Polymarket is not just attracting users—it is keeping them, and by a wide margin.

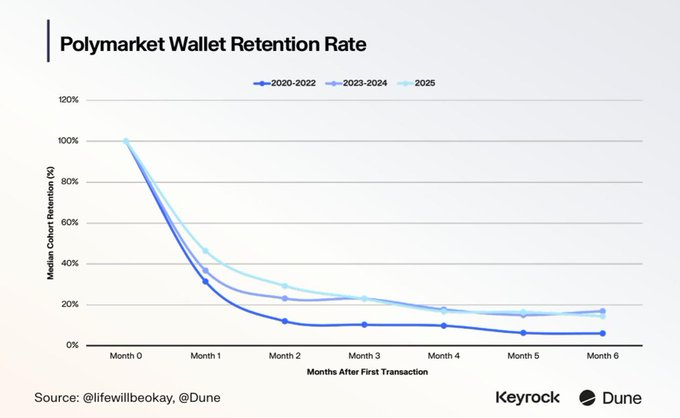

Data from a December 2025 analysis by Dune Analytics and market maker Keyrock shows that Polymarket’s average user retention rate outperforms more than 85% of crypto protocols across networks, DeFi platforms, wallets, and trading applications. In an industry where short-lived activity is common, the figures point to something deeper than temporary hype.

“Among a sample of 275 crypto projects, Polymarket’s average retention outperformed over 85% of protocols.”

This performance stands out at a time when many crypto products struggle to keep users engaged beyond their first month.

Prediction Markets Post Explosive Growth

The strong retention numbers come after a period of extraordinary growth for prediction markets. Over the last two years, monthly notional volume across major platforms surged from under $100 million to more than $13 billion—an increase of roughly 130 times.

User activity expanded at a similar pace. Since early 2024, total transactions across prediction markets jumped from around 240,000 to more than 43 million, while monthly active users rose from about 4,000 to over 612,000.

Polymarket played a central role in that expansion. The platform processed approximately 95 million trades during this period, accounting for around 54% of cumulative market activity.

Monthly trades on Polymarket alone grew from roughly 45,000 to about 19 million, with notable spikes surrounding the 2024 U.S. presidential election and sustained momentum through October this year.

What Users Are Trading On

Category-level data helps explain why engagement has remained strong. According to Dune’s 2025 prediction market analysis, sports accounted for 39% of Polymarket’s total volume, followed by politics at 34% and crypto at 18%. Together, these three categories represented about 90% of all notional volume on the platform.

Kalshi, Polymarket’s closest U.S.-based competitor, showed a different profile. Sports dominated its activity, contributing roughly 85% of total volume.

Beyond headline categories, emerging segments also saw rapid growth. Economics-related markets expanded tenfold on Polymarket and by 905% on Kalshi. Technology and science markets grew by 1,700% on Polymarket, while open interest across both platforms was driven largely by economics, which rose 700%, and social and culture markets, up 600%.

Retention: Crypto’s Persistent Weak Spot

While crypto has proven effective at drawing in new users during bull cycles, sustained usage remains rare. The Dune–Keyrock study tracked monthly cohorts of new active users and measured how many returned to trade in subsequent months. The results highlighted how uncommon consistent engagement still is across the sector.

“In markets where liquidity depends on frequent participation, weak retention can signal shallow growth.”

Against that backdrop, Polymarket’s performance looks exceptional. Its retention metrics suggest that users are not merely speculating once and leaving, but returning repeatedly to participate in new markets.

Why Prediction Markets Keep Users Coming Back

Prediction markets operate differently from most crypto applications. Activity is tied directly to real-world events—elections, sports tournaments, macroeconomic releases—that unfold continuously and predictably over time.

This event-driven structure creates built-in reasons for users to return. Unlike yield farming or short-term trading strategies that rely heavily on incentives, prediction markets encourage repeat participation through relevance and timing.

“The engagement is linked to real-world events… creating recurring reasons for users to re-engage.”

As a result, trading activity becomes habitual rather than episodic, helping platforms maintain liquidity without constant subsidies.

Crypto Platforms Take Notice

Polymarket’s retention advantage has not gone unnoticed. Several major crypto firms have moved to integrate or launch prediction market offerings in recent months.

Coinbase is preparing to roll out tokenized equities alongside prediction markets, following reported leaks of its event-based trading interface. Wallet provider Phantom has announced a partnership with Kalshi to bring prediction markets directly into its app.

Bitnomial recently received approval from the U.S. Commodity Futures Trading Commission (CFTC) to operate prediction markets and provide clearing services. Gemini has already launched its own in-house prediction market, now available across all 50 U.S. states.

These moves suggest a broader industry shift. Platforms facing inconsistent engagement outside periods of high volatility appear to be searching for features that encourage steady, repeat usage.

A Familiar Lesson, Revisited

The idea behind prediction markets is not new. As Dune Analytics notes, the University of Iowa’s Iowa Electronic Markets, launched in 1988, consistently outperformed traditional polling in forecasting political outcomes. Later, NADEX became the first CFTC-regulated exchange to offer event-based contracts tied to economic indicators.

What has changed in the 2020s is scale. Blockchain infrastructure, on-chain settlement, and clearer U.S. regulatory signals have allowed platforms like Polymarket and Kalshi to reach millions of users globally.

In a sector still grappling with the challenge of long-term engagement, Polymarket’s retention data offers a rare example of sustained usage at scale. The numbers suggest that when crypto products align closely with real-world incentives and timing, users are far more likely to stay.

No related posts.