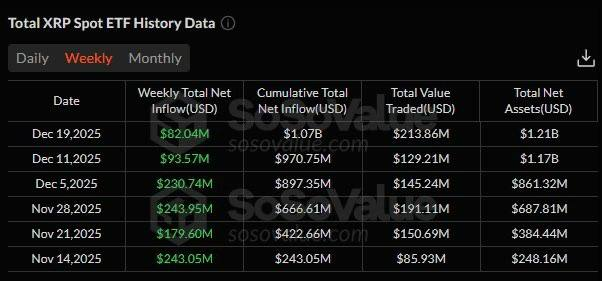

Spot XRP exchange-traded funds have continued to attract strong investor interest, extending their positive momentum to a sixth consecutive week as total net inflows climb beyond the $1.2 billion mark.

The sustained run highlights a notable shift in sentiment toward XRP-focused investment products, particularly among institutional and risk-conscious investors seeking regulated exposure.

The latest weekly data shows that inflows have remained consistently positive, reinforcing what market watchers describe as a “green streak” that now spans more than a month and a half.

This performance places spot XRP ETFs among the strongest-performing digital asset funds in recent weeks, especially at a time when flows into other crypto-linked products have been uneven.

Institutional Demand Drives Momentum

Analysts attribute the continued inflows largely to rising institutional participation. Spot ETFs allow investors to gain direct exposure to XRP without the operational and custody challenges of holding the asset outright.

For asset managers, these products offer a compliant and transparent route into the XRP market, which has historically faced regulatory uncertainty in some jurisdictions.

The crossing of the $1.2 billion cumulative inflow threshold is widely seen as a psychological milestone. It suggests that demand is not only persistent but also scaling, with larger capital allocations entering the market rather than short-term speculative flows.

Several market participants note that weekly inflows have remained resilient even during periods of broader crypto price consolidation.

Market Implications for XRP

The steady inflow trend has added a layer of structural support to XRP’s market narrative. While ETF inflows do not directly dictate spot prices, they often signal longer-term confidence and can influence liquidity conditions. Increased ETF holdings also reduce the circulating supply available on exchanges, a factor that traders tend to watch closely.

Beyond price considerations, the performance of spot XRP ETFs may influence future product development across the crypto ETF space.

Fund issuers are closely monitoring investor appetite, and sustained success could accelerate the launch of additional XRP-related investment vehicles or encourage broader diversification beyond Bitcoin and Ethereum-focused funds.

As the six-week streak continues, market participants will be watching whether inflows can maintain their pace or even accelerate further. For now, the data points to a clear message: regulated exposure to XRP is gaining traction, and investor confidence in these products remains firmly intact.

No related posts.