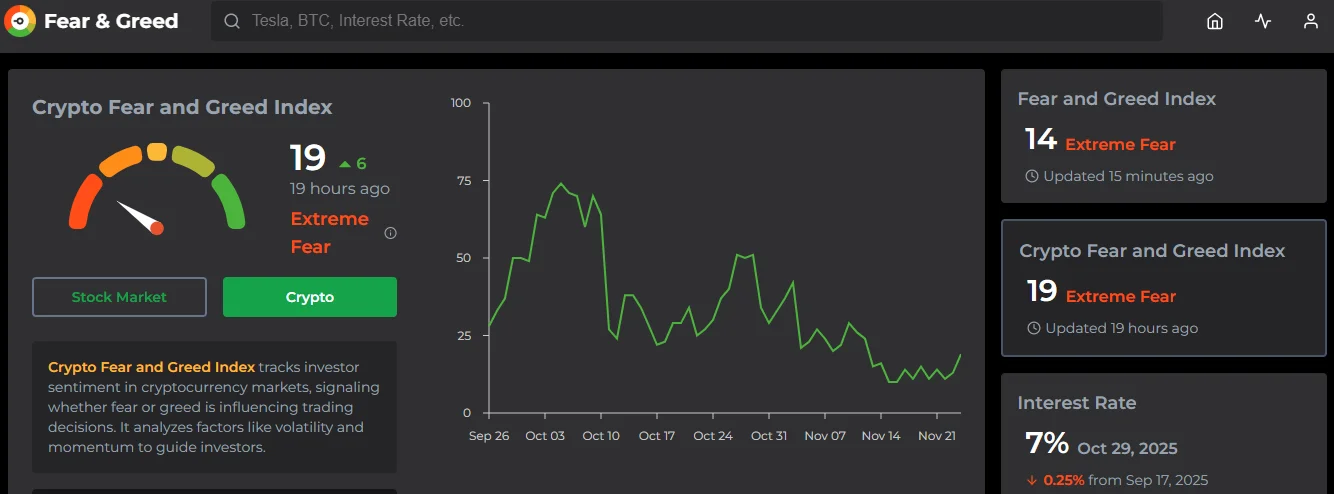

Extreme fear at 19. Yet the market keeps showing signs of quiet accumulation. This is usually where smart money loads up while everyone else hesitates.

The crypto market has been through a rough patch lately, with sharp drops leaving traders on edge. But today brings a small glimmer of hope. Bitcoin climbed 0.8% to hit $86,999, while Ethereum edged up 0.6% to $2,842.

These aren’t massive jumps, but after days of heavy selling, even modest gains feel like a breather. The total market cap has ticked up to $3.14 trillion, offering some stability amid the chaos.

Still, the past 24 hours saw $209 million in liquidations, a stark reminder that volatility isn’t done yet. Many positions got wiped out, and that kind of pain keeps sentiment low.

Traders have been hammered by recent swings, and fear is the dominant mood. Even with these slight rebounds, confidence hasn’t bounced back. The Crypto Fear & Greed Index, a key gauge of market psychology, sits at 19—firmly in “extreme fear” territory.

This low reading shows investors are still skittish, holding back from big moves. It’s not surprising after the down days, but it highlights how fragile things remain.

Key Takeaways

- Extreme fear at a reading of 19 shows traders remain deeply cautious despite the slight market rebound.

- Mild price upticks in BTC and ETH likely reflect temporary relief driven by oversold RSI conditions.

- Anticipation of a potential Fed rate cut in December is supporting sentiment, but not yet restoring confidence.

- Extreme fear historically aligns with accumulation phases where patient investors quietly position for future recovery.

Extreme Fear Persists Even as Rate Cut Expectations Rise

A key factor behind the recent bounce is renewed anticipation of a Federal Reserve rate cut in December. Lower interest rates historically shift capital into risk-on assets like crypto, as investors seek higher yields and alternative growth avenues.

However, this optimism hasn’t translated into emotional conviction. The Crypto Fear & Greed Index sits at 19, firmly in the Extreme Fear bracket. At this level, most market participants remain defensive. Price action may be bouncing, but sentiment hasn’t recovered.

“The market is still deeply in the grip of fear… Traders remain cautious, wary of further downside.”

Fear-driven environments often produce mispricing—both on the downside and during rebounds—as emotional selling dominates over rational valuation.

RSI Suggests Oversold Conditions — But Relief May Be Temporary

From a technical perspective, the recent price rise coincides with oversold readings on the Relative Strength Index (RSI). That means the market was pushed lower faster than its natural equilibrium would suggest, forcing a snapback.

Still, analysts caution that this could simply be a relief bounce rather than the start of a sustained uptrend.

“This may just be a temporary relief bounce rather than the start of a larger bullish trend.”

Many traders have moved into observation mode — not selling aggressively, but not buying heavily either — waiting for macro signals to become clearer.

What Exactly Does an FGI Reading of 19 Mean?

The Fear & Greed Index acts as an emotional barometer of the market. It incorporates:

- Market volatility (25%)

- Trading volume (25%)

- Social media sentiment (15%)

- Market surveys (15%)

- Bitcoin dominance (10%)

- Google search trends (10%)

At 19, extreme fear typically indicates that:

- Retail traders have panicked or exited positions.

- Long-term investors remain steady.

- Selling pressure has already flushed out weak holders.

- Value buyers may begin accumulating selectively.

“When the Crypto Fear & Greed Index hits extreme lows, it often signals that weak hands have already sold.”

While this does not guarantee a price bottom, extreme fear conditions historically precede some of the strongest recovery phases in crypto cycles.

Quiet Accumulation Beneath the Noise

Behind the visible market turbulence, there may be a quieter trend emerging: institutional and high-conviction accumulation. Price may be moving slowly, but the depth of extreme fear implies that patient capital is positioning gradually rather than aggressively.

Right now, public sentiment suggests “danger,” but experienced investors often reinterpret this same moment as “discount.”

No related posts.