Institutional adoption refers to the integration and acceptance of cryptocurrencies and blockchain technology by large organizations, such as banks, investment firms, corporations, and other entities. Unlike individual investors, these institutions have significant resources, expertise, and influence in the financial landscape.The growing interest from institutions often leads to increased legitimacy and stability within the cryptocurrency market. Their participation can drive mainstream acceptance and create new opportunities for investment and innovation. When companies like Tesla or Square purchase Bitcoin, or when major financial institutions offer cryptocurrency services, it signals confidence in the asset class.Institutional adoption can also foster improvements in regulatory frameworks and infrastructure, making cryptocurrencies more accessible and safer for all users. As more institutions participate, it can lead to more sophisticated products and services, such as exchange-traded funds (ETFs) and custodial solutions, which cater to a diverse range of investors.

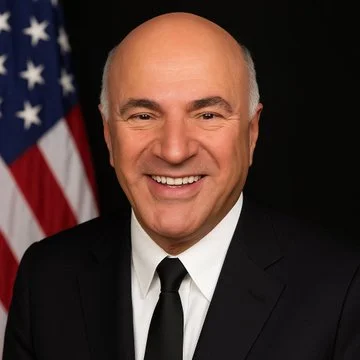

Kevin O’Leary Won $2.8 Million in Defamation Case Against Crypto Influencer Bitboy Crypto

Businessman and television personality Kevin O’Leary has secured a $2.83 million default judgment in a U.S. federal court against former