Strategy has added another sizable chunk of Bitcoin to its balance sheet, reinforcing its position as the world’s largest corporate holder of BTC.

According to a recent SEC filing and a public statement from executive chairman Michael Saylor, the company acquired 1,142 BTC for roughly $90 million between February 2 and February 8, 2026, at an average price of about $78,815 per coin.

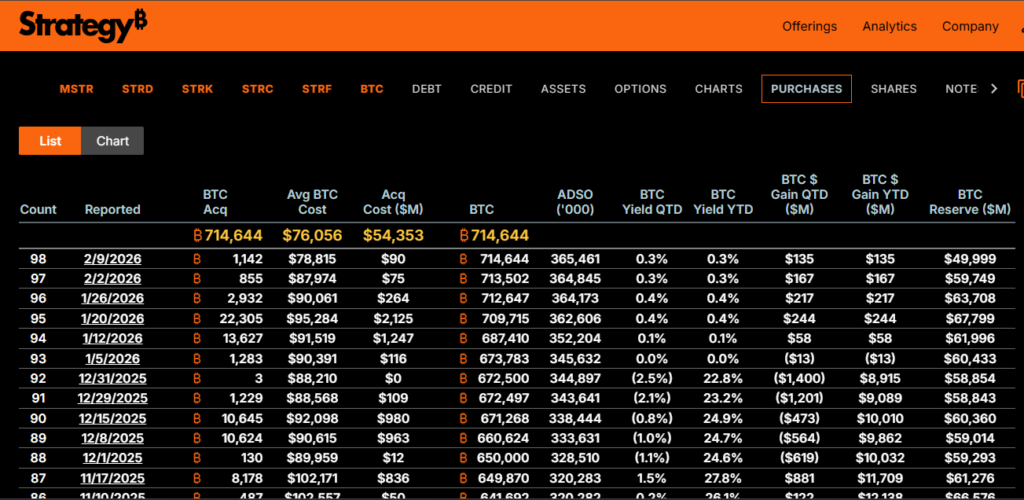

With this purchase, Strategy’s total Bitcoin holdings now stand at 714,644 BTC, accumulated at an average cost of approximately $76,056 per Bitcoin. The total amount spent on Bitcoin so far is estimated at $54.35 billion.

“Strategy has acquired 1,142 BTC for ~$90.0 million at ~$78,815 per bitcoin. As of 2/8/2026, we hodl 714,644 $BTC acquired for ~$54.35 billion at ~$76,056 per bitcoin.”

— Michael Saylor, February 9, 2026

Key Takeaways

- Strategy’s latest $90 million Bitcoin purchase reinforces its long-term conviction despite the asset trading below its average cost.

- Total holdings of 714,644 BTC make Strategy the largest corporate Bitcoin holder by a wide margin.

- Unrealized losses exceeding $5 billion highlight the balance-sheet risk tied to Bitcoin price volatility.

- Funding Bitcoin buys through equity sales continues to link MSTR stock performance closely to BTC movements.

- Large-scale accumulation removes supply from the market, potentially tightening liquidity during future demand surges.

Buying More as the Market Pulls Back

The timing of the latest purchase has drawn attention across the crypto and traditional finance communities. Bitcoin is currently trading below $70,000, meaning Strategy’s average acquisition price now sits above spot levels. Market estimates suggest the company is carrying around $5.1 billion in unrealized losses following the recent pullback.

Despite this, Strategy continues to buy. The firm funded the latest acquisition by selling approximately 616,715 shares of its own stock, raising close to $89.5 million. This approach has become familiar: when Bitcoin dips or consolidates, Strategy raises capital through equity markets and converts it into BTC.

Critics argue the move reflects poor timing, as the purchase occurred shortly after Bitcoin briefly touched highs near $79,000. Some analysts described the buy as chasing a local top, especially given the sharp retracement that followed.

Supporters, however, see consistency rather than miscalculation. Strategy’s leadership has repeatedly said it is not trading Bitcoin but accumulating it with a multi-year, even multi-decade, horizon.

A Balance Sheet Tied to Bitcoin

Strategy’s aggressive accumulation has reshaped how investors view the company. Once known primarily as a business intelligence software firm, it now trades more like a leveraged Bitcoin proxy.

The company’s Q4 2025 financials reflected this reality. Strategy reported a loss of roughly $17.4 billion, largely driven by accounting treatment tied to Bitcoin’s price decline during the quarter. While much of that loss is unrealized, it has intensified debate around the risks of concentrating so much corporate capital in a single volatile asset.

Equity markets reacted quickly to the latest purchase. Shares of MSTR fell more than 5% following the announcement, even after rallying about 26% the previous week when Bitcoin briefly moved above $70,000.

Options data shows just how closely Strategy’s stock is now linked to Bitcoin. Open interest in MSTR options reportedly accounts for more than 85% of the company’s market capitalization, far above levels typically seen in large technology stocks.

Most bullish bets are clustered between $125 and $150, while the $100 level has emerged as a key downside area where traders are hedging risk.

Confidence or Concentration Risk?

Michael Saylor has remained publicly unfazed by the criticism. Over the weekend, he posted a chart of Strategy’s Bitcoin purchases on X with a short caption that has become something of a mantra for long-term holders.

“Orange Dots Matter.”

The message reflects Saylor’s belief that each purchase permanently removes supply from the market, regardless of short-term price action. From this perspective, volatility is noise, and drawdowns are opportunities to accumulate more scarce assets.

From a market structure standpoint, Strategy’s holdings are significant. Controlling over 714,000 BTC means a large amount of supply is effectively locked away, reducing the number of coins available on exchanges. While this does not guarantee higher prices, it can contribute to tighter liquidity during periods of rising demand.

Still, the risks are clear. Bitcoin and MSTR now move closely together, exposing shareholders to amplified swings in both directions. If Bitcoin experiences a prolonged downturn, Strategy’s balance sheet and stock price could face further pressure.

What the Market Is Watching Next

For now, Strategy shows no sign of slowing down. The latest $90 million buy signals that management remains committed to its Bitcoin-first strategy, even as paper losses mount and scrutiny increases.

Whether this approach will be remembered as disciplined conviction or excessive risk-taking will depend largely on Bitcoin’s long-term trajectory. What is certain is that Strategy has placed one of the largest corporate bets in financial history on a single asset—and it continues to double down.

As Bitcoin trades below Strategy’s average cost, the company stands as a live case study in high-stakes conviction, testing the patience of critics and the faith of believers at the same time.

Related posts:

- TON Network Records More Growth as TVL Surpasses $770M

- Big Bets on Trump: Polymarket Whales Drive Election Wagering Over $400M

- BlackRock ETF Overtakes Grayscale’s to Become the Top Crypto Fund, Says Arkham

- SEC Charges Brothers in $60M Crypto Ponzi Scheme

- Gurbir Grewal Steps Down As SEC Enforcement Director