Day trading is all about speed, and to stay ahead, you need more than just market know-how, you need the right trading platform.

Whether you’re a newbie dipping your toes into the market or a seasoned pro refining your strategies, the platform you choose can be the difference between success and frustration. The best platforms provide real-time data, quick trade execution, low fees, and powerful tools to analyze and act fast.

With so many options available, some overflowing with features and others designed for simplicity, how do you choose the right one? Let’s find out.

Key Takeaway

- The goal of day trading l is to capitalize on small price movements that happen throughout the day.

- Interactive Brokers is a top choice for professional day traders.

- Trade station allows you to create your own indicators, alerts, and automated strategies even if you’re not a programmer.

- Webull is perfect for traders who want to go beyond the basics, but still value a mobile-first experience

- ETRADE offers features which highlights active stocks and explains the price changes to you.

- Tastytrade makes trading options easy, fast, and secure right from your desktop, tablet, or phone.

What is Day Trading?

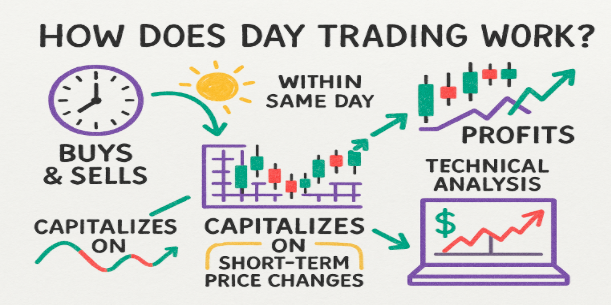

Day trading is a fast-paced trading style where traders buy and sell financial instruments like stocks, forex, crypto, or commodities within the same trading day.

The goal is to capitalize on small price movements that happen throughout the day. Unlike long-term investors who hold assets for months or years, day traders close out all positions before the market closes.

Think of it like flipping products at a flea market: you buy low in the morning and hope to sell higher before the day ends.

Day trading requires a sharp eye, quick decisions, and constant market monitoring. It’s a strategy used by many to generate daily income, and it’s become even more popular thanks to technology, mobile apps, and zero-commission trading.

In day trading, seconds matter. The difference between profit and loss can come down to how fast your order gets executed or whether you have the right tools to analyze the market in real time

A good day trading platform offers:

- Fast execution speeds to keep up with market moves

- Advanced charting tools to spot trends and set up trades

- Low fees and commissions to help you keep more of your gains

- Reliable customer support when issues arise mid-trade

- Strong security to keep your funds and data safe

- Demo accounts for practicing before risking real money

| Platform | Best For | Stock | Option | Futures | Security features | Unique features |

| UEEx | fast, high-leverage crypto day trading with automation and copy-trading tools. | 1.50% | 1.50% | 0.05% | Distributed cold storage,- Access control with IP and wallet whitelisting,- Proof of Reserve | Copy trading, notable privacy feature providing each user with 2000 unique addresses, Native token, UE Coin, boosts functionality through transaction |

| Interactive broker | Professional and active traders needing global access, low fees, and advanced tools | $0 (Lite)$0.0005–$0.0035 (Pro) | $0.15–$0.65 per contract (tiered) | $0.25–$0.85 per contract | Two-Factor Authentication (2FA)-SIPC protection (up to $500K)- Additional insurance via Lloyd’s of London- Strong encryption and secure login protocols | Access to 150+ global markets- IBKR Lite & IBKR Pro account options- Fractional shares (for U.S. clients) |

| Trade station | Active traders, options traders, and algorithmic strategy developers | $0 | $0.60 per contract | $1.50 per contract($0.50 for micro e-minis) | Encrypted data transfers and secure login credentials | EasyLanguage for custom algorithm building- Advanced charting and backtesting tools |

| Robinhood | Beginners who want a quick and easy start | $0 | $0.00 per contract | Not supported | 2FA + SIPC protection up to $500,000 | Instant deposits and commission-free trading in a simple, mobile-first app |

| Webull | Tech-savvy beginners and intermediate traders | $0 | $0.55 per contract (index options) | Not supported | Biometric login, 2FA, SIPC, Apex Clearing insurance | Free advanced charting and paper trading with real-time data |

| Etoro | Social traders and crypto-curious beginners | $0 for stocks (no leverage) | Not supported | Not supported | SSL encryption, FCA/CySEC regulated, cold wallet storage | CopyTrader lets you follow and copy pro traders automatically |

| Zulu Trade | Passive traders who prefer automation | Varies by connected broker | Varies by connected broker | Varies | Encrypted transactions + regulated broker connections | Follower-trader network with automated signal copying |

| Tastytrade | Active options traders and strategy testers | $0 | $1.00 to open, $0 to close | $2.50 per contract ($1.50 for micro) | SIPC protection + secure account monitoring | Options-focused tools with capped fees and custom strategy builders |

| Meta Trade | Forex and CFD traders | Depends on broker | Depends on broker | Depends on broker | Encrypted client-server communication | Expert Advisors (EAs) for custom bots and deep backtesting |

UEEx: Best for fast, high-leverage crypto day trading with automation and copy trading tools.

UEEx is a rapidly growing trading platform designed for fast, high-frequency trading in both crypto and traditional assets. It’s especially popular among traders who want to use leverage, automate strategies, or copy successful traders.

With its fast execution speed and user-friendly interface, UEEx is built for day traders who need quick moves, multiple asset options, and flexible tools.

Pros

- High leverage options (up to 125x) for futures and margin traders.

- Wide asset selection, supports crypto, stocks, and fiat pairs.

- Built-in copy trading & trading bots for automation.

- Demo trading accounts to practise strategies without risk.

- User-friendly interface suitable for both beginners and pros.

Cons

- High leverage increases the risk of large losses.

- Not as widely recognized as platforms like Binance or Coinbase.

Interactive Brokers (IBKR): Best Broker for Professional and Active Traders

Interactive Brokers, also known as IBKR, is a top choice for professional day traders. It offers access to over 150 global markets, meaning you can trade stocks, options, forex, futures, and more in one place.

They also offer charting tools that allow you to study stocks using different chart styles and indicators.

Pro

- Access advanced research tools and fast trade execution all in one platform

- Choose between IBKR Lite (for casual traders) and IBKR Pro (for active/professional traders)

- Offers a wide range of educational content and in-depth market research

Con

- While powerful, the app isn’t as beginner-friendly as some competitors.

- Requires time and effort to fully utilize all features and tools effectively.

Fees (for U.S. users):

- IBKR Lite: $0 for U.S. stocks and ETFs

- IBKR Pro: $0.0005–$0.0035 per share (the more you trade, the less you pay)

- Options: $0.15–$0.65 per contract (based on your plan)

- Futures: $0.35–$0.85 per contract

Also Read: Best Crypto Exchanges in Burundi(2026 Review)

Trade Station: Active traders, options traders, and Algorithmic Strategy Developers

TradeStation is another top trading platform in professional day trading. Known for its powerful desktop platform and deep customization, it’s perfect for those who want to test strategies, automate trades, or code their own trading systems.

Their custom scripting language allows you to create your own indicators, alerts, and automated strategies even if you’re not a programmer. TradeStation supports stocks, options, futures, crypto, and more. It also features EasyLanguage programming, exceptional order execution readily.

Pro

- Great tools for both technical and fundamental analysis

- Includes a demo account for practice and strategy testing

- Advanced platform with fast and reliable trade execution

- Affordable pricing for active traders

- EasyLanguage feature makes it simple to create trading algorithms

Cons

- Doesn’t support fractional share trading

- Dormant cash in your account earns very little interest

- The platform can be difficult for beginners

Fees

- Stocks and ETFs: $0

- Options: $0.60 per contract

- Futures: $1.50 per contract

Robinhood: Best for Beginners who want a quick and easy start

Robinhood is a beginner-friendly trading app that helped popularize commission-free stock trading in the U.S.

It’s built for simplicity, making it easy for new traders to start buying and selling stocks, ETFs, and options, all from a clean mobile app.

It has $0 commission trading on stocks, ETFs, and options, user-friendly mobile and web platform and a Real-time market data and basic research tools

Pro

- No trading fees for stocks and options

- Great for beginners due to its simple interface

- Easy access to fractional shares

- Fast account setup and instant funding

- Cryptocurrency trading supported

Cons

- No access to mutual funds or bonds

- No advanced charting or technical tools

- Limited customer support

- No copy trading or paper trading

Fees

- $0 for trading U.S. stocks, ETFs

- $0.00 per contract

Webull: Best For Tech-savvy beginners and intermediate traders

Webull is perfect for traders who want to go beyond the basics, but still value a mobile-first experience. Webull allows you to practice your strategies with simulated trades using real-time data.

It also gives you the opportunity to trade pre market and after-hours, something many beginner platforms don’t offer. Webull is a great option for day traders with smaller accounts and simpler trading needs.

Pro

- Trade and do research from your phone anytime

- Get free fractional shares when you fund your account

- Access pre-market and after-hours trading

Cons

- Doesn’t offer custom order routing

- Trade execution may be less reliable due to payment for order flow (PFOF)

Fees

- $0 for trading U.S. stocks, ETFs, and listed options

- Some index options cost $0.55 per contract

- Regulatory fees may apply, but Webull doesn’t profit from them

Also Read: Best Crypto Exchanges in Uruguay (2026 Review)

EToro: Best for Social traders and crypto-curious beginners

eToro is a global social trading platform that blends investing with a social network-like experience. It’s best known for its CopyTrader feature, which allows users to automatically copy the trades of top-performing investors.

It allows you to trade stocks, ETFs, crypto, and forex in one place. It is beginners friendly and has no commission on stock trades.

Pro

- Ideal for beginners and passive investors

- Copy trading saves time and lowers the learning curve

- Offers a wide range of assets including crypto and forex

- Easy to use on desktop and mobile

- Strong global reputation and regulation

Cons

- High spreads on crypto and CFDs

- Inactivity fee after 12 months

- Limited technical tools for advanced traders

- Not all assets available in every country

Fees

- $0 for stocks (no leverage)

- Etoro does not support both option and futures fees

Zulu Trade: Best for Passive Traders who prefer Automation

ZuluTrade is a copy trading platform that connects traders (called “signal providers”) with followers who want to automate their trading by copying others. You don’t trade directly through ZuluTrade—you connect it to a supported broker.

Pro

- Fully automated copy trading

- Transparent trader rankings and stats

- Useful for hands-off or beginner traders

- Supports multiple asset types via partner brokers

- Risk filters help control exposure

Cons

- Fees vary depending on the broker used

- No manual trading on ZuluTrade itself

- Performance depends on chosen signal providers

- Requires some setup with a third-party broker

Fees

- Fees varies by connected broker

Tastytrade: Best for Active Options Traders and Strategy Testers

Tastytrade makes trading options easy, fast, and secure right from your desktop, tablet, or phone. Available on both Android and iOS, it’s perfect for active traders.

With helpful tools like a liquidity rating and an analysis tab to assess your trade’s profit and loss potential, you’ll have everything you need to make informed decisions. Dive into the world of options trading with tastytrade.

Pro

- Powerful research tools and features for options trading

- Liquidity rating helps you find the best options to trade

- Extensive educational content, including helpful videos

Cons

- Takes time to learn how to use the platform

- Most education and resources focus only on options trading

Fees:

- Stock and ETF trades: $0

- Cryptocurrency trades: $0

- Options on futures: $2.50 per contract

- Futures contracts: $2.50 each

Meta Trade: Best for Forex and CFD traders

MetaTrader 4 and 5 (MT4/MT5) are powerful platforms mostly used by forex and CFD traders. They’re known for their custom indicators, expert advisors (EAs), and deep analytical tools.

You can trade through a broker that supports MetaTrader. It Supports automated trading via Expert advisors, works with thousands of brokers worldwide, and has advanced charting with many indicators.

Pro

- Highly customizable with technical tools and scripts

- Supports automated bot trading

- Works with many brokers globally

- Lightweight and fast

- Great for intermediate to advanced traders

Con

- Outdated design and not very beginner-friendly

- No built-in stock or crypto trading (depends on broker)

- No direct customer support (support comes from the broker)

- Learning curve for using advanced features

Fees

- Fees depends on the broker

How Does Day Trading Work?

Day trading platforms cater specifically to day traders, offering features like fast trade execution, low margin rates, and powerful tools for tracking prices and news in real time.

Most of these platforms provide commission-free trading for stocks, ETFs, and mutual funds, with some also allowing commission free options trading though fees might apply for certain contracts.

While there’s typically no account minimum to start, day traders should beware of FINRA’s ‘pattern day trading’ rules. This regulation states that if you make four or more day trades in five business days and those trades exceed 6% of your total trades, you must maintain at least $25,000 in your margin account.

A margin account allows you to borrow money from your broker, which can amplify both potential gains and losses. If your account balance dips below $25,000, you’ll freeze your day trading until you replenish it

Factors to consider when choosing the Right Day Trading Platform

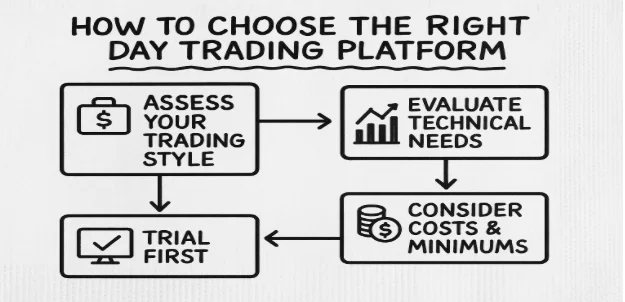

With so many platforms out there, finding the right one can feel overwhelming. But not to worry, it all comes down to matching the platform with your trading style, technical needs, and budget. Let’s break it down step by step.

Assess Your Trading Style

Not all traders are the same, and your style determines the kind of tools and features you’ll need. Ask yourself: How do I trade? look for platforms with real-time news, scanning tools, and detailed charts.

If you rely on bots or automated strategies, go for platforms that support coding languages like Python or EasyLanguage.

Evaluate Technical Needs

Your platform should match your technical expectations. Here’s what to look for:

- Speed & Execution: Fast trade execution is critical, especially for scalpers. Delays can mean lost profits.

- Charting Tools: Look for interactive charts with multiple timeframes, indicators, drawing tools, and customizable layouts.

- Automation Support: Interested in algorithmic or bot trading? Make sure the platform allows for automated strategies, backtesting, and scripting.

Consider Costs & Minimums

Every dollar counts in day trading. Here’s what to check:

- Commissions: Are stock and ETF trades free? What about options or futures?

- Margin Rates: If you trade on margin, compare rates, some platforms are much cheaper than others.

- Account Minimums: Some platforms require a few hundred dollars to get started, while others let you open an account with $0.

- Data Fees: Real-time data, especially for options or futures, might cost extra. Make sure to check.

Trial First

Before you commit real money, take your platform for a test drive. Most good platforms offer free accounts where you can trade with virtual money. Explore features, and see how the platform performs in real time.

Testing helps you build confidence, avoid mistakes, and make sure the platform fits your needs risk-free.

Conclusion

Finding the best day trading platform depends on your goals, experience, and trading style. If you’re just starting out, Robinhood or Webull offer simple, low-cost ways to get into the market.

Prefer a social approach? eToro and ZuluTrade are perfect for following or copying other traders. For those who want full control and deep customization, MetaTrader and TradeStation are built for strategy-driven traders.

And if you’re looking for pro-level tools and global market access, Interactive Brokers is hard to beat. No matter which one you choose, make sure it fits your needs, offers good support, and helps you grow as a trader. D’t be afraid to test out a few with demo accounts before committing.

At the end of the day, the best platform is the one that helps you trade smarter, faster, and with more confidence.

Also Read: How Will Blockchain Impact Healthcare?

FAQs

What is the best platform for beginner day traders?

Webull and eToro are great for beginners. They’re easy to use, offer free trades, and have helpful learning tools to get you started

Which day trading platform has the lowest fees?

UEEx, Interactive Brokers (IBKR) and Webull offer very low or even zero commissions for stocks and ETFs. IBKR also has cheap margin rates if you borrow money to trade.

Can I day trade with a small account?

Yes! Platforms like Webull let you start with a small amount, and even offer fractional shares, so you can buy pieces of expensive stocks.

What platform is best for advanced or professional traders?

TradeStation and Interactive Brokers are packed with powerful tools, advanced charting, fast execution, and automation—perfect for experienced traders.

Can I trade from my phone?

Absolutely. Most top platforms like Power E*TRADE and Webull have full featured mobile apps, so you can research and trade on the go.