Bitcoin’s record-breaking rise to $109,000 in January 2025 felt like the peak of a golden era until a sharp reversal in late February. In just weeks, prices dropped over 20%, creating uncertainty across the crypto market.

“I was surprised to see bitcoin at $80,000 and it looks like the bloodletting hasn’t ended yet.”

If you’ve been following closely, you’ve probably noticed the shift: excitement fading, fear growing, and the question on everyone’s mind: Are we entering a crypto bear market? Although prices bounced back slightly in March, hovering above $91,000, many remain unsure about what’s next.

For traders and investors, this phase isn’t just about surviving the downturn but adjusting strategies to the new reality. The good news? A bear market doesn’t have to mean losses. With the right approach, it can be a chance to grow, learn, and even earn profit.

In this article, we’ll look at effective bear market crypto trading strategies to help you manage risk and make smarter decisions during volatile times.

Key Takeaways

- A bear market in crypto is marked by sustained price declines (typically 20% or more) and negative sentiment.

- Effective strategies during bear markets include Dollar-Cost Averaging (DCA), short selling, portfolio diversification, HODLing, and using stop-loss/limit orders.

- Dollar-Cost Averaging (DCA) helps reduce volatility risk by consistently investing fixed amounts over time.

- Short selling allows experienced traders to profit from falling prices but comes with higher risk.

- Types of short selling include margin trading, futures contracts, and options trading, each offering different levels of leverage.

- Portfolio diversification spreads risk across different crypto assets and sectors, including stablecoins.

What Is a Bear Market in Crypto?

A bear market in the crypto space refers to a period when prices of digital assets experience a prolonged and significant decline, typically 20% or more from recent highs. This downturn is often accompanied by widespread negative sentiment among investors, increased selling pressure, and a general sense of uncertainty.

“These types of losses rarely end well and I still think the big capitulation is yet to come.”

A notable example is Bitcoin’s dramatic fall from 2017 and 2018, where Bitcoin peaked near $20,000 and fell below $12,000 from late December 2017 to 2018. Several factors can trigger a crypto bear market, including unfavorable regulatory announcements, broader economic challenges, or shifts in market confidence.

During such times, fear tends to dominate, leading many investors to liquidate their holdings, which further pushes prices downward. At the start of a bear market, trading volumes usually rise as investors rush to reduce risk and exit positions.

However, as prices fall to their lowest levels, trading activity often stabilizes. Interestingly, some traders see these low prices as buying opportunities, hoping to capitalize on a future market rebound.

Bear markets are also marked by heightened volatility, with sharp price swings especially noticeable among major cryptocurrencies. Monitoring economic indicators like inflation rates, interest rates, and employment trends can provide insight into the broader financial environment that impacts crypto markets.

“When you look at the recent slide in Bitcoin and other cryptocurrencies, it’s really a reflection of the broader mood in financial markets right now.”

Additionally, developments within the crypto industry, such as security incidents or sudden project collapses, also spark panic across the market. The 2022 crash of Terra Luna, which erased billions in value quickly, is a recent example of how these events can drag the entire crypto market down.

In essence, recognizing these signs is essential for anyone looking to implement effective bear market crypto trading strategies.

Best Bear Market Crypto Trading Strategies

Trading in a bear market requires more than just patience, as you need a clear strategy to protect your investments and potentially capitalize on market opportunities.

Here are some of the best bear market crypto trading strategies to consider during times of sustained market decline:

Dollar-Cost Averaging (DCA)

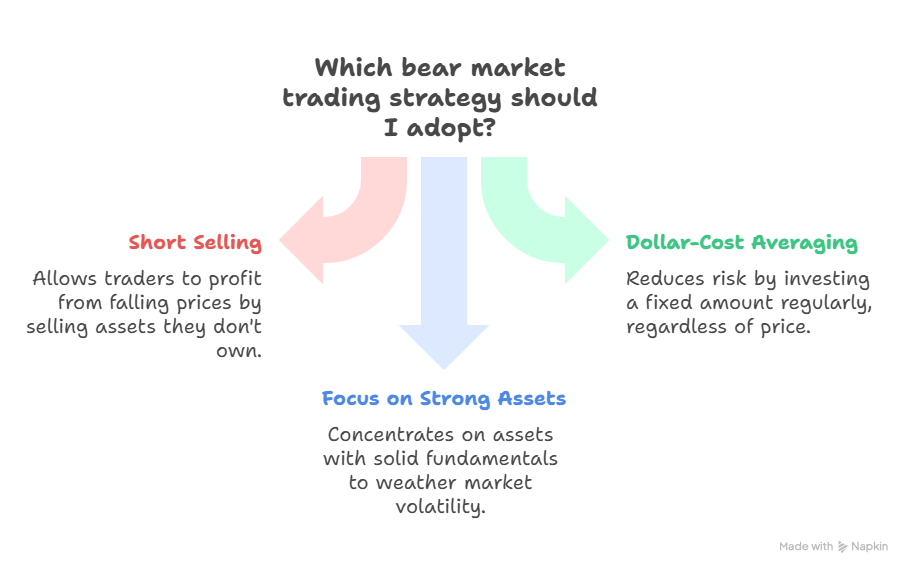

This approach involves investing a fixed amount of money into a cryptocurrency at regular intervals, whether weekly, monthly, or quarterly, regardless of the asset’s price at each purchase.

The main advantage of DCA is that it helps reduce the impact of market volatility. Instead of trying to time the market perfectly, which is especially difficult during unpredictable bear phases, you steadily accumulate assets over time.

When prices are low, your fixed investment buys more units; when prices are high, you buy fewer. This averaging effect lowers your overall cost per unit, smoothing out the highs and lows of volatile markets.

DCA also takes the emotional pressure off investing decisions during downturns.

By sticking to a consistent plan, you avoid the risk of making large purchases at peak prices only to watch their value fall. For example, instead of investing $1,200 in Bitcoin all at once, you could invest $100 every month for a year.

If the price fluctuates, you’ll sometimes buy more Bitcoin (when prices are low) and sometimes less (when prices are high), but overall, you’ll avoid the risk of making a large investment at a market peak.

Some investors take this a step further by increasing their investment during significant market dips, commonly referred to as “buying the dip.” So, if Bitcoin drops sharply one month, they might double their regular $100 investment to $200 to take advantage of the lower price.

Overall, Dollar-Cost Averaging is a disciplined, low-stress way to build crypto holdings steadily during bear markets, helping you stay invested without trying to predict short-term price movements.

Short Selling

Short selling is a trading strategy that allows you to profit when the price of a cryptocurrency drops. Instead of buying and holding, you borrow the asset, usually through a margin trading platform and sell it at the current market price.

Later, when the price falls, you buy it back at the lower price and return it to the lender, keeping the difference as profit. This strategy is especially useful during bear markets, where downward trends are more common and predictable.

Let’s say you borrow 1 Bitcoin at $90,000 and sell it right away. If the price drops to $80,000, you can buy it back and return it, securing a $10,000 profit (excluding fees and interest). The more the price drops after your initial sale, the higher your potential return.

There are a few methods you can use to short-sell cryptocurrencies:

- Margin Trading: Allows you to borrow crypto or funds from a broker to place larger trades than your current balance would permit. This is one of the most common ways to short crypto.

- Futures Contracts: Let you agree to sell a crypto asset at a future date for a set price. If the market price drops below the contract price, you gain.

- Options Trading: Gives you the right (but not the obligation) to sell an asset at a predetermined price, which can be beneficial in falling markets.

While short selling can be profitable, especially during market downturns, it comes with higher risk. Since you’re using borrowed funds or assets, losses can be magnified if the market moves against your position. It’s best used by traders who have a solid understanding of technical analysis and risk management.

Portfolio Diversification

Portfolio diversification is a key strategy for managing risk, especially during a bear market. Instead of putting all your funds into a single cryptocurrency, diversification means spreading your investments across multiple digital assets.

This approach helps reduce the impact of sharp price drops in any one asset, making your overall portfolio more resilient to market volatility. In the crypto space, diversification goes beyond just holding different coins. It also involves investing across various sectors such as decentralized finance (DeFi), non-fungible tokens (NFTs), blockchain gaming, and more.

Each sector responds differently to market changes, so spreading your assets can smooth out fluctuations and open up new growth opportunities. For instance, instead of investing $10,000 entirely in Bitcoin, you might allocate $4,000 to Bitcoin, $3,000 to promising DeFi tokens, $2,000 to NFT-related projects, and keep $1,000 in stablecoins.

This way, if Bitcoin’s price falls sharply, your losses are cushioned by other assets that may be less affected or even rise. Including stablecoins in your portfolio is another smart diversification tactic.

Stablecoins also maintain a relatively steady value and provide liquidity, allowing you to quickly move into promising investments when market conditions improve. Having some stablecoins on hand acts like a reserve fund, ready to capitalize on market dips without having to sell off other assets at a loss.

HODLing

This is a strategy built on patience and conviction, and holding onto your crypto assets through market ups and downs without selling during downturns. The term originated in 2013 from a typo on a Bitcoin forum where a user declared they were “HODLING” instead of “holding.”

Since then, it has become a rallying cry among crypto investors who believe in the long-term potential of blockchain technology and its communities.

This approach encourages investors to remain calm and avoid reacting emotionally to market volatility or price drops.

Instead of trying to time the market or make quick profits, HODLing focuses on the belief that, over time, the value of quality cryptocurrencies will grow despite short-term fluctuations. HODLing is especially effective in bear markets because it helps investors avoid panic selling at low points.

By holding steady, investors position themselves to benefit when the market eventually recovers. For instance, if you bought Ethereum at $3,000 per coin before a market downturn. Instead of selling when the price dropped to $1,800, you hold your position, trusting in Ethereum’s long-term development.

When the market rebounds, your investment regains value and potentially grows beyond your original purchase price. HODLing requires patience and confidence, but can be a powerful way to navigate the volatility inherent in crypto markets.

Use of Stop-Loss and Limit Orders

In a bear market, managing losses is just as important as seeking profits. One effective way to control risk is by using stop-loss and stop-limit orders, tools designed to automatically sell your crypto assets when prices reach certain levels, helping to limit potential losses.

- Stop-Loss Order

A stop-loss order is an instruction you place with your exchange or trading platform to sell a cryptocurrency once its price falls to a predetermined level. This order helps you protect your investment by setting a maximum loss you’re willing to accept on a trade.

Once the stop price is hit, the order becomes a market order and sells at the next available price. For example, if you buy Bitcoin at $50,000 and want to limit your loss to 10%, you can set a stop-loss at $45,000. If the price drops to or below this point, the stop-loss order will trigger, selling your Bitcoin to prevent further losses.

- Stop-Limit Order

A stop-limit order adds more control by combining two price points: the stop price, which activates the order, and the limit price, which sets the lowest price at which you’re willing to sell. When the stop price is reached, the order becomes a limit order, which only executes at or above the limit price.

This means you avoid selling at prices far below your stop level during sudden market drops, but it also carries the risk that your order may not be filled if the price falls too quickly.

A good example of this is, for instance, you bought Ethereum at $3,000 and want to protect your investment during a volatile bear market. You set a stop-limit order with a stop price of $2,850 and a limit price of $2,750.

If the price falls to $2,850, the order is triggered, but your Ethereum will only sell if the price remains above $2,750. This approach helps prevent your assets from being sold at an unexpectedly low price during sudden market drops.

Risk Management in Bear Market Crypto Trading

Managing risk in a bear market is critical to protecting your capital and staying positioned for future gains. Here are some essential risk management principles that align with successful bear market crypto trading strategies:

Set Clear Entry and Exit Points

Avoid emotional decisions by determining your entry and exit points before initiating a trade. Ensure you define the maximum loss you can tolerate and stick to it.

Avoid Overtrading

Trying to time every small movement can lead to poor decision-making and unnecessary losses. Focus on high-probability setups and preserve your emotional energy.

Position Sizing

Never allocate more than a reasonable percentage of your portfolio to a single trade. Risking 1–2% per trade can protect you from large losses over time.

Maintain Liquidity

Always keep part of your portfolio in stablecoins or fiat equivalents. This provides flexibility to buy dips or exit positions without being forced to sell at a loss.

Avoid Leverage (Unless Experienced)

Trading with borrowed funds in a volatile bear market can magnify losses quickly. If you must use leverage, use it conservatively and only with tight stop-loss orders in place.

Stay Informed, Not Reactive

Bear markets are noisy. Follow trusted sources, track macroeconomic indicators, and avoid making impulsive decisions based on hype or fear.

Conclusion

While bear markets can feel discouraging, they’re a natural part of the crypto cycle. Instead of fleeing the market, traders and investors who embrace calculated, informed bear market crypto trading strategies like DCA, short selling, and HODLing are often better positioned when recovery begins.

With solid risk management and emotional control, a bear market can become a period of growth both in knowledge and long-term returns. Remember, no strategy guarantees success, but a clear plan can keep you steady while others panic.

Frequently Asked Questions(FAQs)

Should I Sell All My Crypto In A Bear Market?

No. While some traders choose to exit, strategies like HODLing, diversification, and using stop-losses can help you navigate downturns without fully cashing out.

What Is The Best Crypto Strategy During A Bear Market?

The best strategy depends on your risk tolerance, but combining dollar-cost averaging, diversification, and using stop-losses is effective for most investors.

Can You Make Profits During A Bear Market?

Yes. Strategies like short selling and selectively buying undervalued assets can generate profits even in falling markets.

What Should I Do If My Portfolio Drops Significantly In Value?

If your portfolio drops, assess the fundamentals of your investments. Consider rebalancing, diversifying, or holding strong assets instead of panic selling.

Are Stablecoins Useful In Bear Markets?

Yes. Stablecoins offer liquidity and stability, making them useful for preserving capital and re-entering the market during dips.