A quiet shift is taking place in how young Americans think about information, forecasting, and even finance itself. Instead of relying solely on polls, pundits, or traditional betting platforms, a growing share of Gen Z and Millennials are turning to prediction markets—and they believe these platforms are on track to become a major part of everyday culture.

Recent survey data from consumer research firm The New Consumer, produced in collaboration with Coefficient Capital, shows that 31% of Americans expect prediction markets to grow into a bigger and more influential cultural force.

That headline figure, however, hides a sharp generational divide. Among younger Americans, enthusiasm and awareness are far higher, signaling a long-term shift rather than a short-lived trend.

“A third of young Americans think prediction markets are the future. And they’re putting their money where their mouth is.”

Key Takeaways

- 31% of Americans, especially younger generations, believe prediction markets will play a bigger cultural role.

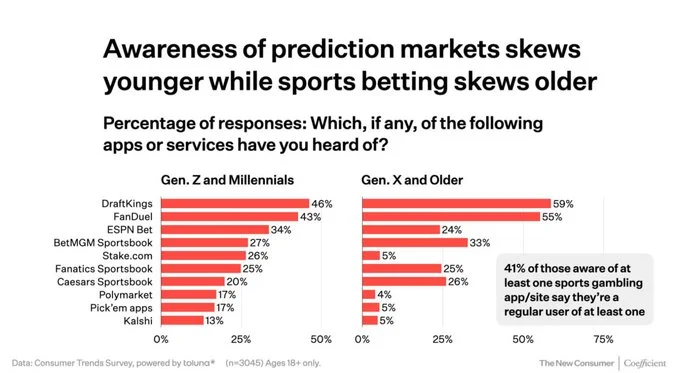

- Gen Z and Millennials show significantly higher awareness of platforms like Polymarket (17%) and Kalshi (13%) than older generations.

- Kalshi and Polymarket now have a combined valuation of $20 billion with weekly trading volumes in the billions.

- Public interest remains strong, with search activity 20–30 times higher than pre-2024 election levels.

- Regulatory changes and recent legal victories have cleared the way for prediction markets to expand alongside sports betting.

A Clear Generational Divide

Prediction markets allow users to trade on the likelihood of real-world events—from elections and economic data to sports outcomes—using market prices as a signal of probability. While the concept has existed for years, it is younger consumers who are now driving adoption.

According to the survey, 17% of Gen Z and Millennials are aware of Polymarket, compared with just 4% of Gen X and older respondents.

Kalshi follows a similar pattern, with 13% awareness among younger users versus 5% among older generations. This gap mirrors how younger audiences gravitate toward new information platforms long before they reach the mainstream.

The researchers behind the report emphasize that their work is independent. The New Consumer focuses on identifying emerging market trends and consumer behavior, and its reports—developed alongside Coefficient Capital—are not commissioned by the companies being analyzed.

Capital Is Flowing In Fast

The growing cultural interest is being matched by serious money. The survey, which polled more than 3,000 U.S. consumers through Toluna, arrived as prediction markets began attracting capital at a pace rarely seen in niche financial platforms.

Kalshi recently raised $1 billion, pushing its valuation to $11 billion. Around the same time, Intercontinental Exchange, the owner of the New York Stock Exchange, invested $2 billion in Polymarket, valuing the platform at $9 billion. Combined, the two firms now carry an estimated $20 billion valuation.

That capital is being put to work quickly. Trading volumes on both platforms have surged to record levels.

“The chart has generally stayed up and to the right since the start of the year.”

Kalshi is now processing roughly $1.7 billion to $2.3 billion in weekly volume, while Polymarket regularly sees $1 billion to $1.7 billion per week, based on widely cited on-chain analytics dashboards. Growth has been consistent, week after week, pointing to sustained usage rather than one-off spikes.

Search Interest Signals Staying Power

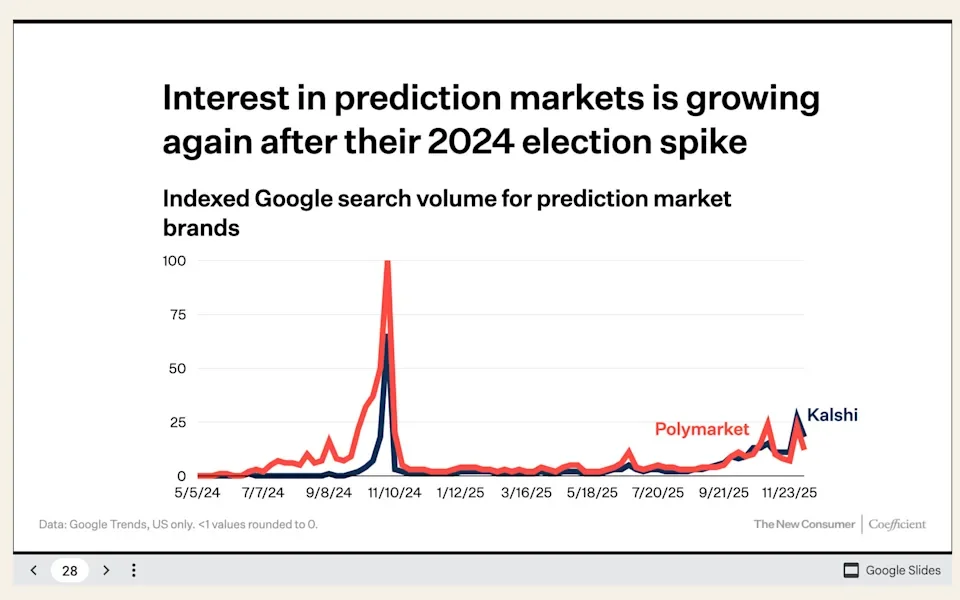

Public curiosity around prediction markets peaked during the 2024 U.S. election, when election-based contracts drew global attention. While search traffic cooled after the election cycle ended, interest never returned to old lows.

Google Trends data shows that searches related to prediction markets are still running 20 to 30 times higher than pre-election levels. That baseline reset suggests prediction markets have crossed from novelty into ongoing relevance—especially among digital-native users who treat markets as information tools, not just betting venues.

Regulation Stops Blocking—and Starts Clearing

For years, regulation was the biggest obstacle facing prediction markets in the United States. That stance has softened considerably.

Under CFTC Chairman Michael Selig, regulators have adopted what industry participants describe as a more forward-looking approach—signaling tolerance rather than hostility. This shift has already reshaped the landscape.

Polymarket, which exited the U.S. market in 2022, returned in late 2025 with full regulatory approval.

Kalshi, after winning a major legal battle against the CFTC in May 2025, gained the ability to offer federal-level election markets. While Kalshi still faces resistance from some state regulators—particularly in states with legal sports betting—the broader direction of policy is now clearer than it has been in years.

For younger users, these legal battles appear to be background noise rather than deal-breakers.

Prediction Markets vs. Sports Betting

One of the most revealing parts of the survey asked respondents to compare the future cultural importance of sports betting and prediction markets. The results were surprisingly close.

About 34% said sports betting would become more important in everyday life, while 31% said the same for prediction markets—a statistical tie. Another 38–39% believe both will largely maintain their current roles.

That parity matters. Sports betting already enjoys mass adoption, major advertising budgets, and regulatory clarity in many states. For prediction markets to be mentioned in the same breath—especially by young Americans—signals a meaningful change in perception.

Rather than viewing prediction markets as gambling, many younger users see them as a hybrid of finance, data analysis, and real-time forecasting.

The Next Stress Test: 2026 FIFA World Cup

The next major test may come sooner than expected. The 2026 FIFA World Cup is projected to generate $35 billion in bets globally, making it one of the largest betting events in history. Whether prediction markets can capture a meaningful share of that attention will help determine whether their recent momentum holds—or fades.

Skeptics argue that the sector could be overheating, driven by hype, regulatory luck, and speculative capital. Supporters counter that prediction markets offer something traditional betting and media cannot: continuously updated probability signals shaped by financial incentives.

For now, the data points in one direction. Awareness is rising fastest among younger generations, capital continues to pour in, and regulatory pressure has eased rather than intensified.

Whether prediction markets become a core part of finance or remain a specialized tool is still an open question. But if Gen Z and Millennials are right, these markets are no longer on the fringe—and they’re not going away anytime soon.