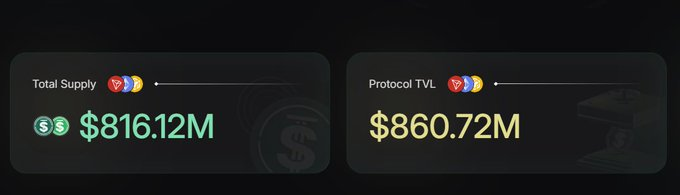

The decentralized stablecoin USDD has crossed a notable threshold, recording fresh highs in both circulating supply and total value locked, a move that reflects growing confidence in its role within decentralized finance.

“The decentralized stablecoin USDD has reached a significant milestone, with its supply surpassing $816 million. Additionally, the total value locked (TVL) in USDD has climbed to over $860 million.”

USDD’s Latest Growth Signals Strong DeFi Demand

USDD’s supply, now standing above $816 million, places it among the more actively used decentralized stablecoins in the market. At the same time, TVL exceeding $860 million suggests that a substantial portion of USDD is not sitting idle but is actively deployed across DeFi protocols, including lending, liquidity provision, and yield-focused applications.

The gap between supply and TVL is particularly telling. A higher TVL than circulating supply often indicates that users are repeatedly committing USDD across multiple on-chain use cases, reinforcing its utility beyond simple value storage. This trend points to sustained on-chain activity rather than short-term speculation.

Adoption Driven by Utility, Not Hype

Unlike centralized stablecoins that rely on custodial reserves, USDD operates through decentralized mechanisms designed to maintain its peg while remaining accessible across multiple DeFi platforms. Its recent growth suggests users are increasingly comfortable using algorithmic and decentralized alternatives, especially as DeFi participation expands across different chains.

Market observers note that stablecoin growth is often a leading indicator of broader DeFi activity. As traders and liquidity providers seek stability amid market volatility, capital tends to flow into stable assets that can be quickly redeployed when opportunities arise.

USDD’s rising TVL aligns with this pattern, indicating it is being actively used as a base asset within DeFi strategies.

What This Means for the DeFi Market

USDD’s milestones come at a time when competition among stablecoins is intensifying. Achieving over $860 million in TVL places USDD in a stronger position to attract protocol integrations and deeper liquidity pools, both of which are critical for long-term relevance.

“This growth highlights the increasing adoption and utilization of USDD in the decentralized finance (DeFi) ecosystem.”

If current usage trends hold, USDD’s expanding footprint could further strengthen its role as a settlement and liquidity asset across DeFi, reinforcing the broader shift toward decentralized financial infrastructure.

No related posts.