Staking is quickly becoming one of the easiest ways to earn from crypto without trading. By simply locking up your crypto to help validate transactions on a network, you can receive rewards often without needing advanced technical skills.

However, this wasn’t always the case. When staking was first introduced as an alternative to energy-heavy mining, it required more effort and expertise. But with the rise of cryptocurrency staking platforms, the process has become far more user-friendly, opening the door for everyday investors to participate.

From Peercoin’s early adoption of staking to Ethereum’s major shift in 2022, the staking ecosystem has grown rapidly, both in value and in tools designed to support it. In this article, we’ll break down how these platforms work, what to look out for, and which ones stand out in today’s market.

Key Takeaways

- Cryptocurrency staking platforms enable users to earn rewards by locking up crypto to support blockchain networks.

- The three main types of crypto staking platforms include Centralized Exchanges, DeFi & Non-Custodial Platforms, and Wallet-Based Platforms.

- Popular platforms include Coinbase, StakeWise, Trust Wallet, Rocket Pool, Gemini, and LedgerLive.

- Choosing the right platform involves considering security, transparency, fees, reward structure, validator quality, and flexibility around lock-up periods.

- Liquid staking platforms provide tradable tokens representing your stake, adding liquidity and more ways to use your assets.

What Is Cryptocurrency Staking?

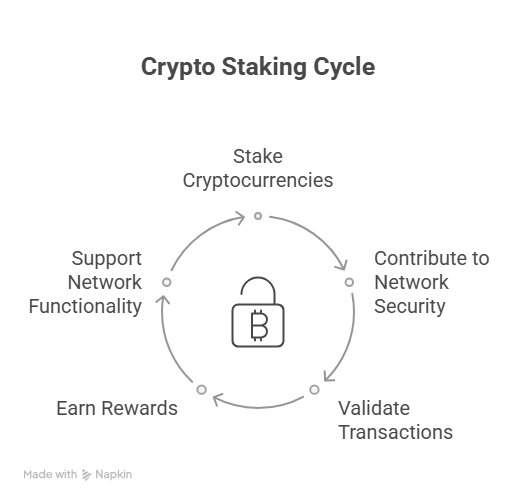

Cryptocurrency staking is a process where token holders lock up their coins to help maintain and secure a blockchain network that uses a Proof of Stake (PoS) system. By staking their tokens, participants known as validators take part in verifying and validating new transactions on the blockchain.

The more tokens a validator stakes, the higher their chances of being selected to add the next block of transactions. To make it easier, think of staking like earning interest on money in a savings account or dividends from shares.

When you stake your crypto, you essentially put your tokens to work and earn rewards in return, usually paid in the same cryptocurrency. Furthermore, to become a validator, you typically need to lock your tokens into a staking contract and run special software to process transactions.

However, many cryptocurrency staking platforms and apps have simplified this process, allowing users to stake their crypto directly from wallets or exchanges without needing technical expertise.

For example, platforms like Binance or Coinbase offer easy staking options where they handle the technical details for you, sometimes for a small fee. However, while staking can offer steady rewards, it typically requires locking your funds for a set period and understanding the specific rules of each blockchain.

How Cryptocurrency Staking Platforms Work

Cryptocurrency staking platforms act as intermediaries that make staking easier and more accessible, especially for users who might not want to run their own validator nodes or manage technical setups.

Instead of handling the complexities of staking on their own, users can deposit their crypto assets into these platforms, which then pool the tokens and take care of the staking process on their behalf. Here’s a step-by-step overview of how these platforms generally work:

- You start by transferring your tokens, such as Ethereum (ETH), Cardano (ADA), or Solana (SOL), to the staking platform’s wallet or account.

- The platform then pools together many users’ tokens to reach the minimum required amount for staking. Some blockchains require a high minimum stake (e.g., Ethereum requires 32 ETH to run a validator node), but platforms let you stake any smaller amount by aggregating funds.

- The platform runs one or more validator nodes that perform the blockchain’s transaction validation and consensus tasks. This technical work involves checking transactions and adding new blocks to the chain.

- Validators earn staking rewards for helping secure the network. The platform collects these rewards and distributes them proportionally to all users who contributed tokens to the pool, usually after deducting a small service fee.

- Most platforms offer easy-to-use dashboards or apps that allow users to track their staked assets, rewards earned, and manage withdrawals when permitted.

Top Cryptocurrency Staking Platforms

| Platform | Type | Supported Rewards | Rewards (APY/APR) | Key Features | Limitations |

| Binance.US | Centralized Exchange | ETH, ADA, BNB, MATIC, etc. | Up to 16.50% | User-friendly, flexible/locked staking, regular rewards | Not available in all regions |

| Coinbase | Centralized Exchange | ETH, SOL, ADA, AVAX, etc. (130+) | Up to 14% APY | Easy for beginners, regulated, broad asset selection | High fees, limited availability in some regions |

| Gemini | Centralized Exchange | ETH, SOL | ~4.95% (SOL) | Secure, regulated, Staking Pro option, no minimum for standard staking | Limited assets, standard staking unavailable in UK |

| Lido Finance | DeFi / Non-Custodial | Ethereum (ETH via stETH) | Competitive, varies | Liquid staking, use stETH in DeFi, community governance | Smart contract risk, ETH-only focus |

| Rocket Pool | DeFi / Non-Custodial | Ethereum (ETH via rETH) | ~2.43% APR | Decentralized, liquid staking, no lock-up, node staking option | ETH-only, lower APR than some exchanges |

| StakeWise | DeFi / Non-Custodial | Ethereum (ETH via osETH) | ~2.47% APY | Vault marketplace, liquid staking, solo staking option | ETH-only, newer protocol |

| Trust Wallet | Wallet-Based | ETH, SOL, TRON, DOT, etc. | Variable by network | Mobile staking, non-custodial, validator choice | Mobile only, lacks advanced analytics |

| Ledger Live | Wallet-Based | TH, SOL, ATOM, DOT, etc. | Variable by network | Hardware security, full self-custody, no Ledger fees | Less flexible, validators may charge fees |

When looking at the top cryptocurrency staking platforms, they generally fall into three categories based on several factors. Here are some of the top staking platforms you can start with:

Centralized Exchanges

Centralized exchanges are online platforms where you can buy, sell, and stake cryptocurrencies through a centralized service provider. When you stake on these platforms, you typically deposit your tokens into the exchange’s custody, and they manage the technical side of staking, including running validator nodes.

Binance

Binance.US is one of the leading centralized cryptocurrency staking platforms, offering users the chance to grow their crypto holdings with competitive rewards rates of up to 16.50%. The platform supports a variety of popular Proof-of-Stake (PoS) cryptocurrencies, including Ethereum (ETH), Cardano (ADA), Binance Coin (BNB), Polygon (MATIC), and several others, providing users with diverse staking options.

One of Binance.US’s main advantages is its user-friendly interface, which makes staking accessible to both beginners and experienced investors.

Additionally, users can choose between flexible or locked staking periods, allowing them to balance liquidity needs with maximizing rewards. Staking rewards are typically distributed regularly, enabling users to see steady growth in their holdings.

However, a notable limitation is that Binance.US Staking services are not available in all regions, restricting access for some users. Despite this, for eligible participants, Binance.US provides a reliable and user-friendly staking experience with competitive rewards.

Coinbase

Coinbase provides a straightforward and accessible cryptocurrency staking platform, allowing users to earn up to 14% APY on a variety of supported assets.

With over 130 cryptocurrencies available for staking, including popular options like Ethereum (ETH), Solana (SOL), Cardano (ADA), and Avalanche (AVAX), Coinbase makes it easy for both beginners and experienced investors to put their crypto to work.

The good news is that you can start staking with as little as $1, providing flexibility for those new to staking or with smaller portfolios. One of Coinbase’s key advantages is its user-friendly interface.

Its interface guides customers through the staking process while handling all technical details such as validator node management and reward distribution. Coinbase’s regulated environment and strong security measures provide added peace of mind, especially for users prioritizing compliance and safety.

With a competitive reward structure and broad asset selection, Coinbase remains a top choice for staking crypto with ease and confidence.

“Our staking product is not a security. Customers never turn their assets to Coinbase, for instance. And we really just are providing a service that passes through those coins to help them participate in staking, which is a decentralized protocol.”

Brian Armstrong, CEO of Coinbase

Gemini

Gemini Staking offers a secure and regulated platform that combines the benefits of decentralization with the ease of use Gemini is known for. Its intuitive user interface makes staking accessible, even for beginners, while providing competitive network rewards on select assets.

On Gemini, you can stake with no minimum amount on the standard staking option, and rewards are shared proportionally among participants.

However, this option does not allow tracking of positions on-chain, and all rewards accumulate in a single address managed by Gemini. Notably, standard staking is unavailable in the UK.

For advanced users, Gemini offers Staking Pro, which provides on-chain transparency, segregated reward addresses, and full control over validator data.

Additionally, Gemini’s staking asset selection is more limited compared to other platforms, with prominent options like Ethereum (ETH) and Solana (SOL), offering APYs of around 4.95% for SOL.

While Gemini’s staking platform doesn’t support a wide range of cryptocurrencies, it prioritizes security, regulatory compliance, and simplicity for users seeking trusted staking opportunities.

DeFi and Non-Custodial Platforms

Decentralized finance (DeFi) platforms enable users to stake crypto without handing over custody of their assets.

These platforms often utilise smart contracts to pool user funds and distribute rewards, providing users with more control and, in some cases, greater flexibility.

Lido Finance

Lido Finance is a leading decentralized staking platform empowering Ethereum users since 2020. It offers liquid staking through its stETH token, allowing users to earn competitive rewards while maintaining deep liquidity.

Unlike traditional staking, Lido’s non-custodial design ensures that no single party can control or access stakers’ funds, providing enhanced security and trust.

You can trade stETH on secondary markets or use it as collateral for lending, borrowing, and leverage staking, adding flexibility and opportunities beyond simple staking rewards. Lido also supports restaking and diversified rewards, maximizing earning potential.

Additionally, Governance is transparent and community-driven as key decisions are made through public votes by LDO token holders, ensuring accountability to users and the broader Ethereum ecosystem. This balance of decentralization, security, and flexibility makes Lido Finance a top choice for Ethereum staking.

“As part of the Deutsche Börse Group, we are dedicated to setting industry standards for security and innovation in digital asset services. The integration of the Lido Protocol into our wallet solution is a significant step in meeting the needs of our institutional clients.”

Kasper Luyckx, Head of Wallet Infrastructure & Staking Services at Crypto Finance AG

Rocket Pool

Rocket Pool is a leading decentralized liquid staking protocol for Ethereum, designed to make ETH staking accessible, flexible, and community-driven. With Rocket Pool, you can stake as little as 0.01 ETH and receive rETH, a liquid staking token.

This token increases in value over time as rewards accrue, currently offering an average 2.43% APR.

What sets Rocket Pool apart is its easy unstaking, with no minimum lock-up period.

rETH can also be traded, used as collateral, or integrated across DeFi platforms, offering utility beyond passive rewards. For more advanced users, Rocket Pool also supports node staking, allowing individuals to operate validator nodes and earn additional commission rewards.

As a truly decentralized protocol, Rocket Pool strengthens Ethereum’s security while giving users greater control and flexibility over their staked assets.

StakeWise

StakeWise is a flexible Ethereum staking platform that lets users stake on their own terms, either solo or by pooling with others. With its liquid staking token, osETH, you earn rewards every second simply by holding, and can stake or unstake in moments with no long lock-up periods.

At the core of StakeWise is its staking marketplace, powered by a decentralized network of Vaults. Users can browse and select Vaults run by node operators based on performance, decentralization, or reward rates, currently offering projected APYs around 2.47%.

Additionally, for advanced users, StakeWise offers liquid solo staking, allowing individuals to run nodes, open their own Vaults, and accept ETH delegations, all without needing collateral.

With its focus on user control, decentralization, and DeFi integration, StakeWise gives stakers a powerful, transparent, and customizable way to earn ETH rewards.

Wallet-Based Platforms

Wallet-based platforms allow users to stake directly from their personal wallets, either software or hardware. This gives users full custody of their private keys and more control over their assets while still enabling staking rewards.

Trust Wallet

Trust Wallet is a mobile, non-custodial wallet that enables users to stake popular Proof-of-Stake coins directly from their phones while maintaining control of their private keys.

You can earn rewards on assets like Ethereum, Solana, TRON, and Polkadot, with rates varying based on network performance and validator selection.

Staking through Trust Wallet is simple, with no centralized intermediary, users select a validator and delegate their assets within a few taps. Trust Wallet also supports on-chain governance participation for certain assets.

As a self-custodial platform, it offers strong user control, but it lacks advanced analytics and desktop compatibility. Still, its simplicity, mobility, and wide token support make it an excellent choice for staking on the go

Ledger Live

Ledger Live offers secure staking integrated with Ledger hardware wallets, allowing users to earn rewards while retaining full self-custody of their assets. It supports a growing list of coins, including Ethereum (ETH), Solana (SOL), Cosmos (ATOM), and Polkadot (DOT).

Using Ledger Live’s Earn section, users can explore staking opportunities, track live reward earnings, and access validator options, all while their private keys remain safely stored offline. This makes it ideal for long-term holders who prioritize security without sacrificing growth.

Ledger doesn’t charge staking fees, though validators may take a commission. It’s best suited for users who value high-grade asset protection alongside transparent, non-custodial staking. While less flexible than some mobile apps, Ledger Live offers unmatched security for staking directly from a hardware wallet.

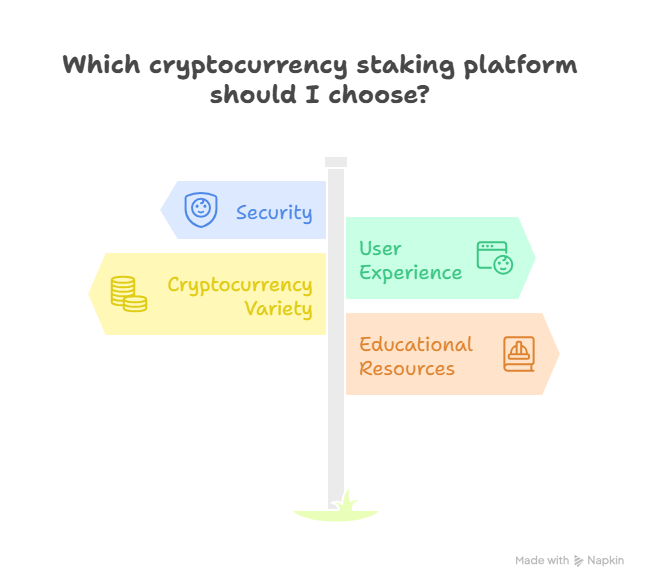

How to Choose the Right Staking Platform

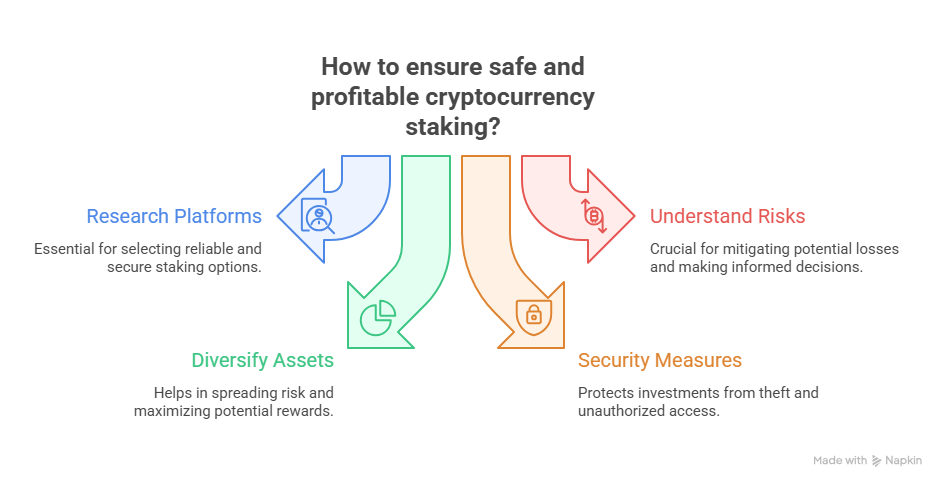

Source: Napkin

Selecting the best cryptocurrency staking platform isn’t just about choosing a platform with the highest APY.

It’s also necessary to think about security, usability, transparency, and alignment with your personal goals. Here’s a deeper look at what to consider beyond surface-level factors:

Research on Custodianship and Control

Before staking, know who controls your crypto. Centralized platforms often hold your assets on your behalf, increasing convenience but introducing counterparty risk.

However, non-custodial and wallet-based platforms keep you in control but may demand more technical involvement. Your comfort with risk and technical skill should guide your choice.

Evaluate Transparency and Governance

Platforms governed by decentralized communities (e.g., Lido or StakeWise) offer public decision-making, increasing trust.

Thus, investigate how the platform manages rewards, fees, and validator selection. Clear communication about these elements is a sign of a platform that values its users.

Look for Flexibility, Not Just Returns

Staking isn’t one-size-fits-all. Some platforms lock your tokens for fixed periods, limiting liquidity. Others offer liquid staking tokens you can trade or use in DeFi. Decide how important access to your funds is, and whether you want to use your staked assets elsewhere.

Check the Validator Network Quality

The strength of the underlying validator nodes also directly impacts your rewards and security. Platforms that vet validators for reliability, decentralization, and security reduce the risk of slashing penalties and downtime. In essence, a diverse validator set is a positive indicator.

Assess Fees and Reward Distribution

Fees can eat into your returns over time. Therefore, understand how fees are structured, whether fixed, percentage-based, or hidden, and how rewards are calculated and distributed. Also, look use transparent platforms that make this information easily accessible.

“There are platforms that choose to have a fixed yield for a specific lock-up term with a maximum reward per user, while others adjust their yield daily based on the staking rewards left within a specific pool.”

Claudiu Minea, CEO and co-founder at SeedOn

Consider User Experience and Support

Especially for beginners, a smooth interface and responsive customer support make a big difference. Look for platforms that provide educational resources, clear staking terms, and active community engagement.

Security Practices and Track Record

It is also important to check the platform’s history for security incidents, audits, and partnerships. Secure smart contracts, multi-signature wallets, and regular code reviews reduce the risks of hacks or bugs.

Tips for Safe and Profitable Cryptocurrency Staking

Here are some tips to guide you when staking cryptocurrency:

Start With Thorough Research

Before committing any funds, take time to research the platform’s reputation, user reviews, and technical background.

Look for third-party audits and security certifications. Understanding the team behind the platform and their transparency is crucial for trust.

Understand the Tokenomics

Every staking opportunity comes with its own set of rules, such as minimum stakes, lock-up periods, reward rates, inflation effects, and unstaking conditions.

It is vital to learn how the rewards are generated, how often they’re distributed, and whether the token supply affects long-term returns.

Diversify Across Networks and Platforms

Avoid putting all your crypto eggs in one basket. Different blockchains have different risk profiles, and platforms vary in security and fees. Spreading your stake can reduce risks from a single point of failure.

Keep an Eye on Validator Performance

Some platforms allow you to choose or switch validators. Regularly check validators’ uptime and behavior. Validators with poor performance can reduce your rewards or even lead to slashing penalties.

Conclusion

Cryptocurrency staking platforms play an important role in making staking accessible and secure for many users. They simplify the process of earning rewards by handling technical tasks and managing validator nodes.

Therefore, picking the right platform means looking at how safe, transparent, and flexible it is, as well as understanding the fees and risks involved. As staking grows, platforms that focus on clear rules and user control will become more important.

Essentially, using staking platforms thoughtfully can help you earn steady rewards while staying connected to the blockchain ecosystem.

Frequently Asked Questions (FAQs)

What are cryptocurrency staking platforms?

Cryptocurrency staking platforms are services or protocols that allow users to lock up their crypto assets to support blockchain operations and earn rewards, often handling technical aspects like validator management.

How do staking rewards work?

Staking rewards are typically distributed based on the amount staked and validator performance, paid out periodically in the network’s native token.

Can I unstake anytime?

It depends. Some platforms and networks have lock-up periods, while others offer liquid staking tokens for more flexible access.

Related posts:

- The Future of Crypto Trading: A Deep Dive into Technical Analysis APIs

- Cryptocurrency Trading Strategies Every Investor Should Know

- How to Interpret Japanese Candlestick Patterns in Crypto Trading

- Trend Lines in Charts: What You Need to Know

- How to Trade Futures: A Beginner’s Guide to Futures Trading