Plutus is a London based fintech company founded in 2015 with a mission to help bridge the gap between traditional finance and cryptocurrency.

Most standard debit cards don’t bridge that gap, leaving crypto users stuck converting assets manually or paying hefty fees just to spend their holdings. That’s where crypto-linked debit cards come in, offering a way to use digital assets seamlessly in the real world.

The demand for crypto debit cards has grown rapidly in recent years as more people look for flexible ways to earn rewards, pay globally, and combine their financial lives into one platform. Whether it’s for travelers avoiding high foreign transaction fees, or investors who want to maximize crypto rewards on daily purchases, these cards are becoming a key tool in modern finance.

The Plutus Debit Card stands out in this space by combining Visa-powered payments with crypto cashback rewards and unique lifestyle perks. It’s not just a card, it’s part of a larger ecosystem that includes a wallet for both fiat and crypto, plus access to a decentralized exchange.

In this review, we’ll explore everything you need to know about the Plutus Debit Card from features and fees to rewards and real user feedback. We’ll also compare it to other strong alternatives, so you can decide if it’s the right fit for your needs in 2025.

And if you’re interested in trading, platforms like UEEx are also worth noting. UEEx is a leading crypto exchange known for low-cost trading and reliable tools for both beginners and advanced traders.

Key Takeaway

- The Plutus Debit Card is a crypto-powered Visa card that lets you spend your cryptocurrencies like cash

- Every time you use the Plutus card, you can earn up to 3% cashback in PLU

- Transaction fees and limits depend on your subscription plan and can change anytime

- Plutus operates in the UK and Europe but isn’t a traditional bank.

- Higher tiers require staking PLU tokens and benefits include access to more perks,

What is the Plutus Debit Card?

The Plutus Debit Card is a crypto-linked Visa card that allows users to spend both traditional money (fiat) and cryptocurrencies in everyday life. Unlike a standard debit card tied only to your bank account, the Plutus card connects to a wallet that supports both fiat and digital assets, giving users the freedom to move between the two.

This setup makes it especially appealing to people who want to use their crypto holdings for regular purchases without going through a complicated exchange process every time.

The card is issued by Plutus, a fintech company founded in 2015 that focuses on bridging the gap between traditional finance and decentralized finance (DeFi). Over the years, the company has built an ecosystem that includes not just the debit card but also a mobile app, a non-custodial wallet, and access to a decentralized exchange (DEX). Together, these tools make Plutus more than just a card, it’s a platform designed for crypto-savvy consumers.

So, who is the Plutus Debit Card for? It’s primarily targeted at crypto enthusiasts, digital nomads, and rewards seekers. If you want to earn cashback in crypto while paying for groceries, Netflix, or your next flight, this card is designed with you in mind. It also appeals to people who value flexibility, since it gives them the ability to manage both fiat and crypto in a single account.

What sets the Plutus Debit Card apart from traditional debit cards is its reward structure and Web3 integration. Instead of offering generic points or cashback in fiat, Plutus pays users in its native token, PLU. On top of that, users can enjoy subscription rebates for popular services like Spotify and Netflix, which adds an extra layer of value.

Technologically, the card runs on the Visa network, making it widely accepted in millions of locations worldwide. Currently, it’s available across the UK and European Economic Area (EEA), with plans to expand further. While it’s not yet a global product, it already covers a large region where crypto adoption is strong.

In short, the Plutus Debit Card is a modern payment tool built for people who want to combine the benefits of crypto with the everyday convenience of Visa payments.

Quick Facts Table

| Card Network | Visa (accepted worldwide) |

| Annual Fee | Free tier available; Premium £4.99/month; Titanium £14.99/month; Titan £24.99/month |

| APR Range | Not applicable (prepaid debit, not a credit card) |

| Welcome Offer | None (occasional promos may apply) |

| Rewards Rate | Up to 3% crypto cashback in PLU + perks worth up to 15% |

| Foreign Transaction Fees | No fees on foreign currency spending within supported regions |

| Credit Check Required | No (account setup requires KYC verification only) |

| Personal Guarantee Required | No |

| Minimum Requirements | Must be a resident in the UK or EEA; KYC verification; subscription tier chosen |

| Application Timeline | Typically approved within minutes to a few days after verification |

Key Features of the Plutus Card

The Plutus Debit Card is more than just a way to spend crypto, it’s designed as an all-in-one financial tool that combines payments, rewards, and Web3 access. To get a clearer picture, let’s walk through its most important features in detail.

Core Features

At its heart, the Plutus Debit Card functions like any Visa debit card, but with an added crypto layer. Here are the main features that make it stand out:

Fiat + Crypto Wallet Integration

Plutus provides a built-in wallet that supports both euros/GBP and cryptocurrencies. You can move funds between your fiat balance and crypto holdings, making it easy to pay for purchases in either format.

Visa-Powered Spending

Since the card runs on the Visa network, it’s accepted at millions of locations worldwide. That makes it just as practical as a traditional debit card, but with crypto earning potential layered on top.

Cashback in PLU

Every eligible purchase earns rewards in Plutus’ native token, PLU, instead of generic points. This creates upside if the token increases in value, though it also carries volatility risks.

Lifestyle Perks

Plutus offers subscription rebates for services like Spotify, Netflix, and Disney+. These perks are funded through PLU rewards, essentially giving you a “crypto-back” rebate on everyday services.

Decentralized Exchange (DEX) Access

Unlike most debit cards, Plutus connects to a decentralized exchange where users can swap crypto assets directly. This reinforces its Web3-first identity.

Subscription Tiers

Users can choose from Free, Premium, Titanium, or Titan tiers, depending on how much PLU they’re willing to stake and how many perks they want unlocked.

Rewards Program

One of the card’s strongest selling points is its rewards program, which is simple on the surface but layered with options.

Structure and Rates

The base rewards start with up to 3% cashback in PLU on eligible purchases. On higher tiers, users can unlock additional perks worth up to 15%, such as rebates on Spotify, Netflix, Deliveroo, and other lifestyle brands. Unlike traditional cashback cards, the rewards are paid in crypto, which can either be held as an investment or sold.

Redemption

Rewards are credited in PLU, the token at the core of the Plutus ecosystem. Users can trade PLU on supported exchanges, hold it for potential appreciation, or use it to access higher tier levels and unlock more perks.

Flexibility

Since rewards are tied to crypto, users have more options than with traditional cashback programs. Instead of being limited to fiat redemption, they can hold, stake, or convert their rewards within the broader crypto market.

Limits and Controls

Like all prepaid debit cards, Plutus comes with certain limits and restrictions to manage risk and ensure compliance.

Spending Limits

Depending on the subscription tier, users face daily and monthly spending caps. Higher tiers generally increase these limits, making them more suitable for heavy spenders or frequent travelers.

ATM Withdrawals

Cash withdrawals are allowed but capped, often with limits such as €200–€500 per month depending on the plan. Exceeding the free allowance may trigger additional fees.

Transfer Caps

Moving funds between fiat and crypto wallets also comes with restrictions, particularly on free accounts. Premium and Titanium tiers allow greater flexibility.

User Management

At this stage, Plutus is primarily focused on individual users rather than businesses, so multi-user or corporate features are limited.

Technology Integration

The Plutus platform is powered by a mobile app and Web3 tools that connect traditional payments with DeFi.

Mobile App

The Plutus app serves as the hub for managing fiat, crypto, and rewards. Users can track balances, claim perks, and move funds in just a few taps.

Non-Custodial Wallet

Unlike many fintech cards, Plutus offers a non-custodial wallet. This means users keep control of their private keys rather than handing them to a centralized service.

DEX Access

Through the app, users can connect directly to a decentralized exchange to swap tokens. This is a unique differentiator from rivals like Crypto.com or Revolut, which rely on centralized exchange services.

APIs and Web3 Integration

While Plutus isn’t yet a developer-heavy platform, its design leans toward Web3 interoperability. That means future upgrades may expand its DeFi connections, making it a potential long-term ecosystem hub.

Security Features

When it comes to handling both fiat and crypto, security is critical. Plutus employs several protective measures to safeguard users:

Fraud Protection

Because the card is powered by Visa, it comes with standard Visa fraud monitoring and chargeback protections. Suspicious transactions can be flagged or reversed.

Encryption

All wallet and account data is secured with strong encryption, protecting user credentials from unauthorized access.

KYC/AML Compliance

While not FCA-regulated in the UK, Plutus does require Know Your Customer (KYC) verification to prevent fraud and comply with anti-money laundering rules.

Non-Custodial Setup

Since users hold their own private keys, they’re less exposed to exchange hacks. However, this also means they must take responsibility for securing their keys and backups.

Additional Benefits

Beyond payments and rewards, Plutus offers some extra perks that enhance its appeal:

Lifestyle Rebates

Subscribers at Premium and higher tiers can claim crypto-back rebates on streaming services, food delivery, and retail platforms. For everyday users, this is a tangible benefit that can offset subscription costs.

Travel Benefits

While not as extensive as high-end credit cards, the lack of foreign transaction fees makes Plutus a good companion for travel within its supported regions.

Community and Ecosystem Growth

Holding PLU tokens and using the card contributes to the broader Plutus ecosystem. This positions the user as part of a growing Web3 movement rather than just a cardholder.

Insurance Coverage

Some tiers may include purchase protection or travel-related insurance, though this is not as comprehensive as what premium credit cards offer.

Fees and Pricing Structure of the Plutus Card

One of the most important things to understand about the Plutus Debit Card is its fee model. Unlike a traditional credit card, Plutus doesn’t charge interest or late payment penalties, since it’s a prepaid debit card.

However, there are subscription tiers, service fees, and usage limits that can impact how much value you get out of the card. Below is a comprehensive look at the fee structure:

| Fee Type | Details |

| Annual/Monthly Fees | Free tier available; Premium £4.99/month; Titanium £14.99/month; Titan £24.99/month |

| Transaction Fees | No fees on everyday purchases within limits; crypto-to-fiat conversions may trigger spread/fees |

| Cash Advance Fees | Not applicable (prepaid debit, not a credit card) |

| Late Payment Fees | Not applicable (no credit facility, prepaid only) |

| Over-Limit Fees | Spending capped by wallet balance; exceeding free allowances may trigger extra charges |

| Foreign Transaction Fees | No direct fees on foreign currency spending in supported regions; ATM withdrawals abroad may incur extra charges |

| Hidden/Uncommon Fees | High fees on PLU liquidation (converting rewards into fiat); limits on free ATM withdrawals; subscription changes can affect fee structure |

Monthly vs Annual Costs

The Plutus Free plan has no monthly fee but comes with limited rewards and perks. Premium, Titanium, and Titan tiers introduce subscription charges ranging from about £5 to £25 per month. For frequent users who take advantage of cashback and lifestyle perks, these fees can be offset. But for casual spenders, the costs may outweigh the benefits.

Transaction and Conversion Fees:

Everyday purchases don’t carry extra costs, but crypto-to-fiat conversions often include hidden spreads. This means you may not see a direct “conversion fee,” but the rate you receive could be less favorable than the market rate.

Cash Advances and Late Fees

Because the Plutus card is prepaid, there are no cash advance charges or late fees. You can only spend what you’ve loaded, which makes it safer than a credit card but also limits flexibility.

ATM Withdrawals

Users get a set number of free ATM withdrawals each month, depending on their subscription tier. Exceeding that limit adds extra charges, which can make frequent cash use expensive.

Foreign Use

For cardholders in supported regions (UK and EEA), foreign purchases generally don’t attract additional fees, making it travel-friendly. However, ATM withdrawals in other regions may still trigger charges.

Hidden Costs

Perhaps the biggest “hidden” fee is tied to the PLU token itself. Selling or converting PLU to fiat often comes with high spreads or liquidity limits, reducing the value of rewards. Additionally, Plutus has been known to adjust its subscription perks and limits, meaning costs can change over time.

Eligibility and Application Process

Applying for the Plutus Debit Card is more straightforward than applying for a traditional credit card, since it operates as a prepaid Visa card. There’s no credit facility involved, which removes the need for credit checks and guarantees. Still, Plutus enforces regional, identity, and compliance requirements.

Who Can Apply

The Plutus Debit Card is designed for individual consumers, not businesses. Currently, only residents of the UK and European Economic Area (EEA) are eligible. Since it’s prepaid, there’s no minimum credit score required, making it accessible to people who might not qualify for credit cards. Applicants must be at least 18 years old and have a valid government-issued ID.

Required Documents

To meet compliance rules, Plutus asks for standard Know Your Customer (KYC) documents:

- Government ID: Passport, national ID card, or driver’s license to verify identity.

- Proof of Address: Utility bill, bank statement, or government-issued letter (usually dated within the last 3 months).

- Selfie Verification: A live photo or video to confirm the applicant matches the submitted ID.

These documents are necessary to ensure security, prevent fraud, and comply with anti-money laundering regulations.

Step-by-Step Application Guide

- Download the Plutus app from the App Store or Google Play.

- Sign up with your email address and create a secure password.

- Complete KYC verification by uploading ID, proof of address, and a selfie check.

- Choose your subscription tier (Free, Premium, Titanium, or Titan) depending on your needs.

- Order your card, which will be issued virtually first and delivered physically later.

- Top up your account with fiat or crypto to start spending.

Approval Timeline

Most applications are processed quickly. Digital verification can take a few minutes to a couple of hours, though manual reviews (e.g., if documents are unclear) may extend the process to 1–3 business days. Once approved, users gain instant access to a virtual card, while the physical card typically arrives within 7–10 business days.

What Happens After Approval

After approval, you can immediately start using the virtual Plutus Visa card for online purchases. The physical card works at any Visa-supported merchant worldwide. From there, users can load funds, activate cashback rewards, and unlock perks based on their subscription tier. As soon as the first transactions are made, PLU rewards begin to accrue automatically.

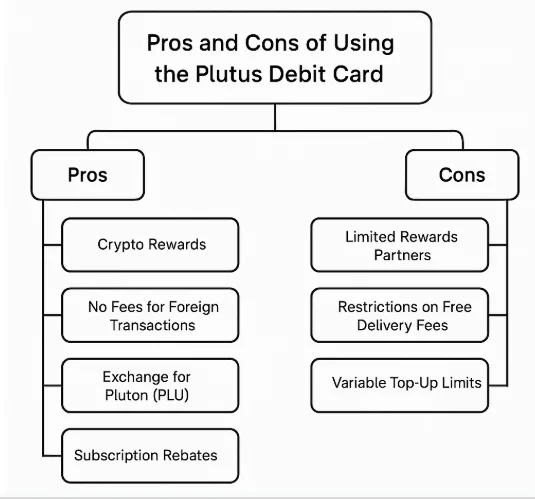

Pros of Using the Plutus Debit card

Like any financial product, the Plutus Debit Card has its strengths and weaknesses. Understanding both sides helps you decide whether it fits your lifestyle and financial goals.

Crypto Cashback on Everyday Spending

Earn up to 3% back in PLU tokens on purchases, which can grow in value if the token appreciates. For example, a frequent shopper spending €1,000 per month could collect €30 worth of crypto rewards.

Lifestyle Perks and Rebates

Subscription rebates on Spotify, Netflix, and Disney+ mean users can offset entertainment costs with crypto rewards. For digital nomads or students, this creates real savings.

Visa-Powered Acceptance

The card works anywhere Visa is accepted, from supermarkets to airlines. This makes it more practical than niche crypto cards with limited networks.

No Credit Check Required

Since it’s prepaid, anyone with valid KYC documents can apply, regardless of credit history. This makes it accessible for those who might not qualify for traditional credit cards.

Web3 and DEX Access

Integrated access to a decentralized exchange allows users to swap crypto directly from the app, adding flexibility for active crypto traders.

Multiple Tiers to Suit Different Needs

From a free plan to premium subscriptions, users can choose the right balance of rewards and costs depending on their spending habits.

Cons of Using the Plutus Debit Card

Unresponsive Customer Support

Many users report slow or inadequate support, particularly when dealing with account suspensions. This can be frustrating if your funds are frozen.

Reward Devaluation and Rule Changes

Plutus has a history of adjusting cashback rates, staking rules, and perks mid-stream. Users relying on stable benefits may be disappointed.

High Fees on PLU Conversion

While you earn rewards in PLU, converting them into fiat can be costly due to spreads and liquidity challenges. This reduces the real value of rewards.

Limited Availability

Currently, the card is only available in the UK and EEA. Travelers or residents outside these regions cannot access it.

Regulatory Concerns

The card is not FCA-regulated in the UK, which raises questions about consumer protections compared to fully licensed providers.

User Reviews and Feedback Analysis of the Plutus Debit Card

To get a balanced picture of the Plutus Debit Card, it helps to look at what real users are saying across trusted review platforms. Ratings vary, reflecting both strong enthusiasm for its rewards and frustration with its customer support and policies.

Aggregate Ratings

On Trustpilot, Plutus holds an average rating of around 3.2 out of 5, based on thousands of reviews. G2 lists it closer to 3.8/5, while Capterra users generally score it above 4/5.

The mix shows that while many appreciate its innovative features, there are persistent pain points holding it back from higher ratings.

Common Praise Themes

Users frequently praise the crypto cashback rewards and streaming service rebates, calling them a practical way to offset everyday costs. One Trustpilot reviewer noted,

“Getting Netflix and Spotify paid back in crypto each month feels like free money.”

Others highlight the convenience of having both fiat and crypto in a single wallet, with one G2 reviewer describing it as

“a smart bridge between traditional banking and crypto.”

Frequent Complaints

The most common criticism centers on rule changes and reward devaluation. Some users complain that cashback percentages or perk availability were reduced after they joined.

For example, a Capterra review mentioned,

“I signed up for 3% cashback but later got downgraded with no clear notice.”

Customer Service Feedback

Perhaps the biggest sticking point is support. Many users describe it as slow or unresponsive, especially when accounts are flagged or suspended. This is particularly worrying because frozen funds can take days or even weeks to resolve.

One frustrated reviewer wrote on Trustpilot:

“When my account was locked, I waited two weeks for a reply and still had no access to my money.”

Top 6 Alternatives to the Plutus Debit Card

The Plutus Debit Card offers crypto cashback, lifestyle perks, and DeFi integration, but it’s not a one-size-fits-all solution. Some users may find the subscription costs, limited regional availability, or customer service issues to be deal breakers. That’s where alternatives come in.

By reviewing other cards, you can compare reward structures, fees, and availability to see which best matches your lifestyle

Also Read: Revolut Card Review: Global Spending Made Easy + Top 5 Alternatives

Crypto.com Visa Card

Best For: Crypto rewards seekers who want flexibility across multiple tokens.

A direct competitor to Plutus, offering higher cashback (up to 5%) and a wide range of perks like Spotify and Netflix rebates. It’s available in more regions but requires staking CRO tokens, which can be risky.

Key Differentiators:

- Tiered reward structure with up to 5% cashback in CRO tokens.

- Wide range of lifestyle perks, including Spotify, Netflix, and Airbnb rebates.

- Available in more global markets compared to Plutus.

Pricing: Free to apply; higher-tier rewards require staking CRO tokens.

Pros:

- Generous cashback rates (especially on higher tiers).

- Broad acceptance through Visa’s global network.

- Lifestyle perks extend beyond streaming to travel and retail.

Cons:

- Requires staking CRO, which can be volatile.

- Past reward cuts have frustrated long-term users.

Why Choose Over Plutus: Crypto.com’s card is more widely available globally, with higher potential cashback rates and stronger brand recognition. If you’re outside the UK/EEA, this is the more accessible option.

Nexo Card

Best For: Frequent travelers and crypto investors looking for premium flexibility.

A premium option that lets you spend without selling your crypto by using it as collateral. You earn cashback in BTC or NEXO, and there are no FX fees, but it’s only available in select regions.

Key Differentiators:

- Up to 2% cashback paid in either BTC or NEXO tokens.

- Instant credit line backed by your crypto holdings, spend without selling assets.

- Integration with the Nexo ecosystem, offering lending, borrowing, and yield products.

Pricing: No monthly or annual fee; interest rates depend on loan-to-value ratio for credit lines.

Pros:

- No need to liquidate crypto—spend against collateral.

- Rewards in stable crypto assets like BTC, not just platform tokens.

- No FX fees in supported regions.

Cons:

- Requires locking assets into Nexo platform.

- Availability limited to certain regions.

Why Choose Over Plutus: Nexo offers a credit line model rather than prepaid debit, making it ideal for crypto investors who don’t want to sell holdings. It’s a more premium option for wealthier or long-term crypto holders.

Binance Card

Best For: Users seeking low-cost entry into crypto spending.

The budget-friendly choice with no subscription fees and up to 2% cashback in BNB. It connects directly to your Binance account, but has fewer perks and faces ongoing regulatory scrutiny.

Key Differentiators:

- Up to 2% cashback in BNB tokens.

- Direct connection to Binance exchange balances.

- No subscription fees; only pay standard Binance trading spreads.

Pricing: Free to apply; no monthly fee.

Pros:

- No upfront subscription cost.

- Easy to integrate with Binance exchange account.

- Cashback applies to all eligible purchases.

Cons:

- Limited perks compared to Plutus or Crypto.com.

- Heavily tied to the Binance, which faces regulatory pressure.

Why Choose Over Plutus: If you want a no-frills, low-cost crypto card, Binance’s card is simpler and cheaper, without requiring staking or monthly fees.

UPay.best Card

Best For: Everyday users who want simple crypto payments and instant liquidity.

A simple, neutral option designed for everyday users. It offers instant, low-interest crypto loans so you can spend without selling assets. While perks are limited, it’s clear and cost-effective.

Key Differentiators:

- Offers instant, low-interest crypto loans for spending without selling assets.

- Supports both fiat top-ups and crypto-backed balances.

- Easy-to-use app with fast transaction settlement.

Pricing: Transparent fee model; no hefty subscription tiers. Loan interest rates start lower than competitors.

Pros:

- Instant access to crypto liquidity without liquidation.

- Simple structure, no confusing tiers or staking requirements.

- Competitive rates for crypto loans.

Cons:

- Still expanding availability; not yet global.

- Fewer lifestyle perks compared to Plutus or Crypto.com.

Why Choose Over Plutus: UPay is ideal for users who want practical crypto liquidity rather than chasing perks. It’s straightforward, with clear costs, making it appealing for new crypto adopters.

Revolut Card

Best For: Users who want a regulated, mainstream fintech card with light crypto access.

A traditional fintech option with strong regulation and travel benefits. It’s not crypto-focused but offers multi-currency support, budgeting tools, and light crypto trading for casual users.

Key Differentiators:

- Primarily a multi-currency debit card with competitive FX rates.

- Crypto trading available within the Revolut app.

- Strong consumer protections as a licensed e-money provider in Europe and the UK.

Pricing: Free standard card; paid tiers (£2.99–£12.99/month) unlock higher limits and perks.

Pros:

- FCA-regulated, offering stronger consumer protection.

- Excellent for international travel (competitive FX, no hidden fees).

- Integrated banking features like savings vaults and budgeting tools.

Cons:

- Limited crypto features compared to dedicated crypto cards.

- Rewards program weaker than Plutus or Crypto.com.

Why Choose Over Plutus: Revolut is better for those prioritizing stability and regulation over maximum crypto perks. It’s ideal if you’re more of a traveler or general fintech user than a hardcore crypto investor.

Monolith Card

Best For: DeFi enthusiasts who want a direct connection between Ethereum wallets and real-time spending.

A niche card for DeFi enthusiasts, linking directly to Ethereum wallets. It’s fully non-custodial and decentralized, but less user-friendly and limited to Ethereum assets only.

Key Differentiators:

- Non-custodial smart contract wallet integration.

- Spend directly from Ethereum assets.

- Open-source ethos appealing to crypto purists.

Pricing: No monthly subscription, but network gas fees apply.

Pros:

- True DeFi integration with no custodial risk.

- Appeals to Ethereum-focused users.

- Transparent fee structure with no hidden spreads.

Cons:

- More complex to use compared to mainstream fintech apps.

- Limited support for non-Ethereum assets.

Why Choose Over Plutus: Monolith is the choice for DeFi-native users who value open-source, Ethereum-only functionality over broad perks or convenience. It’s less polished but highly aligned with crypto’s decentralized values.

Comprehensive Comparison Table

| Card Name | Annual Fee | Rewards Rate | Welcome Bonus | Credit Check Required | Best For (Use Case) | Key Feature | Major Limitation | Overall Rating (out of 5) |

| Plutus Debit Card | Free – €14.99/mo (tiers) | Up to 3% PLU cashback + perks | None | No | Everyday spend with perks | Netflix/Spotify rebates + Visa coverage | Limited to UK/EEA, weak support | 3.5 |

| Crypto.com Visa | Free – $399 staking (tiers) | 1–5% CRO cashback + rebates | $25 CRO | No | Global travelers & perks hunters | Airport lounge, Spotify/Netflix perks | Requires CRO staking, volatile rewards | 4 |

| Nexo Card | Free | 0.5–2% in BTC or NEXO | None | No | Spending without selling crypto | Uses crypto as collateral, no FX fees | Limited availability by region | 4.2 |

| Binance Card | Free | Up to 2% BNB cashback | None | No | Active Binance exchange users | Direct Binance wallet integration | Regulatory uncertainty, fewer perks | 3.8 |

| UPay.best Card | Free / Low fees | Modest rewards, low-interest loans | None | No | Instant crypto loans | Spend without selling crypto instantly | Fewer lifestyle perks | 3.9 |

| Revolut Card | Free – £12.99/mo (tiers) | Up to 1% cashback (premium tiers) | Varies by promo | Yes (soft check) | Travelers & everyday users | Multi-currency wallet + budgeting tools | Limited crypto features | 4.3 |

| Monolith Card | Free | None (fees instead) | None | No | DeFi & Ethereum users | Non-custodial, links directly to wallet | ETH-only, no rewards | 3.4 |

| Coinbase Card | Free | 1–4% in crypto | None | No | US/EU crypto spenders | Direct Coinbase wallet integration | High fees on conversions | 3.7 |

How to Choose: Decision Framework

With so many crypto and fintech cards available, the best choice comes down to your personal needs, spending habits, and long-term financial goals. Below is a decision tree that helps narrow the options.

If your priority is high crypto rewards and perks, Consider Crypto.com Visa.

This card is designed for power users who don’t mind staking CRO tokens in exchange for up to 5% cashback and lifestyle rebates. If you spend heavily on subscriptions, travel, or online shopping, it delivers one of the richest rewards programs.

Also Read: RedotPay Card Review: Spend Crypto Anywhere + Top 5 Alternatives

If you want to earn crypto without selling your holdings, Consider Nexo Card.

Instead of liquidating your crypto, Nexo lets you borrow against it and spend directly. This suits long-term holders who believe their coins will rise in value but still want liquidity. It’s especially attractive for professionals and businesses with crypto treasuries.

If you need a simple, cost-effective option, Consider Binance Card or UPay.best Card.

Binance Card is ideal for those already trading on Binance, offering up to 2% cashback with zero annual fees. UPay.best, meanwhile, appeals to everyday users by providing instant, low-interest crypto loans without the complexity of staking or hidden fees. Both are budget-friendly, but UPay.best feels safer for casual users.

If regulatory trust and financial stability matter most, Consider Revolut Card.

Revolut is regulated, widely available, and integrates with traditional banking. While its crypto rewards are modest, its budgeting tools, multi-currency accounts, and travel protections make it perfect for freelancers, small businesses, or travelers who prioritize compliance and transparency.

If you’re a DeFi enthusiast or want full control of your assets → Consider a Monolith Card.

This card connects directly to your Ethereum wallet, keeping you in full custody of your crypto. It’s not beginner-friendly, but for those who already live in the Web3 world, it offers true decentralization.

If you want a mainstream, widely accepted crypto card → Consider Coinbase Card.

For U.S. and European users, Coinbase offers a straightforward card linked to one of the most trusted exchanges. It’s great for everyday spending, though its fees are higher than most alternatives.

Business Size and Industry Needs

Small businesses may prefer Revolut for expense tracking and compliance. Crypto-native startups could benefit more from Nexo or Crypto.com due to flexible funding and perks.

Cash Flow Situations

If you need liquidity without selling assets, UPay.best and Nexo are strong picks. If you want consistent cashback to offset recurring expenses, Plutus or Crypto.com stand out.

Domestic vs. International Use

Frequent travelers should lean toward Revolut or Crypto.com for global acceptance and perks. Local spenders may find Plutus sufficient, provided they live in the UK or EEA.

Technology Requirements

If you value integration with DeFi, Monolith is unmatched. If you prefer an all-in-one app experience, Revolut or Plutus are better choices

Plutus Card Security & Regulatory Status

When it comes to money, especially crypto security and regulation matter. Let’s break down how safe Plutus is and what you need to be aware of before using the platform.

Licensing and Oversight

Plutus operates in the UK and Europe but isn’t a traditional bank. It partners with regulated financial providers to issue Visa debit cards and manage fiat services, though Plutus itself lacks full banking licenses.

Regulatory Concerns

The UK’s Financial Conduct Authority (FCA) has issued warnings about Plutus. The platform isn’t directly licensed or supervised by the FCA, which means user funds may not be protected by the Financial Services Compensation Scheme (FSCS).

This creates less legal protection if problems arise, so users should avoid storing large amounts long-term. The FCA advises that you check if a firm is authorised before engaging with them.

Verification Requirements

Plutus requires Know Your Customer (KYC) verification for fiat features like card top-ups. This includes valid ID, proof of address, and biometric scans to meet Anti-Money Laundering standards.

However, users frequently report verification delays, sudden re-verification requests, and locked accounts during compliance checks.

Fund Access Issues

Since Plutus relies on external partners for card services, users can get caught in disputes that last days or weeks due to slow customer support. Crypto-only users face lower risks since Plutus offers non-custodial wallets where users control their private keys.

Conclusion

The Plutus Debit Card offers a unique blend of crypto cashback, lifestyle perks, and Visa-powered convenience. With up to 3% cashback in PLU tokens and rebates on popular subscriptions like Spotify and Netflix, it’s one of the few cards that successfully bridges everyday spending with crypto rewards. However, it’s not without flaws—customer support issues, shifting rules, and limited availability make it a mixed bag for many users.

The Plutus card is best suited for UK and EEA-based crypto users who spend regularly on everyday purchases and want to earn crypto in the process. It’s also appealing to lifestyle spenders who can maximize the value of subscription rebates and those already comfortable with staking tokens to unlock higher rewards.

If you’re based outside the UK or EEA, Plutus isn’t currently an option. Similarly, if you prioritize stable rewards, responsive support, or FCA-backed consumer protections, this card may leave you disappointed. High-fee conversions for PLU rewards also make it less attractive to users who want seamless cash access rather than token exposure.

For most users, the Crypto.com Visa Card stands out as the strongest alternative. It offers higher cashback rates (up to 5%), a wider global reach, and more robust perks like airport lounge access. Yes, it requires staking CRO tokens, but for committed crypto spenders, the upside in rewards often outweighs the lock-in risk. For users who value regulation and everyday utility over maximum perks, the Revolut Card is another strong contender.

Plutus occupies a middle ground in the crypto card market. It’s more rewarding than basic fintech cards like Monolith, yet less reliable and far-reaching than giants like Crypto.com or Revolut. Its Web3 integrations and perks make it attractive to early adopters, but frequent changes and support gaps hold it back from being a true market leader. In short: Plutus is a good option for perks-driven crypto users in Europe, but not the most dependable choice for everyone.

Also Read: CoinJar Card Review: Simple, Secure, and Rewarding + Top 6 Competitors

FAQs

What is Plutus and how does it work?

Plutus is a crypto-friendly platform that offers a Visa debit card with crypto cashback rewards. You can earn up to 3% cashback in PLU tokens on every purchase and get rebates on popular services like Spotify and Netflix.

Is Plutus safe to use?

Plutus operates in the UK and Europe but isn’t a traditional bank. While it offers solid crypto features, it lacks full banking licenses and FCA supervision. Users should avoid storing large amounts long-term and be prepared for occasional compliance delays.

What are the different subscription plans?

Plutus offers different tiers from free to premium. Higher tiers provide more perks, require PLU token staking, and offer benefits like priority support and enhanced limits. These Subscription plans offer 3% cashback.

What cryptocurrencies and currencies does Plutus support?

Plutus supports Pluton (PLU) and Ethereum (ETH) for crypto, and EUR and GBP for fiat currencies. It’s available in the UK, Germany, Ireland, Italy, and other European Economic Area countries.

What fees should I expect?

Fees vary by plan. The free Starter plan has 1% trading fees and €0 fiat withdrawal fees. Premium and Pro plans offer 0% trading fees but charge €9.99 card fees. ATM withdrawals have limits and fees beyond free allowances.

Related posts:

- BitHash Affiliate Program: Overview, Benefits & Commission

- ChangeNOW Affiliate Program: Overview, Benefits & Commission

- Bittylicious Exchange Affiliate Program: Overview, Benefits & Commission

- CoinCorner Affiliate Program: Overview, Benefits & Commission

- Lista DAO Affiliate Program: Overview, Benefits & Commission