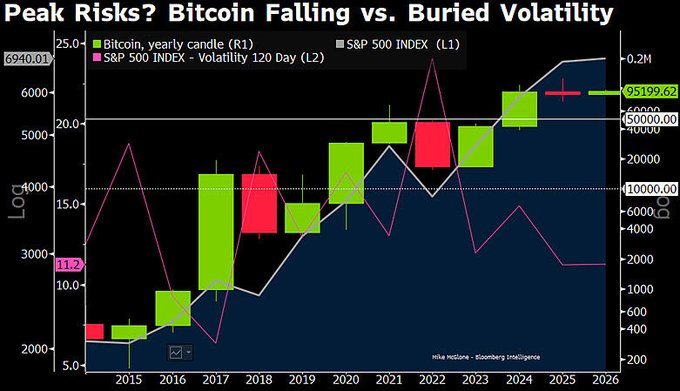

Bitcoin is facing renewed scrutiny after a fresh warning from Bloomberg Intelligence senior commodity strategist Mike McGlone, who believes the leading cryptocurrency may be approaching a prolonged period of mean reversion.

His outlook raises the possibility of a deep corrective phase following what he describes as a 2025 rollover, with downside risks that could see Bitcoin retrace toward the $10,000 level.

McGlone’s view is rooted in historical market behavior rather than short-term price noise. He argues that assets which significantly outperform their long-term averages often experience extended corrections as valuations normalize.

In Bitcoin’s case, years of rapid appreciation, institutional adoption, and speculative inflows may now be giving way to a more sobering adjustment phase.

“Bitcoin may be entering a long-term mean reversion,” McGlone cautioned, pointing to structural signals that suggest the market could be past its peak momentum for this cycle.

Why the $10,000 Level Matters

The $10,000 price zone is not a random figure. It has historically acted as a psychological and technical reference point for Bitcoin, marking both resistance during earlier bull markets and support during periods of stress.

McGlone’s projection does not imply an imminent crash but highlights the scale of downside that could emerge if broader risk markets weaken and liquidity conditions tighten.

He warned that after the 2025 rollover, Bitcoin faces “risks of a move toward $10,000,” emphasizing that mean reversion can unfold over years rather than months.

Implications for Investors

This warning arrives at a time when many investors remain optimistic about Bitcoin’s long-term role as a store of value and hedge against monetary debasement. However, McGlone’s analysis serves as a reminder that even widely adopted assets are not immune to cyclical drawdowns.

For traders and long-term holders alike, the message is clear: risk management and realistic expectations are essential, especially as macroeconomic pressures and market maturity reshape Bitcoin’s price behavior.

While Bitcoin’s long-term narrative remains intact for many proponents, McGlone’s caution underscores the possibility that the next phase may test conviction more than enthusiasm.

No related posts.