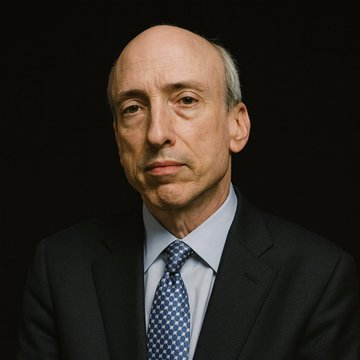

Former SEC Chair Gary Gensler has once again taken a hard line on the cryptocurrency sector, warning that most digital assets—except Bitcoin—remain highly speculative and volatile despite years of rapid market growth and institutional involvement.

In a new interview with Bloomberg, Gensler reiterated a position he held throughout his term as SEC Chairman from 2021 to 2025: that thousands of crypto tokens circulating today offer little to no fundamental value and carry significant risk for retail and institutional investors.

Key Takeaways

- Former SEC Chair Gary Gensler warns that all cryptocurrencies except Bitcoin remain highly speculative and lack fundamental value.

- Bitcoin is singled out as a commodity-like asset, while thousands of altcoins pose significant risk to investors.

- Vanguard’s reversal on crypto access triggers major institutional inflows and boosts market momentum across major digital assets.

- Bitcoin rebounds toward $92,000 following Fed liquidity actions and improving macroeconomic sentiment.

Gensler Draws a Clear Line Between Bitcoin and Other Crypto Assets

Gensler Says Bitcoin Remains ‘Speculative, Volatile’

Gensler emphasized that Bitcoin stands apart from the wider crypto market in the eyes of regulators. He pointed out that while Bitcoin is generally viewed as a commodity, the vast majority of other tokens resemble speculative investment products with unclear backing.

“The American public and the worldwide public have been fascinated with cryptocurrencies. But it’s a highly speculative, volatile asset,” Gensler said.

“And putting aside Bitcoin for a minute, all the thousands of other tokens, not the stablecoins that are backed by US dollars, but all the thousands of other tokens, you have to ask yourself what’s the fundamentals, what’s underlying it.”

He stressed that these assets typically generate no dividends, no tangible returns, and no underlying revenue, making them dependent almost entirely on market sentiment.

His comments echo years of SEC enforcement actions aimed at exchanges and token issuers he argued were operating outside U.S. securities laws.

Crypto Not Seen as a Partisan Battle

Gensler also rejected the idea that cryptocurrency has become a deeply political issue. When asked whether the Trump administration’s involvement in the sector had discouraged some investors or shifted partisan attitudes, he avoided discussing Trump directly and instead argued that crypto oversight is simply a matter of market integrity.

He maintained that protecting U.S. capital markets—not political preference—should guide discussions about the future of digital assets.

Bitcoin Rebounds Toward $92,000 as Institutions Shift Course

Gensler’s remarks arrived at a pivotal moment in the market. Bitcoin surged back toward $92,000 following a volatile week tied to global bond market turbulence and liquidity shocks.

The rebound coincided with a major development: Vanguard, one of the world’s largest asset managers with more than $11 trillion under management, reversed its long-standing opposition to crypto.

In a dramatic policy shift, Vanguard allowed its 50 million customers to trade Bitcoin, Ethereum, Solana, and XRP ETFs. The move—driven by new CEO Salim Ramji, who previously helped architect BlackRock’s Bitcoin ETF—sparked immediate trading activity. BlackRock’s IBIT ETF alone saw $1 billion in volume within 30 minutes of market open.

Bloomberg ETF analyst Eric Balchunas highlighted Bitcoin’s quick 6% price jump shortly after trading began under Vanguard’s new policy.

This marks a complete reversal from the firm’s 2024 position, when it insisted crypto did not belong in long-term retirement portfolios. Now, Vanguard is offering spot crypto ETFs from BlackRock, Fidelity, VanEck, Bitwise, and Grayscale.

Even conservative allocation models suggest enormous inflow potential: a 0.5% allocation of Vanguard’s assets equals roughly $55 billion, surpassing the entire first-year inflows of the 2024 ETF cycle.

Market Responds Across Major Assets

The institutional pivot fueled gains across the crypto market:

- Ethereum rose 8.3% to $3,040

- XRP climbed 7.6% to $2.18

- Total crypto market capitalization expanded 6.5% to $3.22 trillion

Meanwhile, Bitcoin’s rally was supported by new liquidity from the Federal Reserve after the central bank ended quantitative tightening and injected $13.5 billion into the system through overnight funding operations.

Analysts noted that exchange reserves fell to 2.19 million BTC, a multi-year low that typically strengthens buying pressure. Technical traders now see major resistance near $96,000, with support around $87,800.

Altcoins Show Strength But Still Carry Higher Risk

Although Gensler insists most cryptocurrencies lack fundamental value, today’s industry is far more structured than the one he originally regulated.

Leading altcoins such as Ethereum, Solana, XRP, BNB, Cardano, and Chainlink now have:

- Large developer ecosystems

- Deep liquidity

- Global user bases

In some cases, ETF approvals and major institutional holders

Still, these assets are more volatile than Bitcoin, and many traders acknowledge Gensler’s warnings remain relevant for smaller tokens, particularly meme coins like PEPE, FLOKI, and TRUMP, which often rely heavily on social enthusiasm rather than long-term utility.

Some analysts argue that while Gensler’s critique may apply to thousands of low-value tokens, it no longer accurately reflects the broader crypto market. As crypto influencer CryptoRus put it, the industry has moved far beyond the 2017-style “whitepaper coins,” and now behaves more like a global macro asset class.

Macroeconomic Forces Shape Crypto’s Direction

Traditional markets also played a role in this week’s crypto movement. Following a global bond selloff triggered by Japanese rate-hike expectations, the Federal Reserve’s shift toward easier conditions helped stabilize sentiment.

Markets now price in an 80% chance of a 25-basis-point rate cut at the Fed’s December meeting, up from 63% one month earlier, though Fed officials remain cautious about inflation.

Gensler also briefly addressed broader market infrastructure concerns, downplaying a 10-hour outage at the Chicago Mercantile Exchange during Thanksgiving. He said he expected management would respond differently if the failure had occurred during regular trading hours.

A Familiar Warning in a New Market Environment

Gensler’s latest comments show he hasn’t softened his concerns about crypto speculation. His message remains the same: Bitcoin is distinct, stablecoins have clearer backing, and most other tokens pose substantial risk.

But the American and global markets he once tried to regulate have changed dramatically. Institutional players now drive major price swings, ETFs dominate trading volume, and crypto increasingly reacts to central bank policy rather than pure hype.

While Gensler continues to urge caution, much of the industry—and its largest financial backers—appear to be moving in a different direction.

No related posts.