets to be reused to secure additional protocols or services, such as data availability layers, rollups, oracles, and bridges.

While traditional staking supports one network, restaking amplifies capital efficiency by enabling multiple layers of service and reward atop the same collateral. In essence, restaking extends the economic reach of staked assets, while traditional staking limits them to a single domain.

| Feature | Traditional Staking | Restaking |

| Security Scope | Single network | Multiple protocols/networks |

| Yield Sources | Native protocol rewards | Staking + restaking protocol rewards |

| Risk Exposure | Limited to one protocol | Compound risks from multiple sources |

| Capital Efficiency | Moderate | High |

Restaking vs Liquid Staking

Liquid staking transforms staked tokens into a liquid representation (like stETH or rETH), allowing users to use their staked assets in DeFi without unbonding them. It boosts flexibility and composability while still earning staking rewards.

Restaking can incorporate liquid staking tokens (LSTs) by allowing them to be used as collateral for securing additional services. In this model, liquid staking is a prerequisite tool, while restaking is a value amplifier. Liquid staking provides liquidity, but restaking builds on top of that liquidity to generate additional utility and reward streams.

| Feature | Liquid Staking | Restaking |

| Liquidity Provided | Yes | Depends (native or liquid) |

| Composability in DeFi | High | Medium to high |

| Reward Streams | Single (staking) | Multiple (staking + restaking) |

| Smart Contract Dependency | Yes | High |

Restaking vs Delegated Proof-of-Stake

Delegated Proof-of-Stake (DPoS) allows token holders to delegate their assets to a small set of elected validators who handle consensus duties. This model prioritizes scalability and governance but often at the cost of decentralization, since power is concentrated among fewer validators.

Restaking, by contrast, doesn’t change how validators are selected but extends their duties. Validators can opt into securing multiple services using the same staked assets.

Unlike DPoS, which emphasizes representative validation, restaking enhances validator utility without altering governance mechanics. However, it does risk validator centralization due to higher incentive accumulation.

| Feature | Delegated Proof-of-Stake | Restaking |

| Validator Selection | Community-elected | Open (opt-in by validators) |

| Governance Participation | High (delegators vote) | Not tied to protocol governance |

| Purpose | Consensus scalability | Shared security and capital reuse |

| Centralization Risk | High | Medium to high |

“Enabling capital reuse and layered rewards, restaking transforms passive staking into an active engine for multi-protocol security and yield.”

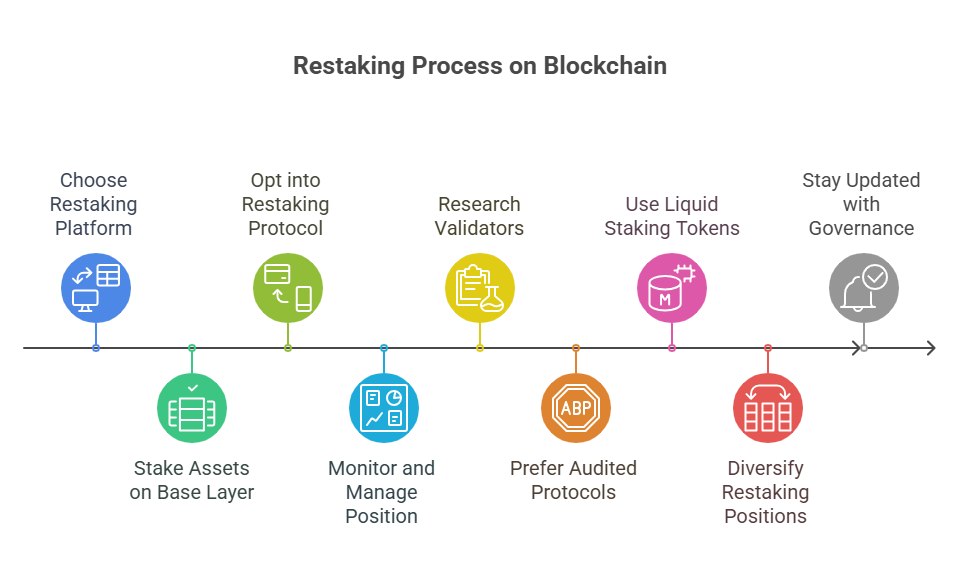

How to Start Restaking

Source: Napkin.ai

Choosing a Restaking Platform

Getting started with restaking begins with selecting the right platform. The most popular and pioneering option is EigenLayer, which operates on Ethereum and supports restaking of native ETH and various liquid staking tokens (LSTs) like stETH, rETH, and cbETH. When choosing a restaking protocol, consider:

- Asset compatibility (native vs LSTs)

- Supported services (e.g., oracles, rollups, bridges)

- Security audits and reputation

- Reward structure

- User experience and management tools

Other alternatives like Karak and emerging protocols on chains like Cosmos and Polkadot may also provide restaking options tailored to different ecosystems.

Steps to Restake Assets

Stake on Base Layer

First, your assets must be staked on the base layer blockchain, for example, ETH staked on Ethereum. You can do this via solo staking, staking-as-a-service, or through liquid staking providers like Lido or Rocket Pool.

Opt into Restaking Protocol

Next, you opt into a restaking protocol. This involves connecting your wallet to the restaking platform and giving permission to restake your base-layer or liquid-staked assets. Depending on the protocol, you may be able to choose specific Actively Validated Services (AVSs) that your stake will help secure.

Monitor and Manage Your Position

Once restaking is live, it’s important to monitor your rewards, exposure to slashing risks, and validator performance. Many platforms provide dashboards to track yields, AVS participation, and validator behavior. Some protocols may also allow redelegation or dynamic allocation as new services emerge.

Tips for Safe Participation

- Research validators before restaking through them, ensure they have a good track record.

- Prefer restaking through audited and transparent protocols.

- Use liquid staking tokens for more flexibility and lower lock-up risk.

- Diversify your restaking positions across AVSs and validators.

- Stay updated with governance and protocol changes that may affect slashing or yield rules.

Economics of Restaking in Crypto

Source: Freepik

Yield Mechanisms and Incentives

Restaking provides multiple layers of yield:

- Base-layer staking rewards (e.g., ETH staking returns)

- Restaking protocol incentives, which may include native tokens, AVS-generated fees, or inflationary rewards

- Bonus incentives (e.g., airdrops or governance incentives)

These combined returns can outpace traditional staking, but come with higher complexity and risk.

Reward Distribution Models

Reward distribution varies by platform but generally involves:

- Validator commission splits: Validators may take a cut from rewards earned through AVS participation.

- Protocol-defined reward pools: Restaking protocols may allocate fixed rewards to participants who secure certain services.

- Dynamic or usage-based rewards: Some services distribute rewards based on how much they use the validator set (e.g., data availability or compute usage).

Proper configuration ensures that stakers are compensated proportionally to their risk and contribution.

Impact on Token Supply and Demand

Restaking can influence token economics in several ways:

- Increased demand for staking (and restaking) may reduce circulating supply, potentially supporting price stability.

- New incentive tokens from restaking protocols might introduce inflationary pressures unless carefully managed.

- The reuse of LSTs can increase liquidity and token velocity in DeFi, potentially stimulating more utility-driven demand.

- If poorly designed, reward mechanisms might create yield-chasing behaviors, leading to unsustainable token emissions.

Conclusion

Restaking enables you to reuse already staked assets across multiple protocols. It enhances capital efficiency, strengthens network security, and opens new avenues for yield generation.

Unlike traditional staking methods that tie assets to a single chain or purpose, restaking introduces a dynamic, multi-layered approach to securing decentralized services like rollups, oracles, and data availability layers. However, with these opportunities come added risks, such as slashing, smart contract vulnerabilities, and potential centralization, which must be carefully managed.

In essence, restaking advances how blockchain security and capital are deployed across the decentralized world.

FAQs

Restaking in crypto refers to the practice of reusing assets that have already been staked on a blockchain to secure additional decentralized services or protocols. Leveraging staked assets across multiple layers, restaking enhances capital efficiency and increases potential yields while contributing to the security of various Web3 ecosystems.

Restaking comes with certain risks, such as slashing (penalties for validator misbehavior), smart contract vulnerabilities, and liquidity constraints. While restaking platforms undergo rigorous security audits, users should be aware of the risks associated with staking and restaking assets across multiple protocols. To mitigate risks, it’s advisable to choose reputable platforms, diversify your positions, and monitor validator performance.

Restaking is ideal for experienced crypto users and investors who have a strong understanding of blockchain staking and are looking to maximize the utility of their staked assets. Those with a long-term investment strategy, and those comfortable with monitoring multiple protocols and reward systems, should consider restaking. Additionally, users who already participate in staking and want to diversify or increase their yield potential may benefit from restaking.

Liquid staking allows users to stake their assets while maintaining liquidity by receiving a tokenized representation of their staked assets, which can be used in DeFi. Restaking, on the other hand, focuses on using already staked assets to secure additional protocols beyond the base layer. While liquid staking offers flexibility, restaking increases the capital efficiency of staked assets by allowing them to serve multiple purposes at once, often within specialized decentralized services.

Yes, there are risks of losing funds in restaking, especially if a validator commits misbehavior (like double-signing or failing to participate), which could result in penalties or slashing. Additionally, vulnerabilities in smart contracts or incorrect protocol configurations may expose users to further risks. Properly researching platforms, understanding slashing risks, and monitoring positions can help mitigate these losses.

Some of the leading platforms for restaking include EigenLayer, which enables restaking on Ethereum, and other emerging protocols in the Cosmos and Polkadot ecosystems. Each platform supports different asset types and services, so it’s essential to choose one that aligns with your staking preferences and the protocols you wish to secure.

While you don’t need deep technical knowledge to start restaking, having an understanding of how staking and restaking protocols work will certainly help. Basic knowledge of how validators operate, how to use Web3 wallets, and how to manage risks like slashing and rewards tracking is beneficial. Most platforms offer user-friendly interfaces to guide you through the process.

Yes, restaking rewards are typically subject to taxation, just like other types of cryptocurrency earnings. The tax treatment may vary depending on your jurisdiction, so it’s important to consult with a tax professional or accountant to understand how restaking rewards will be taxed in your region.

Assets that can be restaked generally include native tokens staked on a blockchain (such as ETH on Ethereum) or liquid staking tokens (like stETH, rETH, or cbETH) representing staked assets. The specific assets that can be restaked depend on the platform and the supported protocols, so it’s important to verify compatibility before participating.