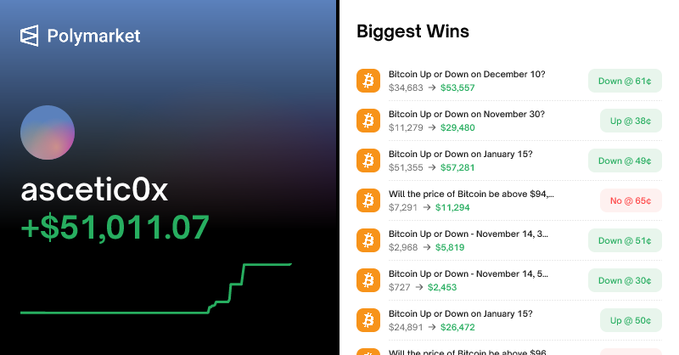

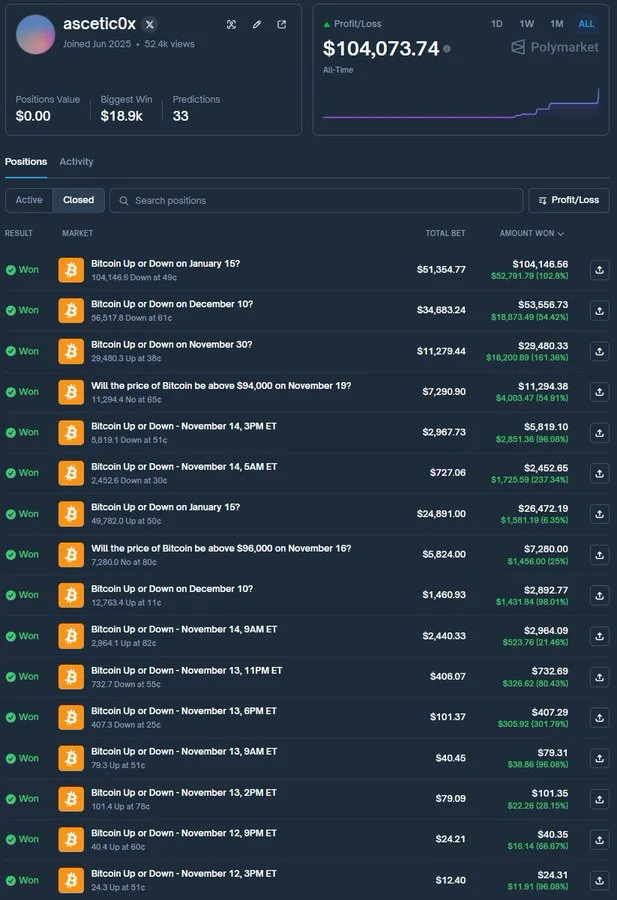

A little-known trader operating under the name ascetic0x has stunned the crypto community after transforming just $12 into more than $100,000 on Polymarket.

The achievement didn’t come from a single lucky wager, but from a series of calculated Bitcoin price predictions compounded over time on the decentralized prediction platform.

Unlike high-risk strategies that rely on one oversized bet, ascetic0x followed a disciplined path. Each successful Bitcoin market call was rolled into the next position, allowing gains to stack gradually. This compounding approach mirrors traditional trading principles, but applied within a prediction market framework rather than spot or derivatives trading.

Compounding Small Wins Into Six Figures

The trader reportedly focused on short- to mid-term Bitcoin price direction markets, selecting outcomes with favorable probabilities rather than extreme odds. By prioritizing accuracy over payout size, ascetic0x avoided major drawdowns and maintained steady growth.

“Success came from compounding accurate Bitcoin predictions instead of chasing one high-risk outcome.”

This strategy highlights a key difference between prediction markets and conventional crypto trading. On platforms like Polymarket, traders are not buying or selling assets directly; they are pricing probabilities.

For skilled market participants, this creates opportunities to profit from sentiment gaps, news timing, and macro signals without heavy leverage.

What This Means for Prediction Markets

Polymarket has seen a surge in activity in recent months, particularly around crypto-related markets. Built on blockchain infrastructure, the platform offers transparent settlement and permissionless access, features that appeal to traders seeking alternatives to centralized exchanges.

“The rise of crypto-based prediction markets shows how knowledge and timing can rival technical indicators.”

The ascetic0x story is already being cited as proof that small capital does not automatically limit opportunity. While such outcomes are rare and require exceptional discipline, the case underscores the growing role of prediction markets as a legitimate trading arena within crypto.

For micro-traders and analysts alike, this episode reinforces a familiar lesson: consistent edge, risk control, and patience can outperform size—especially in markets where probabilities, not price charts, are the main battleground.

No related posts.