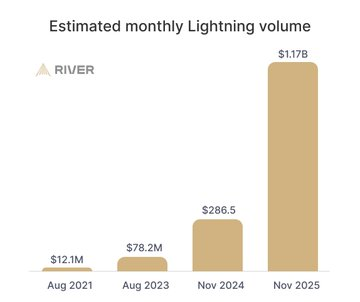

Bitcoin’s Lightning Network has crossed a major adoption threshold, processing more than $1 billion in monthly transaction volume for the first time, according to fresh research from River.

Data compiled by the firm shows that in November 2025, the layer-two protocol handled an estimated $1.17 billion across 5.22 million transactions. The milestone comes during a year in which Bitcoin’s price action has remained relatively flat, underscoring a steady expansion in usage that is not immediately visible on market charts.

Key Takeaways

- River estimates that the Lightning Network processed $1.17 billion across 5.22 million transactions in November 2025, marking its first month above the $1 billion threshold.

- Average transaction size climbed to $223 year-over-year, signaling a shift from experimental micropayments toward larger exchange-related transfers.

- Data aggregated from operators such as ACINQ and Kraken suggests the figures represent more than half of the network’s total capacity.

- New tools released by Lightning Labs could accelerate machine-to-machine payments, potentially reviving high-frequency micropayment activity through AI agents.

A Clearer View of Lightning Activity

River’s estimates are based on anonymized data from major node operators, covering more than half of the network’s capacity. Contributors include ACINQ, Kraken, Breez, Lightspark, and LQWD, among others.

The firm said its methodology adjusts for overlapping payment channels and extrapolates activity from nodes that do not publicly report data. That approach, River argues, offers a more representative picture of network-wide usage.

“This approach allows us to debunk misconceptions that Lightning adoption isn’t happening,” River stated, pointing to the breadth of participation from major operators.

Lightning operates as a second-layer protocol built on top of the Bitcoin blockchain, enabling faster and cheaper transactions by moving most activity off-chain while still settling securely on Bitcoin. The network has long been positioned as a solution for scaling everyday payments without congesting the base layer.

Fewer Transactions, Higher Value

Interestingly, total transaction count in November was slightly lower compared to 2023 levels. Researchers attribute that dip to the decline of earlier micropayment experiments, particularly in gaming and social messaging applications that briefly inflated transaction volumes.

While those use cases failed to sustain momentum, the overall dollar value moving across the network has climbed sharply.

In November 2025, the average Lightning transaction reached $223, nearly double the $118 recorded a year earlier. Analysts say this shift reflects how the network is being used today: increasingly for larger transfers between exchanges rather than small retail payments.

River addressed this shift directly in its social commentary:

“Micropayment theory suggested high-frequency, low-value payments, but mental transaction costs for humans limit this behavior. AI agents, which do not incur mental costs, could change this dynamic, potentially leading to more frequent, smaller payments in the future.”

The comment highlights a practical challenge in consumer behavior. While Lightning can support tiny payments, most users are reluctant to execute dozens of small transactions due to friction, even if fees are negligible.

AI Agents Enter the Picture

New developments may change that dynamic. Last week, Lightning Labs introduced an open-source toolkit designed to allow AI agents to operate Lightning nodes, conduct autonomous payments, and host paid services directly on the network.

The move targets a growing need for machine-to-machine payments, where software agents can transact without human intervention. If widely adopted, such systems could generate higher-frequency, low-value payments at scale — a scenario Lightning was originally built to support.

For now, however, the data suggests that exchange-related flows remain the dominant driver of volume growth. Larger transfers between trading platforms and liquidity providers appear to account for much of the increase in average transaction size.

Beyond the Price Chart

The $1.17 billion figure marks a milestone for Bitcoin’s second-layer infrastructure and adds another data point to the broader adoption narrative. While Bitcoin’s market price has shown limited movement in 2025, Lightning’s growth indicates ongoing expansion in transactional use.

River plans to release a broader report on Bitcoin adoption next week, promising additional metrics on network integration and usage trends across the ecosystem.

Crossing the $1 billion monthly threshold does not, by itself, confirm mainstream retail adoption. But it does demonstrate that Lightning is moving substantial value at scale — a sign that Bitcoin’s utility as a settlement and payment network continues to mature, even in quieter market conditions.

Related posts:

- Hong Kong Police Arrest 72 JPEX Exchange Rug pull Suspects

- Binance CEO Calls Out Nigeria Over ‘Unlawful’ Detention of Exec, Asks for His Immediate Release

- Coinbase Mulls Bringing Wrapped Bitcoin Token cbBTC to Solana Network

- Lena Dunham to Pen Sam Bankman-Fried Biopic for Apple

- Bitcoin and Ethereum ETFs Suffer Outflows for the Second Day Straight