U.S. spot crypto ETFs closed December 11 with sharply divided flows, as investors pulled capital from Bitcoin and Ethereum products while rotating into Solana-linked funds. The day marked a clear pause in the inflow streak seen earlier in the week and highlighted how selective institutional positioning has become as traders reassess risk across the market.

- BTC ETFs: −$77.34 million

- ETH ETFs: −$42.37 million

- SOL ETFs: +$11.02 million

The contrasting movements underscored a shift in short-term sentiment. Bitcoin and Ethereum, long viewed as the default institutional exposures, faced notable selling pressure, while Solana continued to attract steady interest despite broader caution.

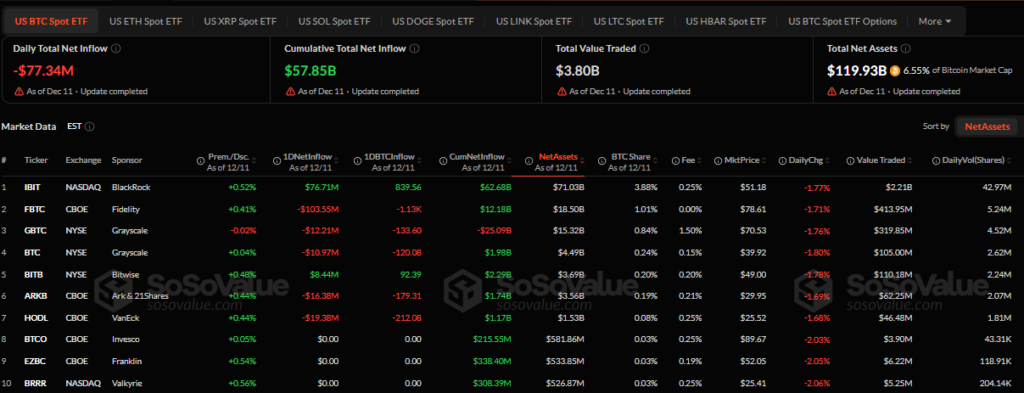

Bitcoin ETFs Lead the Outflows

Bitcoin ETFs accounted for the largest withdrawals on the day, posting a combined net outflow of $77.34 million. The bulk of the selling pressure came from Fidelity’s spot Bitcoin ETF, which alone saw more than $100 million leave the fund. That single move outweighed modest inflows elsewhere and set the tone for the day’s negative headline number.

Other major Bitcoin products also recorded redemptions. VanEck’s HODL and Ark & 21Shares’ ARKB both saw capital exit, while Grayscale’s legacy GBTC and its Bitcoin Mini Trust added further pressure. Together, these outflows pointed to coordinated trimming rather than isolated fund-specific issues.

Still, the picture was not uniformly bearish. BlackRock’s IBIT absorbed a sizeable inflow during the session, and Bitwise’s BITB also ended the day in positive territory.

Those gains, however, were not enough to offset the heavier selling across competing products. Total trading activity in Bitcoin ETFs remained elevated, suggesting that investors were actively repositioning rather than stepping away from the market altogether.

The scale of withdrawals from a flagship product like Fidelity’s FBTC suggests more than retail hesitation. Institutional allocators appear to be managing short-term exposure, possibly locking in profits after recent price moves or adjusting risk ahead of macro events that could influence liquidity and interest-rate expectations.

“Bitcoin ETFs recorded a total net outflow of $77.34 million, led by heavy redemptions from Fidelity’s FBTC.”

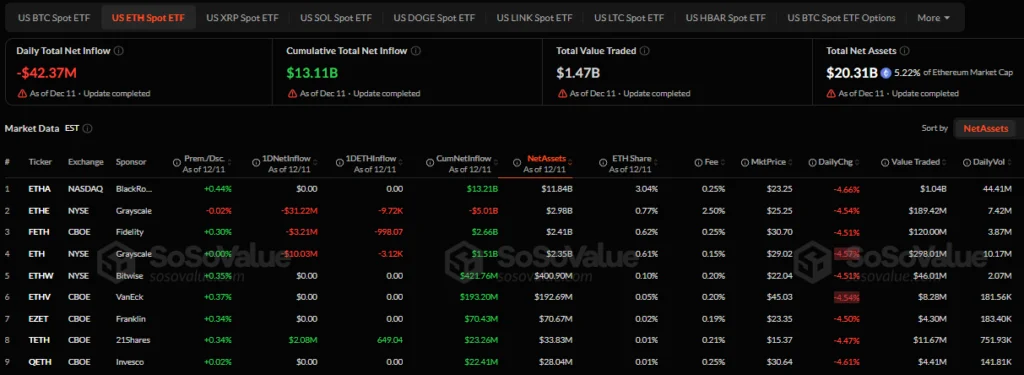

Ethereum ETFs Follow a Similar Path

Ethereum ETFs mirrored Bitcoin’s trend, though on a smaller scale. Spot Ether products collectively saw $42.37 million in net outflows, extending a period of softer demand compared with other parts of the market.

Grayscale’s Ethereum offerings accounted for most of the downside, with its main ETHE product and the Ether Mini Trust both posting meaningful withdrawals. Fidelity’s FETH also contributed to the day’s negative total, reinforcing the sense that investors were broadly dialing back ETH exposure rather than targeting a single issuer.

One fund stood apart. 21Shares’ TETH was the only Ethereum ETF to record net inflows during the session, attracting a modest but notable amount of new capital. While small in absolute terms, the inflow highlighted that investor interest in Ethereum has not disappeared entirely. Instead, it appears more selective, with capital favoring specific structures or fee profiles.

Ethereum’s recent performance has lagged behind Bitcoin and some high-beta alternatives, and that relative weakness seems to be reflected in ETF flows. For many institutions, ETH currently sits in a middle ground—less defensive than Bitcoin, yet facing stronger competition from faster-moving Layer 1 networks.

“Spot Ethereum ETFs saw $42.37 million in net outflows, with 21Shares’ TETH standing out as the sole product to attract inflows.”

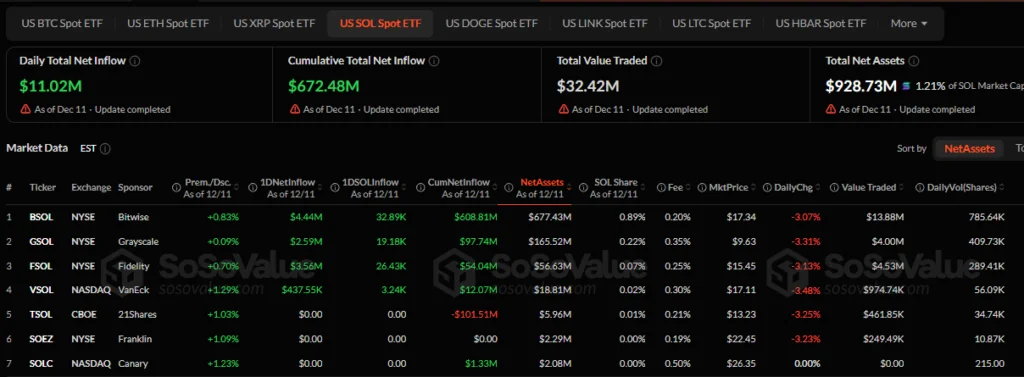

Solana Stands Out With Fresh Inflows

Against this backdrop of caution, Solana emerged as the clear outlier. Spot Solana ETFs recorded $11.02 million in net inflows on December 11, extending a strong weekly trend and reinforcing the network’s growing appeal among professional investors.

Inflows were spread across multiple issuers, with Bitwise, Fidelity, Grayscale, and VanEck all seeing additions to their Solana products. The broad-based nature of the demand suggests that interest in SOL is not confined to a single brand or distribution channel.

Solana’s appeal has been fueled by a combination of factors: improving network stability, an active developer base, and strong performance across DeFi and consumer-facing applications. For institutions looking beyond Bitcoin and Ethereum, Solana increasingly represents a liquid way to express a higher-growth thesis within the ETF wrapper.

“Solana spot ETFs attracted $11.02 million in net inflows, bucking the broader outflow trend seen in Bitcoin and Ethereum products.”

Capital Rotation, Not a Market Exit

Taken together, the day’s flows point to rotation rather than retreat. Capital leaving Bitcoin and Ethereum did not exit the crypto ETF market entirely; instead, a portion of it appears to be reallocating toward alternative assets such as Solana and XRP, both of which continued to post inflows.

XRP ETFs, in particular, added another $16.42 million during the session, reinforcing the idea that investors are spreading exposure across multiple narratives rather than concentrating solely on the two largest cryptocurrencies.

This behavior aligns with a market that is becoming more tactical. After periods of strong inflows, investors often rebalance, trimming overweight positions and adding exposure where momentum or fundamentals appear more compelling. December 11 fit that pattern, with conviction clearly split across asset classes.

Trading volumes across Bitcoin and Ethereum ETFs remained high, signaling active participation even as net flows turned negative. That combination often reflects hedging, profit-taking, and relative-value positioning rather than outright bearishness.

What the Flows Signal

The sharp contrast between Bitcoin and Ethereum outflows and Solana inflows offers insight into how institutional sentiment is shifting late in the year. Bitcoin remains the primary store-of-value play, but its size and maturity can make it the first asset trimmed when investors reduce risk. Ethereum, while foundational, is facing tougher comparisons as newer networks gain traction.

Solana’s steady inflows suggest that some institutions are increasingly comfortable allocating to higher-performance blockchains through regulated products. The ETF structure lowers operational friction, making it easier to adjust exposure quickly as narratives change.

December 11 may not define a lasting trend on its own, but it highlights a market that is no longer moving in lockstep. Crypto ETF flows are becoming more nuanced, with investors expressing differentiated views rather than treating the sector as a single trade.

As the final weeks of the year unfold, these daily flow patterns will remain a key signal to watch—offering real-time insight into where institutional confidence is building, and where caution is setting in.

No related posts.