Animoca Brands has secured a Virtual Asset Service Provider (VASP) license from Virtual Assets Regulatory Authority (VARA), clearing the Hong Kong-founded Web3 investor to expand its regulated crypto operations in Dubai and across the Middle East.

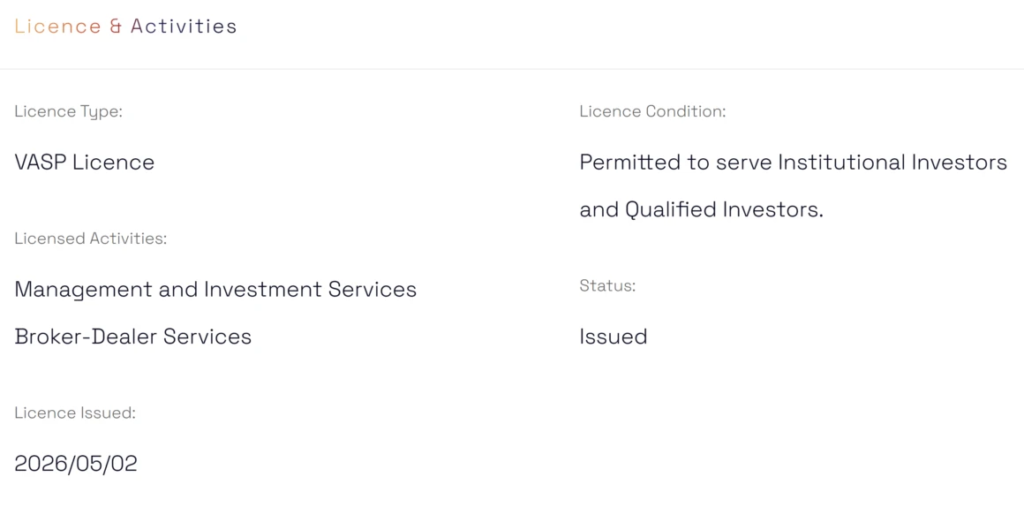

The approval, recorded on VARA’s public register on Feb. 5, authorizes Animoca to provide broker-dealer services and investment management related to virtual assets in and from Dubai. The license covers institutional and qualified investors and excludes the Dubai International Financial Centre (DIFC), which operates under a separate regulatory framework.

Key Takeaways

- Animoca Brands has obtained a VASP license from Virtual Assets Regulatory Authority, allowing it to provide broker-dealer and investment management services to institutional and qualified investors in Dubai.

- The license excludes the Dubai International Financial Centre, which operates under the oversight of the Dubai Financial Services Authority.

- The approval strengthens Animoca’s expansion strategy in the Middle East, adding regulated operations to its portfolio of more than 600 Web3 investments.

- Dubai continues to tighten oversight of digital assets, with recent restrictions on privacy tokens like Monero and Zcash while granting licenses to compliant firms.

Strengthening Institutional Access in Dubai

With the VASP license in place, Animoca Brands can formally engage institutional capital within one of the region’s most structured digital asset regimes.

“This licence enhances our ability to engage with Web3 foundations as well as global institutional and qualified investors within a well-regulated framework,” said Omar Elassar, managing director for the Middle East and head of global strategic partnerships at Animoca Brands.

The authorization enables the company to carry out brokerage, trading, management and investment services tied to digital assets under VARA’s supervision. For a firm known for backing early-stage blockchain ventures, the move signals a deeper commitment to regulated market infrastructure rather than purely venture exposure.

Founded in Hong Kong, Animoca Brands has built a reputation as one of the most active Web3 investors globally. Its portfolio spans more than 600 companies and digital asset initiatives, including projects such as The Sandbox, Open Campus, and Moca Network. The firm also develops its own blockchain-based platforms and content ecosystems.

Dubai’s Regulatory Momentum

VARA was established in March 2022 under Dubai Law No. 4 of 2022 to regulate, supervise, and oversee virtual asset activities across Dubai’s mainland and free zones, excluding the DIFC. Since its inception, the regulator has sought to position Dubai as a compliance-driven hub for institutional crypto businesses.

Animoca’s approval adds to a growing list of crypto infrastructure firms choosing Dubai as a regional base. In October 2025, digital asset infrastructure provider BitGo obtained a broker-dealer license from VARA, allowing its Middle East and North Africa arm to offer regulated trading and intermediation services to institutional clients in the emirate.

At the same time, VARA has demonstrated a willingness to enforce its rulebook. The authority recently disclosed financial penalties against 19 firms for conducting unlicensed virtual asset activities and breaching its marketing regulations. The enforcement actions reinforce Dubai’s message that market access depends on regulatory compliance.

A Tale of Two Regulators: VARA and DFSA

While VARA oversees most of Dubai’s virtual asset ecosystem, the DIFC falls under the authority of the Dubai Financial Services Authority (DFSA). In recent weeks, the DFSA tightened its approach to privacy-focused digital assets.

The regulator prohibited licensed exchanges and financial institutions within the DIFC from facilitating privacy-centric tokens such as Monero and Zcash, citing anti-money laundering and sanctions compliance risks. It also banned the use of mixers, tumblers, and other obfuscation tools designed to conceal transaction details.

Additionally, the DFSA refined its definition of fiat-referenced crypto tokens, limiting the category to tokens backed by high-quality liquid assets and pegged to fiat currencies.

The parallel developments highlight a broader theme in the UAE: authorities are not competing on regulatory leniency but on structured oversight. For companies like Animoca, the path to expansion runs through formal licensing rather than regulatory arbitrage.

Regional Expansion and Strategic Acquisitions

Animoca’s VASP license arrives shortly after the company expanded its content footprint. In January, it acquired gaming and digital collectibles company Somo, integrating Somo’s playable and tradable collectibles into its broader portfolio of blockchain-based projects.

The acquisition aligns with Animoca’s strategy of combining infrastructure, digital ownership, and content distribution.

Yat Siu, co-founder and executive chairman of Animoca Brands, has previously described Dubai and the UAE as among the most forward-looking jurisdictions for digital assets. According to the company, VARA has played a constructive role in guiding firms through the licensing process and encouraging regulated growth.

Institutional Crypto in the Middle East

The VASP license gives Animoca a formal platform to serve institutional investors from within Dubai, one of the Gulf’s leading financial centers. As global asset managers and family offices increase exposure to digital assets, regulated access points are becoming essential.

For Animoca, the approval is more than a compliance milestone. It positions the firm to connect its extensive Web3 investment network with capital pools in the Middle East under a clear supervisory framework.

As Dubai continues to refine its regulatory architecture—balancing innovation with enforcement—firms that secure local licenses are likely to gain a strategic edge. Animoca’s entry into VARA’s regulated ecosystem underscores a broader shift: institutional crypto growth in the region is increasingly being shaped by formal authorization rather than speculative expansion.

Related posts:

- Donald Trump’s $10M Crypto Stash Revealed as Election Heats Up

- US Republicans Embrace Crypto, GOP’s Updated Platform Reveals

- Thai Authorities Bust Illegal Bitcoin Mining Operation After Surge in Power Outages

- Bitfinity Network Mainnet Launches;Aims to Bridge Bitcoin and DeFi

- Scammers Steal $2.2M in Crypto from New Yorkers in Job Scam