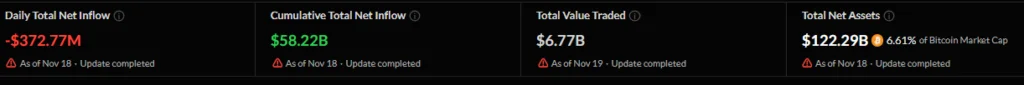

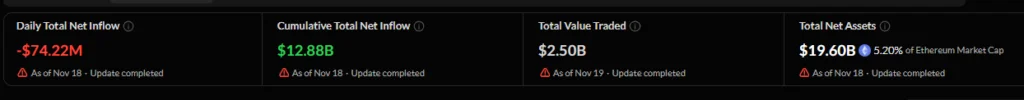

The crypto market witnessed a sharp shift in institutional positioning on November 18 as spot ETF flows painted a contrasting picture across the top digital assets. Bitcoin and Ethereum saw major capital exit their ETF products, while Solana continued its impressive run with fresh inflows.

BTC ETFs recorded $372.8 million in outflows, marking one of the largest single-day withdrawals in recent weeks. ETH ETFs followed with $74.2 million in outflows. Meanwhile, Solana stood out as the only major asset to attract capital, securing $26.2 million in new inflows.

This divergence highlights a broader realignment in investor sentiment and raises key questions about how institutions are navigating current market conditions.

Bitcoin and Ethereum ETFs See Heavy Withdrawals

BTC Outflows Signal Risk-Off Positioning

Bitcoin’s $372.8M outflow reflects a clear risk-off approach among institutional players. The size of the withdrawal suggests that large investors are either locking in profits or moving to reduce exposure amid market uncertainty.

- Factors likely driving this movement include:

- Tighter liquidity across global markets

- Concerns over potential short-term corrections

- Capital rotation into perceived high-growth alternatives

Several major BTC ETF issuers reported redemption pressures throughout the day, contributing to softer price action and lighter market depth.

ETH Outflows Reinforce Concerns Around Market Momentum

Ethereum also felt the pressure, with $74.2M in ETF outflows. While smaller than Bitcoin’s figure, the consistency of ETH withdrawals points to a shift in preference among investors who appear increasingly cautious about Ethereum’s near-term performance.

The withdrawal pattern aligns with ongoing discussions about:

- Rising gas fees

- Slower staking growth

- Decreasing DeFi activity

- ETH lagging behind competitors in relative strength

The simultaneous decline in BTC and ETH ETF flows reflects a broader cooling across major-cap assets.

Solana Defies Market Weakness With Strong Inflows

Institutional Interest in SOL Continues to Grow

While BTC and ETH struggled, Solana recorded $26.2M in ETF inflows, extending a trend that has become increasingly difficult to ignore. The positive flow suggests institutions are not only watching Solana’s progress but are actively accumulating positions.

Solana’s appeal stems from:

- High transaction throughput and low fees

- A rapidly expanding developer ecosystem

- Increasing demand from both retail and institutional investors

- Strong performance compared to other L1 assets

On a day defined by redemptions elsewhere, Solana’s inflow reinforces its growing reputation as a top alternative Layer-1 contender.

A Rotation Trade Into High-Growth Assets

ETF flow data shows a clear rotation at play. Investors appear to be temporarily shifting capital out of the largest assets and into faster-moving, high-growth opportunities such as Solana.

This does not necessarily signal long-term abandonment of BTC or ETH. Instead, it suggests that institutions are seeking better near-term upside while major assets consolidate.

What These ETF Flows Mean for the Market Now

Short-Term Pressure on BTC and ETH

Large outflows often precede weaker price performance. If withdrawals continue, Bitcoin could retest support zones while Ethereum may face difficulty regaining momentum. Reduced ETF liquidity can also translate into lower confidence among short-term traders.

Solana’s Relative Strength Positions It as a Market Outperformer

Even modest inflows during a risk-off session show that Solana enjoys strong institutional backing. If broader market conditions stabilize, SOL could continue gaining market share against its larger rivals.

ETF Flows Are Becoming a Leading Indicator

As ETF-driven trading grows, daily flow data is emerging as a key indicator for:

- Institutional sentiment

- Short-term liquidity trends

- Potential price direction

The November 18 flow numbers highlight how quickly capital can shift—and how closely the market now tracks these movements.

No related posts.